The Daily Drip

Core markets charts updates and commentary

Note: The counts on the right edge are real-time, and they are prone to adjustments as price action develops. Elliott Wave has a fluid approach, is evidence-based, and requires constant monitoring of certain thresholds.

In the counts below, this (( )) = circle on chart

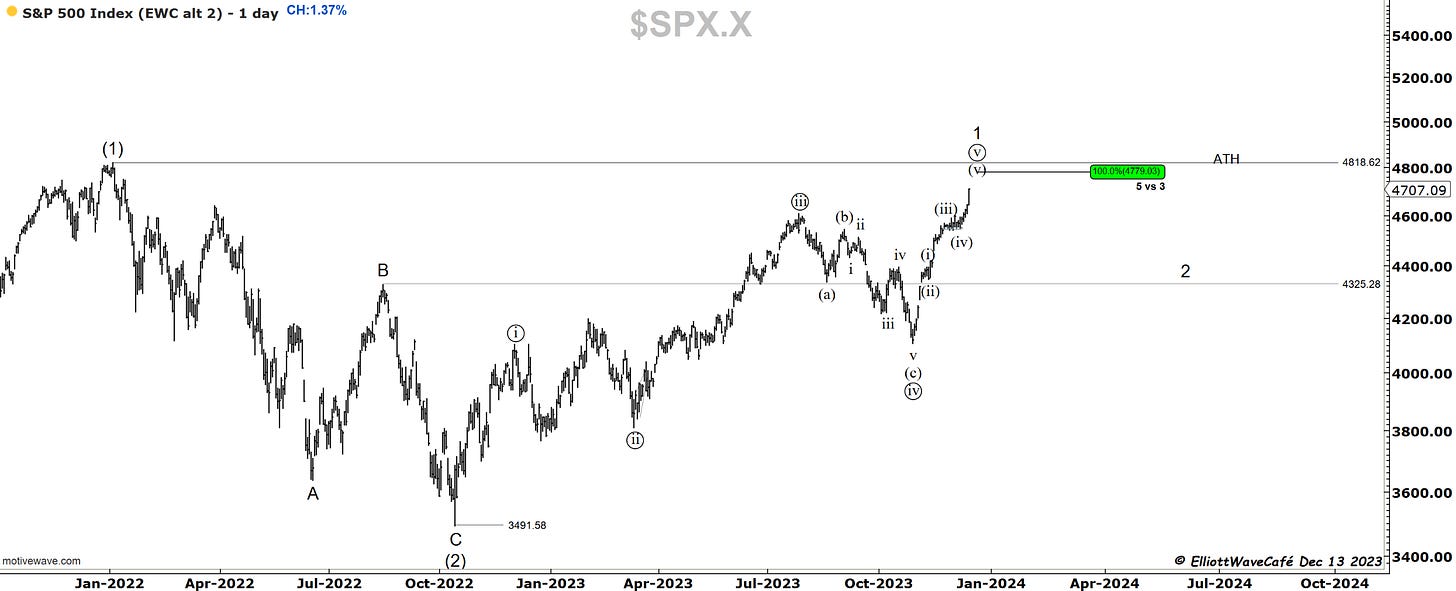

SP500

The first two charts provide a more natural bullish wave progression.

The idea is that we are running towards the completion of the 1st wave of the Oct ‘22 lows. Under these conditions and the current count structure, Wave (v) in the Sp500 cannot go above 4780, or we will have an invalid structure due to Wave (iii) being the smallest. The speed at which this wave developed caught many by surprise, including myself. I was bullish at the Oct ‘23 lows, but I thought that wave (v) of 1 would take a bit longer to unfold and have proper corrections on the internal subwaves. That never materialized, so here we are, inches from new ATH. The market is acting so strongly that I must introduce an alternate count ( the last 2 charts). That looks at the move as a 1,2 ((i)) ((ii)) structure with wave ((iii)) being underway. Inside that 3rd wave, waves (i) and (ii) have already formed. I have some issues there, but I will discuss more in the video.

