The Daily Drip

Core markets charts updates and commentary

Note: The counts on the right edge are real-time, and they are prone to adjustments as price action develops. Elliott Wave has a fluid approach, is evidence-based, and requires constant monitoring of certain thresholds.

In the counts below, this (( )) = circle on chart

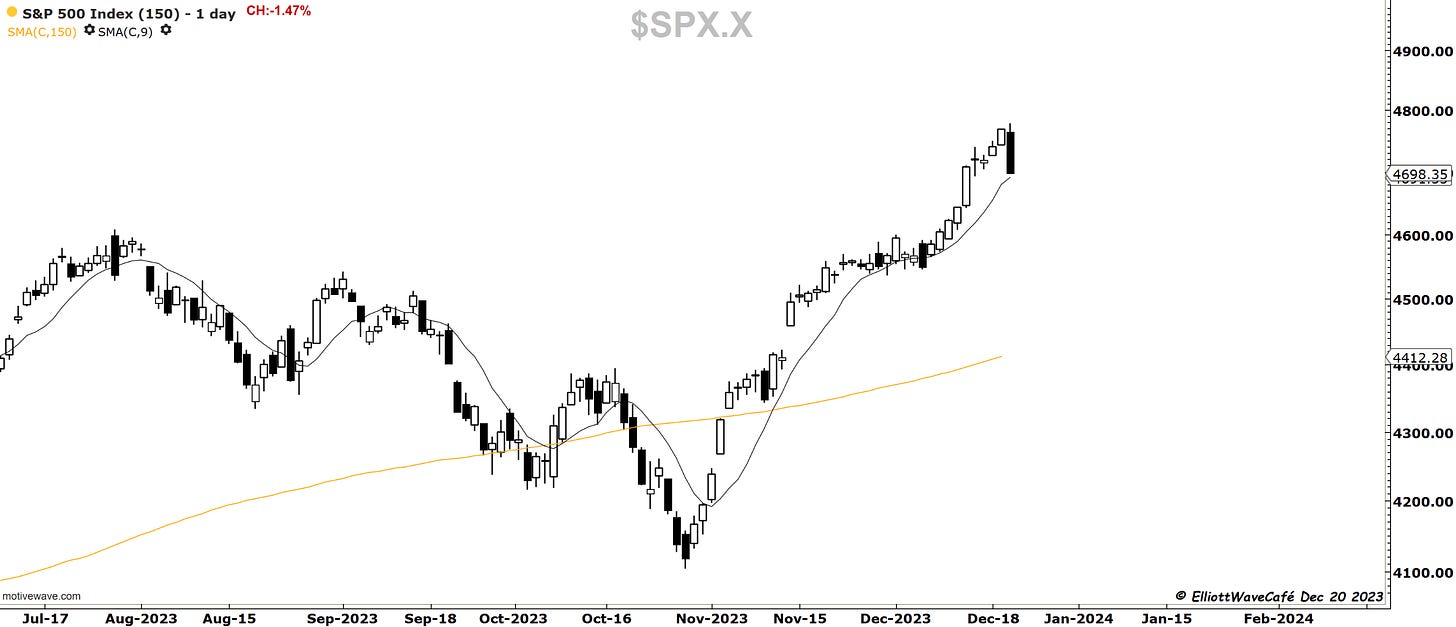

SP500

I closed yesterday’s update with the following words: “However, until the market displays a decent move in the opposite direction, one needs to wait. I think the display of an upcoming corrective period will be quite visible on the chart.”

I think with the price action today and the size of the drop, we got that display. The daily chart below, shows the largest selloff candle since the late Oct rally. The talk on TV for the past few days was that “It’s a given” for the Sp500 to reach new ATH on this run. Unless we push straight up tomorrow like today never happened, those calls might have to wait a while. My initial targets are the highs from July of this year at 4600. How we get there, it’s for the market to decide.

Here is today’s candle touching the 9-day MA. A measure of short-term momentum, this average can provide some temporary support and a reaction higher. If they sell into that, which I expect, we will drop below the average and change its tilt over the next several days. Further corrective price action would follow.

At noon today, just before the selloff started, I sent this trade alert out to members.

On Twitter, I followed up with these 2 tweets.

