Weekly market review

A technical look at weekly trends in core markets.

This weekly report is free and provides a recap of the action in the core markets for the past week. For a deeper dive into market analysis, projections, elliott wave counts, technical reviews, and opportunities, check out the daily updates and videos. A 7-day free trial will give you access to my work.

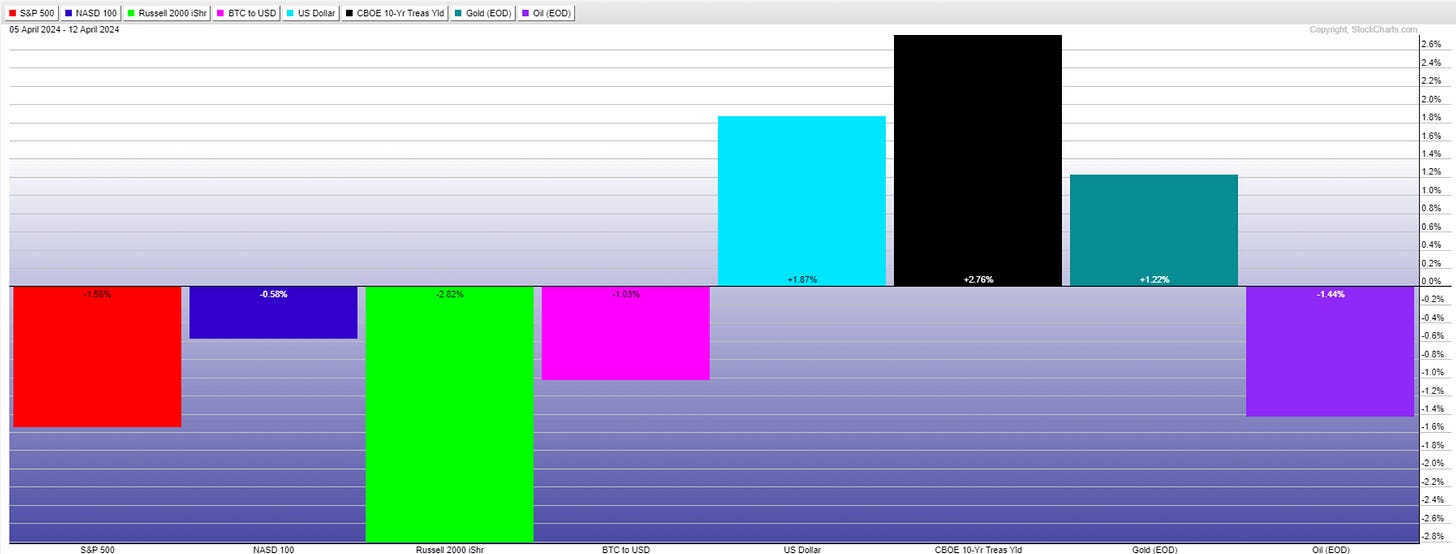

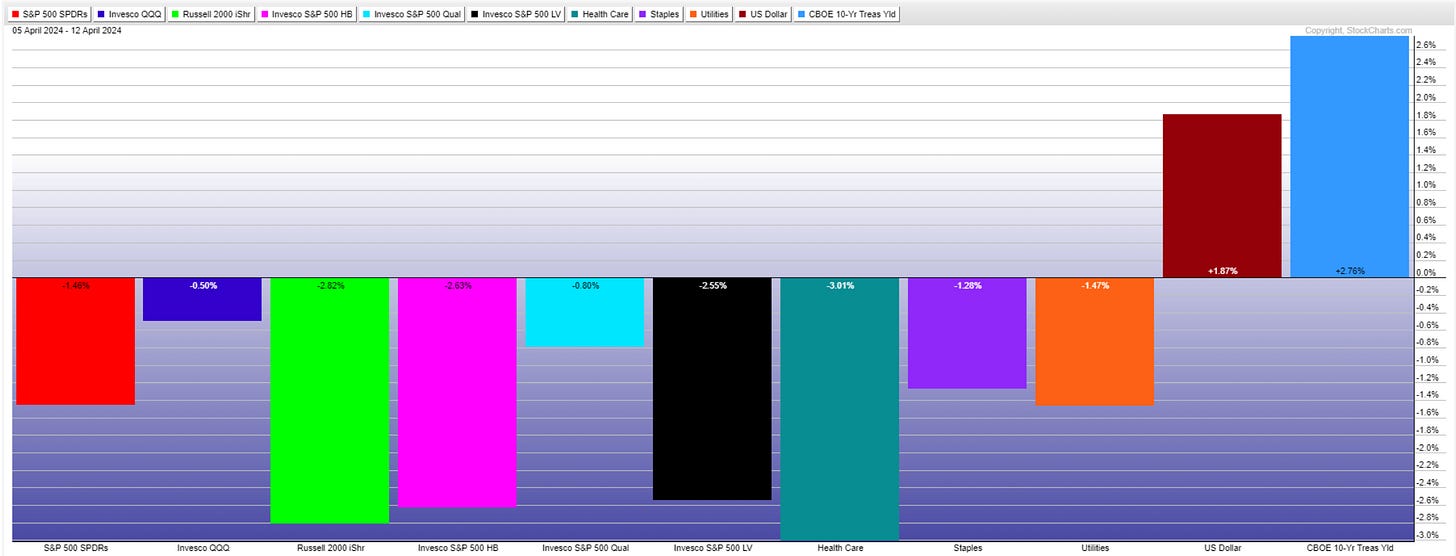

Market performance for this week is below.

Markets retreated into a defensive mode for two weeks in a row. Treasury yields, gold, and the dollar dominated performance.

Sentiment

Volatility jumps at 17, breaking out of a 4-month range.

