The Daily Drip

Core markets charts updates and commentary

Note: The counts on the right edge are real-time, and they are prone to adjustments as price action develops. Elliott Wave has a fluid approach, is evidence-based, and requires constant monitoring of certain thresholds.

In the counts below, this (( )) = circle on chart

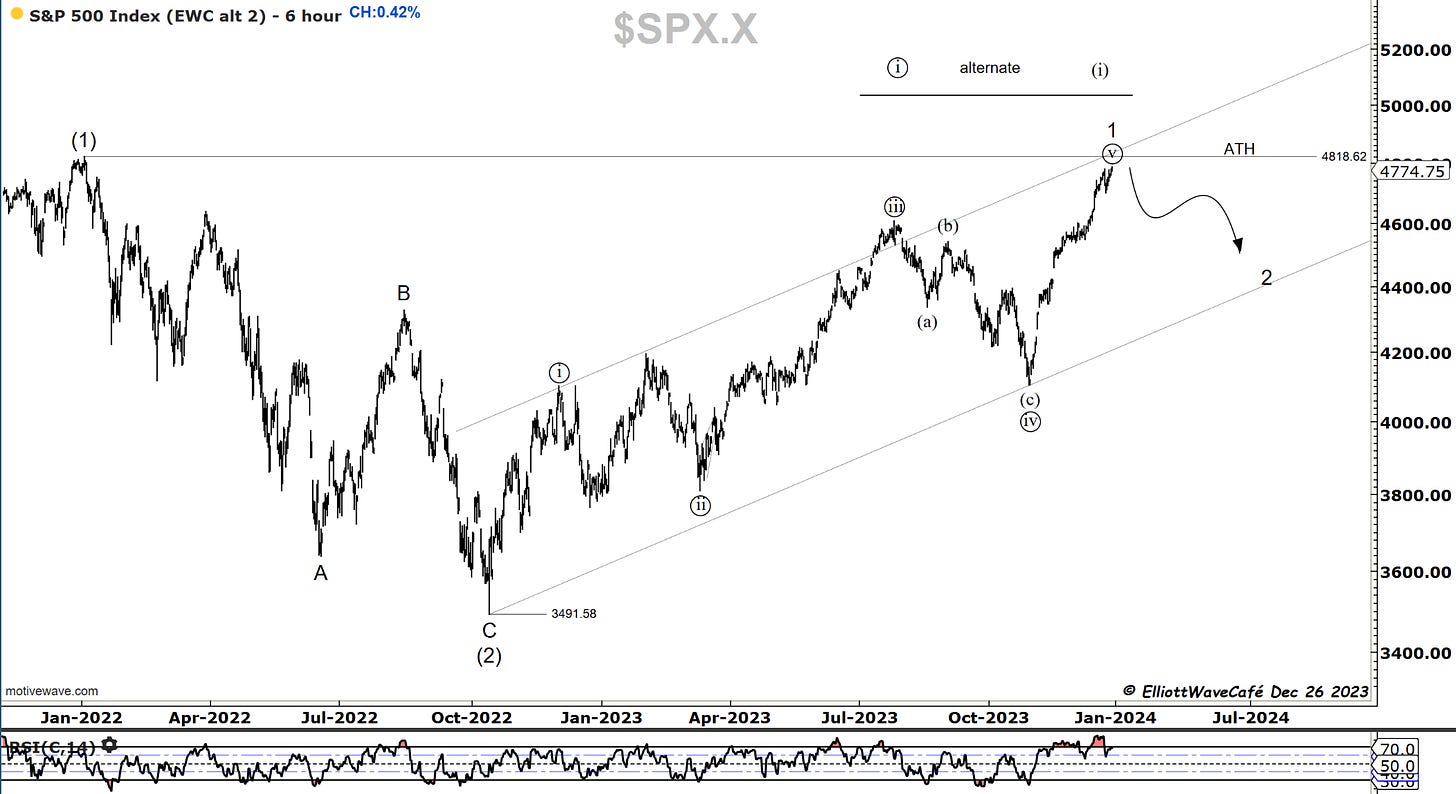

SP500

We are in the final stages of this rally. A very low-volume day ( as expected in the last week of the year) sent the market higher today in an attempt to break to new ATH. We are near 100% perfect equality between waves ((i)) of Oct 2022 lows and the current move from late Oct 2023. Historically, the day after Christmas has been positive about 70% of the time. The following 3 days after that give us only a 30-35% positive rate. Then January and February are not very good performers overall. The first few days of the year are usually good. So, the bottom line is that it will get tougher from here for the indexes to continue rallying at this rate. A consolidation/correction is the most likely outcome, and the counts agree with it. My initial target is 4600.

The alternate counts are suggestions and will kick in depending on how the correction unfolds.

