The Daily Drip

Core markets charts updates and commentary

Note: The counts on the right edge are real-time, and they are prone to adjustments as price action develops. Elliott Wave has a fluid approach, is evidence-based, and requires constant monitoring of certain thresholds.

In the counts below, this (( )) = circle on chart

SP500

Lower still in the SPX. Today, we have broken the previous 4th wave low at 4697. There should be some volatility with NFP tomorrow morning, but the path is to lower prices. There is not much support until 4607. If we get back above 4730, it's likely that this first lower leg is over, and we’re entering an upside correction, followed by another leg lower after.

With a stock like AAPL being so weak, it will be hard for the market to stage anything meaningful to the upside. The stock has now closed below its 150-day MA.

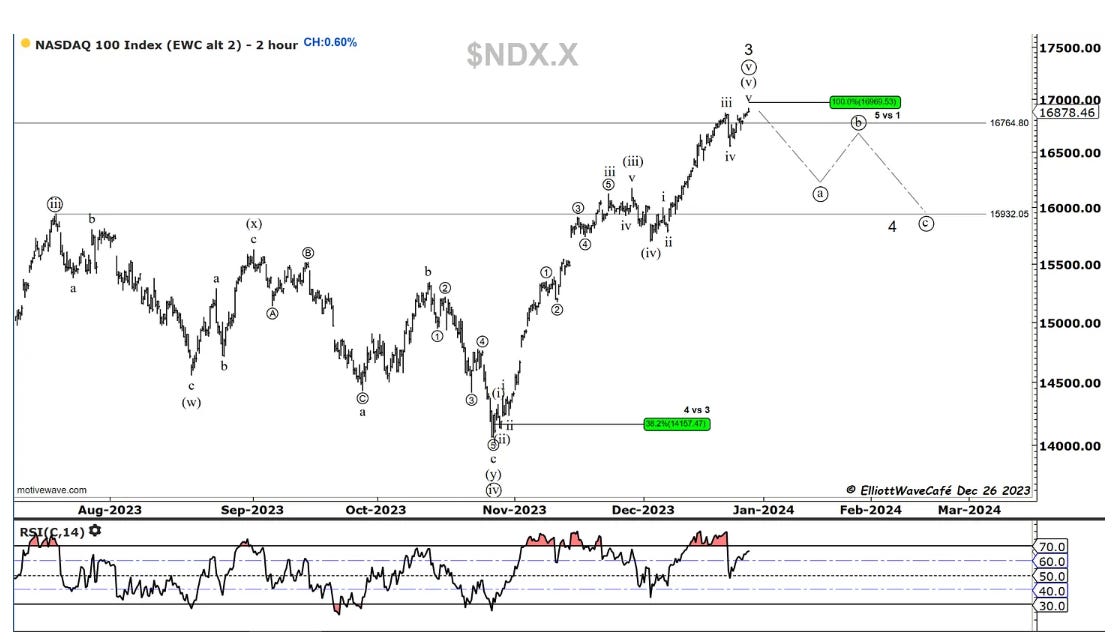

Nasdaq100

NDX is now very close to the 16,166 targets. Here is the chart from Dec 26th. It took a bit of work to finalize the upside move, but we were patient with it, and it paid off.

I do expect bids to start coming in as we approach those support levels. A 3 wave rally will be the hint to reinitiate short positions.