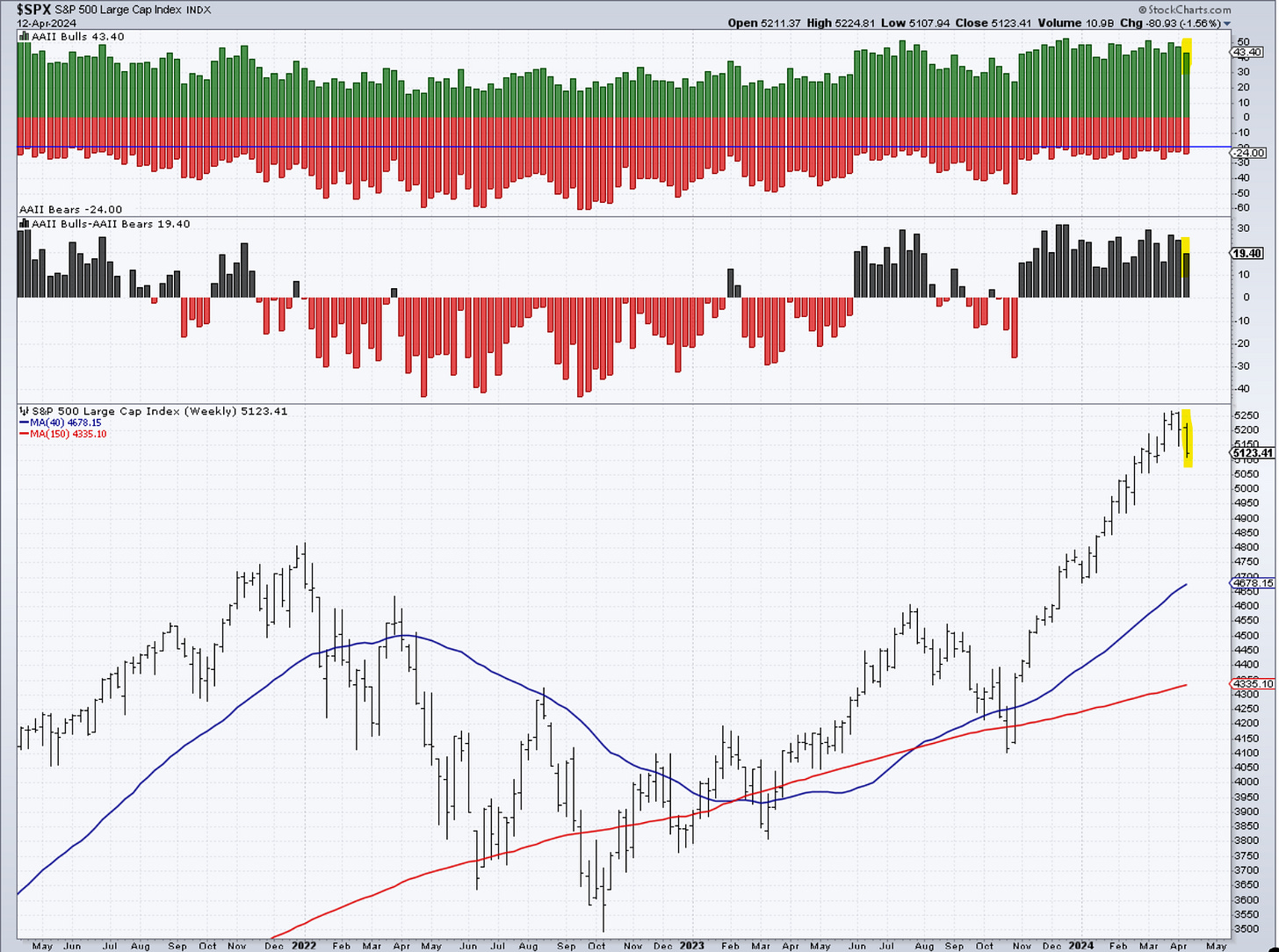

Bullish sentiment has been corrected in the AAII survey.