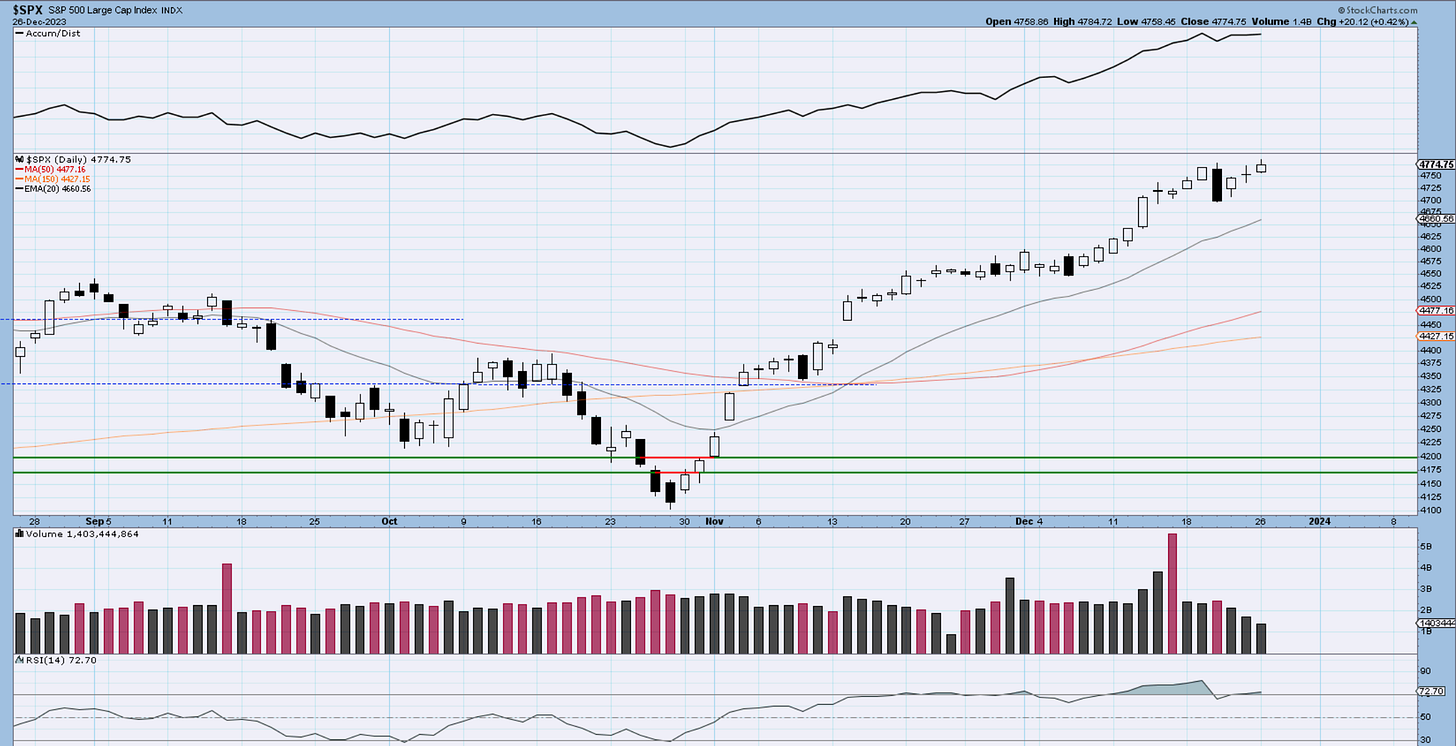

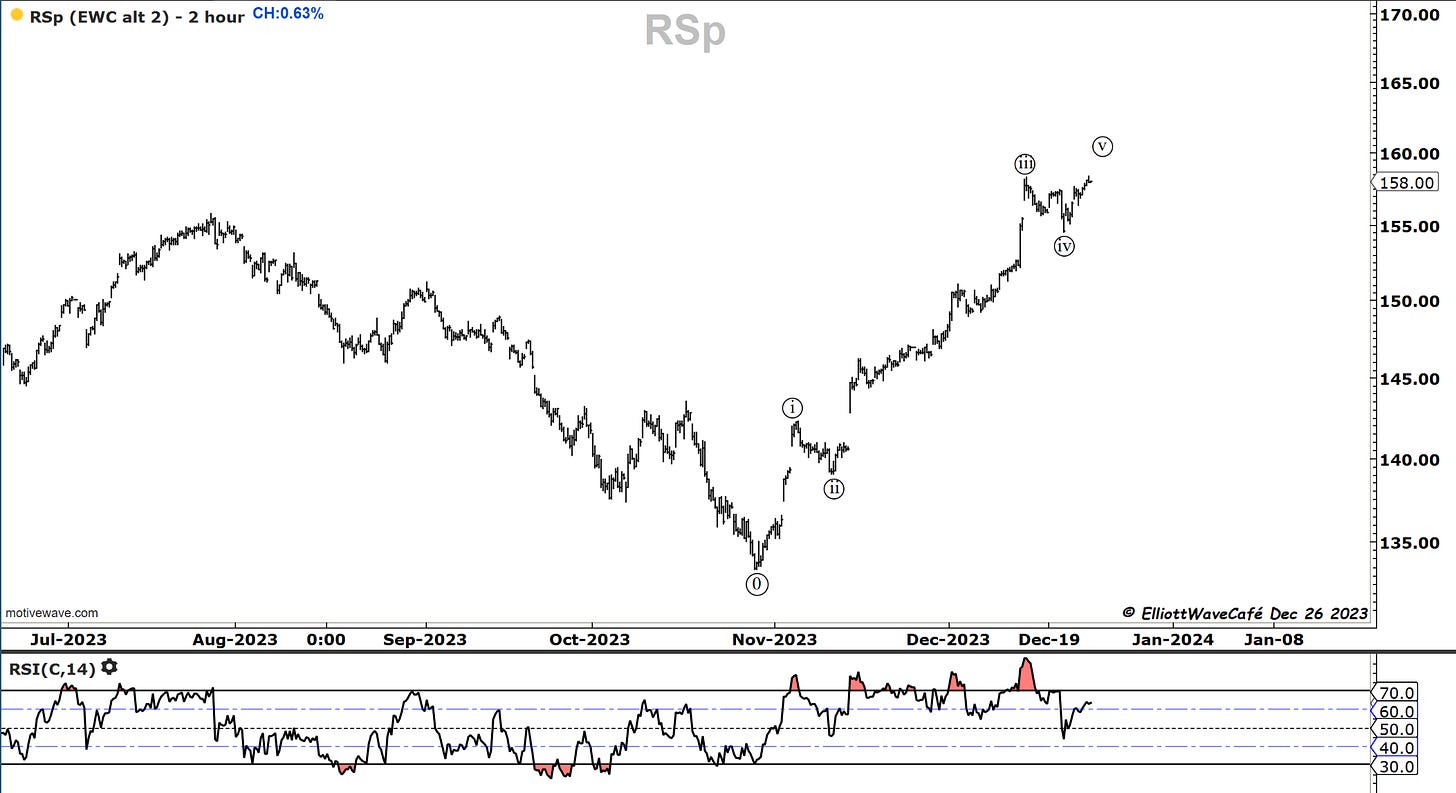

For a quick comparison, I invite you to check out the equal-weight SP500, aka RSP. Here are the waves at the current stage. Not something very inviting with fresh money.