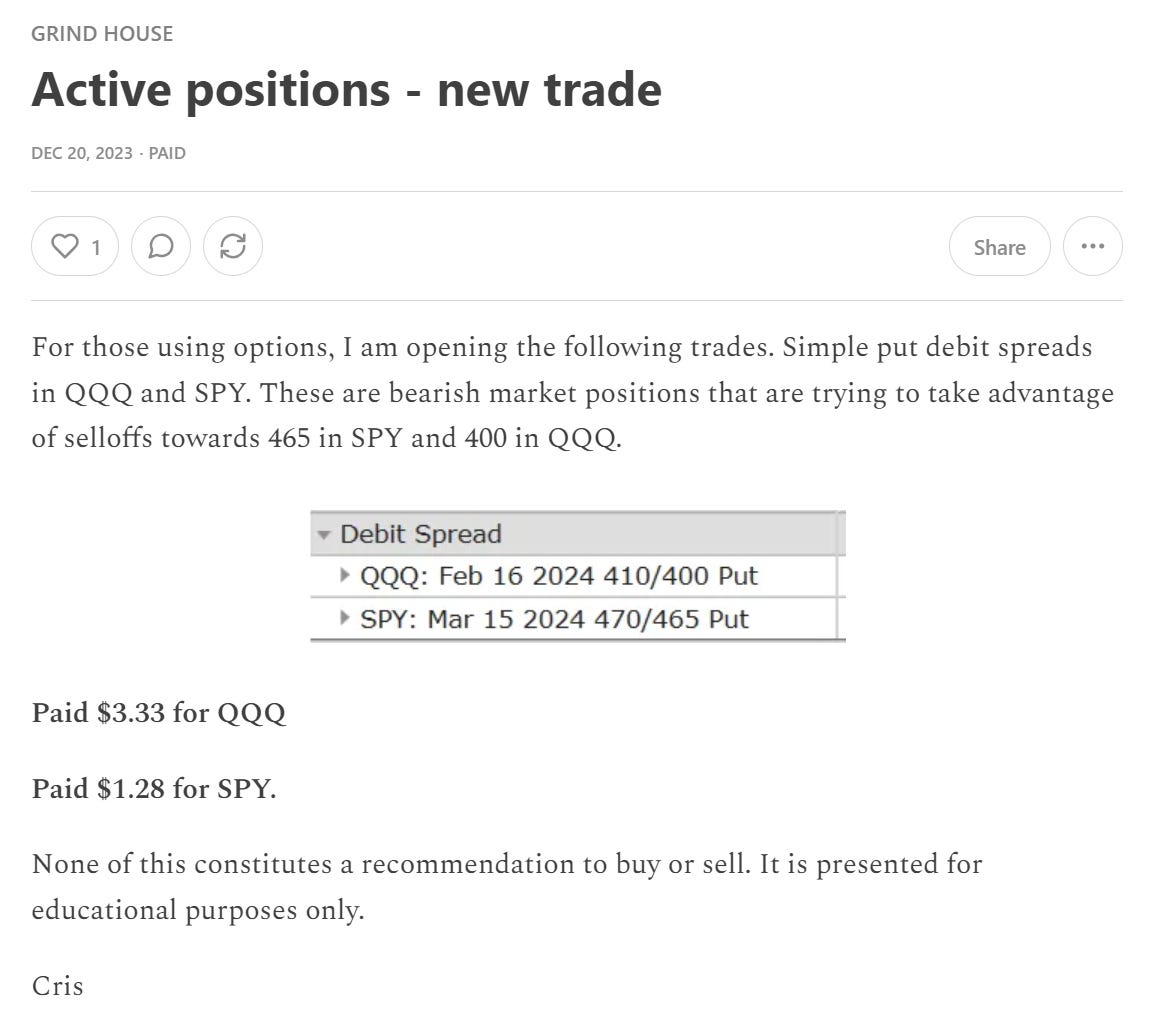

We will be taking off part of this Dec 20th trade tomorrow.

