The Daily Drip

Core markets charts updates and commentary

Note: The counts on the right edge are real-time, and they are prone to adjustments as price action develops. Elliott Wave has a fluid approach, is evidence-based, and requires constant monitoring of certain thresholds.

In the counts below, this (( )) = circle on chart

SP500

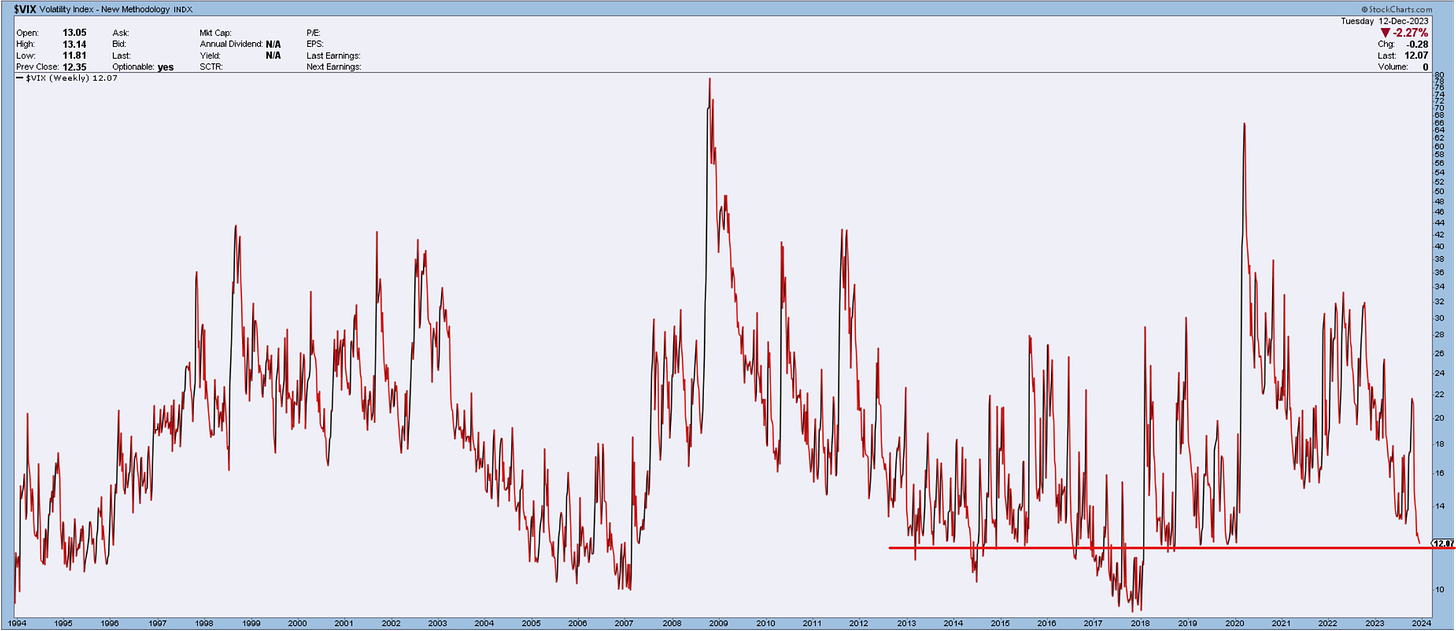

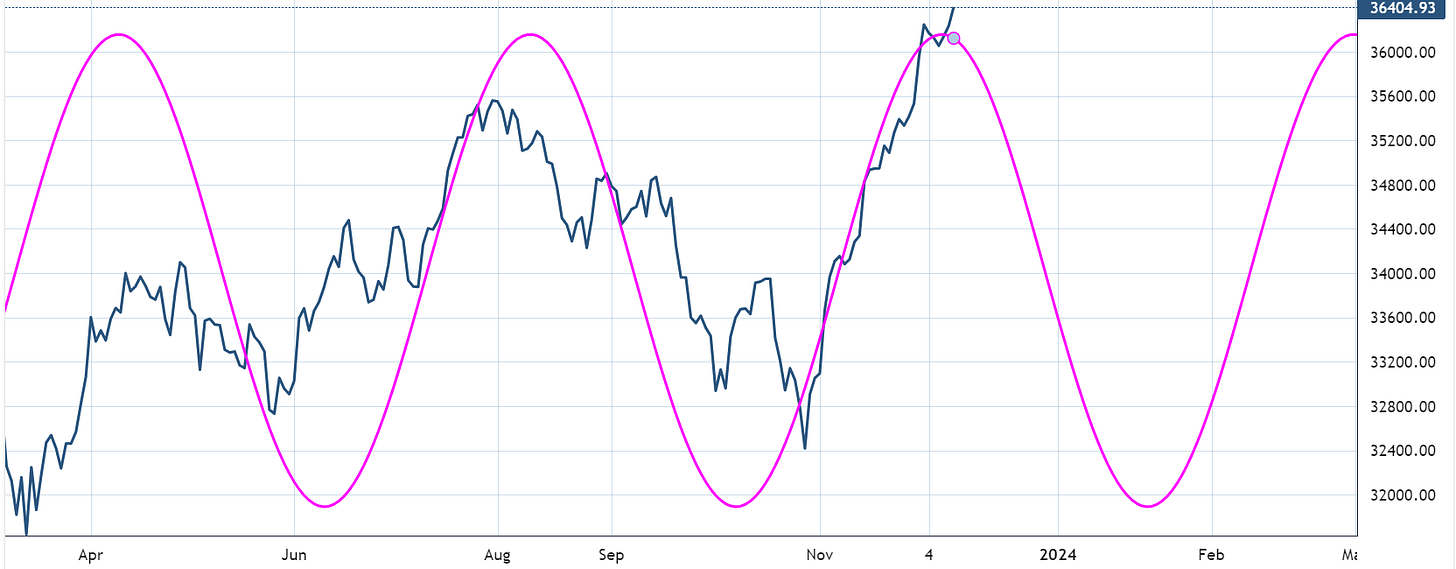

It was another decent day for the index following a CPI number that provided no surprise. We continue climbing in a 5th wave with a VIX dropping at 12. The charts below show the support line from 2013 and the upcoming rising active cycle from an 85-day period.

