The Daily Drip

Core markets charts updates and commentary

Note: The counts on the right edge are real-time, and they are prone to adjustments as price action develops. Elliott Wave has a fluid approach, is evidence-based, and requires constant monitoring of certain thresholds.

In the counts below, this (( )) = circle on chart

SP500

Two days of fairly quiet price action helped build a 4th wave, and it looks like another move higher will complete wave v of (v) of ((v)) of 1. A retest of 4800 should follow. The evidence of a completed sequence higher is nonexistent, and until the price takes some of the key downside levels mentioned, one can only patiently wait.

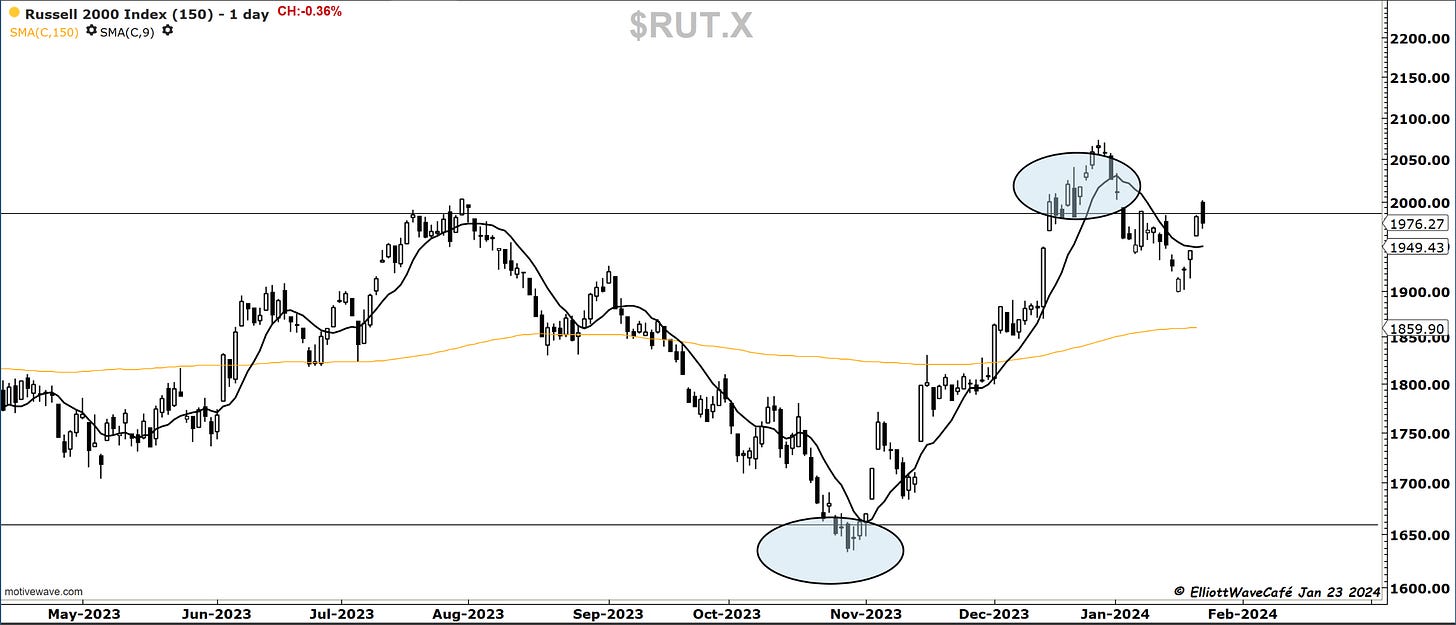

Equal weight, small caps, and geometric line index continue to struggle, not offering yet the kind of support we would like to see as bull markets get underway. That’s not to say it will not come, but so far, it has been muted since the year began.

Nasdaq100

Price is moving up and into the right. It has been doing so for one year. Even tho my work suggests an appropriate correction should be taking place in this first quarter, the market has yet to provide serious price hints about that. The candle chart below displays no form of single or combination of candles suggestive of a top, but I think it will be obvious once it happens. It certainly feels overall like it wants you to “chase it,” and that’s a dangerous proposition.