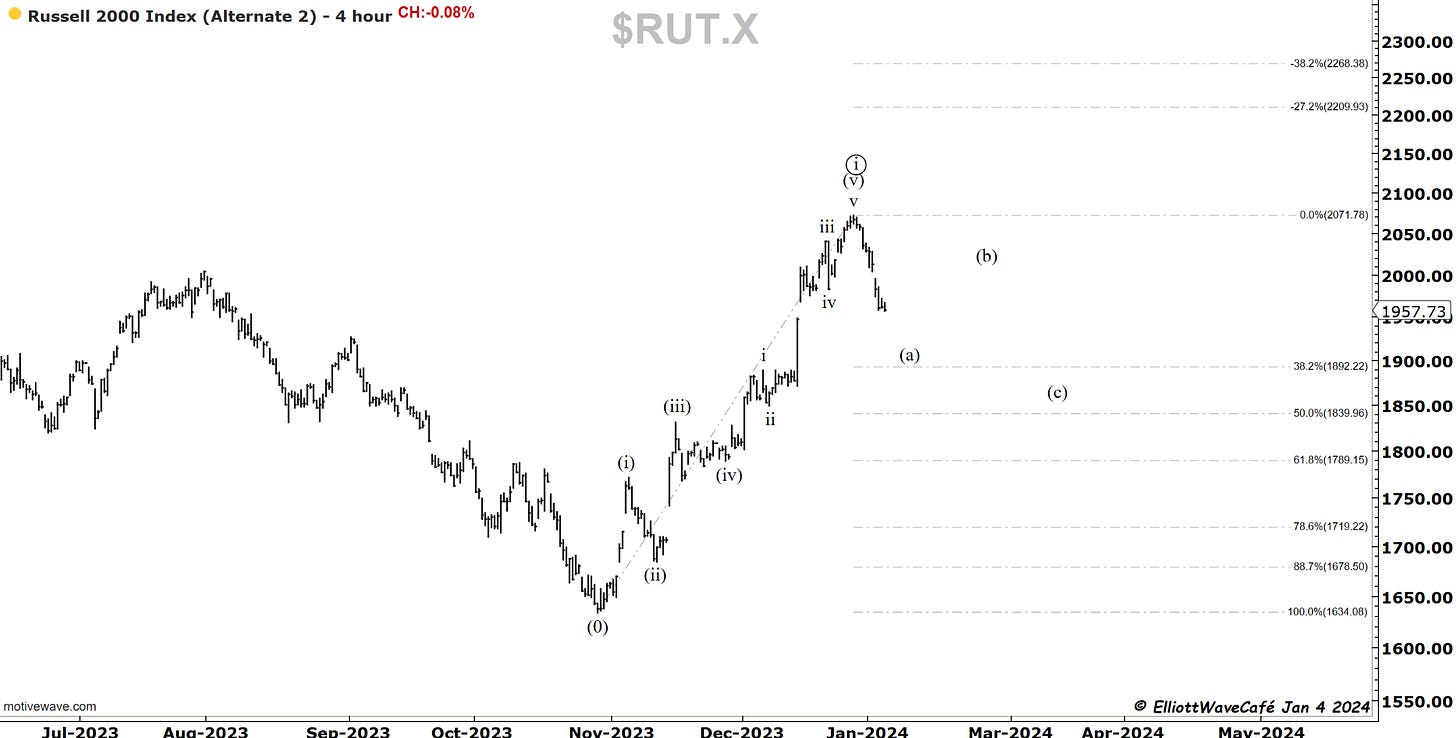

RUSSELL 2000

While this selloff still maintains the guidelines for a 4th wave move, based on what’s happening in the other indices, wave ((i)) is likely done. We are now into the most basic type of correction, which is the zigzag. A move to 1900 barely corrects 38.2% of the rally. Pretty standard.

