The Daily Drip

Core markets charts updates and commentary

Note: The counts on the right edge are real-time, and they are prone to adjustments as price action develops. Elliott Wave has a fluid approach, is evidence-based, and requires constant monitoring of certain thresholds.

In the counts below, this (( )) = circle on chart

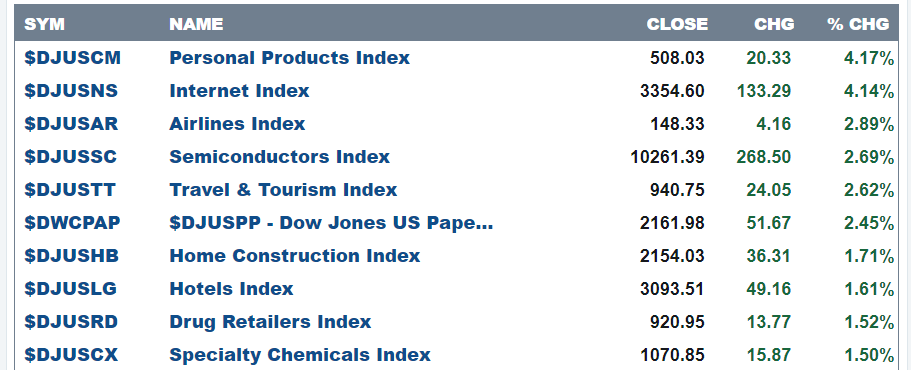

Here are today’s top 10 best performers out of 104 industries.

70 positive closes and 34 negative.

and bottom 10 …

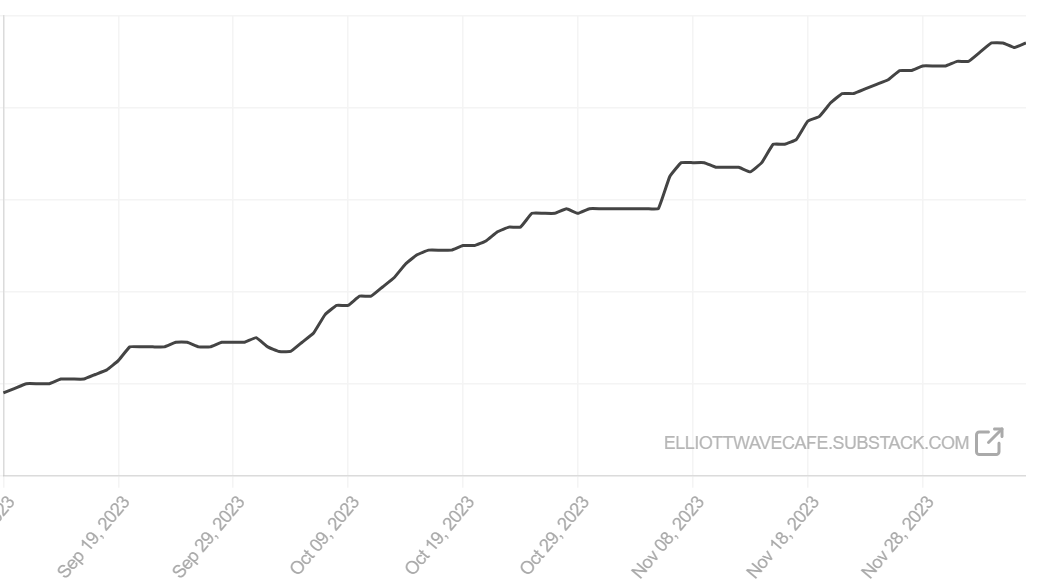

Welcome to the last report of the week! I want to sincerely thank all the subscribers to this letter and show you the EWCafe growth over the past several months. I think is a 3rd wave :). Thank you for reading and I hope you find my writing and charts helpful to your trading/investing.

