The Daily Drip

Core markets charts updates and commentary

Note: The counts on the right edge are real-time, and they are prone to adjustments as price action develops. Elliott Wave has a fluid approach, is evidence-based, and requires constant monitoring of certain thresholds.

In the counts below, this (( )) = circle on chart

Here are today’s top 10 best performers out of 104 industries.

42 positive closes and 62 negative.

and bottom 10 …

SP500

It takes more volume on advancing stocks vs declining stocks to sustain the momentum higher in this market. That has been falling for the past couple of days. The regular volume has been drying up as well. It could have something to do with the US holiday, but that’s how corrections start. There is a chance we have to complete one more 4th wave and another push higher in five, but the road is approaching its end. It will lead to a correction towards 4400 in the SP500.

I am watching 500 stocks for exhaustion signals on the upside and that list is growing by the day. The Mag7 are also flashing yellow. Most of them are in 5th waves.

Nasdaq100

Small pullback today of 1/2 %, but we’re back below July highs. Just like in the spiders an alt wave (iii) is a concern, but overall the upcoming correction is ticking louder.

RUSSELL 2000

On a weak day once again the small caps were the hardest hit. Will this index continue to disappoint investors? If it’s an ABC countertrend in B, then they have no idea what’s coming next. Those fib zones shown need to hold, or else we go much lower.

The second chart still deserves respect as long as key levels are respected.

Dow30

Wave similarities are abundant between main indices. Waiting on a better confirmation signal. A break below a previous 4th is a start.

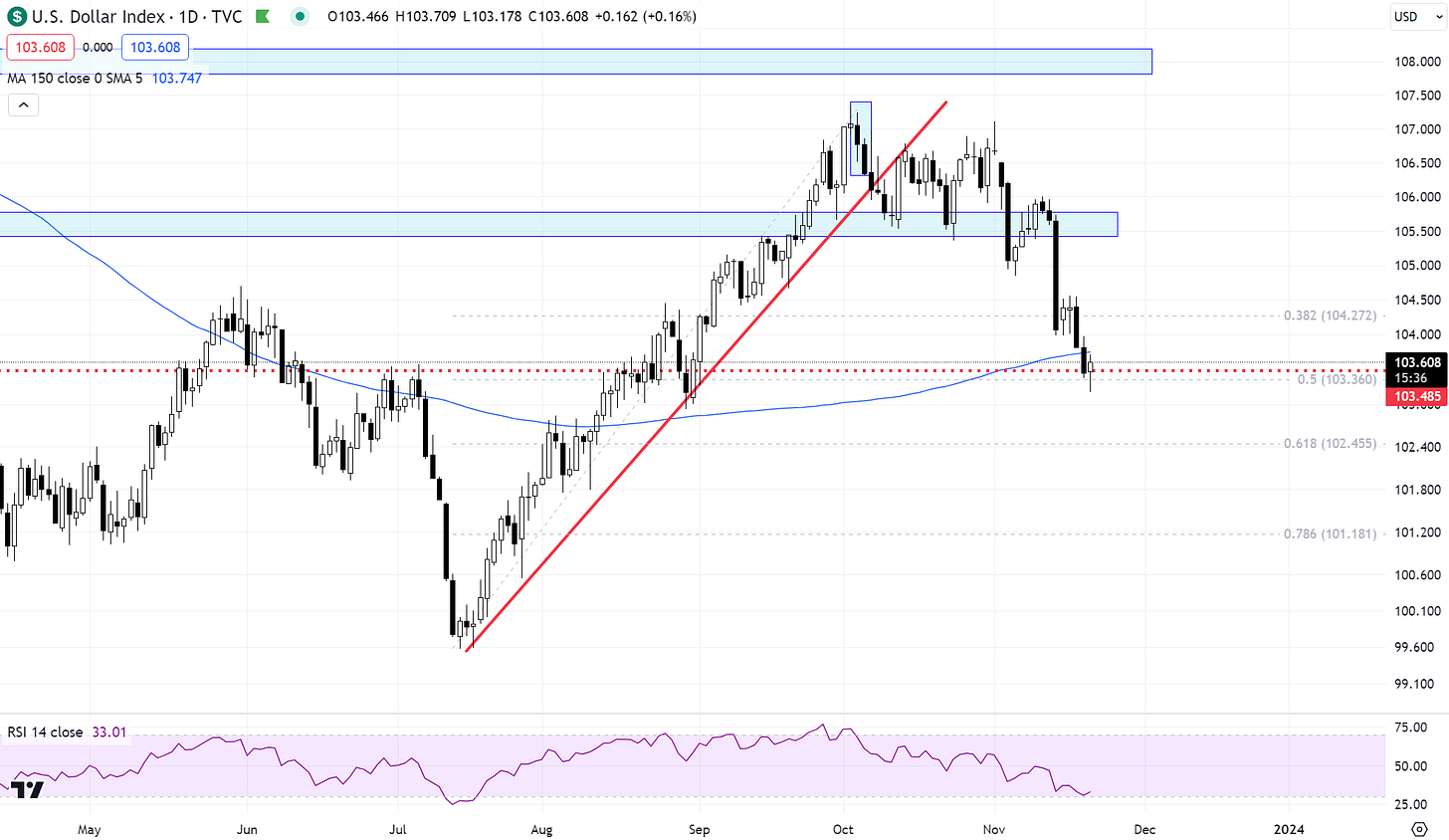

US Dollar and Yields

prior comments on DXY stand. today we paused for a bit at support. Let’s see if they continue to respect this zone. I think they will.