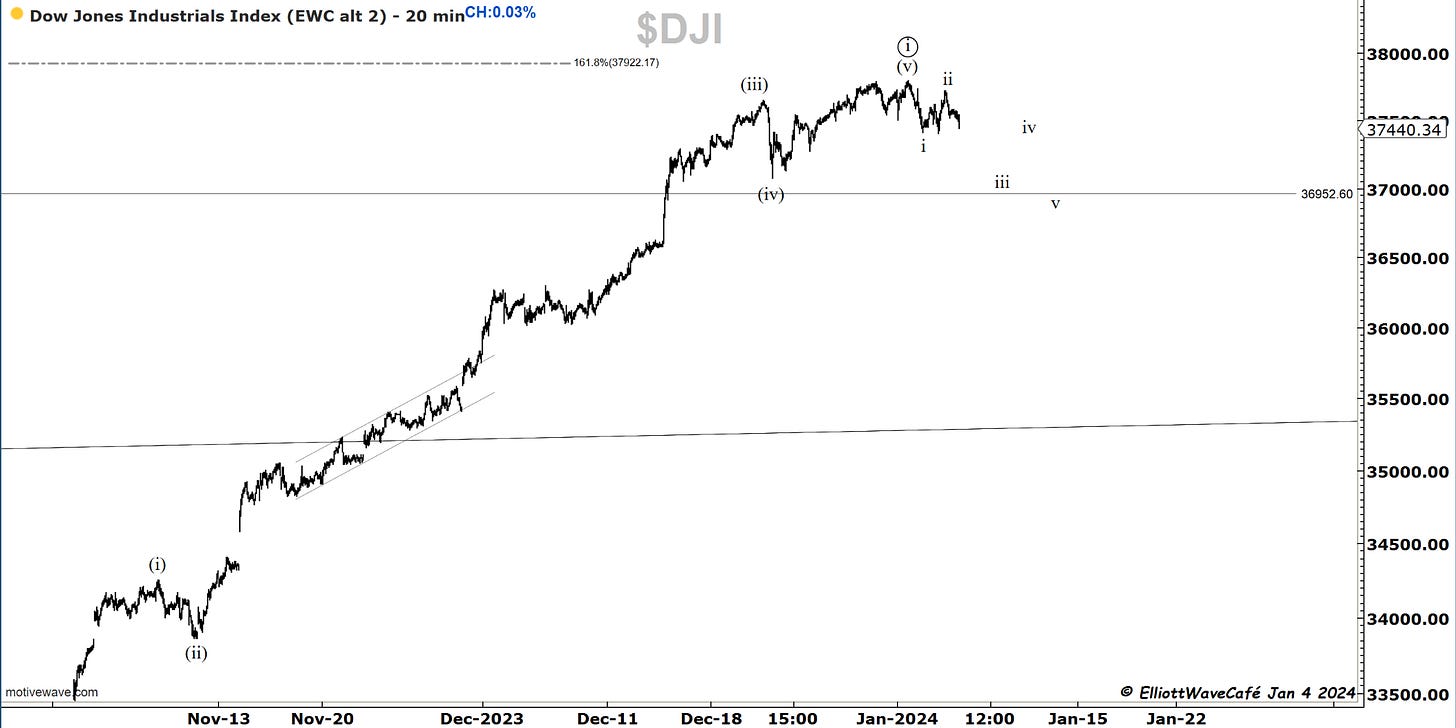

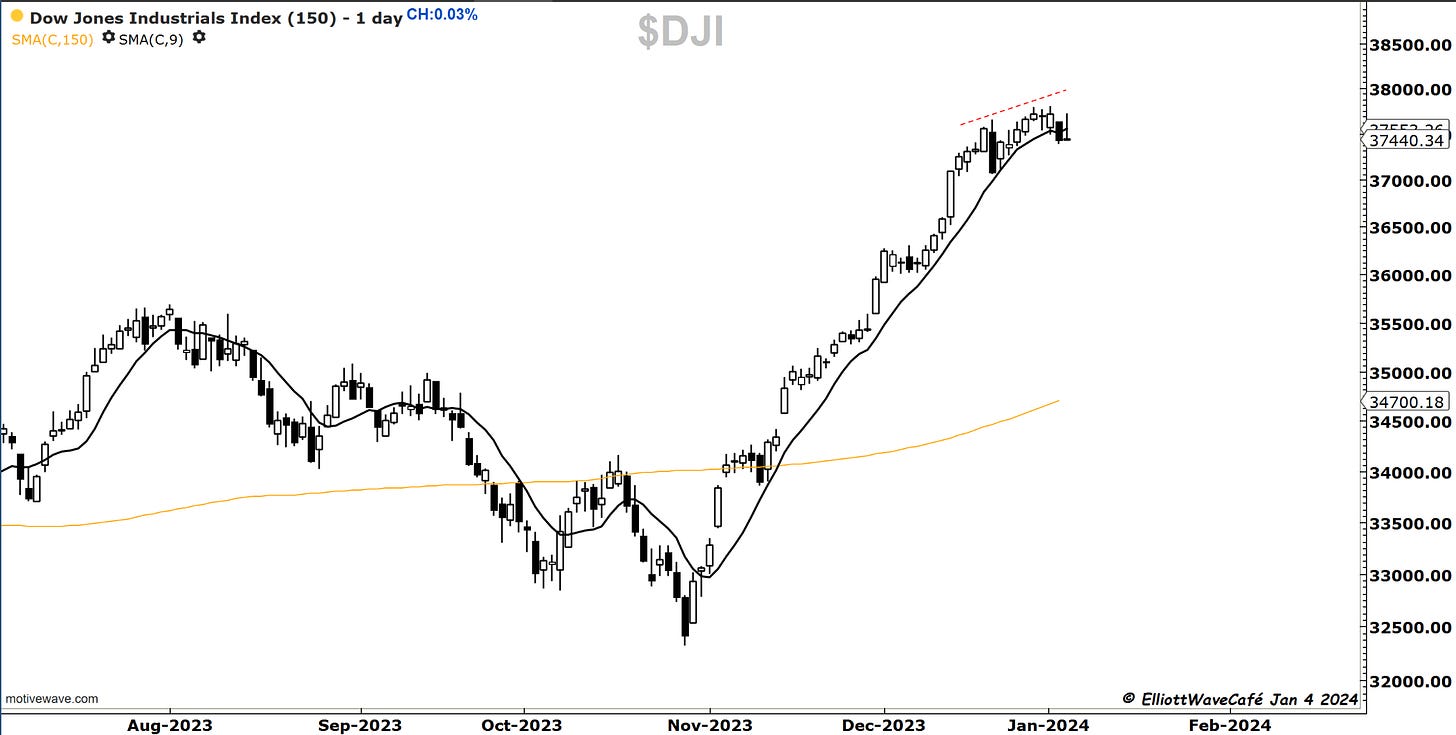

Dow30

Dow tried to rally today but failed and closed back below the 9-day. There is no clear downside impulse yet, but once we tag 37k, it should become more visible. Dow has a lot of correcting