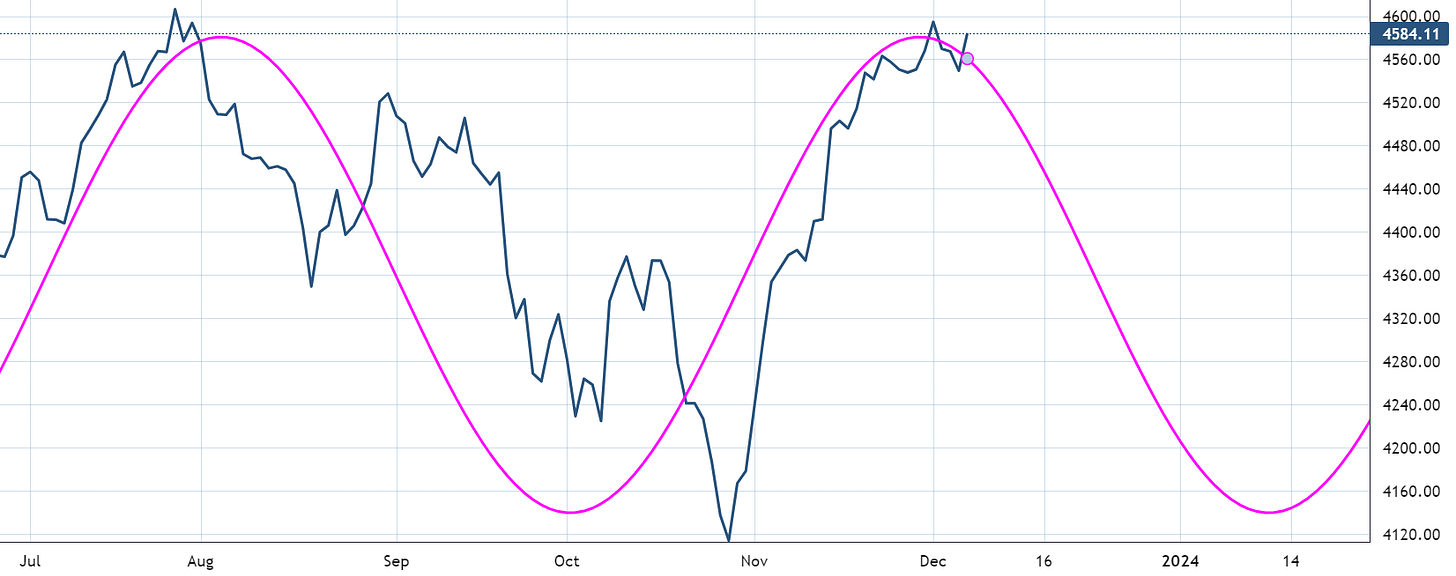

SP500

The 4545 level was held in the SP500, and today, we bounced higher. The immediate bearish count is being put under pressure. If tomorrow's NFP number sends the index above 4600, it will delay the corrective pattern until wave (v) of ((v)) is complete. Below 4545 correction should already be underway, and we are looking for 4500 initially.

As a reminder, here is the 80-day active cycle in the SP500 for perspective on bullishness.