Nasdaq100

The first Nasdaq chart is the active one where we’re tracking either wave (1) or 3 towards completion. At 16,969, we would have wave ((v)) and ((i)) equality. The second chart, just like in the SP500, displays a more bullish setup where wave (1) actually completed already. It is followed by wave 1 and a very short 2. I also have some issues with this, which I will discuss in the video.

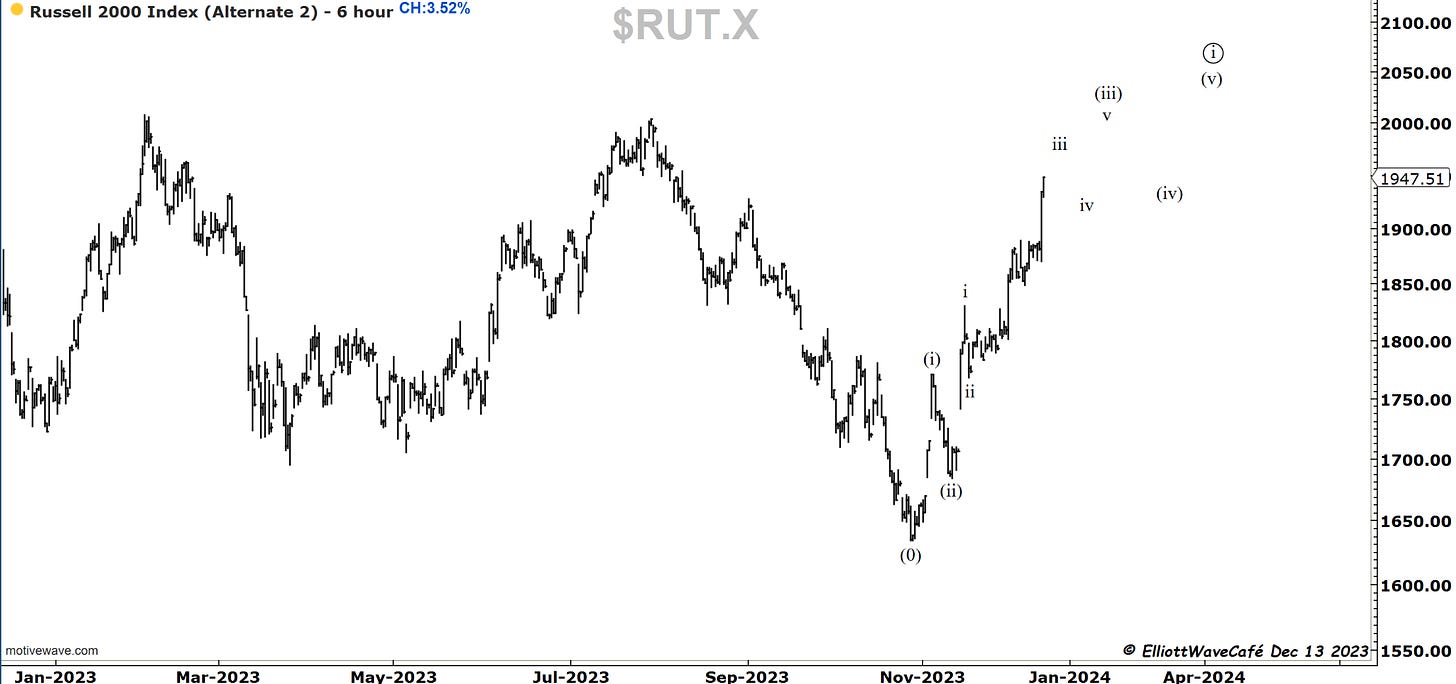

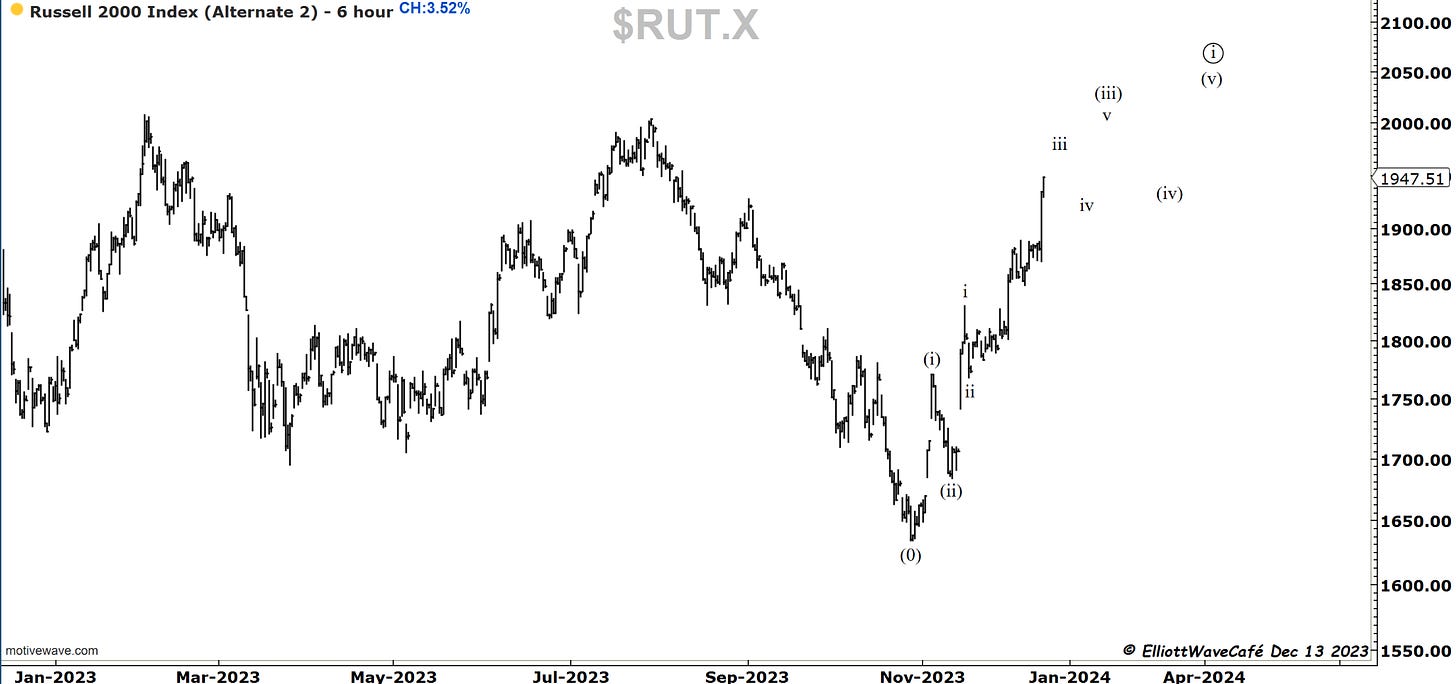

RUSSELL 2000

The Russell is proving here more and more that a wave ((2)) correction was completed below 1650 at the end of October. The hunt for wave ((i)) continues, either as the first chart or the second. Suggests buying pullbacks in wave ((ii)) is right.