to do, and I continue to view the area near 36k as a sensible target.

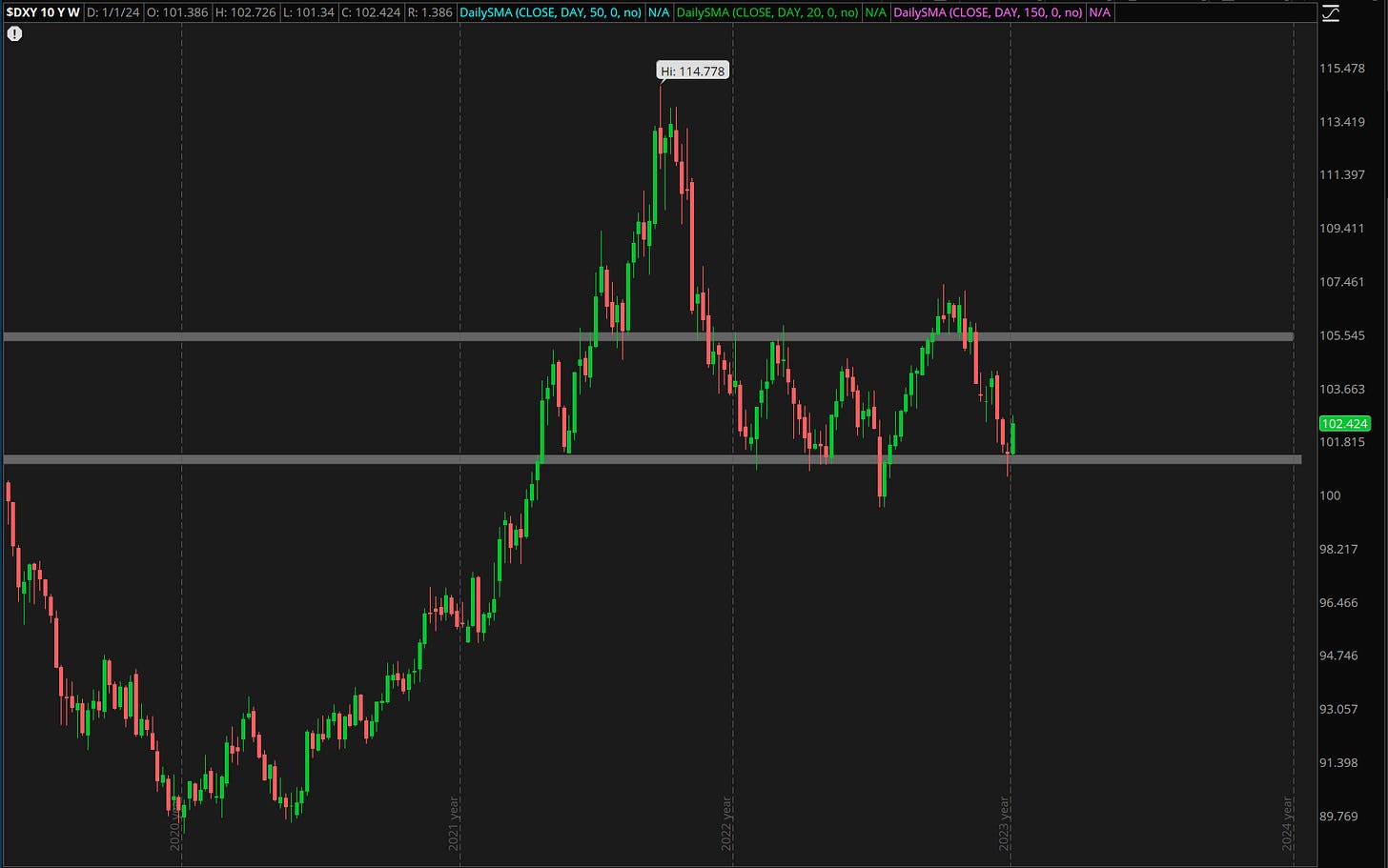

US Dollar and Yields

Both dollar and yields have now turned higher from their support levels. This behavior will likely continue at least for the rest of the month.