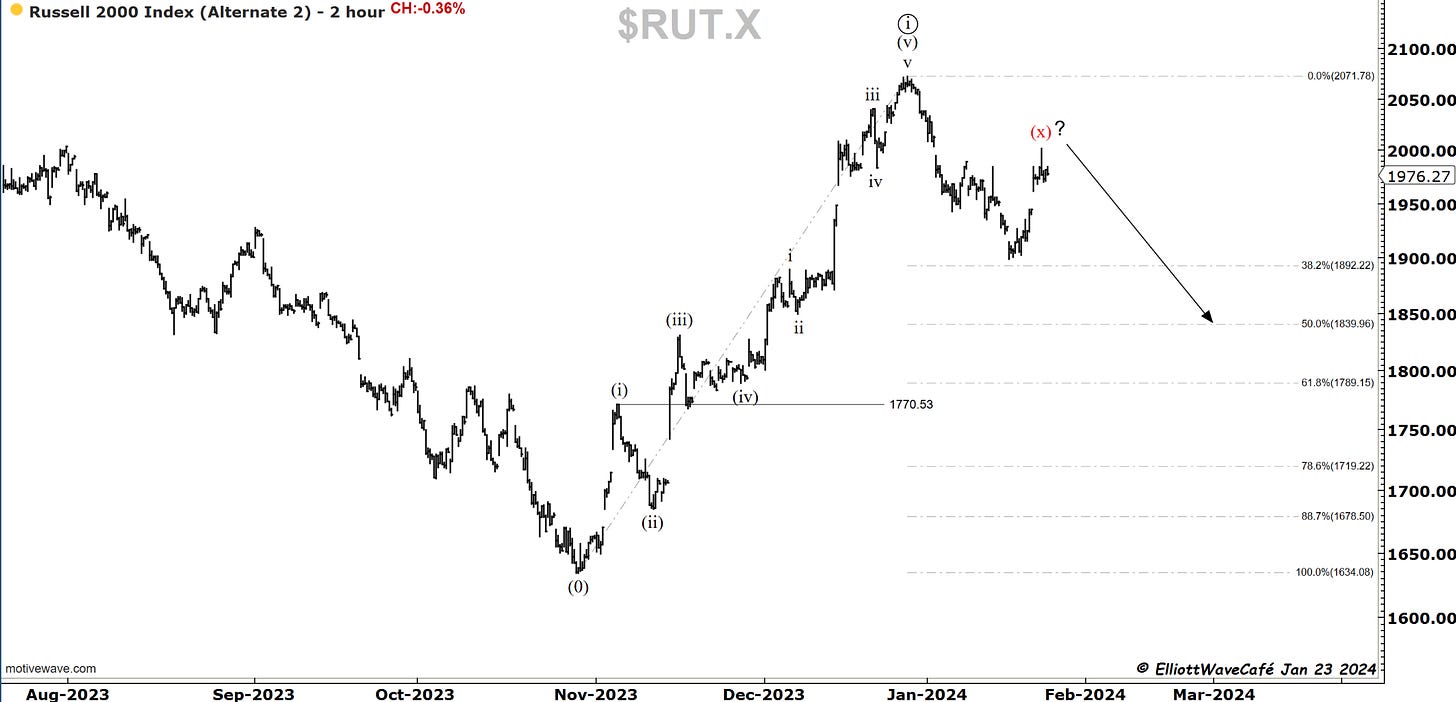

RUSSELL 2000

Once again, there was no follow-through on the small caps, ending up negative -0.36% on the day. If we have an (X) rally as part of a larger complex pullback, then we need to continue failing here and break below 1900. Once above 2000, the odds are growing that we will do a break above 2100.