To conclude, I don’t think this is a low-volume, take-profit, and resume course higher type of move. Many of the signs presented in these daily updates have been hinting that we’re getting overly frothy. The bullish exuberance was steaming from the TV corners, with some of the largest bears on the Street capitulating. It is the moment of capitulation that turns things around; it is when you cannot hold anymore that the boat is turning. I have seen it in my own behavior and many others over the years. This is why sentiment is so powerful and will never change. This is how waves form and how R.N. Elliott could identify them. He was probably a master at reading sentiment. He did not just sit on the front porch and graphed charts. He was talking to people, listening and paying attention to the news, and “feeling” the tape. Of course, you plot it on the chart with price, but between that and “smelling” the moves, it takes years, sometimes decades, of listening to the buzz of the market.

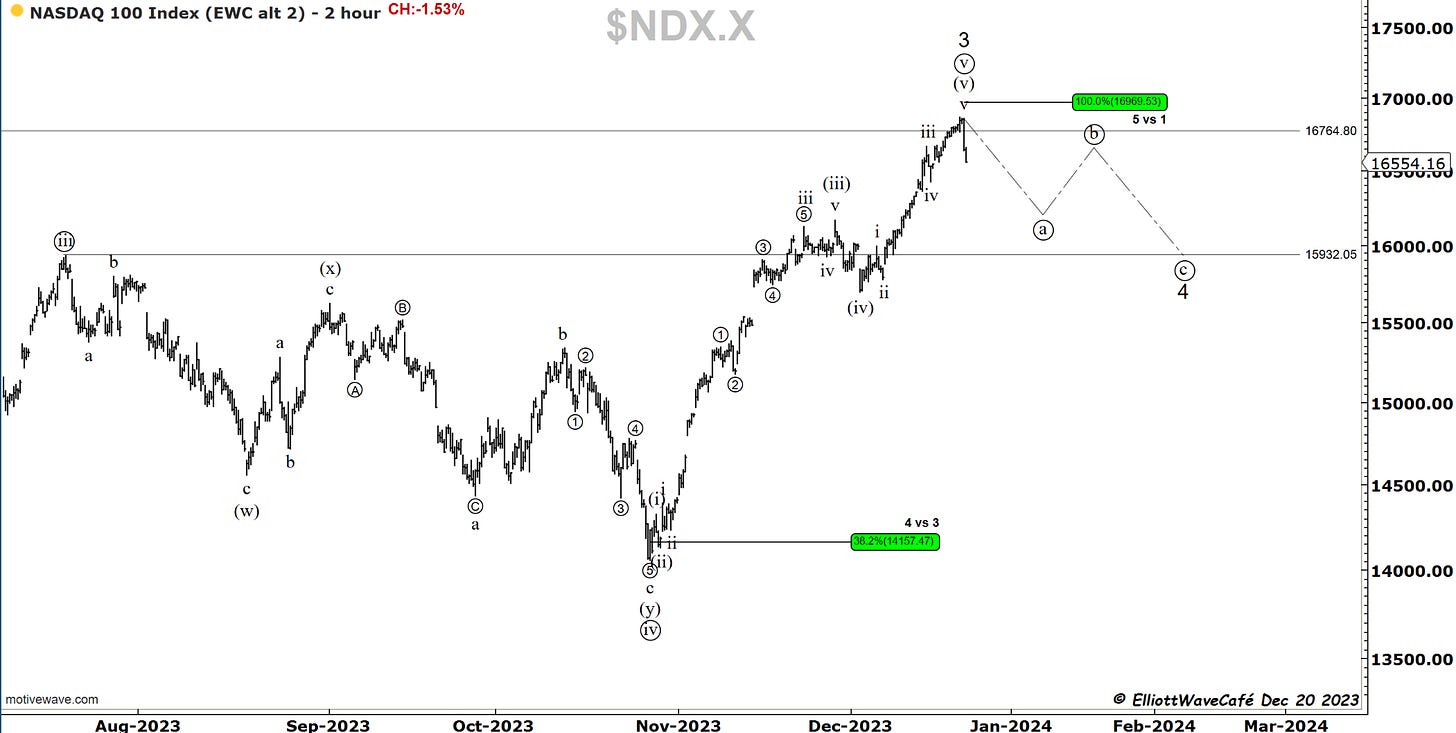

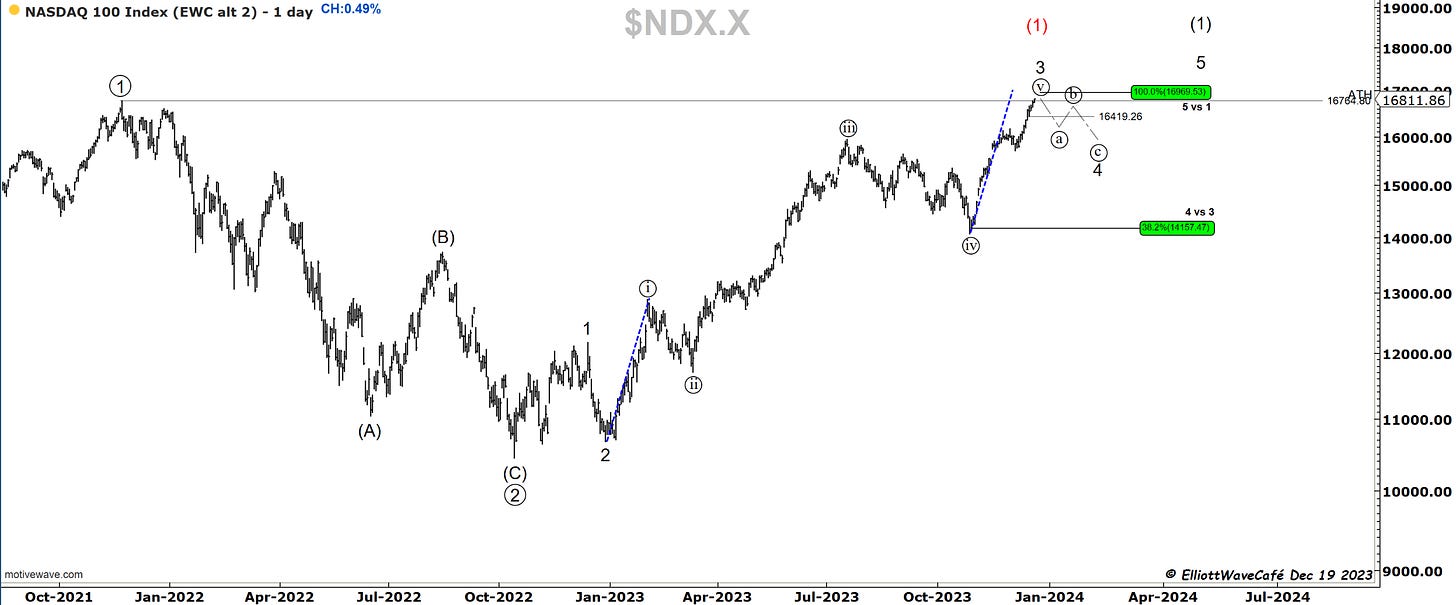

Nasdaq100

With just a few points ahead of wave equality, the market ran out of buyers. Why? The last one just bought that top tick. Then the orders have to come lower to find buyers, but they’re nowhere to be found, then the sellers smell blood and start selling, then the last tick buyers realized what they just did and sell. Suddenly, that door is too small, and everyone is trying to escape. We will hear tomorrow that this sellof is just a small retracement and means nothing. That view will get validated with prices moving up to meet