The Daily Drip

Core markets charts updates and commentary

Note: The counts on the right edge are real-time, and they are prone to adjustments as price action develops. Elliott Wave has a fluid approach, is evidence-based, and requires constant monitoring of certain thresholds.

In the counts below, this (( )) = circle on chart

SP500

If my wave count is correct, we will reach 38.2% retracement of wave (iii) at 4385. The correction remains within normal parameters even tho it feels heavy as things unfold in real-time. We have strong additional support at 4325 if the selloff continues. I want to remind you this is a monthly option expiration week which tends to be usually heavy on volatility. There was a lot of premium built into these options over the course of the rally. I think it’s got something to do with it. Once a 4th wave low is established, we should begin the next advance towards 4600 and above.

Nasdaq100

After the rejection from 15,265 the index made a new low and is now approaching the next area of heavy demand near 14,687. This previous wave iv low coincides with 38.2% retracement of wave (iii) just like int the SP500. I think we hold there and start to turn upwards once again.

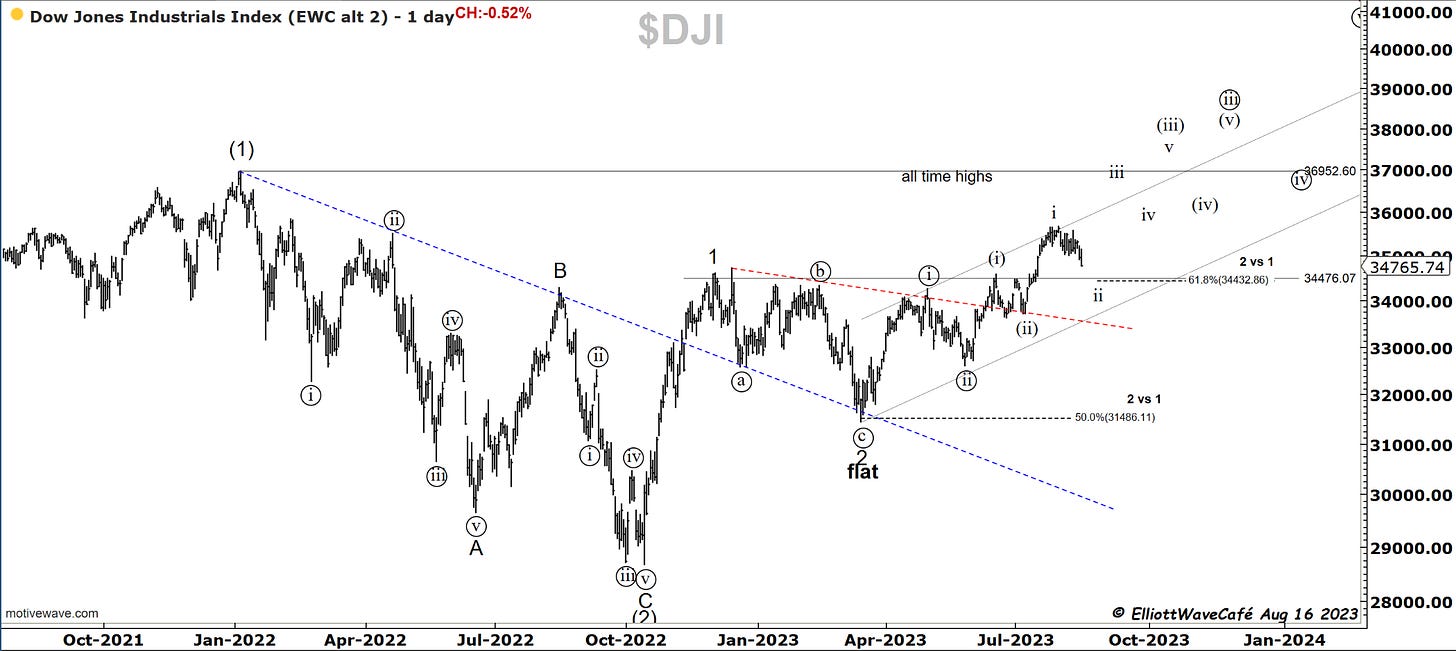

Dow30

Dow Jones is getting near the previous breakout zone of 34,500, where if you notice on the chart, we have 61.8% levels for wave ii. So far, we have looked at three charts all pointing to important fib levels in their respective corrections. I think the market holds there and bounces.