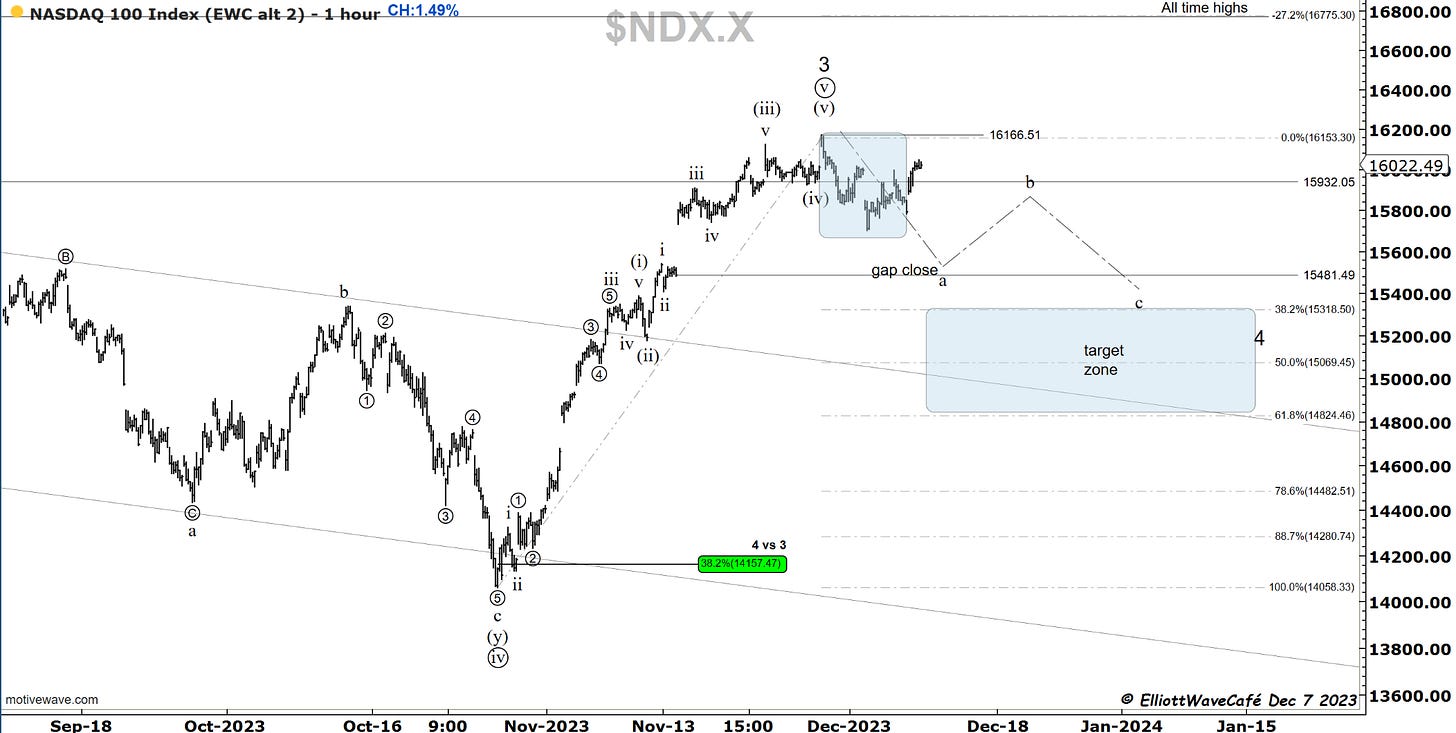

Nasdaq100

A strong +1.49% rally threw cold water over the 1,2 1,2 prospects mentioned yesterday. It is now becoming unlikely that any corrective move at this stage will take the shape of a clean zigzag. We either make a new high and reset the corrective expectations after, or we resume lower in a complex setup. Tomorrow’s volatility might offer some answers. I am still of the opinion that the move lower so far in Nasdaq is quite short and insufficient in correcting the entire November advance.