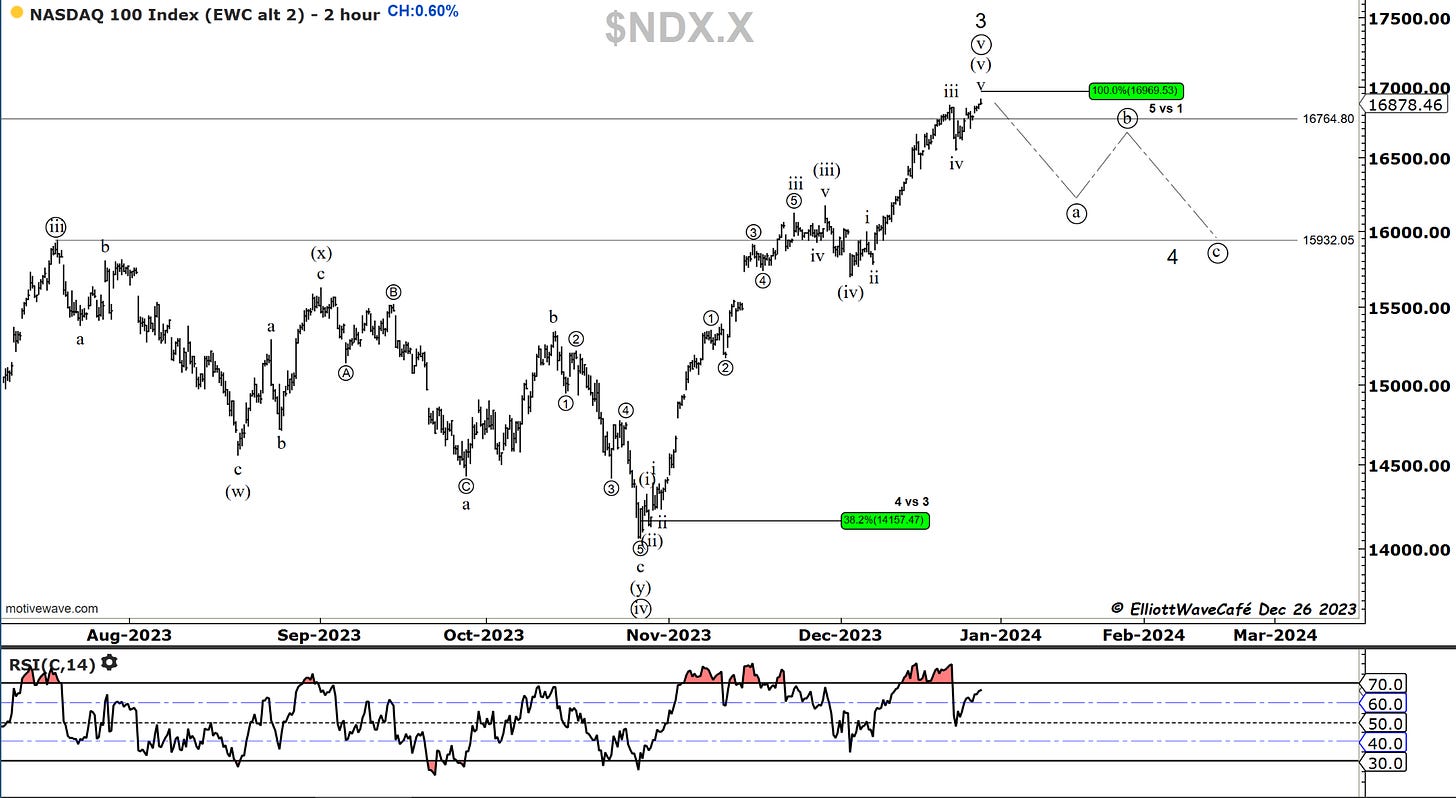

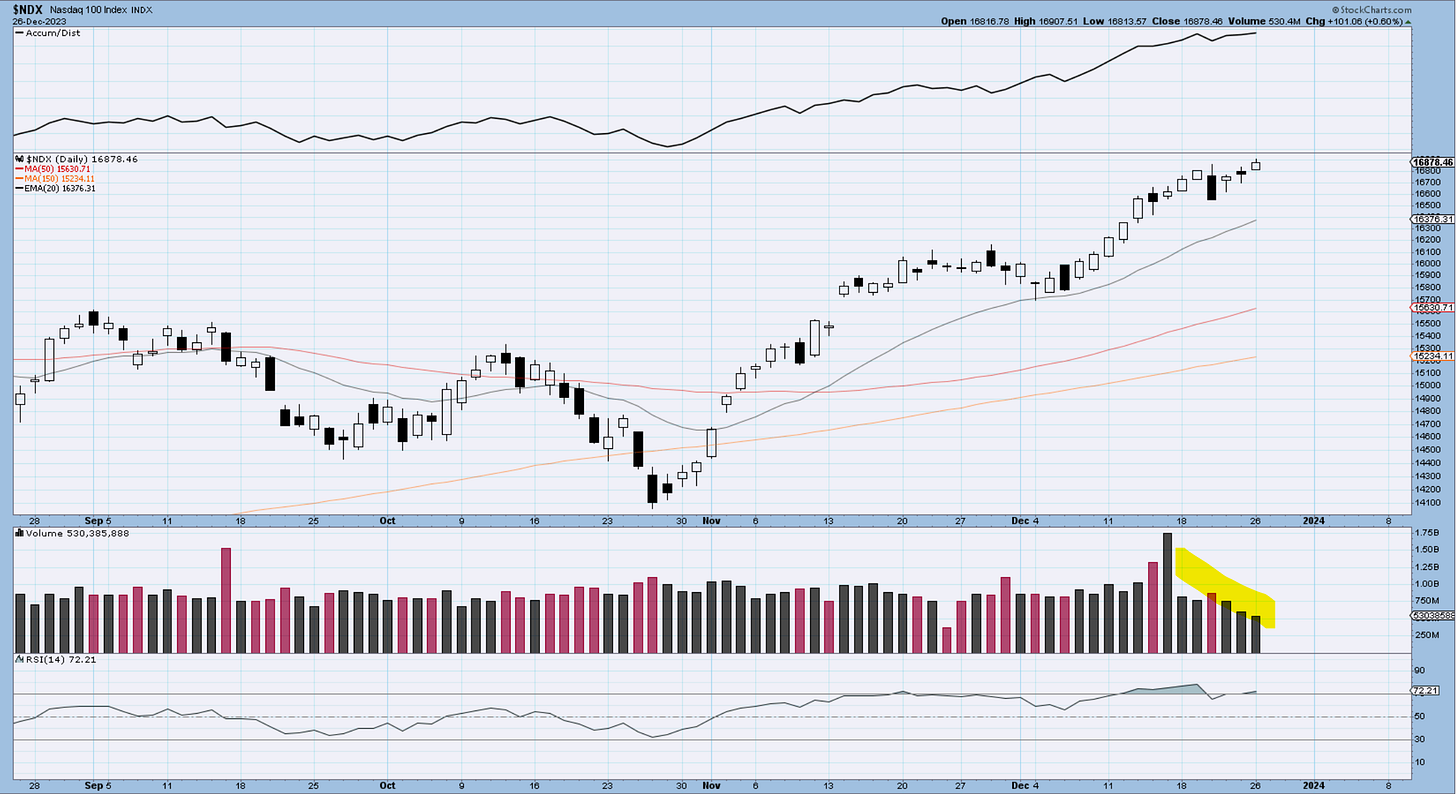

Nasdaq100

We did make a new high once again, but I think the selloff from last week was a warning sign of an upcoming correction. It might take several tries to establish the top-of-a-five-wave move. A breakback below 16,550 would be needed to get that higher conviction.

Wave equality near perfection.

A dry-up of volume is visible in the Nadsdaq as well.

