The Daily Drip

Core markets charts updates and commentary

Note: The counts on the right edge are real-time, and they are prone to adjustments as price action develops. Elliott Wave has a fluid approach, is evidence-based, and requires constant monitoring of certain thresholds.

In the counts below, this (( )) = circle on chart

Here are today’s top 10 best performers out of 104 industries.

88 positive closes and 16 negative.

and bottom 10 …

SP500

A slow meltup higher today on low volume as US traders are marinating the turkey. Let’s see if she can hunt that 4607 before Nov ends. The advance is slowing down but there is no actual price evidence of a turnaround yet. I remain on high alert for that scenario and will press short bets once the opportunity arises. A standard EW approach is to only short after A wave unfolds, on a B wave rally to take advantage of C. Easier said than done. I will be posting any positions in our live position tracker.

Nasdaq100

The market is taking the last few gasps of air as it attempts to make new highs. My take is that we’re not far from a corrective unfold. Friday should be light, but a wave 3 top will be found before next week completes.

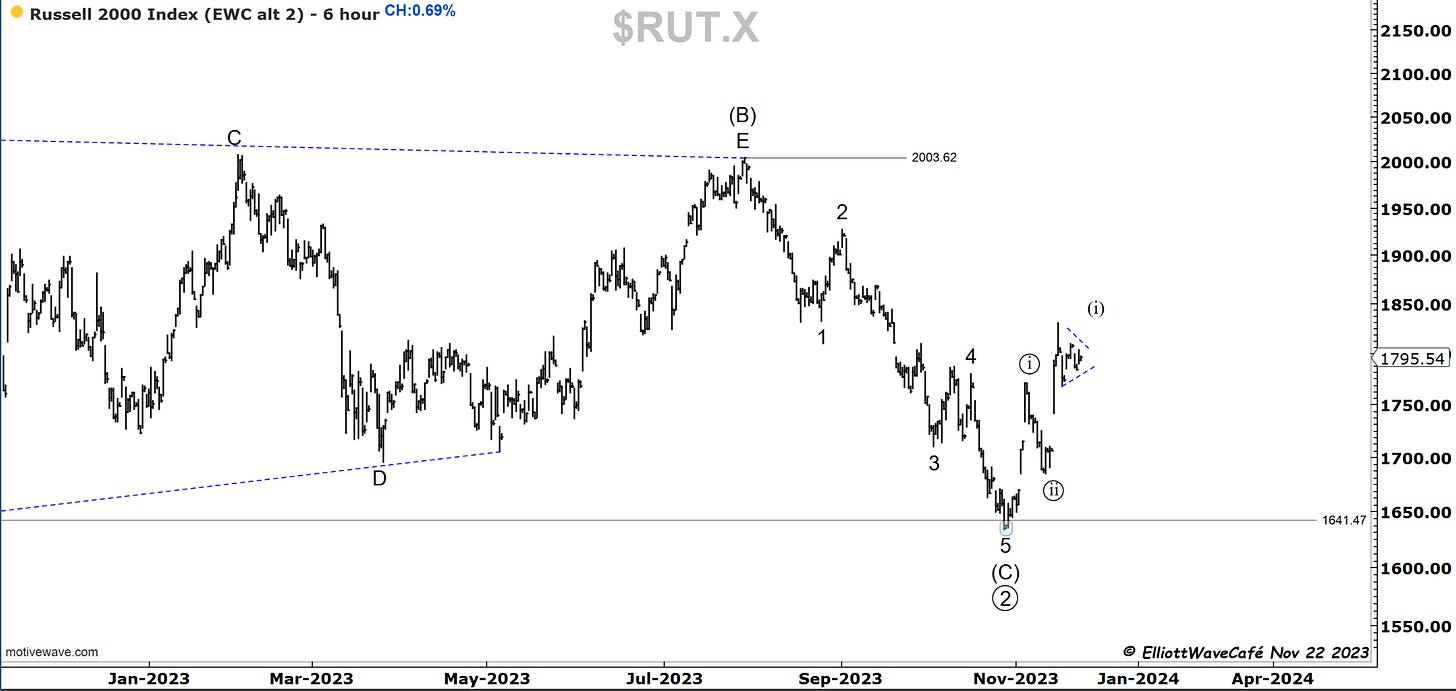

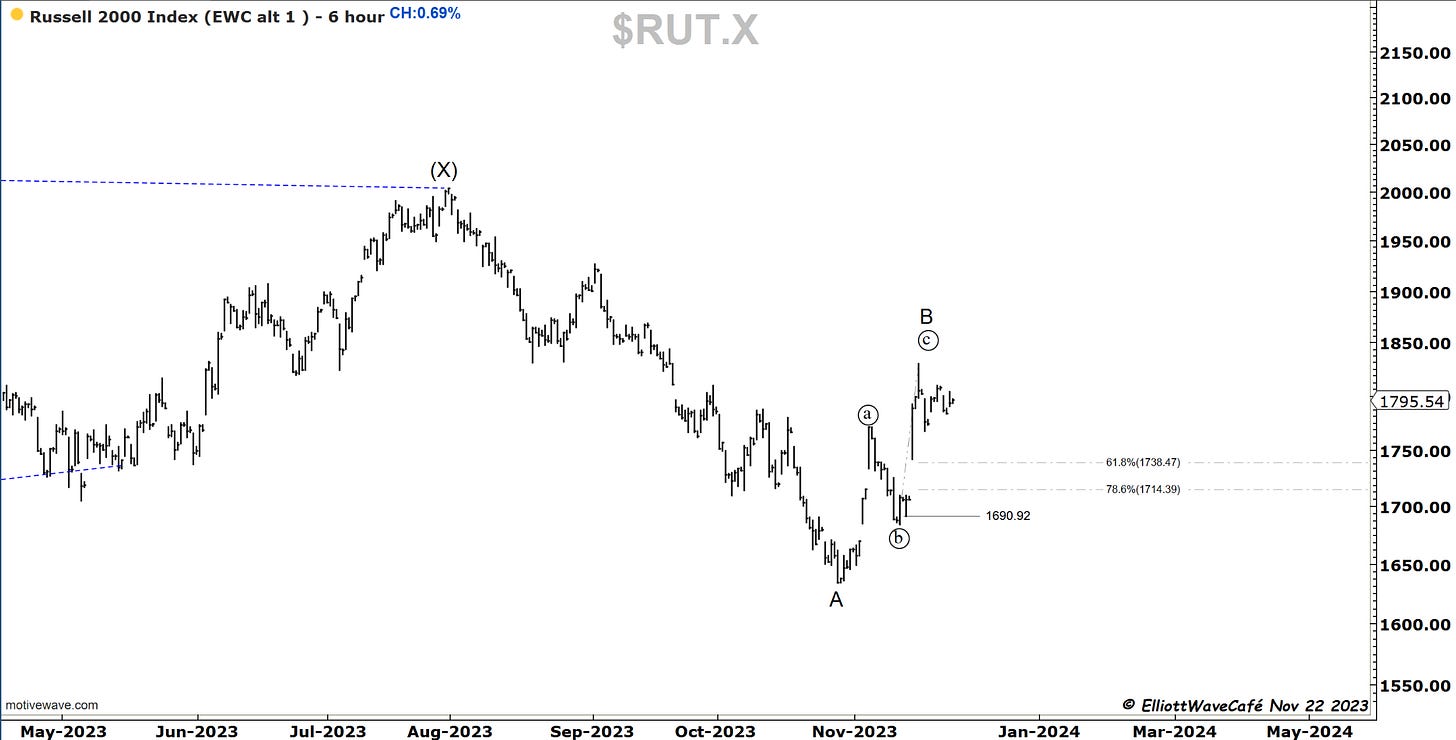

RUSSELL 2000

A 0.69% increase in the small caps, with a picture that is largely unchanged. Is that a small triangle before wave (i) actually completes?

Not the reaction I want to see after an ABC rally. The market consolidates rather than dropping lower. More convicting will build if we crack below that 61.8%.