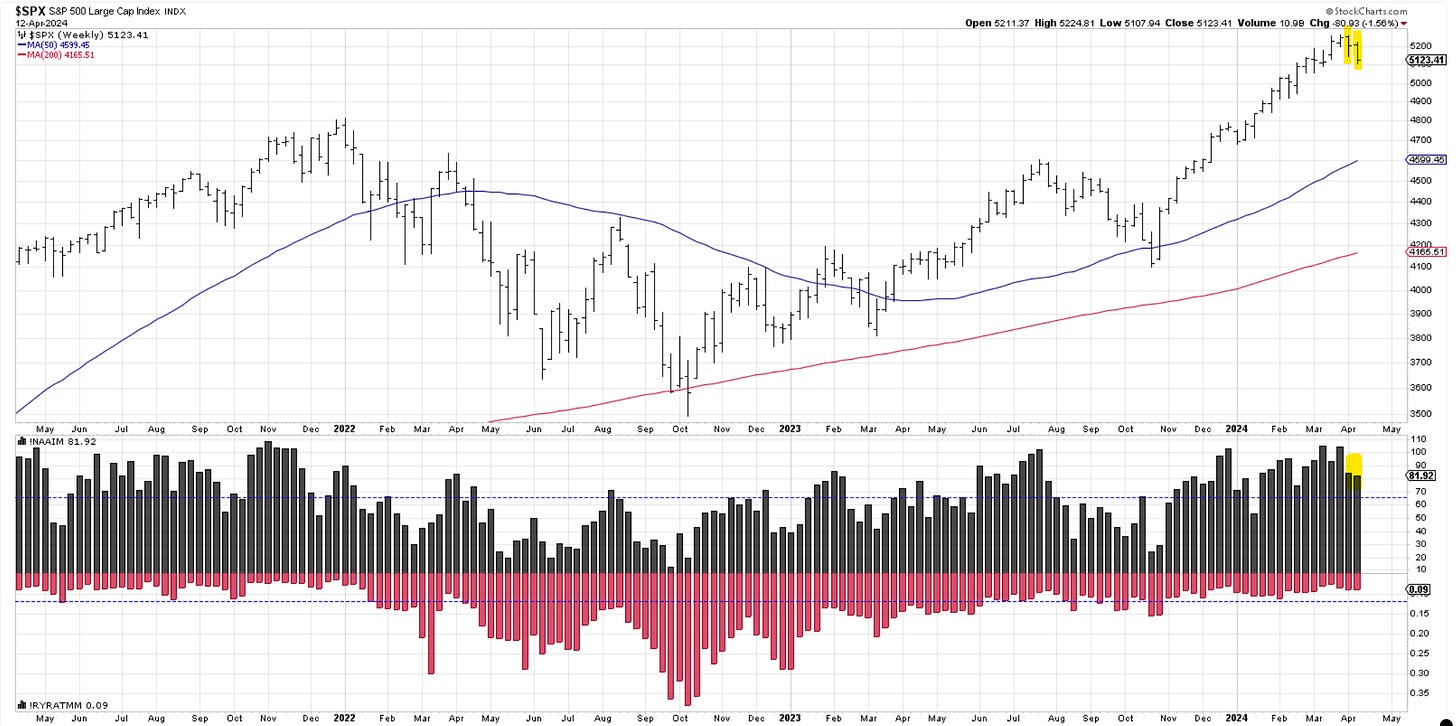

Investment managers reduced positions to 80% invested as the pullback occurs.

