The Daily Drip

Markets review, strategy and analysis

I will be in Miami for the rest of the week, so I won’t be able to record videos, but I will give you my quick written thoughts on the market action.

SP500.

There has been a clear volume increase as we begin the new year of trading. Today was a strong day that faded a bit, but nonetheless, we were able to squeeze up +0.55%. We’re back above the key moving averages, and as long as we can maintain that, I will keep an upward bias. I would like to see the RSI get back above 50 and the PPO above zero line to accelerate confidence in further long exposure. 6049.75 is a key level that opens the gates for new highs if we overtake it.

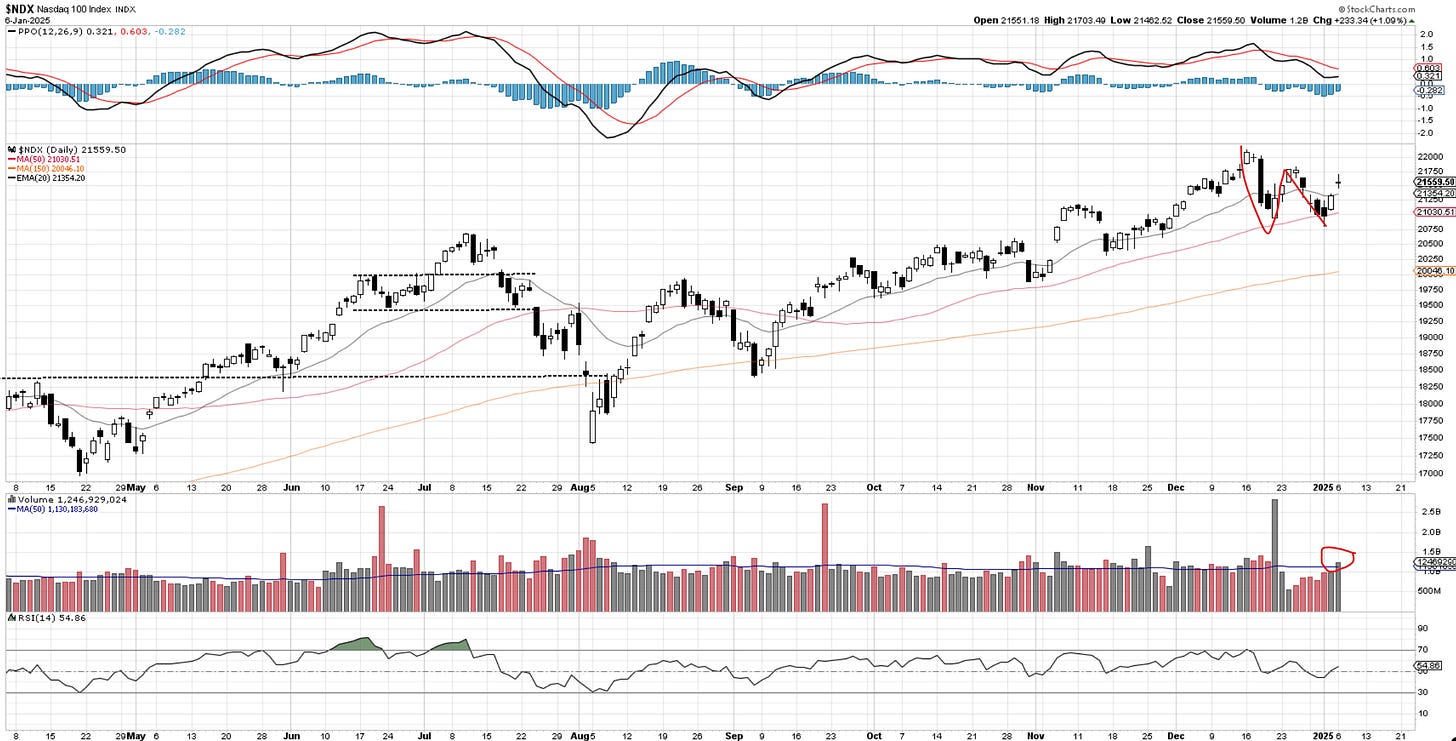

Nasdaq 100.

The 3-wave decline stands clear at this point. The volume was substantial, showing good signs of buying from the 50-day average. We mustn’t lose Friday’s lows to keep risk in check. As long as that holds, I have confidence in my long positions. Upside 21837,69 is the key here.

Mags.

There was a pleasant reaction from the bottom of the channel, where we increased our expectations for a bounce. The RSI held at 50 as well. The 2% gains are not to be ignored and give the 3-wave decline a beautiful look. As we know, three waves are corrective, so we expect further upside here. It’s not guaranteed, but that’s what I expect.