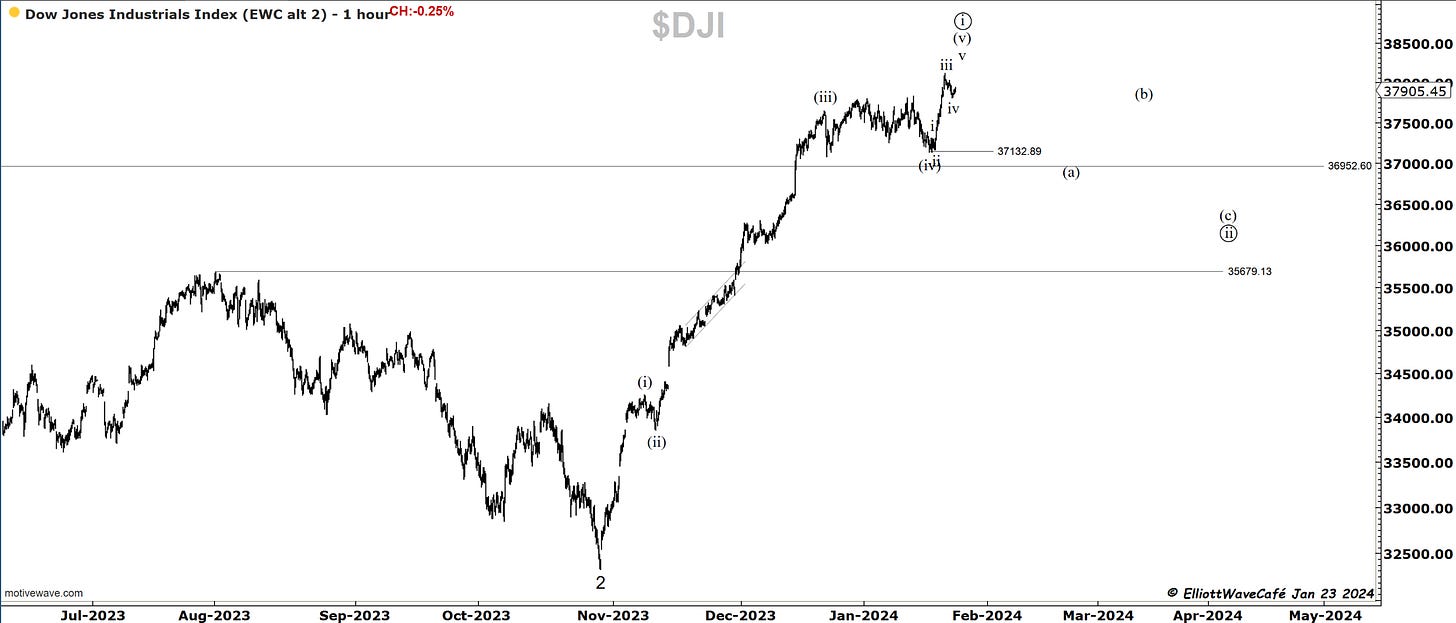

Dow30

Dow was negative as well, but it seems that one more push higher would terminate a 5-wave impulse. Then, we would look for a breakback below 37,800. I have sent an alert out today to members about opening short positions in this market.

US Dollar and Yields

The dollar made a fresh high today since December bottom. It looks like a good impulse, and we can even count 5-waves. Another view is that wave (iii) is actually wave i at the lower degree, and we have much higher to go. A break back below 103 would nullify that view. It is impressive to see at this juncture that the equities have performed quite well, even with a strengthening greenback. If the dollar finds a top here and reverses, that should be an even stronger tailwind for equities. Something tells me that this market could be churning until the Fed meets at the end of this month.

Yields are sitting quietly below a cluster of resistance with a visible 3-wave move from the lows. I think that if they are to start another leg lower, they should do it from here. If that does not happen at too fast of a pace, it should benefit risk assets, especially small caps. My bet was that we would see 4.3% before new lows, but we’re holding still below those levels.

Gold

There are no updated comments on Gold.

I continue to look at Gold in a multitude of ways, and I arrive at the same conclusion. I hate this market :). I might stop covering it until it gives me something to work with. That failed breakout has probably frustrated thousands of traders. It’s a three-wave move; not too many questions there. It’s probably right to own it above 2100. Until that happens, it’s a big load of nothing. Below 1960, it opens a larger can of warms.

Bitcoin

There's not much to add here other than we’re getting a bit of that expected bounce from the middle channel line. We have gotten fairly close to my first target of 38k. I discussed BTC in last night's shared video. You can find that on You Tube.

Something like this is possible in the lower time frames.

We are now hitting the central line of the ascending channel, a place that can offer some temporary bearish relief. I continue to believe that if we get any bounces, they will be short-lived, and this market will continue to move towards 36k area.

“Double shot” Daily member video coming up next,

If you’re new to Elliott Wave or need to refresh, there is a 7-hour video course with downloadable slides under The Coarse tab on the website.

Have a great day wherever you are! - trade well, and don’t forget to subscribe and drop a like if this letter helps you in any way.

Cris

email: ewcafe@pm.me