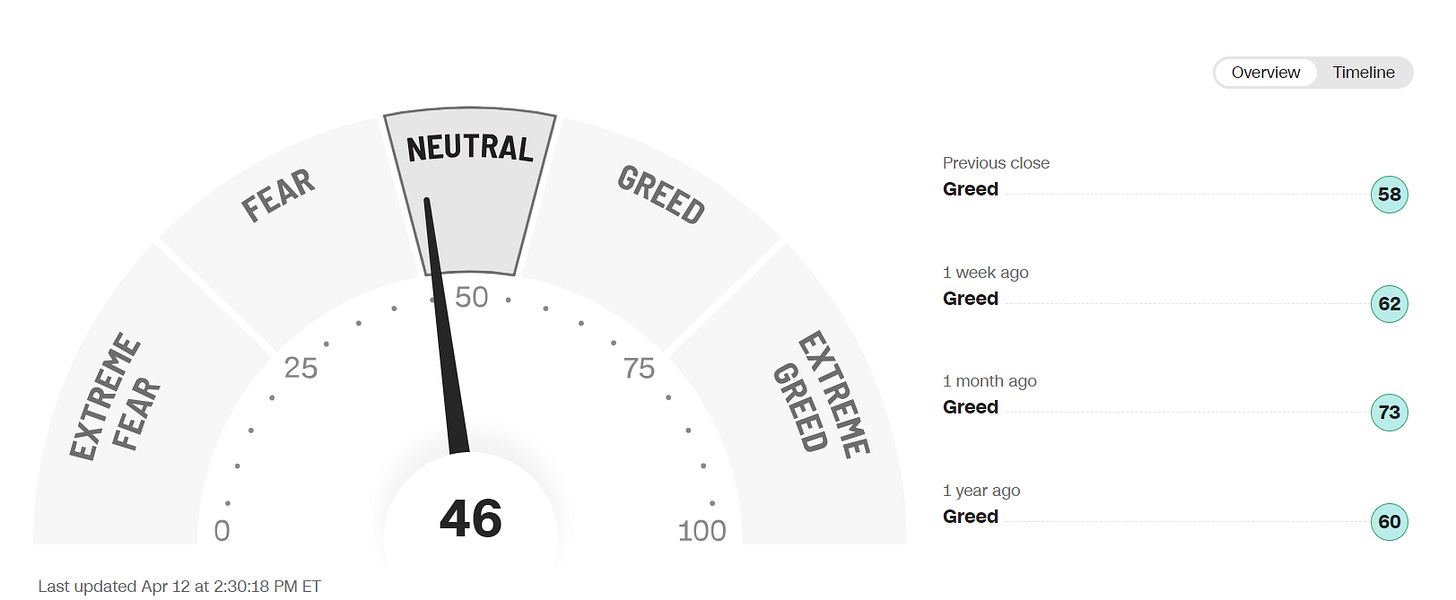

The sentiment section would not be complete without the CNN gauge of Fear vs. Greed.