Ever since the dollar broke that trendline, with little consolidation delay, it was a roll over. We are trading at 103.50 and are just at the 150-day MA. It’s also a pretty major horizontal level for the greenback so I would be cautious down here.

Here the EW variation count that we have been tracking .

prior comments stand- flat market today with support kicking in.

Looking for 10Y yields to start finding support near 4.35 zone followed by a 3 wave setback.

Gold

Gold passed that .786 line we had as radar. The qualifications for a (b) wave are starting to wane. I am on alert for it being a wave i instead, but not ready to commit just yet. Both cycles and seasonally continue to call for weakness into end of Nov. From there is fair game. So maybe that (c ) wave is a pipe dream.

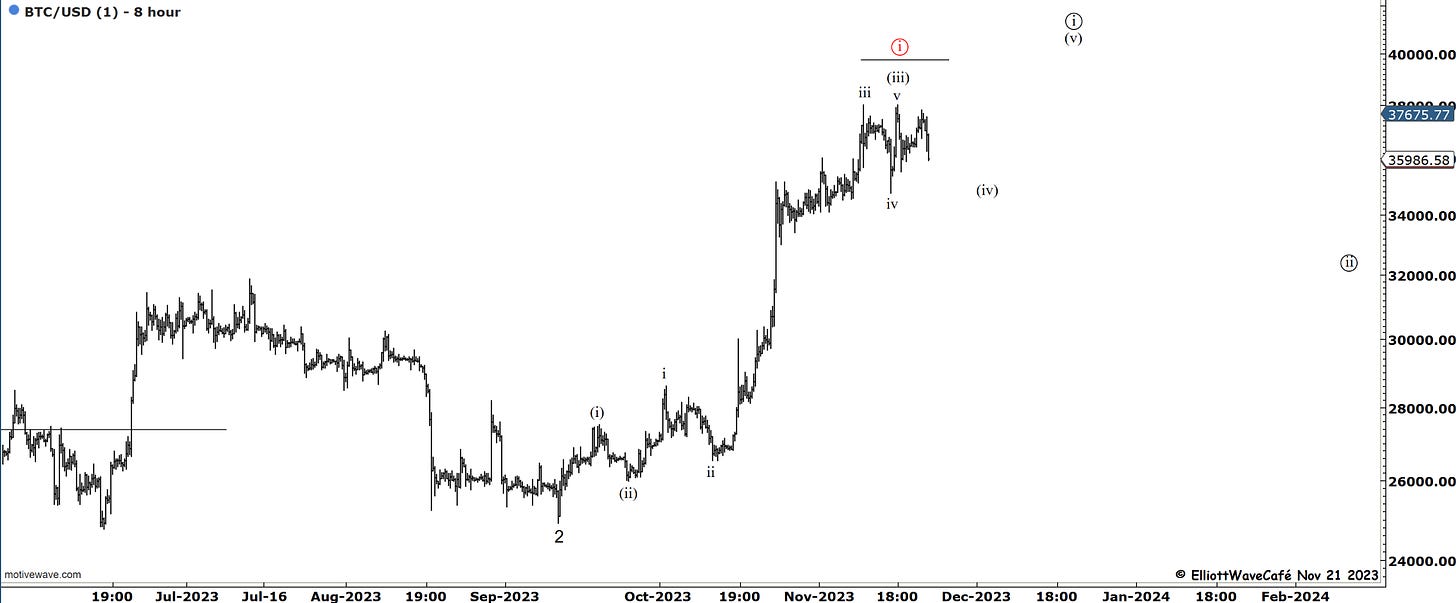

Bitcoin

Just when you’re about to call the all-clear on these markets, tape bombs start dropping. The Binance news comes at a time when people were getting a bit too bullish on the space. Here in EW and sentiment analysis, we learn not to get carried away by excitement. Is possible that we go once again through a corrective period until we wash out the overly bullish tilt and talk. Crypto miners have never really caught on to the latest altcoins daze.

In terms of counts, I still maintain the outlook we’ve been having over the past several weeks. We are in wait and correct mode, cycle, and seasonality. There is a slight chance wave ((i)) has already been completed, but I reserve the right to keep that as an alternate at the moment. A break below 34k, would likely secure it. The larger pullback, if realized, we’ll take us to the 30-32k zone.

Tomorrow will be the last issue of this week.

Daily video coming up next for members,

Have a great day wherever you are! - trade well, and don’t forget to subscribe and drop a like if this letter helps you in any way.

Cris

email: ewcafe@pm.me