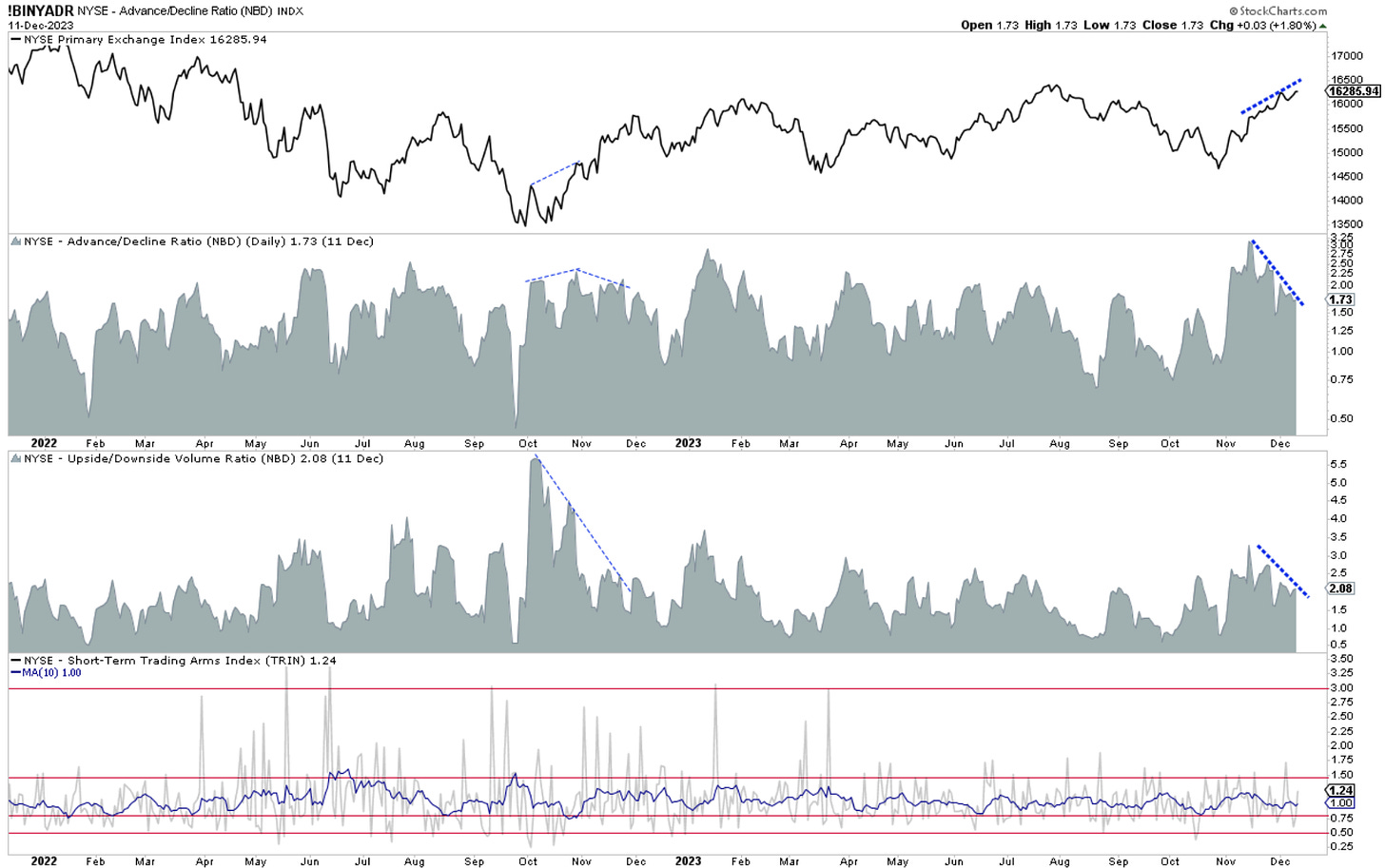

The put/Call ratio touches levels where traders feel very comfortable buying calls. It serves as a contrarian indicator. It could go a bit lower, but it is starting to flash warning signals. The last chart looks at the volume of advancing stocks vs declining stocks, and you can see how there is less and less powder provided to push these stocks higher.

I maintain my cautious bias based on these observations and a few others mentioned in prior reports. In last night’s video, I discussed the upside levels for SP500 and detailed the count formations on the markets we follow, nat gas and BTC.