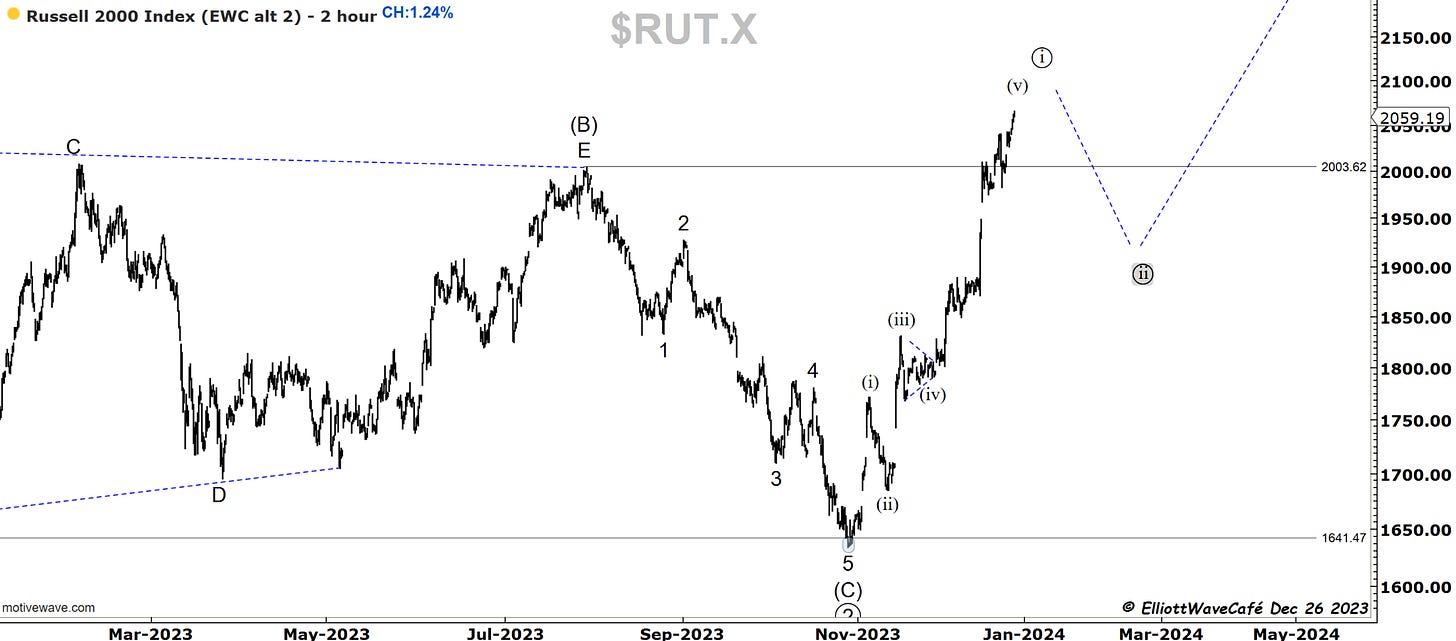

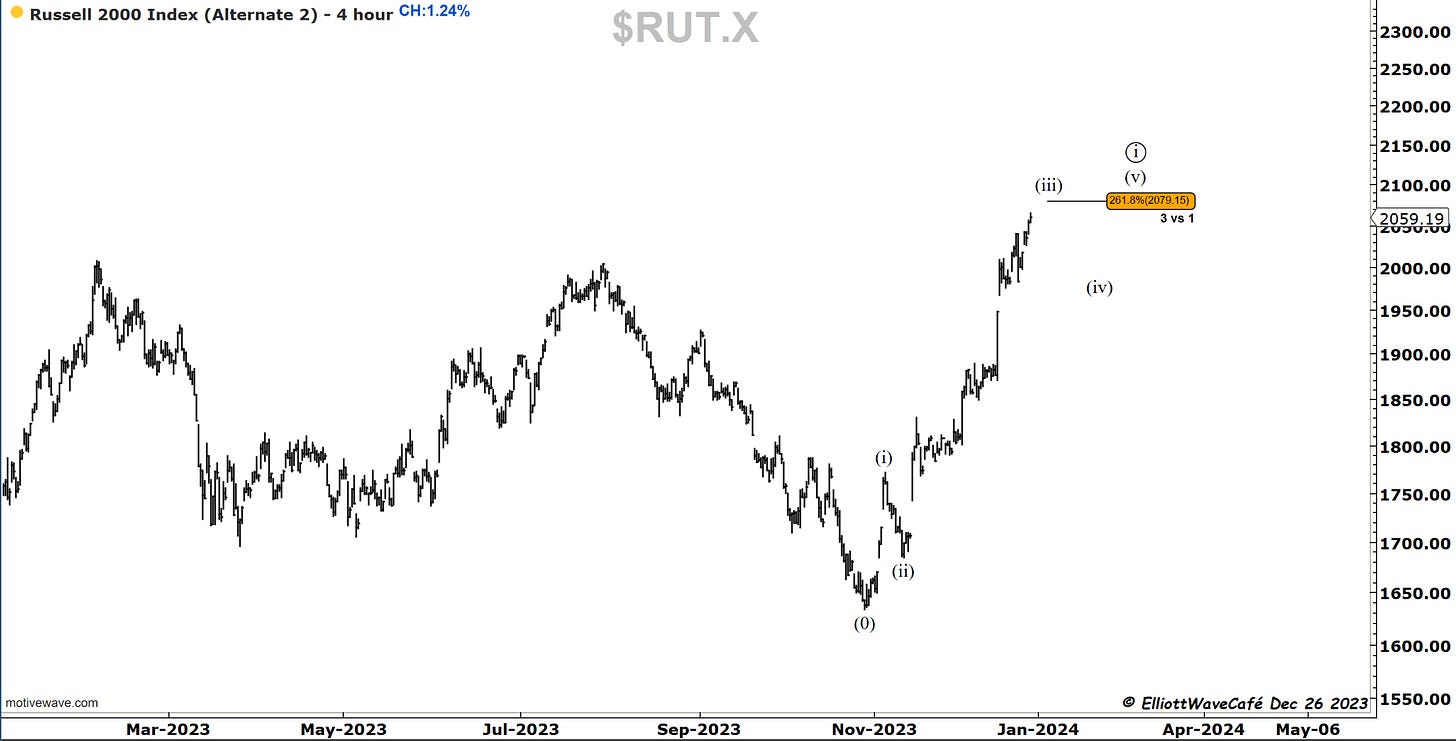

RUSSELL 2000

I am monitoring 2 wave counts in the Russell. The first one has an extended 5th wave and the second an extended 3rd near 261.8%. Both suggest we’re close to completing the move. A wave ((ii)) will be unfolding next.