new sell orders and destroyed once again on the way down, until those people say it’s just another chance to buy at lower prices and so on…. you know the story. Eventually, once everyone is scared that this correction is very bad , we form a bottom, and up we go again.

Even tho this looked like a diagonal; it was not officially one. The market reaction treated it like it was. It is the type of selloff you get after ending diagonals complete. Looking closely, you can see a very nice motive wave in that final wave (v). The fact that it moved so slowly exasperated the bears and gave ultra confidence to bulls to buy. It's the best combination for maximum damage.

If correct, the targets should be just above 16k initially.

Once again, the display of wave equality in blue.

RUSSELL 2000

I will leave yesterday’s comments below. Today, we ticked higher just enough to complete wave ((5)).

Like clockwork, as mentioned yesterday, another push higher to work wave ((5)). Everything else is unchanged. Take a look at IWM cycle work with the active 108-day cycle. Any further bullish bets here have increased risk.

Dow30

I read somewhere that today was the 2nd worst day in the DOW since March. That is pretty decent evidence that the rally has come to an abrupt end. Of course, one could say that one day does not change a trend, but what’s the fun in saying that? This is an ugly day. We will see what type of follow-through it gets.

The initial targets are July highs at 35,679. Remember, markets have a funny way of getting to obvious targets. Those 3 dotted lines on the chart suggest direction, not precision.