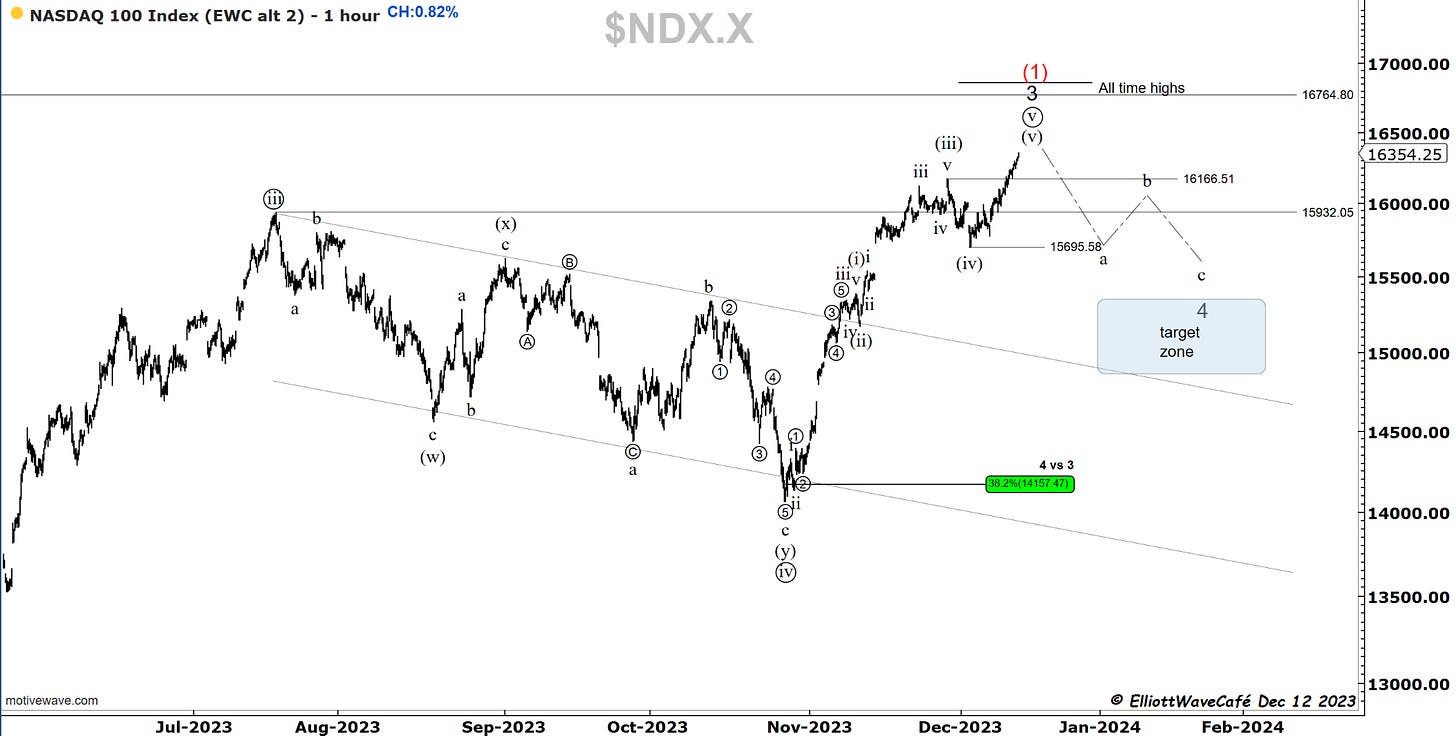

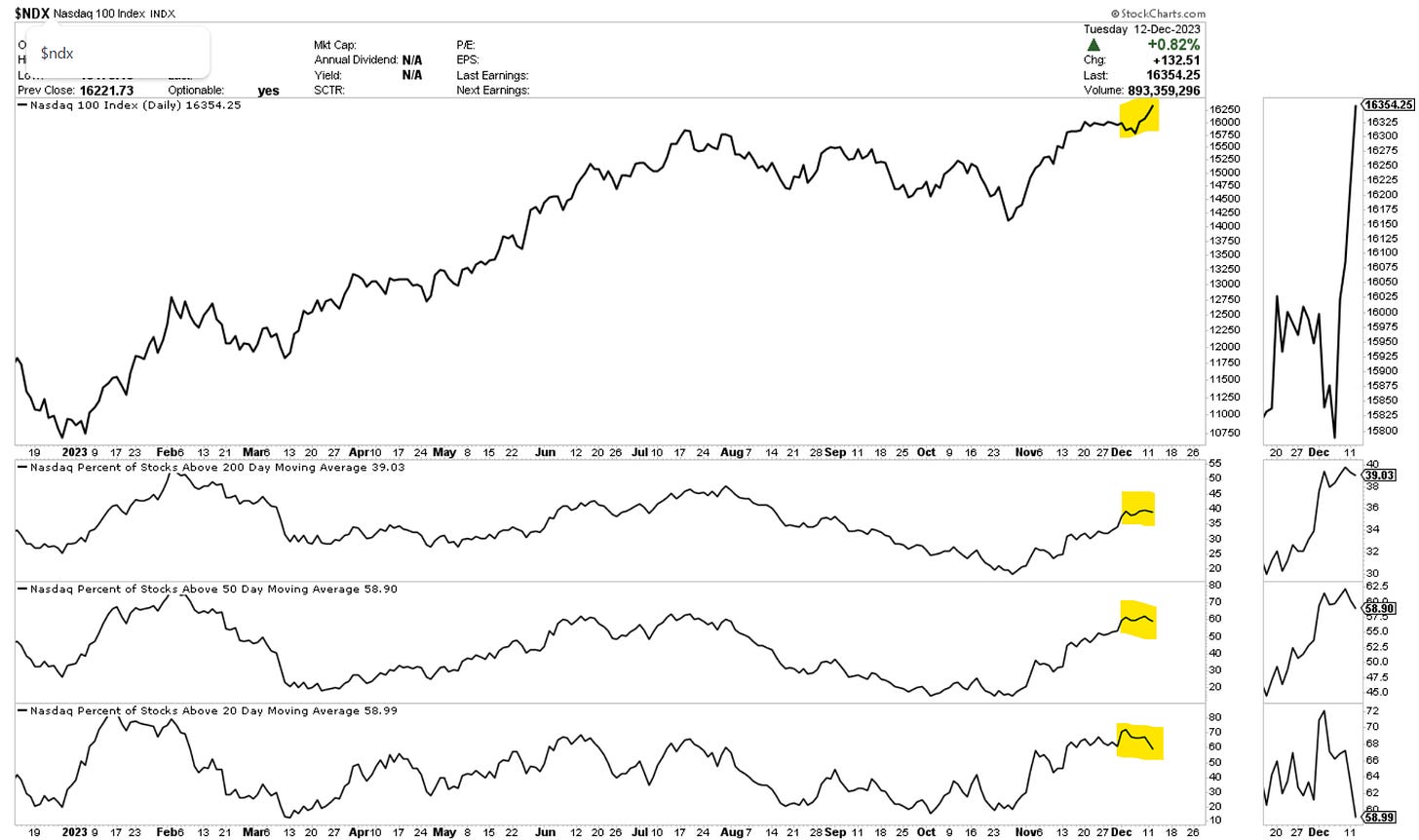

Nasdaq100

If you notice on the chart below, this is how we form a head and shoulder formation. There is a rise in a 5th wave, followed by a drop in wave a of a corrective pattern. The b is what creates the right shoulder. One of the things that’s needed is lower volume as we get higher, and that’s not really dropping much in the Nasdaq. It is worth noting that we’re having one of the best days regarding 52-week highs, but lots of stocks decline below their 20-day Ma and stall at the 50-day. The declining stocks are also increasing. Keep a close eye on this behavior as we trend higher in this wave.