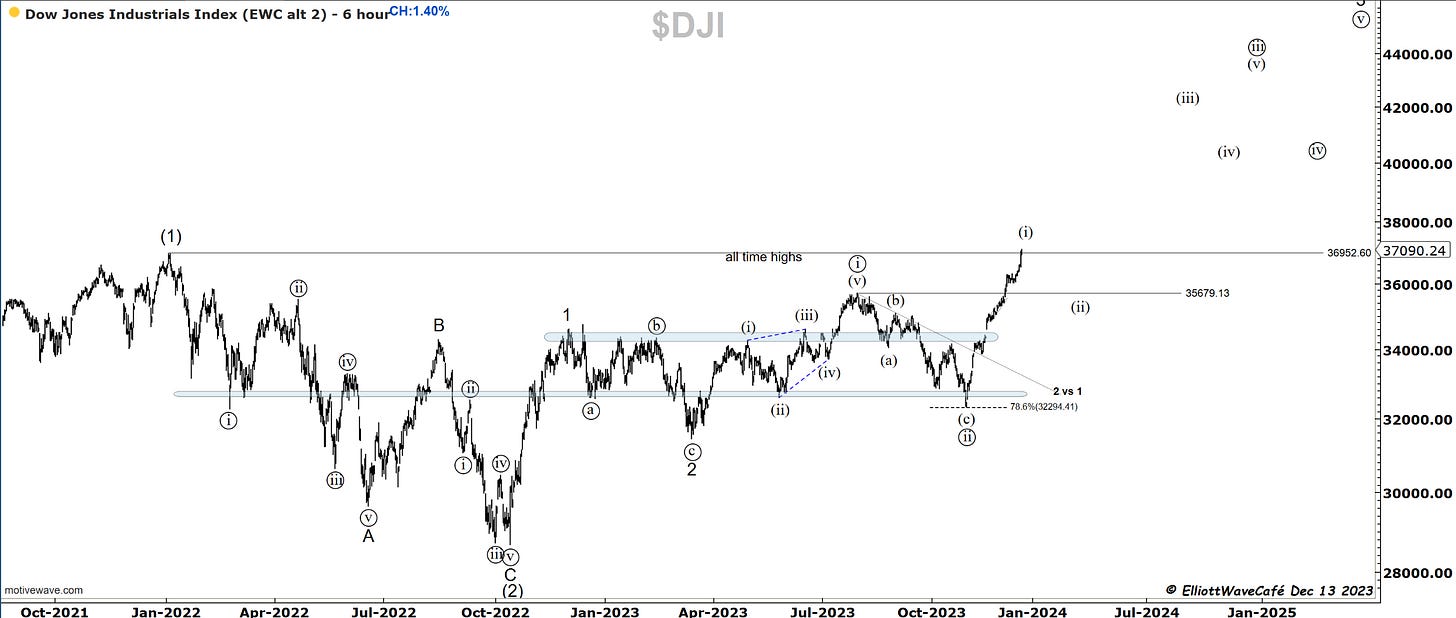

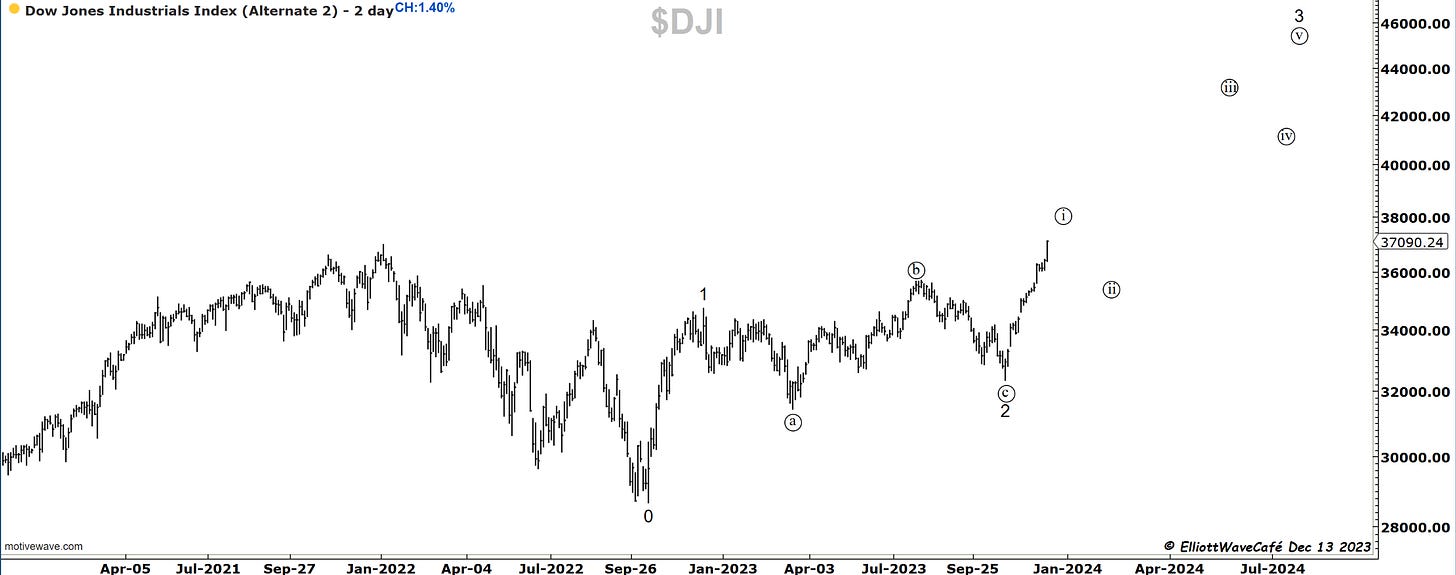

Dow30

Two counts here as well. The first is the original one that we we have been following for a while now. I am very surprised at how strong this wave (i) is and how little pullback is provided. I still see a decent 5wave move in there and expect a pullback in wave (ii). One of my predictions from early summer became true with Dow hitting new ATH before the year is over. The trip to get here had to get us first through an ugly July/Oct correction, followed by an impressive rally. “Market get to obvious places, in the least obvious way.”

The second chart is a variation of the first, it looks at wave 2 as being a running flat. Even here, a wave ((ii)) formation should not be far from forming. I know the Fed today said party on, but the market has a way of bringing news out of the shadows that will be blamed for any corrective pattern. Going straight up won’t be sustainable, so it’s just a matter of waiting for that corrective wave to unfold. It should be nearby.

US Dollar and Yields

Both dollar and yields fell aggressively today. It was a full-on risk appetite after Fed comments. We’re just above 4% on the 10-year, close to that golden zone of 61.8%. A temporary bottom is near and will be followed by a reversal towards 4.4% initially. This will coincide with a pullback in equities.