Dow30

Tick tick to another high. The expectation is the same as on the other indices.

US Dollar and Yields

More support reaction today in the dixie. Increases the relevance of this level. If the dollar finds a bid here, that’s a headwind for equities and with them being elevated it won’t take much to get traders to bail out. Dollar is the silent king. Speaks softly and carries a big stick.

That 4.38 support continues to hold on the 10YR. No large rally of it yet which tells me they’re still pressuring towards a break. I see the chances of a 3 wave rally elevated.

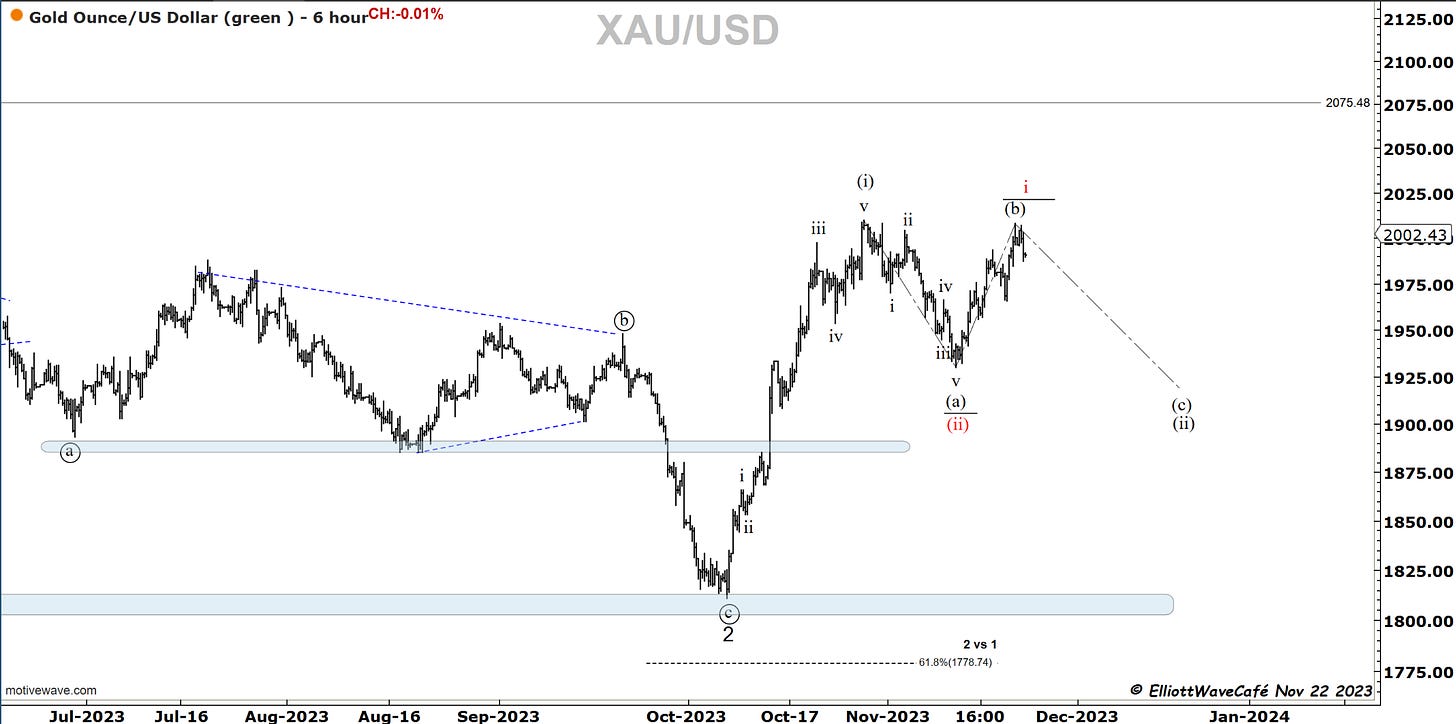

Gold

Gold dropped a bit in sympathy with a small dollar rally. Not reading much into it. If it breaks 1965 we can talk about something more. For now, it’s a “wait”.