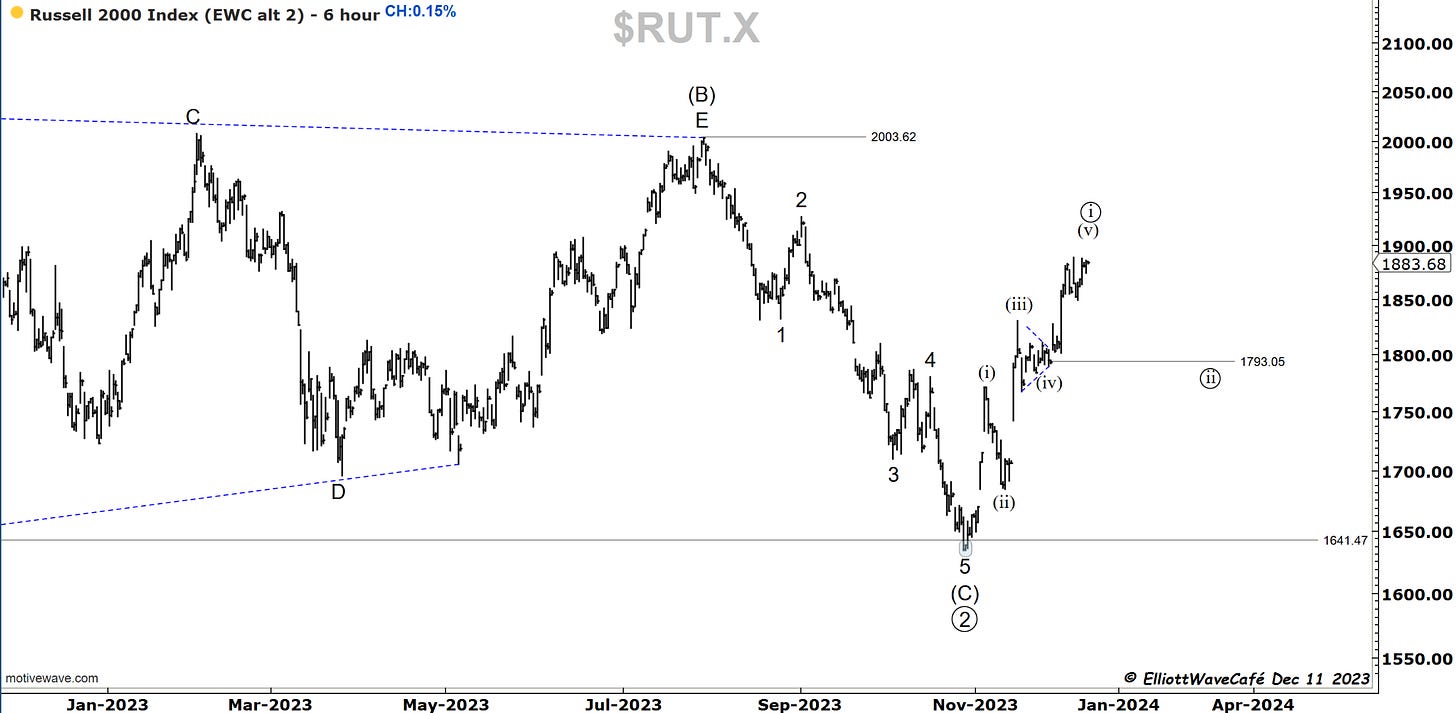

RUSSELL 2000

no changes, prior comments remain- the index continued to struggle to advance today. If rates rally higher, there will be troubles in this sector once again.

The Russell was a bit calmer today but revisited the highs from last week. I am keeping the current count but notice how the the advancing legs are within close equality of each other. That could be a sign that something else is going on structurally. ( a 1,2 1,2 from the lows without the triangle,or a complex correction). We should know more this week. Once above that (B ) wave high, there should be some clear traveling towards ATH.