This gauge reflecting market at the moment coming from greed into neutral as markets correct.

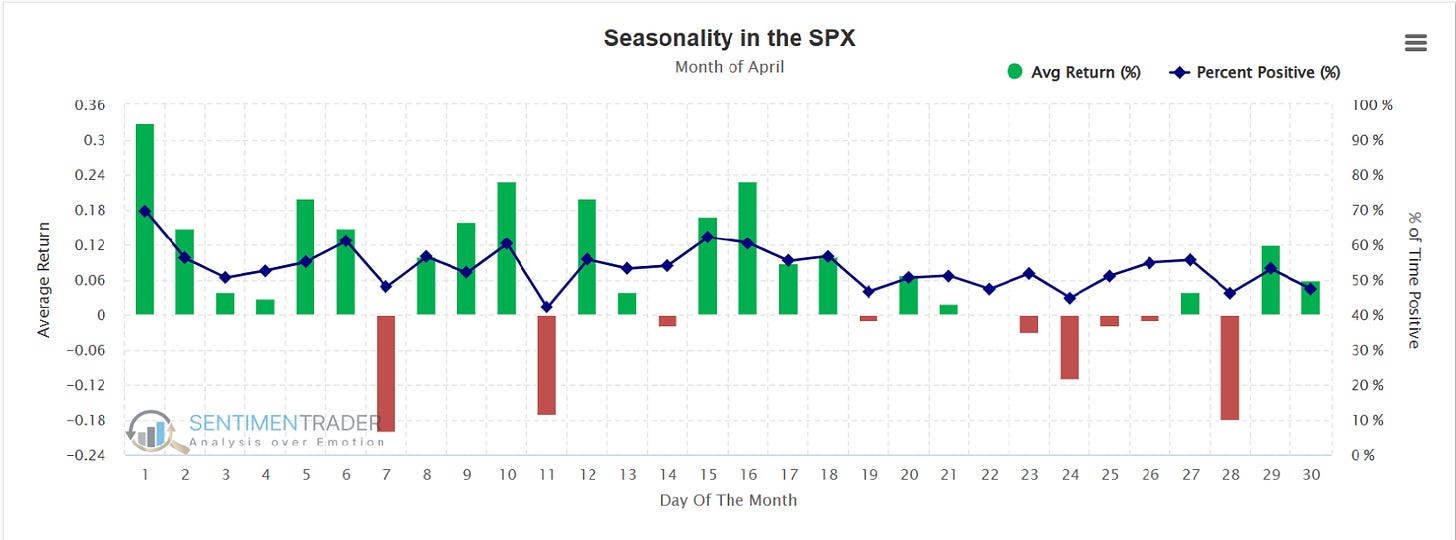

Seasonality

SP500. Here is the daily price action for April. Historically, April is a pretty decent month, especially in the first 20 days.