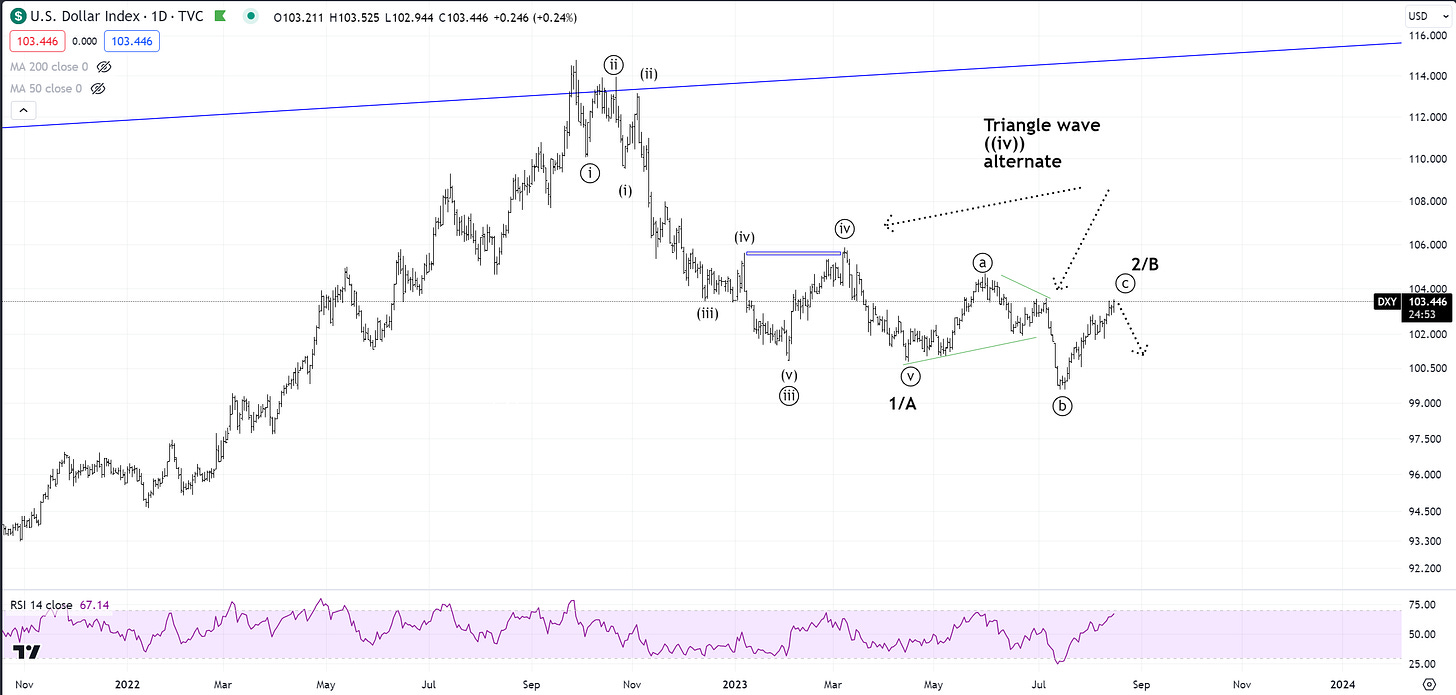

US Dollar

prior dollar comments remain

The dollar is the fly in the ointment. The moment is made the low in mid-July, the risk assets have started to correct. We’re starting to hit some heavy resistance zones here, so a pullback should be imminent. The larger question looms, is this wave ((c )) of a flat or just wave ((a)) of a larger wave 2/B. ( when one considers latest low as wave ((v)) of 1/A). If we’re correct in calling the equity risk correction complete, then the dollar should have headwinds here.