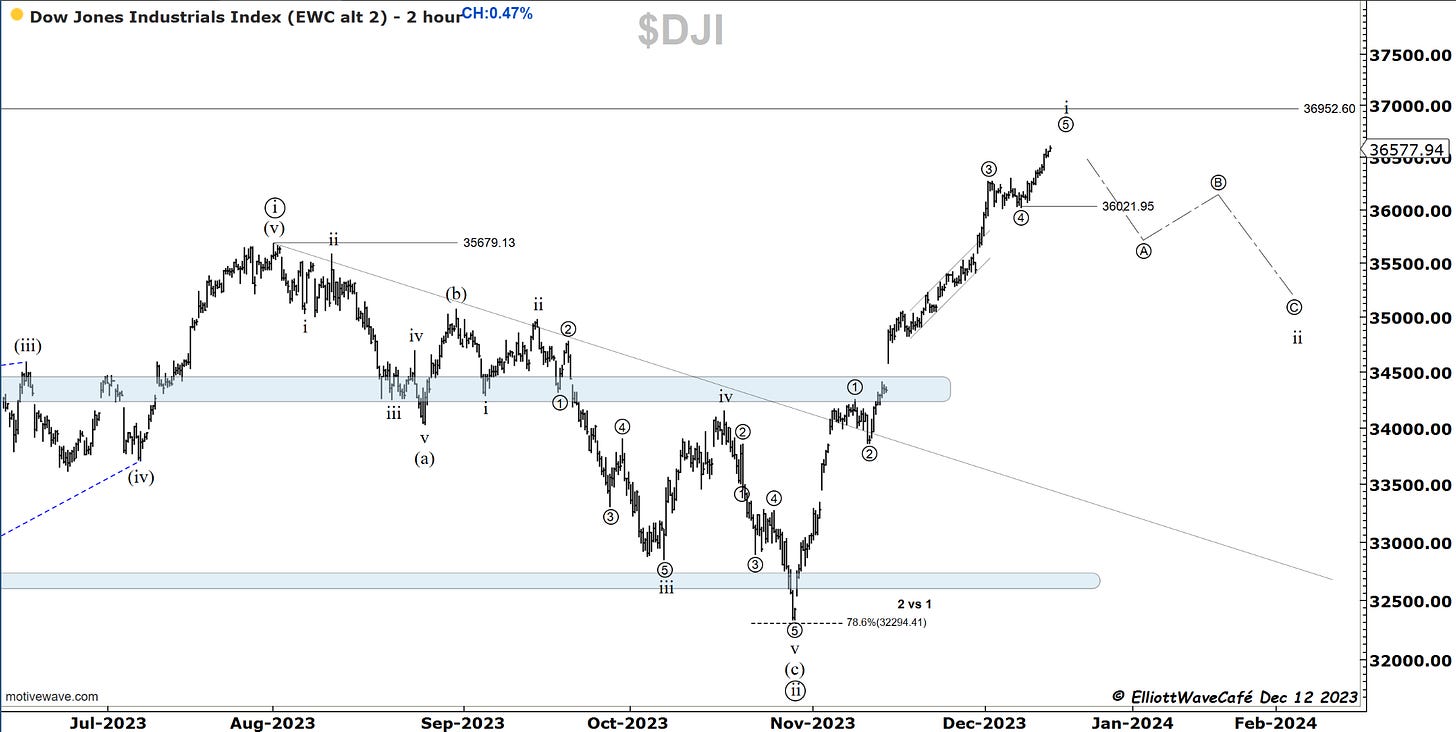

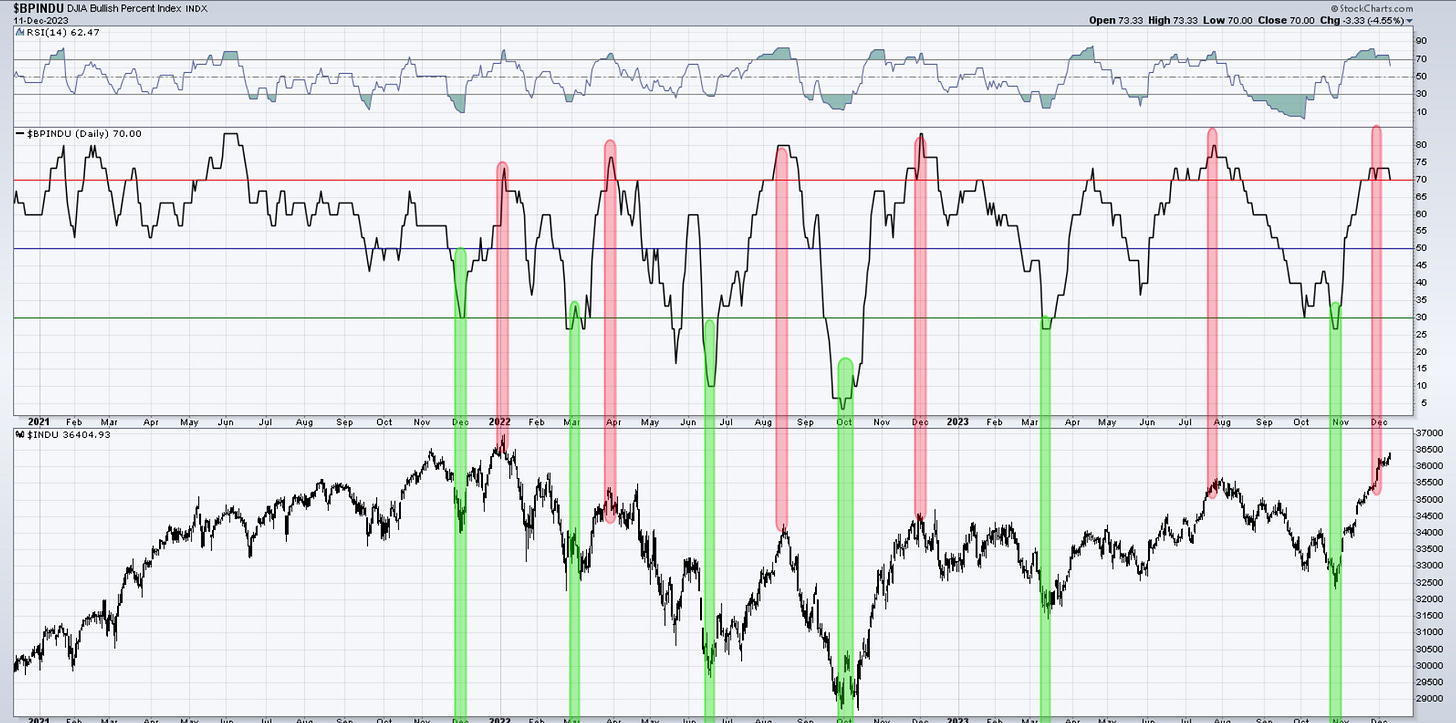

Dow30

Getting closer and closer to new ATH after 2 years spent correcting. Once we hit the top of this 5th wave, the chart should show it pretty clearly. It has not happened yet. My bet is that we’re running on borrowed time.

