The Daily Drip

Core markets charts updates and commentary

Note: The counts on the right edge are real-time, and they are prone to adjustments as price action develops. Elliott Wave has a fluid approach, is evidence-based, and requires constant monitoring of certain thresholds.

In the counts below, this (( )) = circle on chart

SP500

When in doubt, zoom out. The best we can do here in the SP500 is to wait for a resolution of this tight consolidation. For the many healthy stocks out there, we do have some sick ones that can’t catch a bid yet. This creates a balanced structure until someone succumbs to pressure. The monthly options expiration is this Friday and could provide some catalyst for swings over the next few trading days. My view remains towards higher, with some short positions trying to balance weakness.

1h Chart below with unfilled gaps in red.

Nasdaq100

There really isn’t any arguing that can be done with Nasdaq here. The sequencing points higher until it doesn’t. By that, I mean we need to see some swing lows get taken out before we can hint at other outlooks. For now, I will continue to label at lower degrees the 1,2 series, which squeezes the bullish hand. This market outpaces everything else out there. Ready for the largest Nasdaq rally in history with AI arrival? What if it happens? What if it rivals the dot.com era? These are questions worth asking. In the end, we’re here for major opportunities. Let’s give them a try.

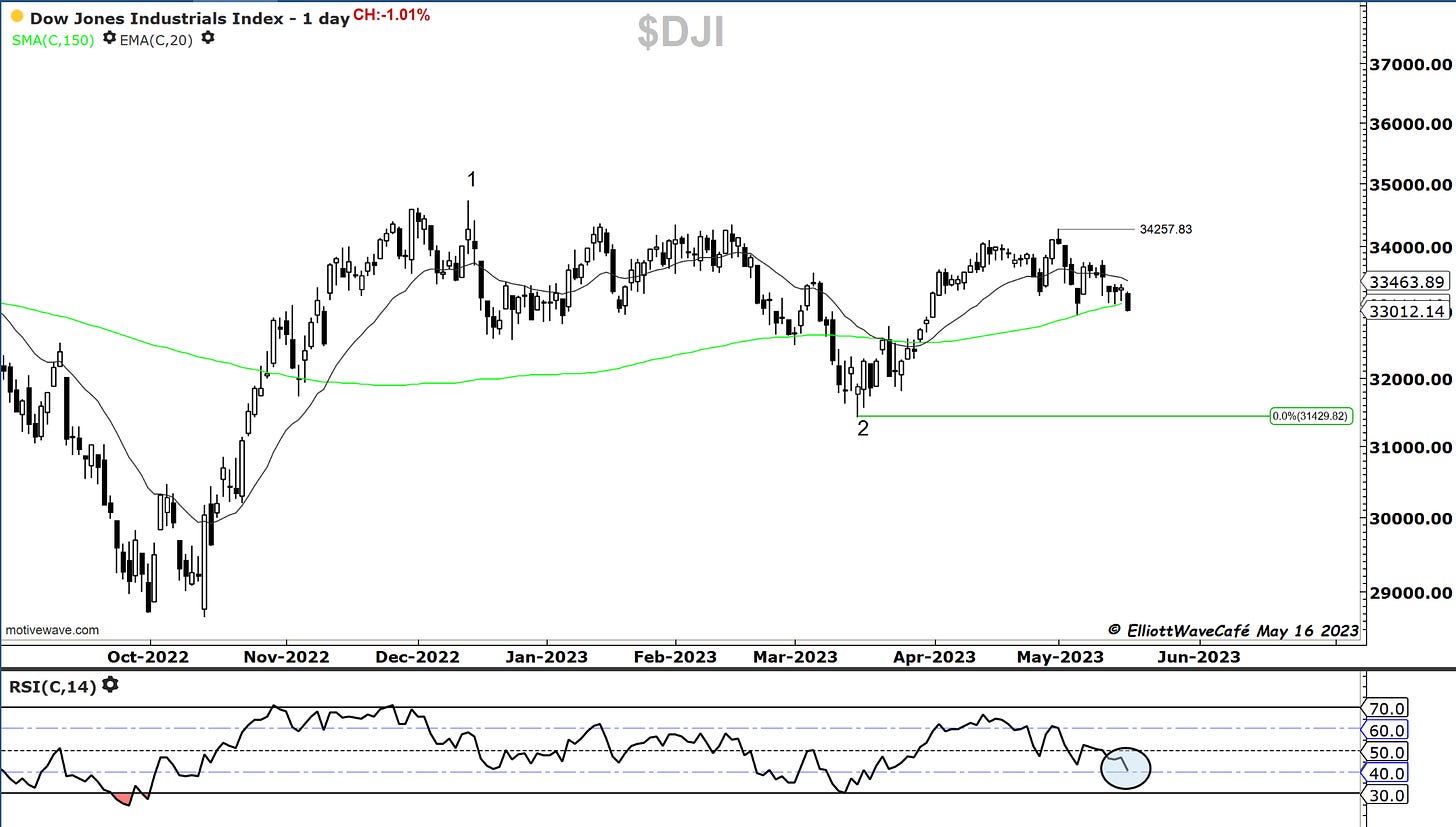

Dow30

Dow Jones composite struggled across all three areas. Industrials, Utilities and Transports. We’re coming into good support, and although we just broke below the 150-day, I notice once again a 40 RSI, where bulls usually lick their chops in uptrends. If we manage to recover and get back above 33,600, I would say it’s likely the correction ended, and we’re ready for the breakout. The problem we have is a big rotation from value into growth, and believe me, no one wants to underperform by being exposed to weak sectors. We need to wait for the “Revenge of the Dow”. Season 2 coming to a theater near you.