Gold

prior comments in GOLD remain. We accelerated the selloff towards the confirmation of a 3 wave rally. The 1,2 1,2 does not appear convincing. A break of 1973, should send us below 1900.

A bit of a selloff in Gold with the stronger dollar, but nothing worth changing drastically the overall picture. There are arguments to be made for just a 3 wave little rally after the December drop. Hovering near all-time highs does not give us a whole lot to work with. I am going to refrain from making any strong calls until we see some of these key levels getting challenged.

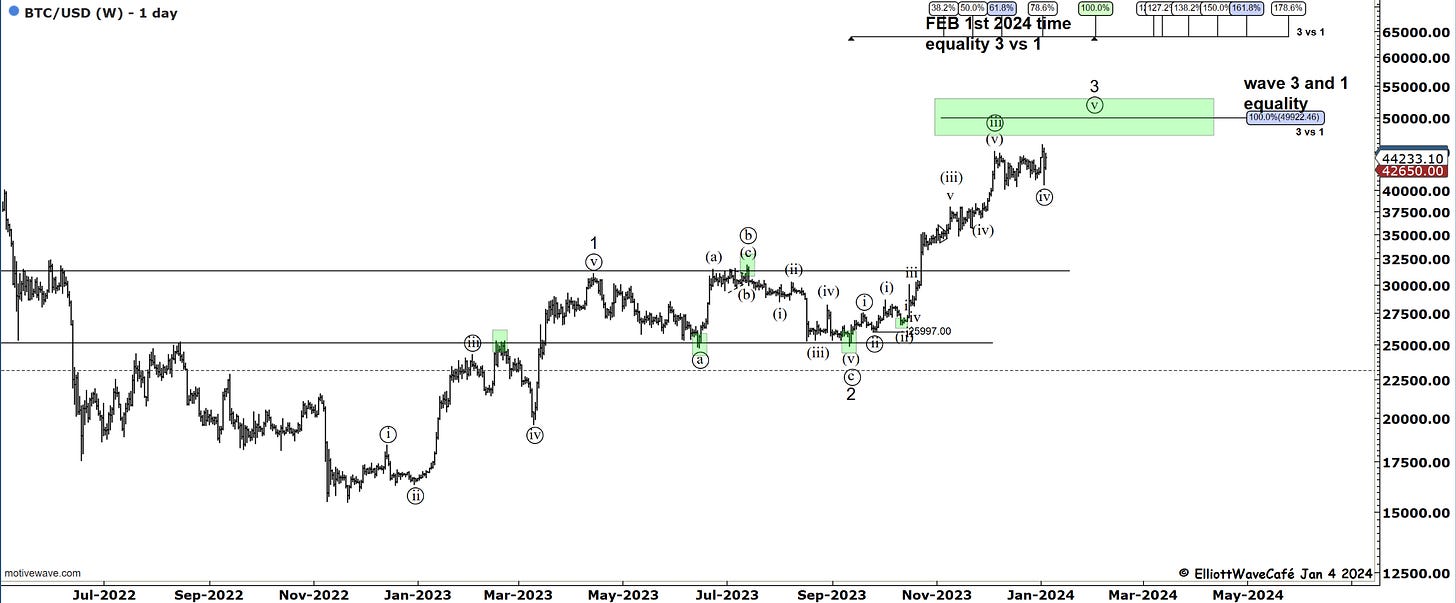

Bitcoin

Bitcoin has recovered most of the losses from below 41k. Thinking a wave ((i)) was completed at 45,925, this rally should be faded. Rumors are that an ETF approval will be issued tomorrow. Let’s see how this shakes out.

In case I am totally off, here is the upside count version towards 100 wave equality. 49,922.

“Double shot” Daily member video coming up next,

If you’re new to Elliott Wave or need to refresh, there is a 7-hour video course with downloadable slides under The Coarse tab on the website.

Have a great day wherever you are! - trade well, and don’t forget to subscribe and drop a like if this letter helps you in any way.

Cris

email: ewcafe@pm.me

thanks for the insights chris. let's see how monday plays out, my overall sentiments is bearish.