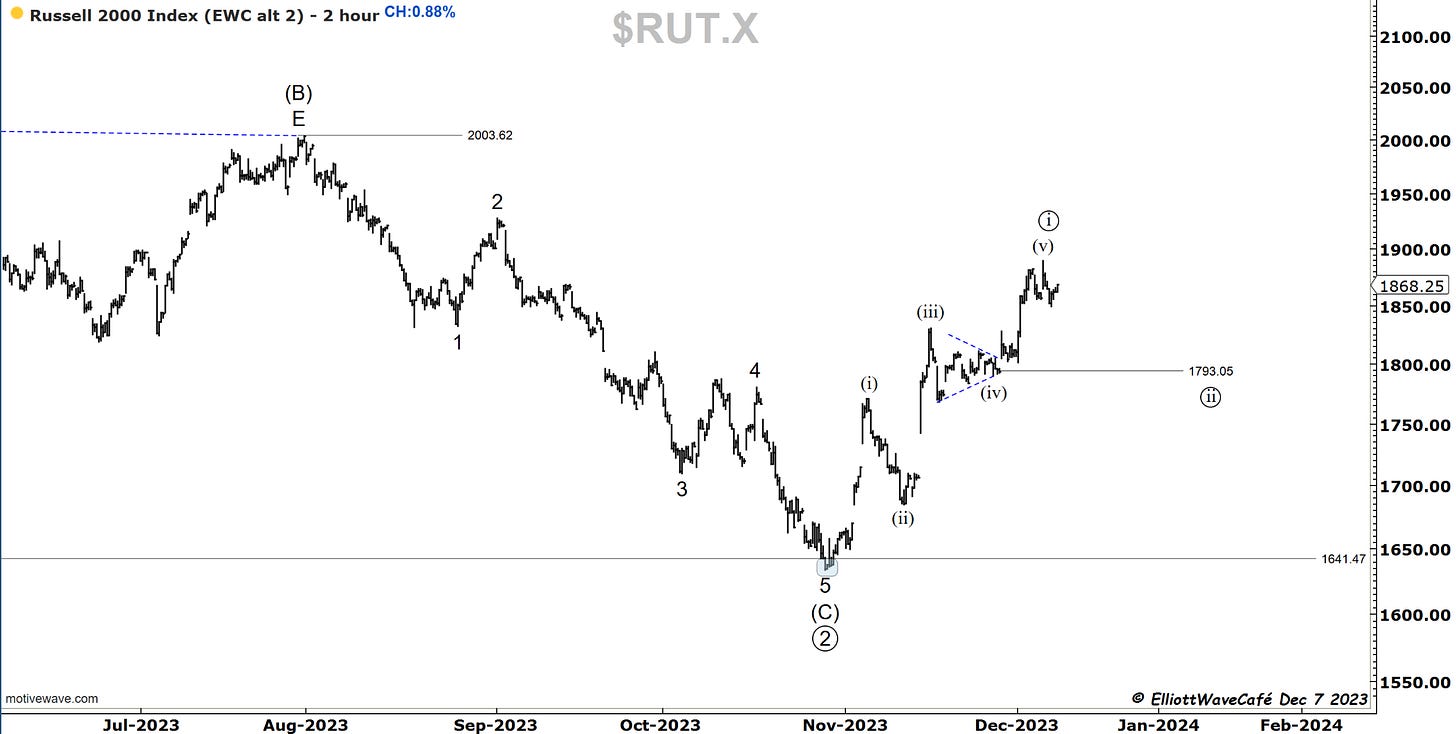

RUSSELL 2000

no changes here. prior comments remain.

Today’s move higher in Russell was made to complete a 5th wave (v). Based on that, we would now need to see a throwback towards the triangle apex at 1793. We will revise the count once and if we get there.

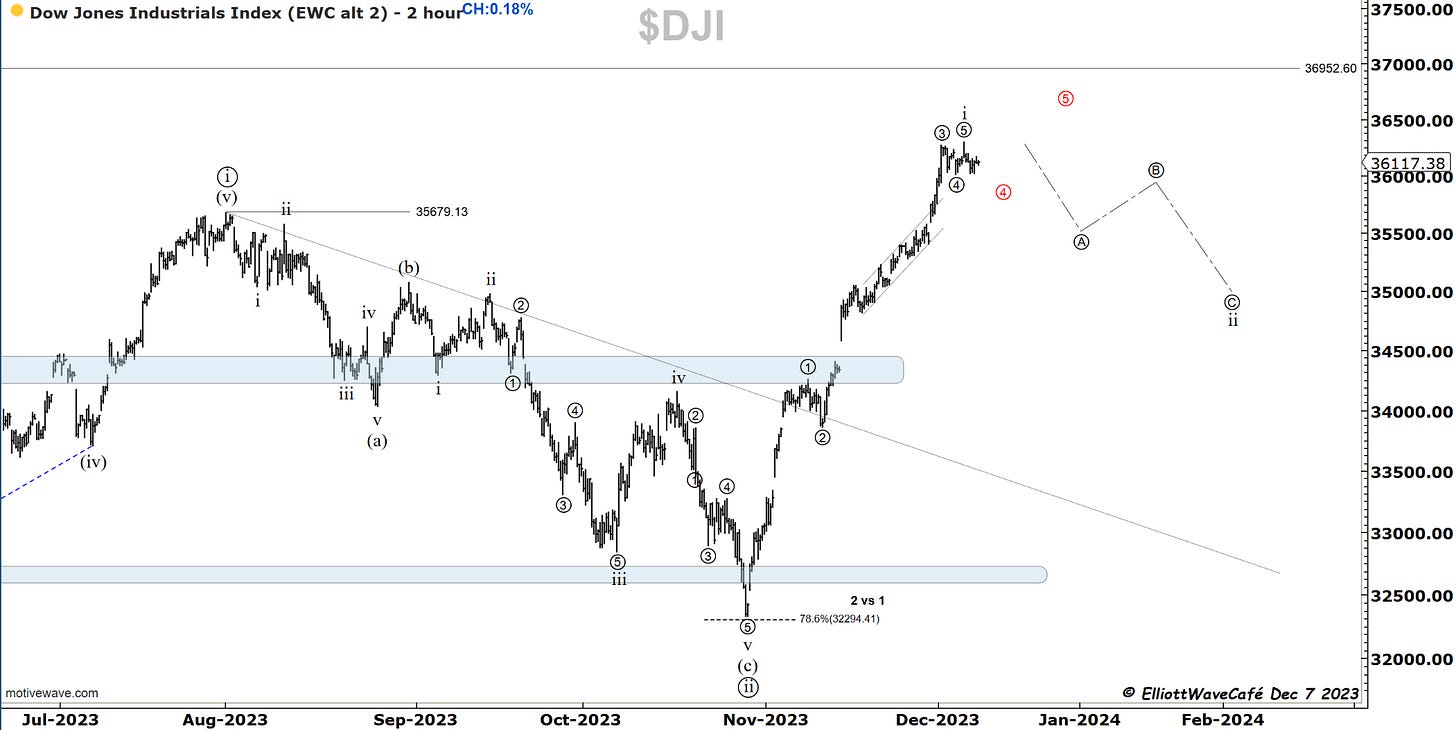

Dow30

Dow was relatively weak today. The count stands and an appropriate correction should start unfolding in the not-too-distant future. Any move higher should be short-lived.