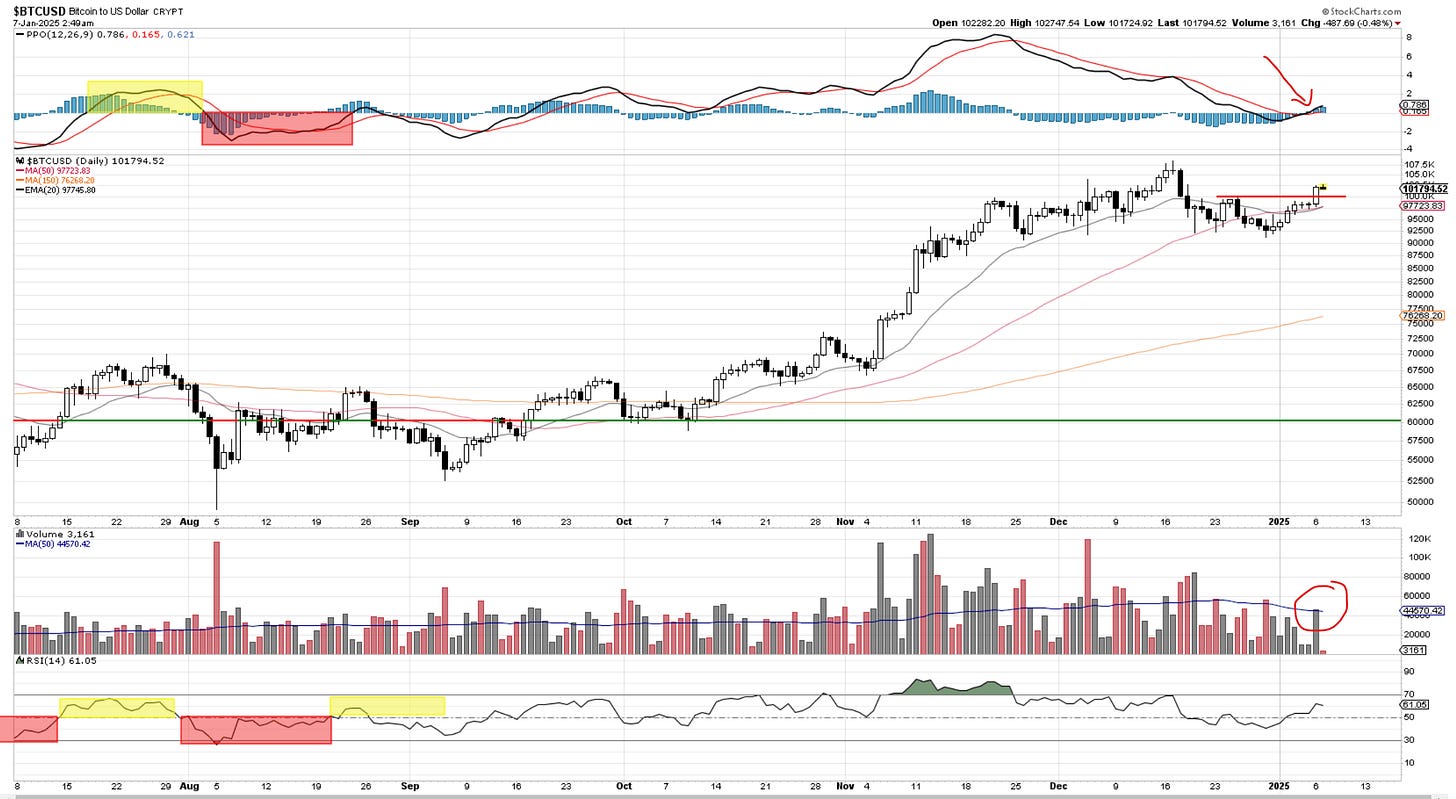

Bitcoin

Today, a key zone in BTC was removed, increasing my confidence that looking toward new highs is a standard expectation. The volume was good, and the PPO remained above zero. I would not want to see a decline and a close below today’s low of 97,908. If that were to happen, today’s signal would be invalidated. Any fresh long positions based on today’s break would be eliminated. It’s okay to be wrong; it’s not okay to stay wrong. If I had only drilled this into my head sooner in my trading career, I would have saved myself a lot of money and aggravation.

To conclude, I am trying to stay optimistic and still give the market the benefit of holding the uptrends. It's been choppy and corrective, but there are plenty of stocks that continue to act well. The big boys' mags are holding their own, and even semiconductors have staged a great rally. We will watch closely for signs of fading, failures, and breaks of key averages. Until then, not every selloff is the beginning of a crash, and not every rally is the beginning of a rip-your-face-off rally. Sometimes markets just grind for direction and battle levels. With two weeks away from a new administration, I am doubtful we can get impressive moves in either direction. But I will stay vigilant day by day.

For those wanting to chat with fellow traders, the link is below.

Thanks for reading.

Cris

If you’re new to Elliott Wave or need to refresh, there is a 7-hour video course with downloadable slides under The Coarse tab on the website. Requires a yearly “Founding Member subscription.” You can find it HERE.

Cris

email: ewcafe@pm.me

Have fun in Miami, Chris!

Here in Germany, Miami is very, very well known thanks to this cult series:

https://www.youtube.com/watch?v=P2suaYwoXzM

Those were great times! 😃