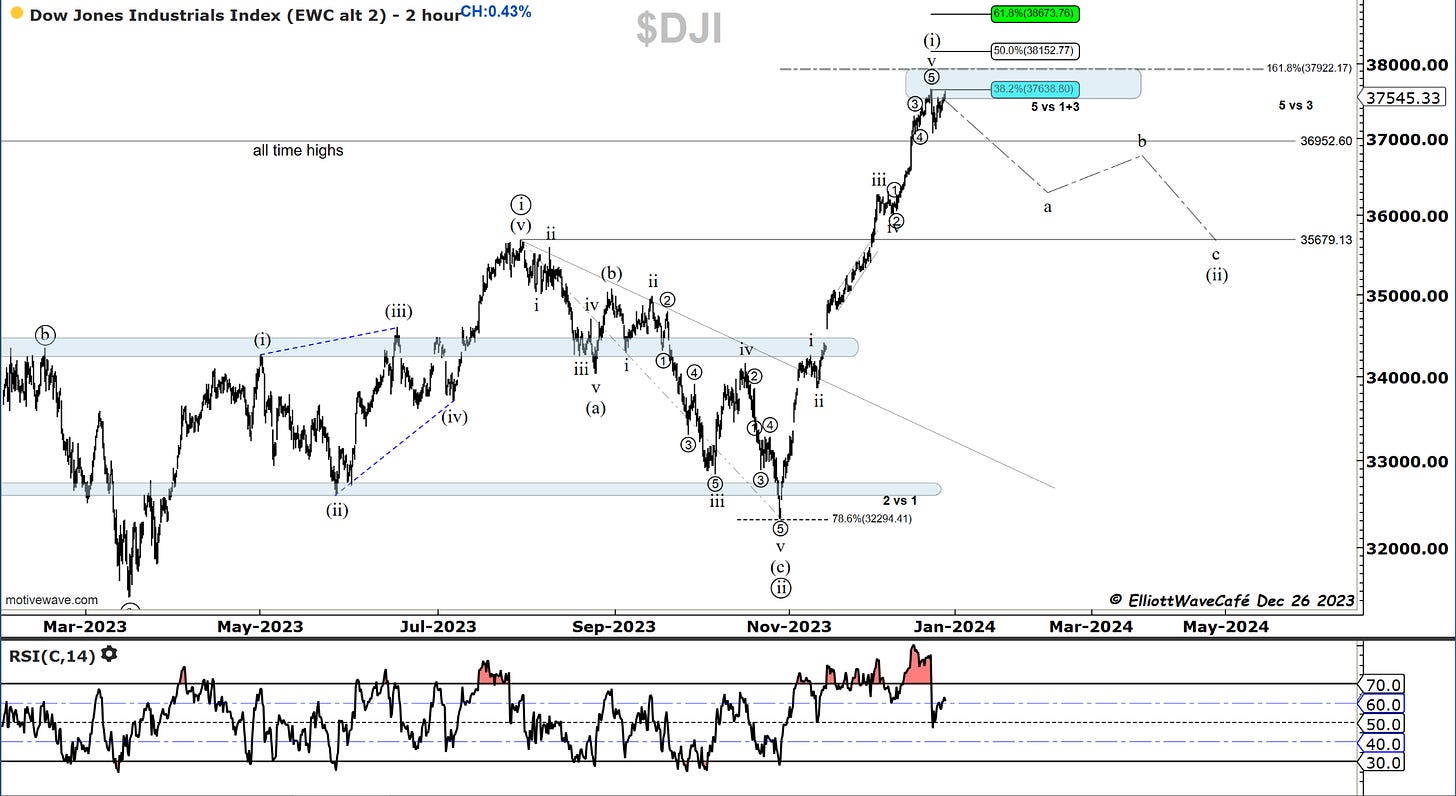

Dow30

Dow recovered the losses from the last selloffs, but the chart will be struggling going forward for a couple of months. A re-test of 36000 is very likely. A break of 37k should get things going.

AAPL is the most important stock in the world and is not doing that well. Broke below its 9-day MA.

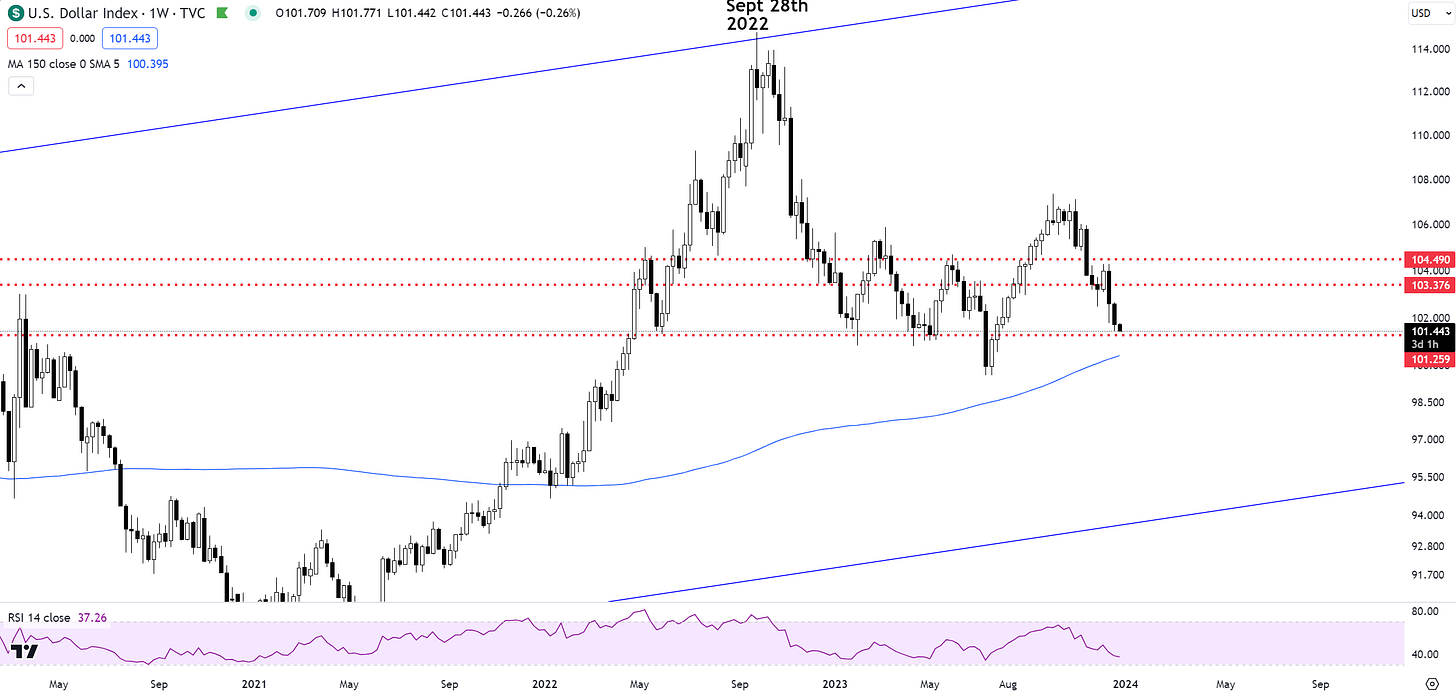

US Dollar and Yields

My message here stays the same. Both dollar and yields are at strong support levels. If they bounce, risk trades will need to take a back seat for a while.

I have been watching markets for the past 15 years, and I am still in awe of how well the 61.8 number works across all time frames. Here is the 10yr yield.