Price

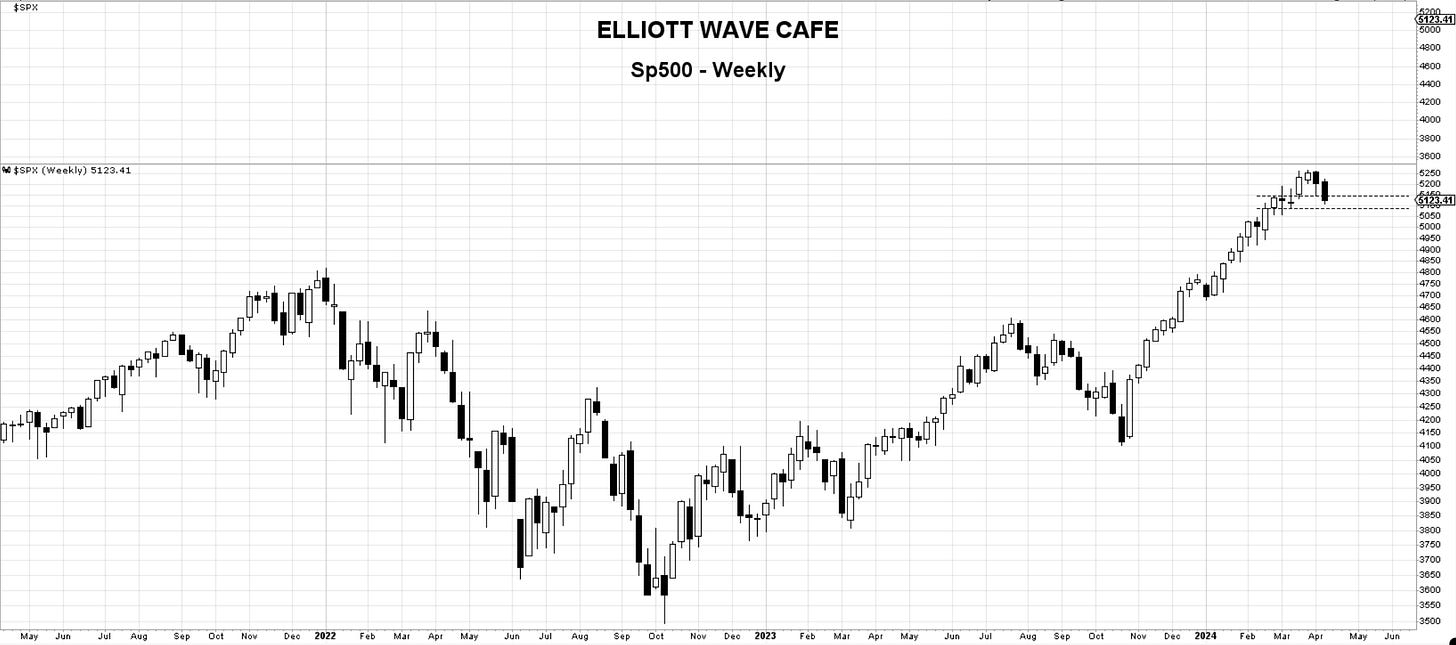

SP500. The first signs of trend interruption are starting to appear. 5085 is the next important zone for support. The 10-week MA sits just below current prices, and it’s being tested for the first time since January. Usually, it does not give way on first tests from highs, so I expect some back-and-forth to take place and for the market to debate direction. A reduction in risk exposure is warranted until evidence of solid buying appears.

RSP—equal weight SP500. The equal-weighted index experienced aggressive selling, breaking the trendline and closing below the 10-week MA. If we continue selling over the upcoming days, we will have sizeable horizontal support at 158.

Nasdaq100. The Nasdaq holds the best position among the indices on this latest selling. There is no clear break of consolidation zones until we lose 17,800. Not making any assumptions is best, but we should focus on reducing long exposure if we lose the levels mentioned.

