The Daily Drip

Markets review, strategy and analysis

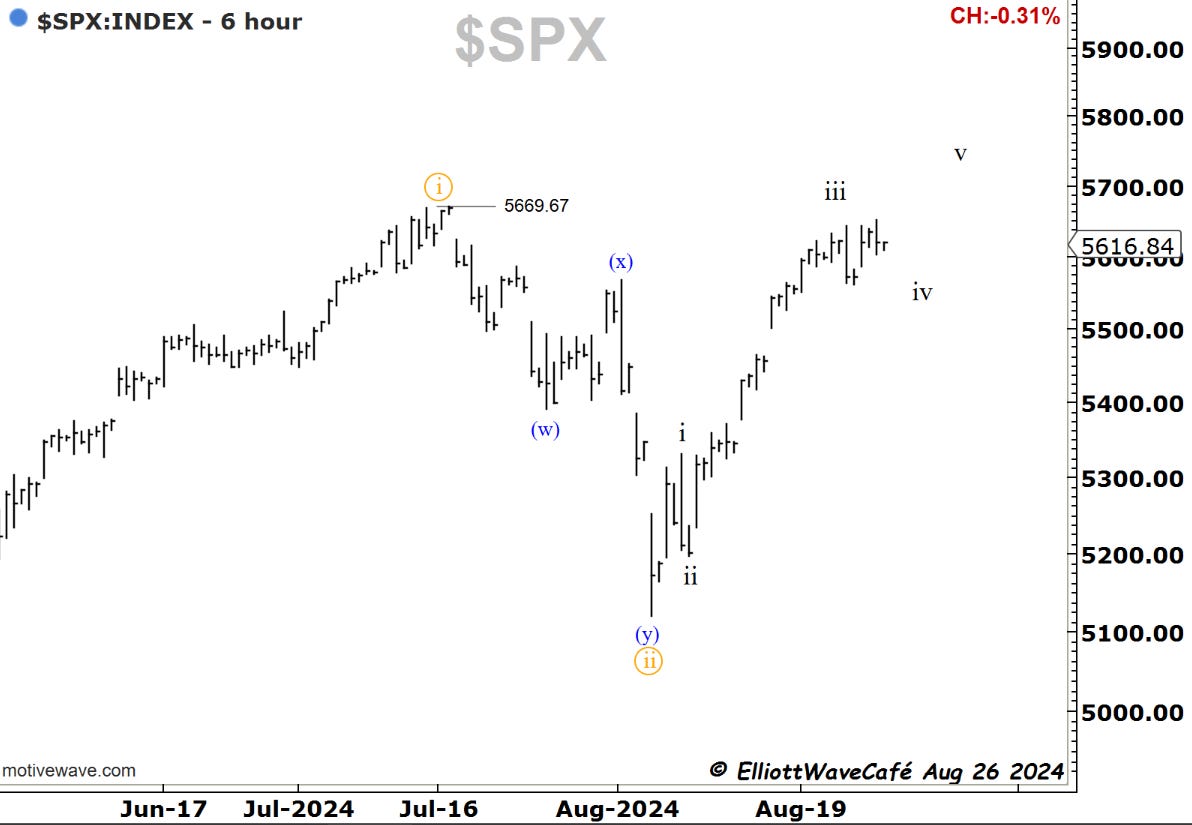

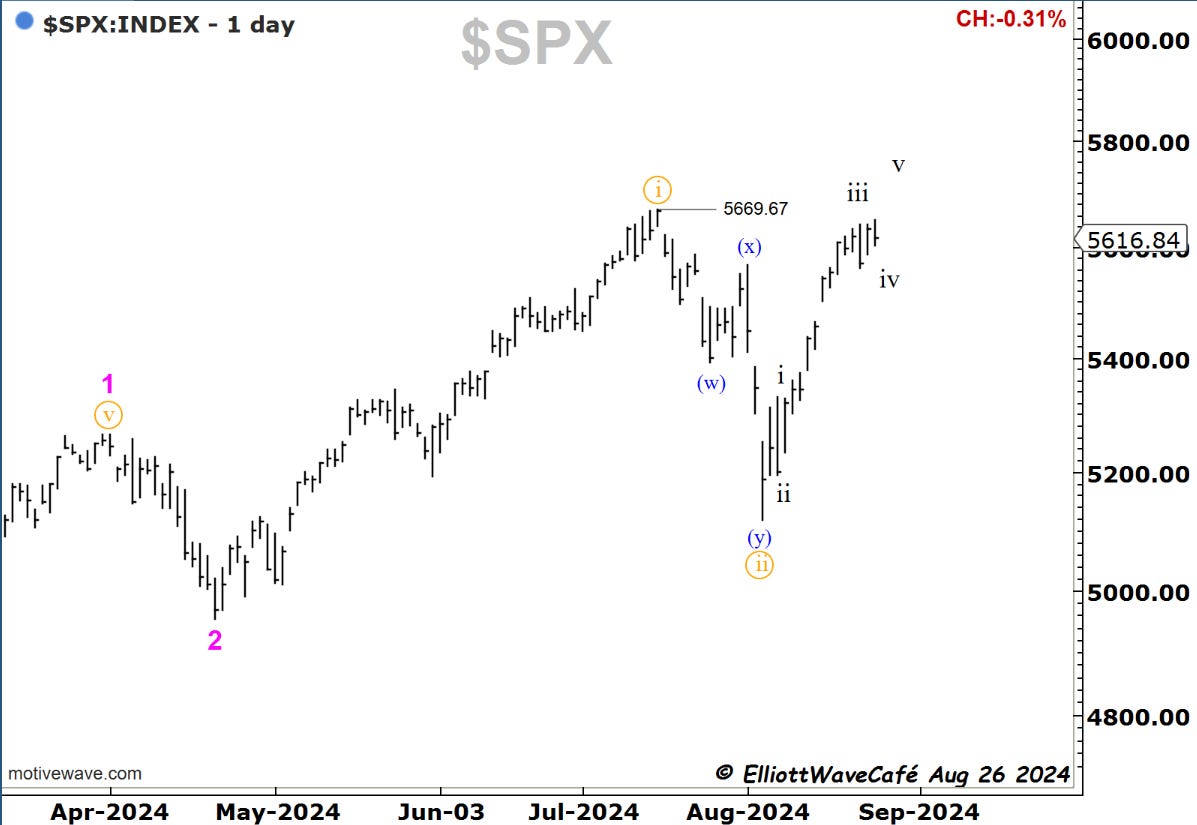

SP500.

I hope everyone had a good weekend.

Powell’s rate cut signal Friday came, of course, after the market had already been rallying by about 10% from the August lows. It is no surprise that some latecomers will have to be tested here if they bought the news. It is possibly what creates a fourth wave before another thrust in wave v begins. If we get another three-wave decline after this five-wave thrust, that will create the next long opportunity. But remember that the market does not have to do that. It does not have to do anything that we’re expecting it to do. It’s the most basic and raw reality of markets.

I have cut some long exposure today, bringing it to about 84% long from a bit over 100%. If possible, I want to avoid a corrective period, so I will watch the 20—and 50-day MAs on indexes and individual stock holdings to see if I need to pull back some more.

The technical page tells me to stay the course and let the market develop further. All indicators I watch are positive. A break below 5450 would be an alarm signal.

Let’s have a look at BTC and the rest of the markets …