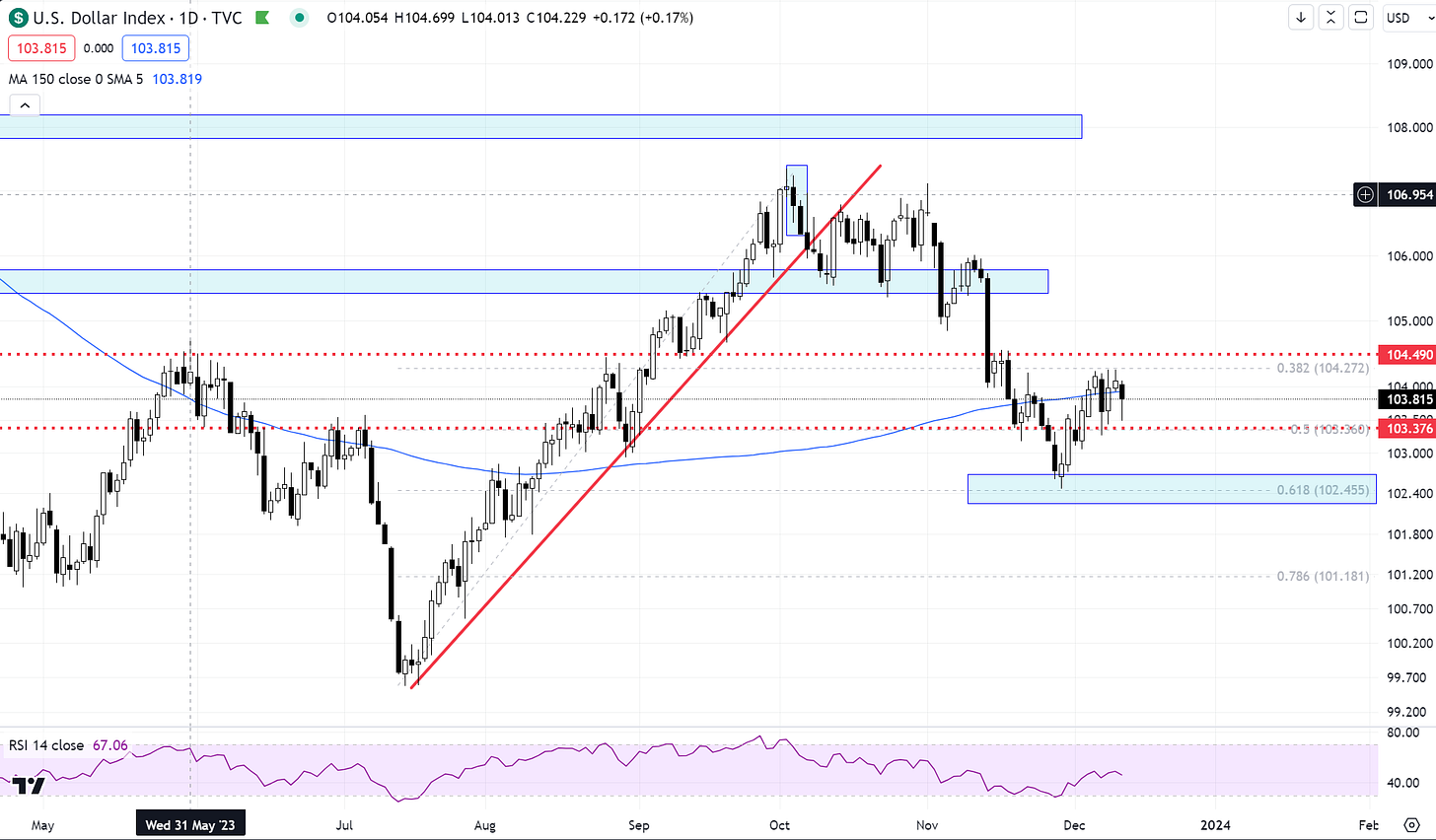

US Dollar and Yields

The dollar gave a bit back today but bounced from 103.30 support. We’re stuck between levels here, but if the yields rally following Fed, the dollar will have no choice but to break 104.30 to the upside. A lot of dovishness has been built in since the last fed meeting. We’ll find out how the market reads Jay Powell tomorrow but the risks are skewed lower. If he presents a hawkish posture we could have an initial push higher to add more bulls to the mix , followed by a reversal. Let’s not forget we have a large monthly option expiration on Friday. I would bet a lot of premium has been been built over the last month. They could shake the tree to see who falls.

Gold

no changes, prior comments remain. still weak after that massive failure. My bet is that it continues lower towards 1970. Then a possible bounce in three waves and lower again.