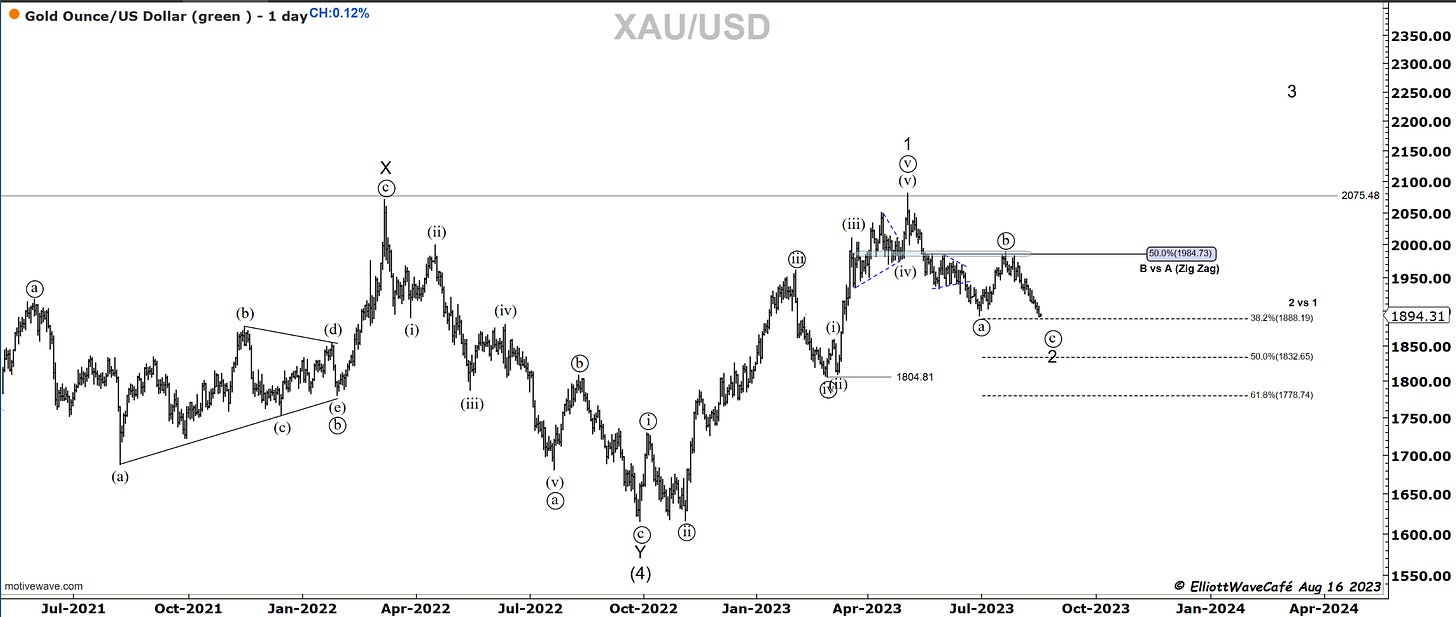

Gold

With the drop below wave ((a)) low, we need to consider now this move as being wave ((c )) of 2. We are still just at 38.2 levels of the rally since Oct lows, so there still could be a bit further weakness for a few days. The 1804 could be a magnet as well. Keep an eye on the dollar here, as it’s running into resistance. A move back above ((b)) highs would hint that wave 3 is getting started.