US Dollar and Yields

The dollar established at least a temporary bottom last Thursday. It has not really responded heavily to today’s action. There might be some more downside in it, I reckon. If the market selloff continues, I bet the dollar will be rising. It's still early for that, especially with yields continuing to sell lower today.

Yields decline has stabilized just above 3.87%. It will be much tougher to continue sliding from here. The market has already staged a pretty strong decline in anticipation of Fed-rate cuts. Any hint that it gets delayed could lead to a severe repricing of bonds. In my view, the risks are to the upside from current levels.

Getting closer and closer to the 61.8%. The bond selloff and yield rally are not very far.

Gold

No changes in the yellow metal, but a rise in yields and a stronger dollar should help it move lower.

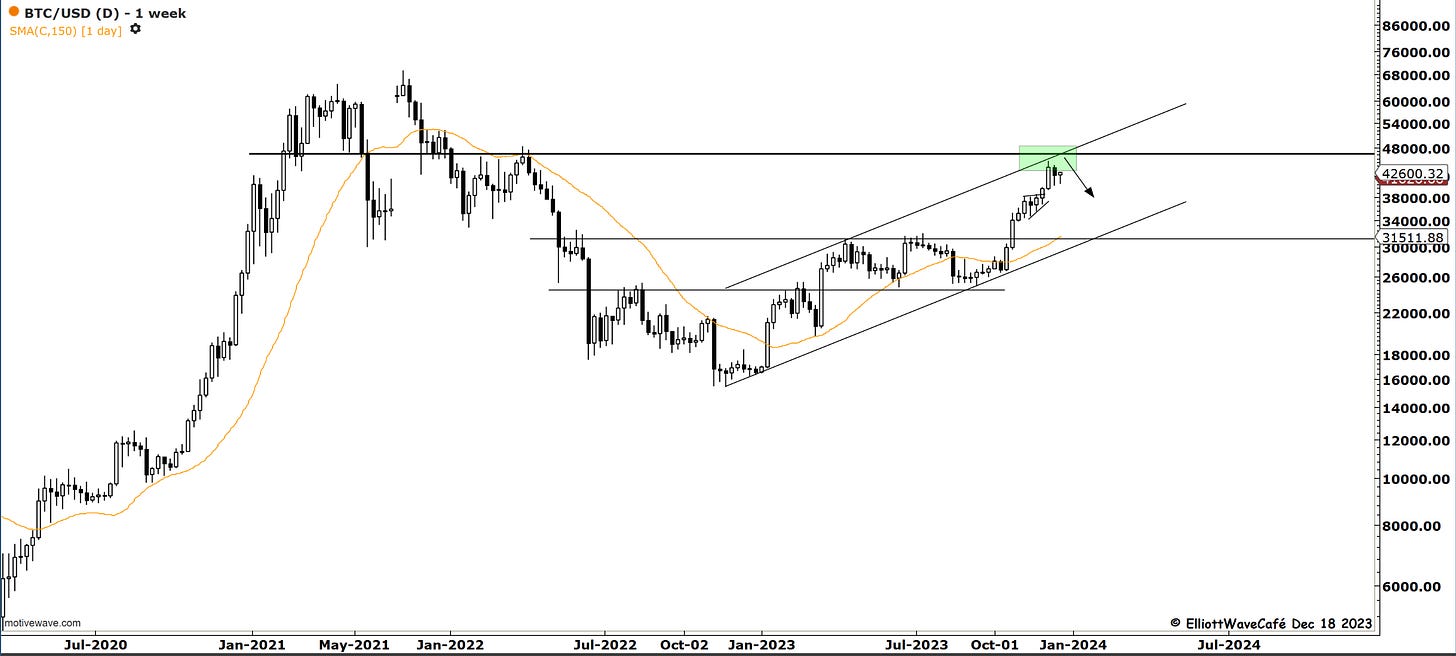

Bitcoin

Identifying here another three-wave rally in Bitcoin. I would be surprised if she turned impulsive. If she does, I would refer you to the second chart, where a 4th wave might still lead us to the upside. However, it would be the final 5th wave, leading to a correction next nonetheless. I would not get too cute getting caught long without protection.

Here is the updated price action in BTC since cautioning of a likely topping cycle.

“Double shot” Daily member video coming up next,

If you’re new to Elliott Wave or need to refresh, there is a 7-hour video course with downloadable slides under The Coarse tab on the website.

Have a great day wherever you are! - trade well, and don’t forget to subscribe and drop a like if this letter helps you in any way.

Cris

email: ewcafe@pm.me