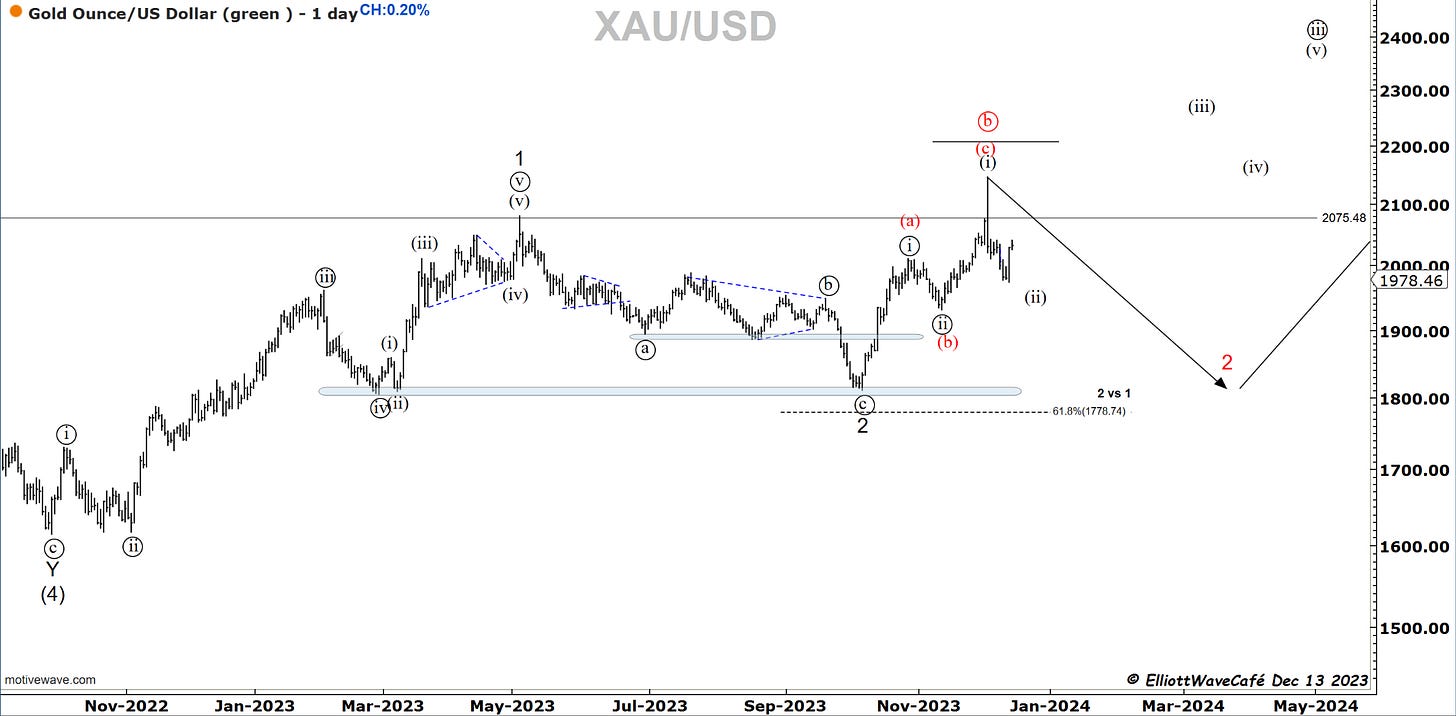

Gold

Gold rallied today on dollar weakness and apparently the telegraphing of easing financial conditions. Under the 1,2 1,2 setup, we should continue to climb and get back above 2075. But, if they sell into this rally, we will have another confirmation that the ABC move to new highs was the real deal and further weakness is upcoming.