Gold‘s failed breakout continues to manifest itself through further drops in price. It appears more and more likely that an ABC-type move took place. A move like that to new highs is usually B wave of a flat. That 1,2 1,2 idea is hard to swallow at this juncture.

Bitcoin

The move from the highs in BTC is impulsive. Either from here or after another quick push lower, we should correct in 3 waves, followed by another decline. If we get back above 44k it’s likely this drop was just wave C of a flat. With that being said, even if we make an additional high, it should be short-lived.

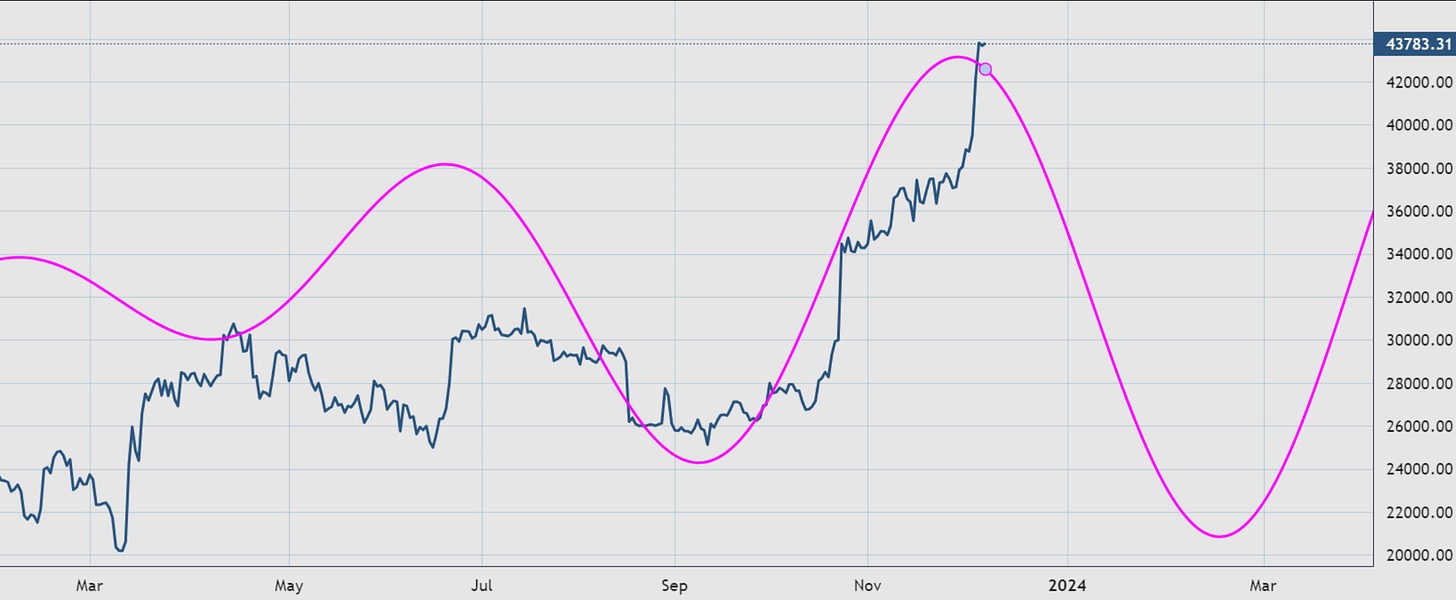

Here is the 150-180 day cycle in BTC suggesting a likely period of weakness upcoming. The depth of the correction is not what we’re looking for here but rather time spent on it.

“Double shot” Daily video coming up next,

Have a great day wherever you are! - trade well, and don’t forget to subscribe and drop a like if this letter helps you in any way.

Cris

email: ewcafe@pm.me