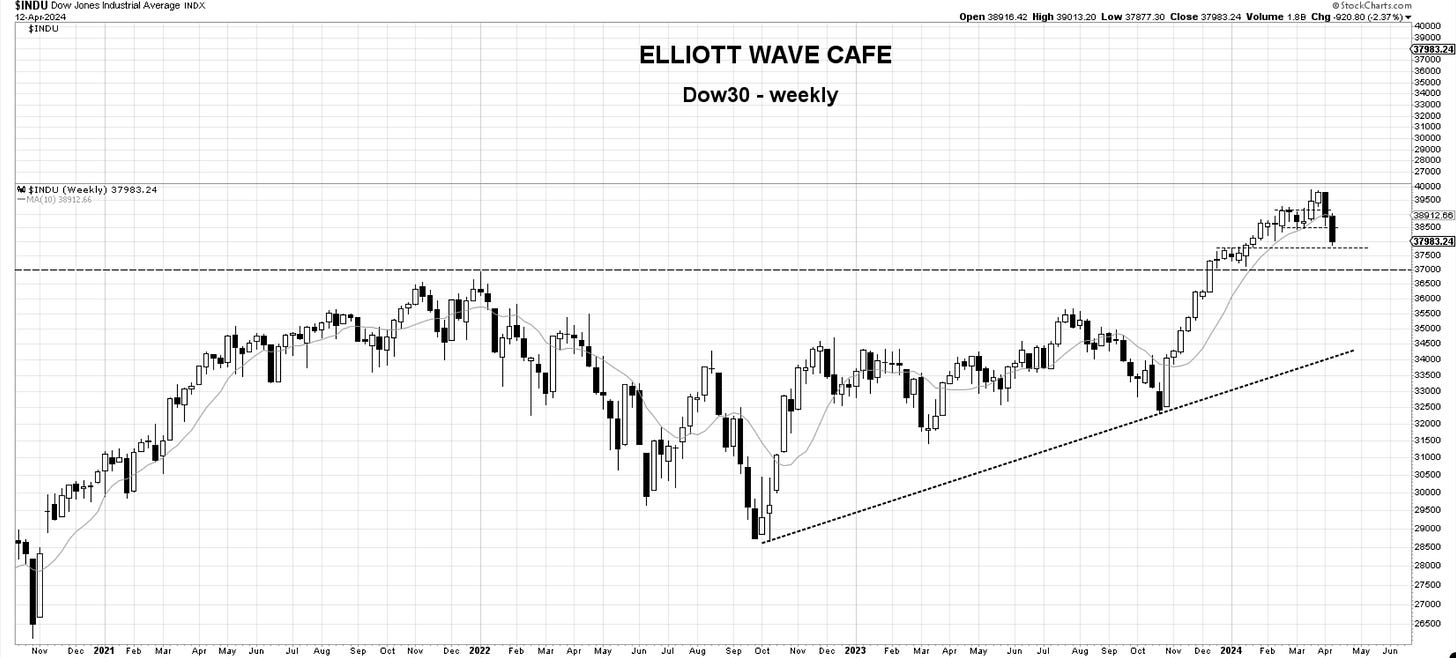

Dow Jones 30—The index had two weeks of heavy distribution and is approaching intermediary support at 37,800. The close below the 10-week MA suggests limited long exposure until it is recaptured and remains upward-sloping. The much larger level for support is 37k, the highs from 2022 before the cyclical bear market began.

IWM—small caps. The supply zone at 210 proved too much for the bulls to absorb. It failed to get continuation and sent the price back below the 10-week. 196 sits just below, a level that has been tested to the upside three times as the market was trying to come out of the bear market. I do expect some decent fights to happen at that level. Remember that shakeouts are part of normal market behavior before the intended trend resumes. It is essential, however, that this is proven before investing decisions are made.

Bitcoin— has spent the last 5 weeks building a base near the all-time highs. There is no break in trend with prices remaining above uptrending averages. A loss of 61k would suggest further corrective price action. Until that happens, the focus remains to the upside.

US Dollar - We talked in the last update about the dollar threatening to break the 105 level and the pressure it can put on equity performance. The fact that we cracked above 106 is important with 107 just above. When the dollar rises, risk has a tendency to suffer.

Gold—After hitting 2448, Gold has come off to close below the halfway point of the latest weekly candle. This is the first sign of selling we have seen in about eight weeks. The trend remains higher but one should not forget to take partial profits if lucky to catch moves of 15% in the precious metal.

Oil—It was a slow week in Oil, but it remains above the key 83 levels. With prices trending above the 10-week average, long exposure is right, and 80 is a defense level.

Thank you all for reading; I will see you next week. Leave a comment or suggestion below. Join our chat to discuss markets with fellow traders.

In the meantime, please consider subscribing and supporting EWCafe and read “The Daily Drip,” where I provide daily market updates, videos, and commentary on core markets.

Cris,

EWCafe

email: ewcafe@pm.me