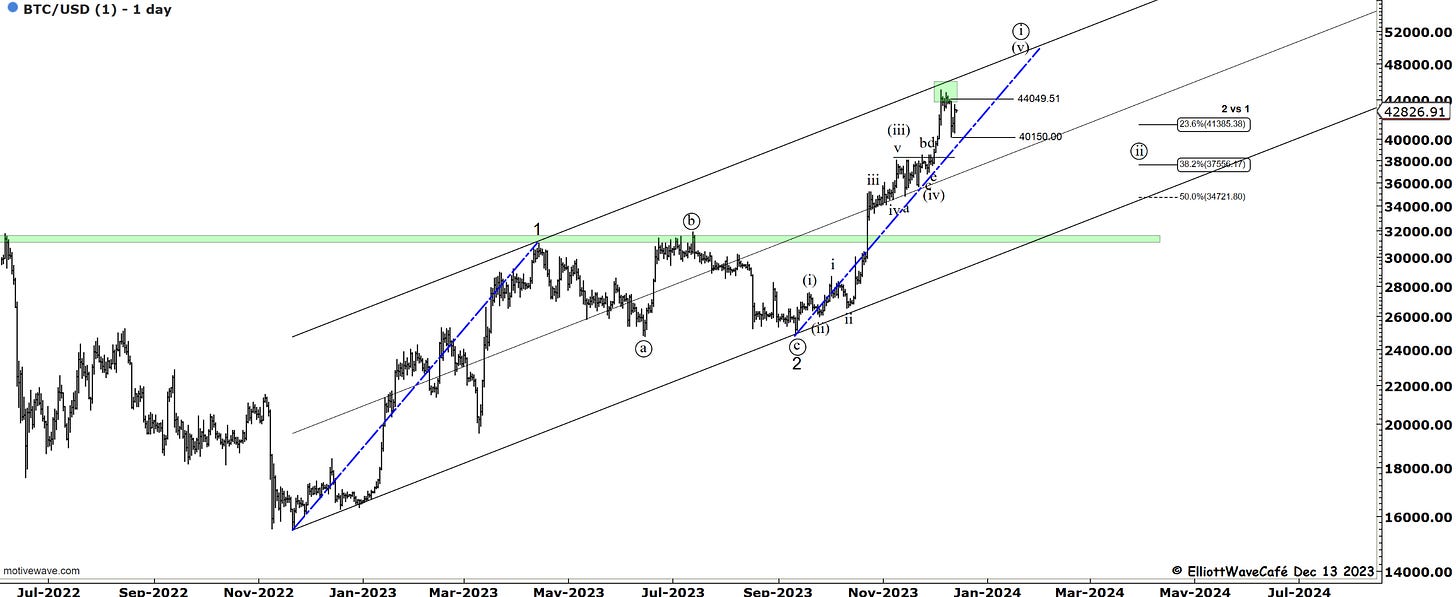

Bitcoin

After a 5-wave decline of the 44,754 high, we’re getting a 3-wave correction higher. It would be expected for this to turn back lower below 40,150. FYI, wave equality comes in near 50k if we have another push higher due to the current drop being a flat instead. ( see 2nd chart).

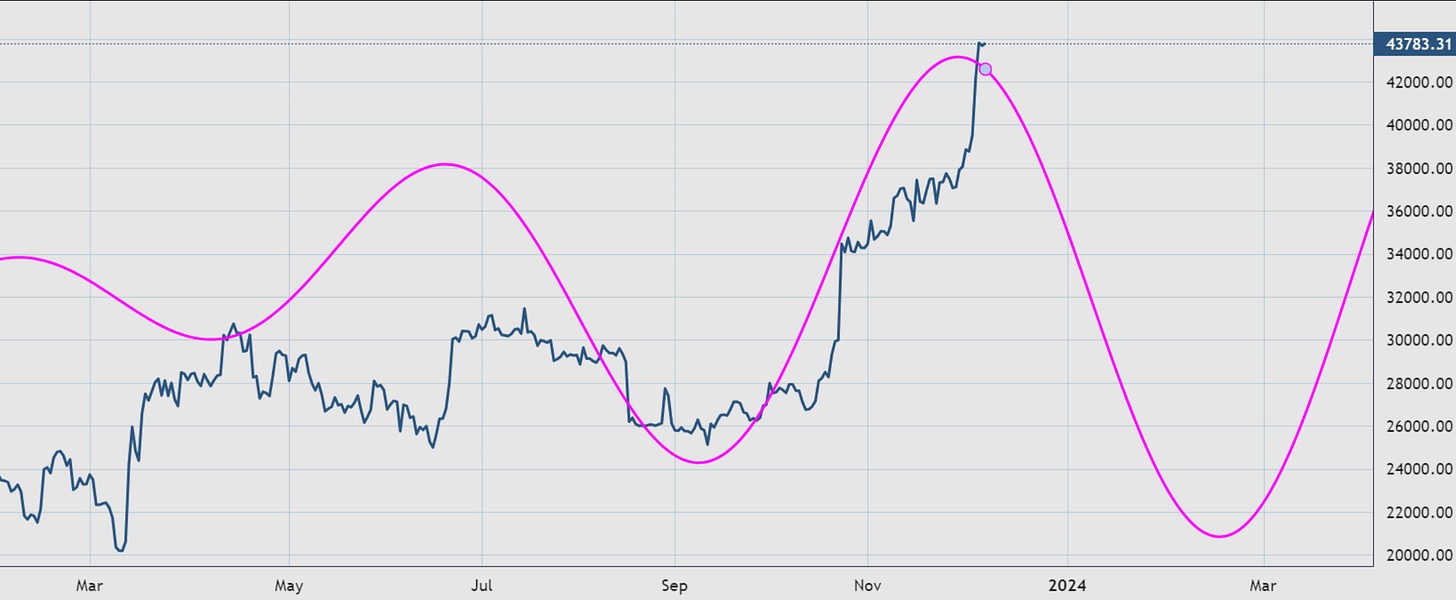

Here is the 150-180 day cycle in BTC suggesting a likely period of weakness upcoming. The depth of the correction is not what we’re looking for here but rather time spent on it.

“Double shot” Daily video coming up next,

Have a great day wherever you are! - trade well, and don’t forget to subscribe and drop a like if this letter helps you in any way.

Cris

email: ewcafe@pm.me

Great updates.