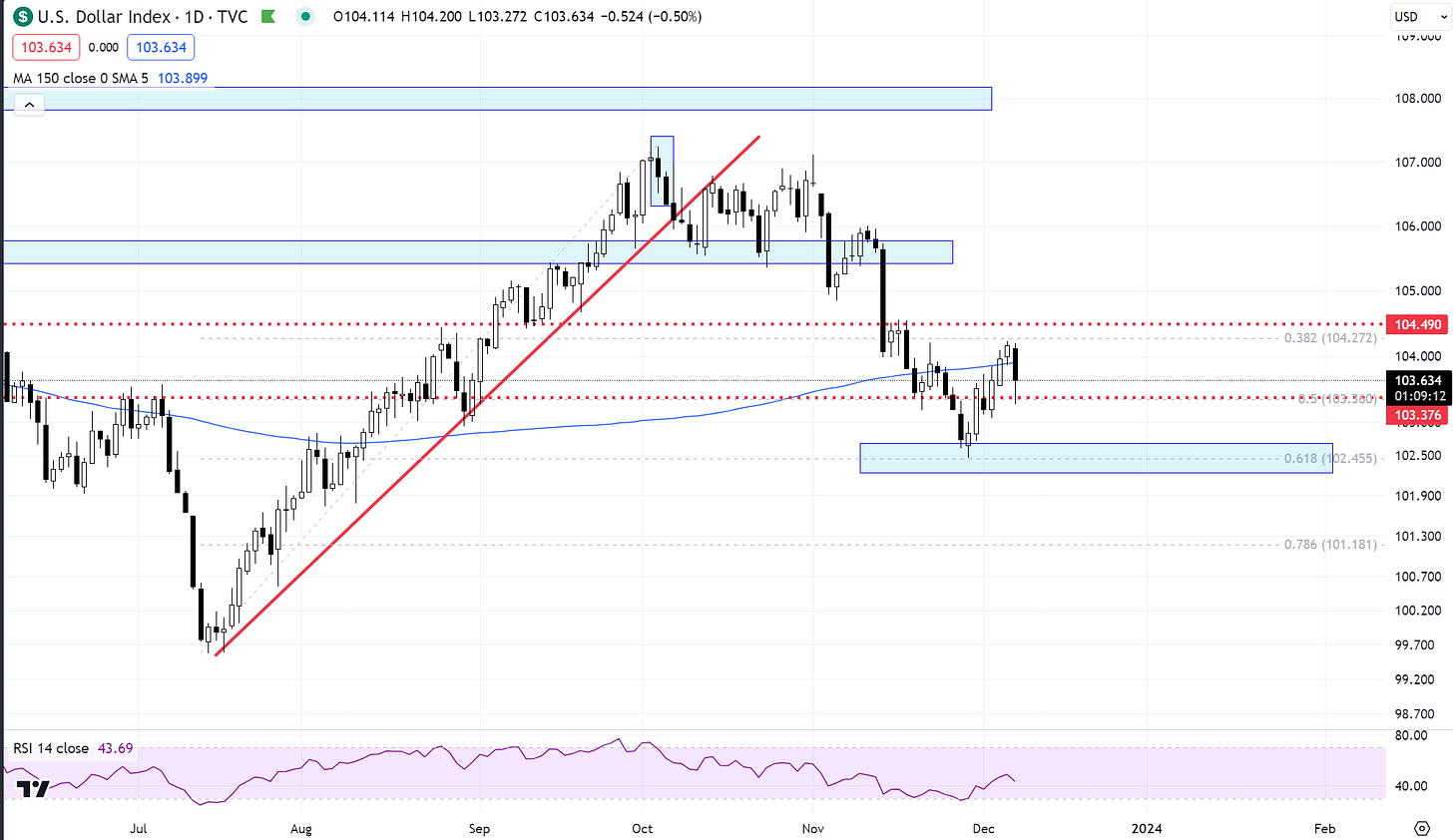

US Dollar and Yields

The dollar gave up a bit of ground today back into previous support. With yields appearing to stabilize for a second day, it could regenerate and push higher once again especially if a strong NFP number is being displayed tomorrow morning. That should send yields higher. Tough to believe here at the 150day and near 4% that a weak NFP number can melt yields down. This is where the “buy the news” axiom comes in ( or sell them if you think at the corresponding bonds TLT).