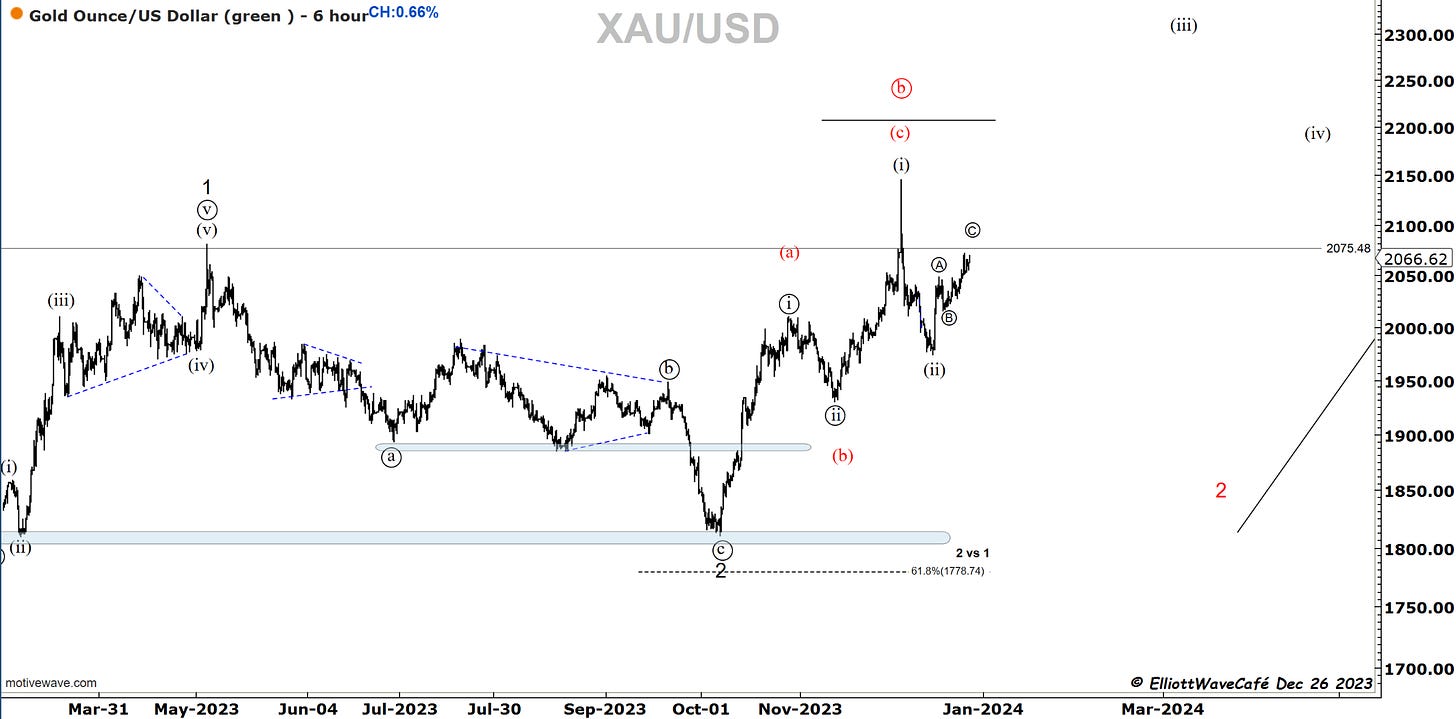

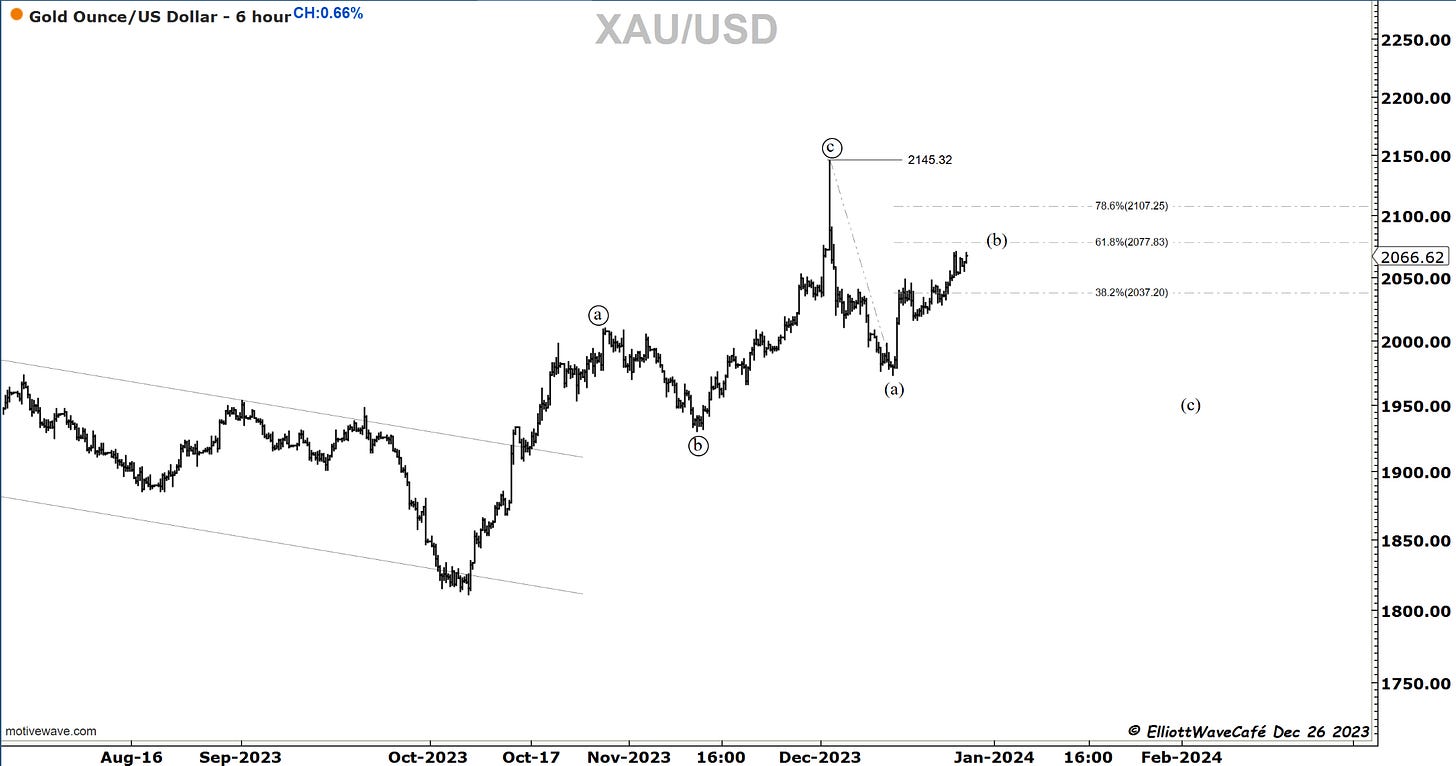

Gold

Gold has recovered nearly 61.8% of the latest selloff. What happens here will dictate the next direction. A move above 78.6 will put back in favor the 1,2 1,2 count from the first chart. A failure will open the door for further drops in wave ((c)) of 2 red (a flat formation). With potential rallies in the dollar and higher in yields, the second scenario has a good standing. Let’s see how it reacts.

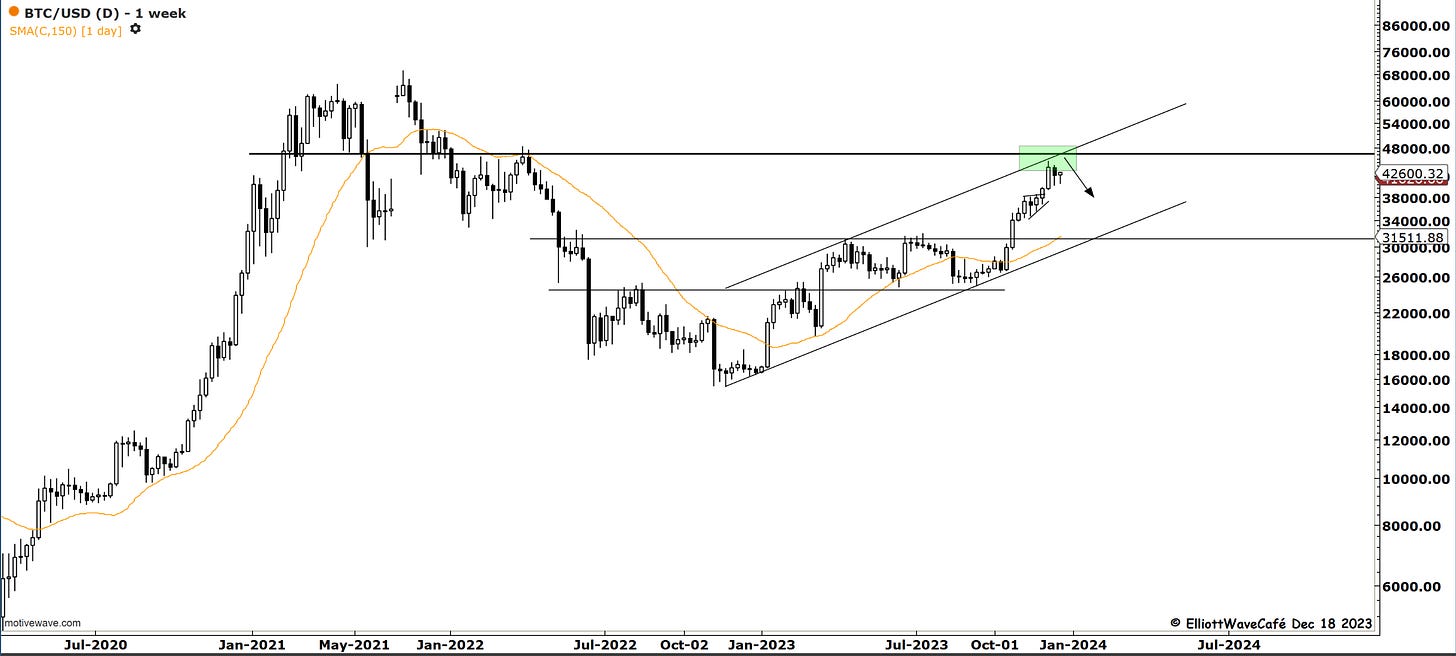

Bitcoin

As bullish things “feel” when BTC is trying to make another high, a disciplined approach looks at evidence rather than feelings. Proven once again, we have a very strong resistance near 44k. The break below 41,823 confirms a 3-wave rally. Contained by the channel as well. The bottom of that channel is being tested right now. A break below should send us towards 40k. Conversely, if we crack 44k to the upside, we will revert to this being a 4th wave with one more quick push higher.( see previous updates). Both scenarios point towards a correction in BTC for the next couple of months.

None of these comments can anticipate what the price reaction will be in case of an ETF approval. It could very well be a sell-the-news event, after an initial spike higher.

Here is the updated price action in BTC since cautioning of a likely topping cycle.

“Double shot” Daily member video coming up next,

If you’re new to Elliott Wave or need to refresh, there is a 7-hour video course with downloadable slides under The Coarse tab on the website.

Have a great day wherever you are! - trade well, and don’t forget to subscribe and drop a like if this letter helps you in any way.

Cris

email: ewcafe@pm.me