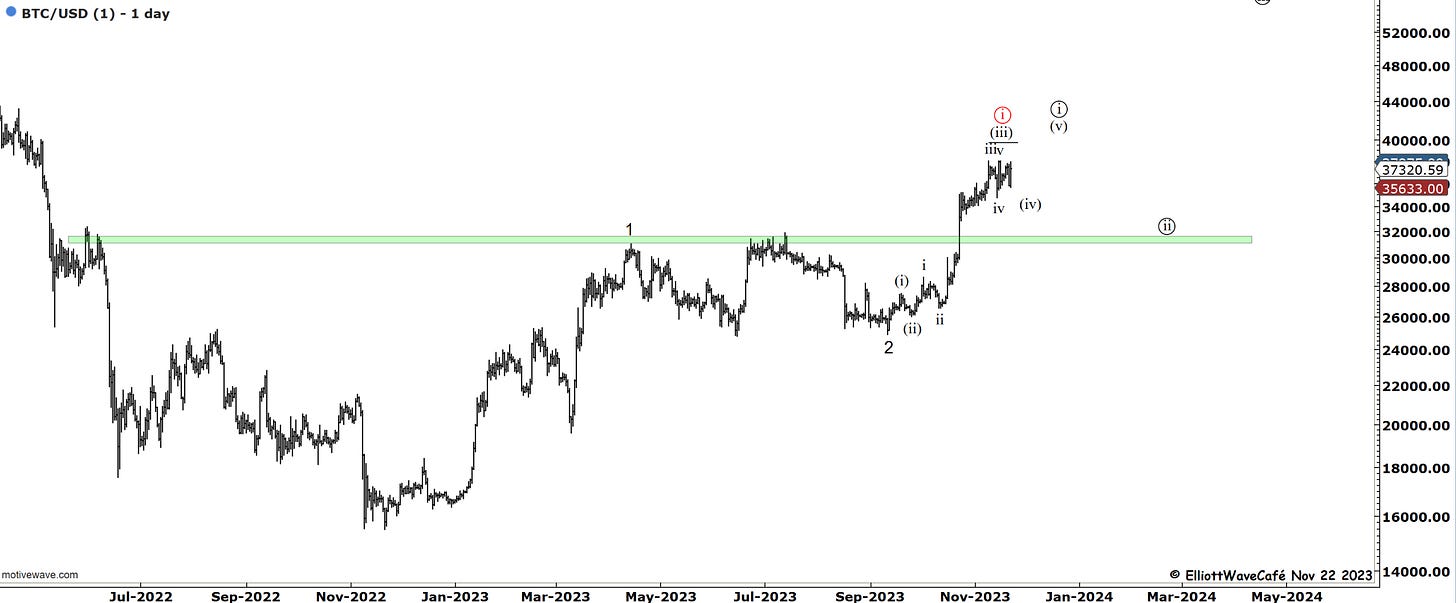

Bitcoin

Crypto traders live and die by every movement of this asset class. Especially newer ones. Not every dip is a crash and not every rally is a moon. Most times there is sideways, false starts, retreats, and fakeouts. I said something on Twitter and I am sure here on this letter a few weeks ago.

Since that last thrust on Nov 9th, we went nowhere, but it seems that we crashed and rallied a few times over. The sentiment was frothy back then and it needed to adjust. Maybe it has already. I don’t have the same edge on reading that sentiment anymore, so I will refer to the EW counts for the time being.

4th waves are tricky, so take a look at the price action since roughly Oct 23rd. A multitude of complex waves and triangles. The way it continues to build this sideways mess, suggests that we can still have one more thrust in wave (v) before we begin the corrective process once again. If we do escape higher without checking back towards 32k, then the crypto market has extreme underlying strength and it’s prone to explosive action. My bet is not on that at the moment. But I can be convinced.

I will resume market coverage at the close on Monday the 27th.

Happy Thanksgiving to all who celebrate it! Thank you for your support and continued interest in my writing coverage.

Have a great day wherever you are! - trade well, and don’t forget to subscribe and drop a like if this letter helps you in any way.

Cris

email: ewcafe@pm.me