Gold

Just hinting at this in Gold until we get better visibility following this failed breakout. It really hasn’t managed to get anything going back to the upside. If it had been a Sunday night “glitch” we should have recovered most of the losses already. This action here is not favorable for longs.

Bitcoin

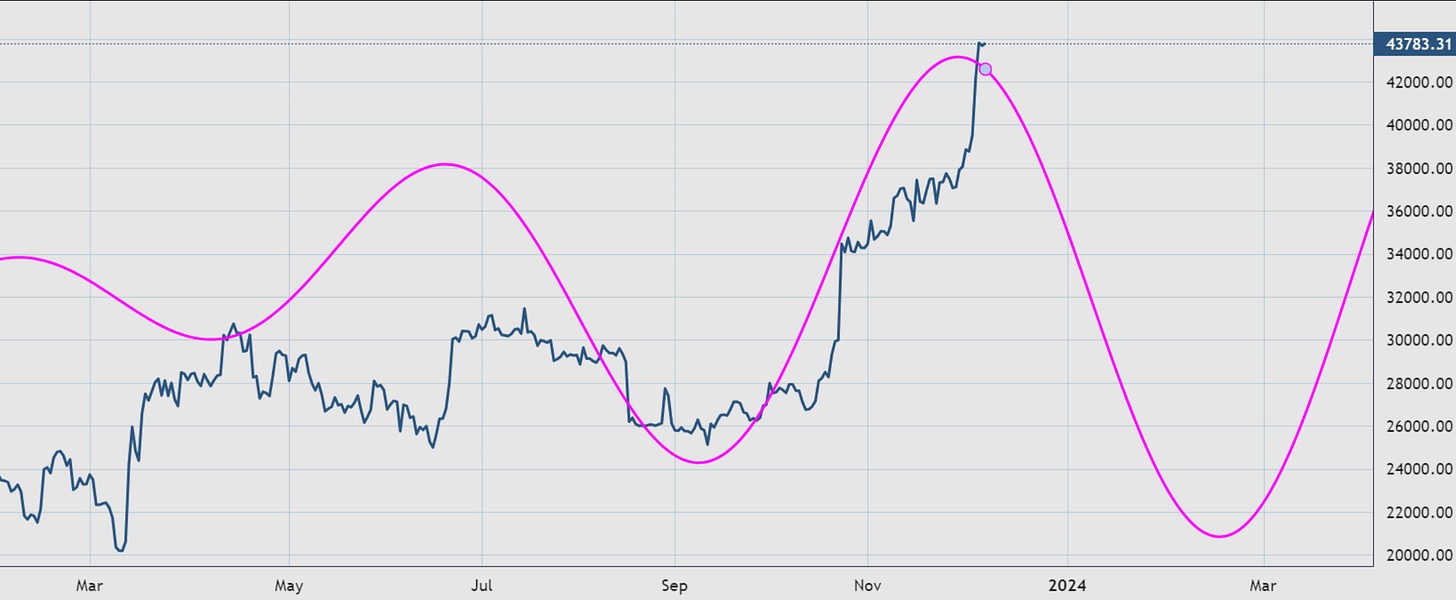

Bitcoin is correcting slightly as expected. There could still be a couple of attempts at higher prices, but they should prove short-lived. The confluence zones discussed in these updates along with a wave count that should exhaust itself soon, continue to make me believe that the pullback is growing its odds. The crypto gears seem to shift towards ETH and altcoin land for the near-term. I have no technical opinion on those at the moment.

Here is the 150-180 day cycle in BTC suggesting a likely period of weakness upcoming. The depth of the correction is not what we’re looking for here but rather time spent on it.

The much larger count can be found here. Presented this on Nov 16th note.

“Double shot” Daily video coming up next,

Have a great day wherever you are! - trade well, and don’t forget to subscribe and drop a like if this letter helps you in any way.

Cris

email: ewcafe@pm.me