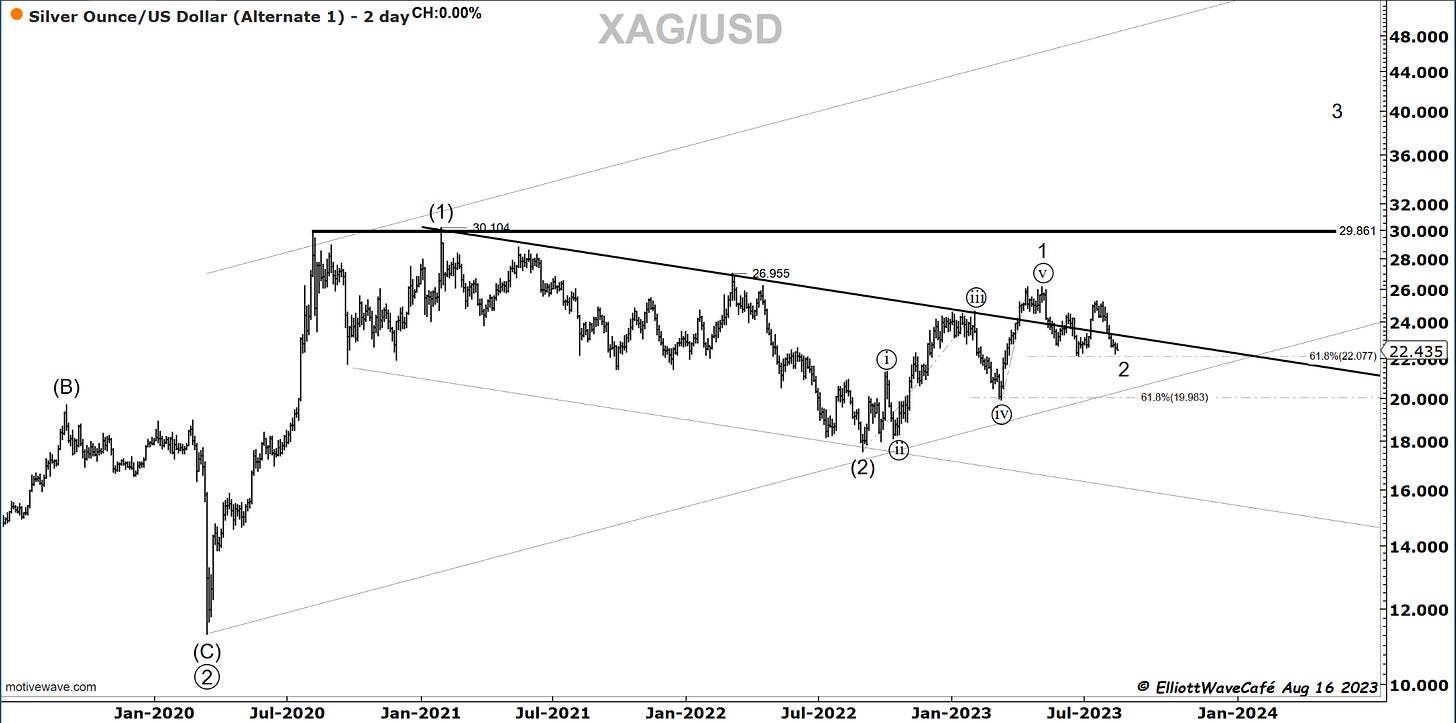

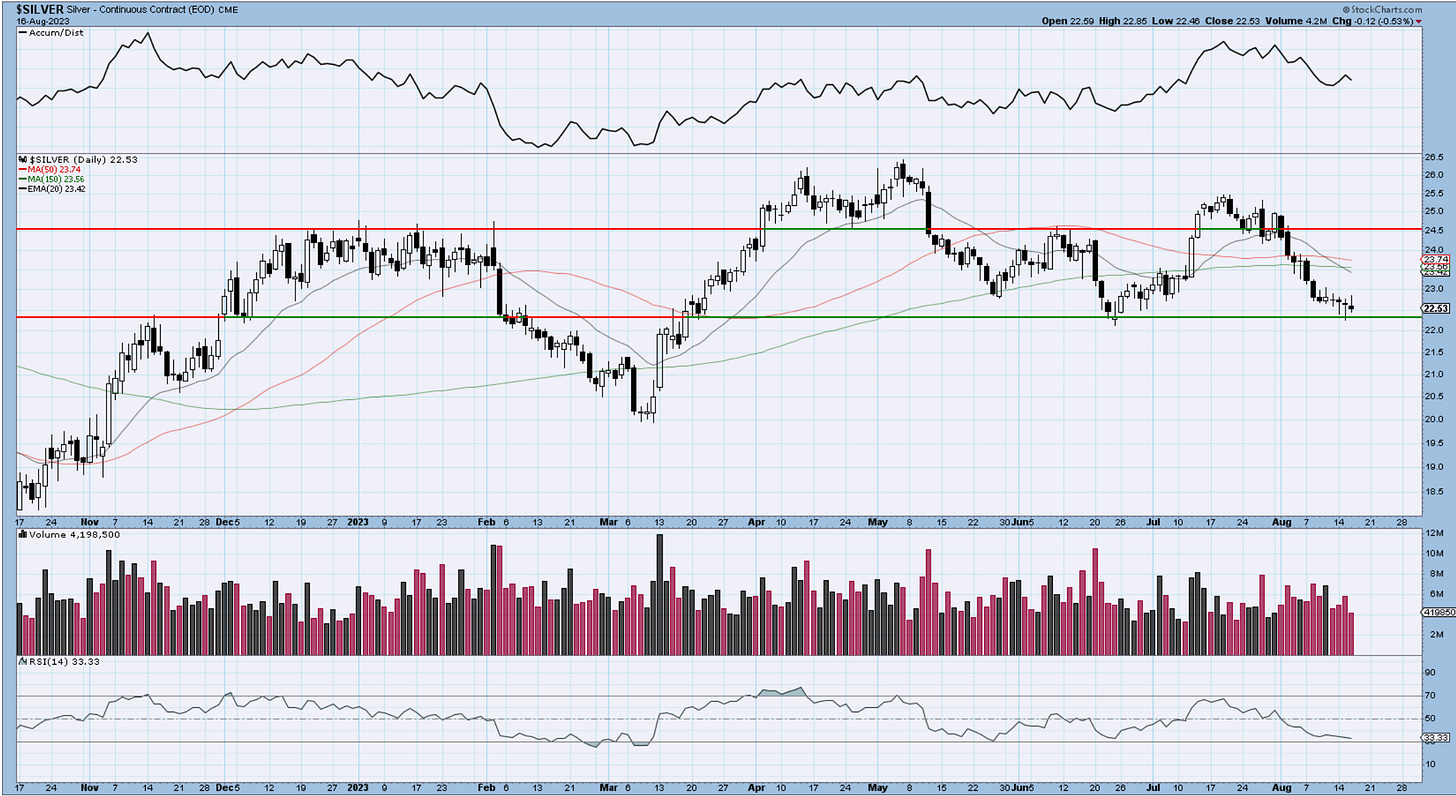

Silver

Massive Silver support here at 22.30. I will be starting to build long positions tomorrow.

Bitcoin

Any rally attempts in BTC continue to fail, pushing the corrective structure further to the right. If we break lower, we have 27105 at 61.8% as a fighting zone and anything below that could unleash a lot more selling. Bitcoin and ETH movement has been minimal since April. One of these days, the space will explode in volatility once again. One thing that worries me about this count, is that a 1,2 ((i)), ((ii)) should not behave like this. I think we’re getting very close to a resolution here.

See you tomorrow - trade well,

Cris

email: ewcafe@pm.me