The Daily Drip

Core markets charts updates and commentary

Note: The counts on the right edge are real-time, and they are prone to adjustments as price action develops. Elliott Wave has a fluid approach, is evidence-based, and requires constant monitoring of certain thresholds.

In the counts below, this (( )) = circle on chart

Here are today’s top 10 best performers out of 104 industries.

50 positive closes and 54 negative.

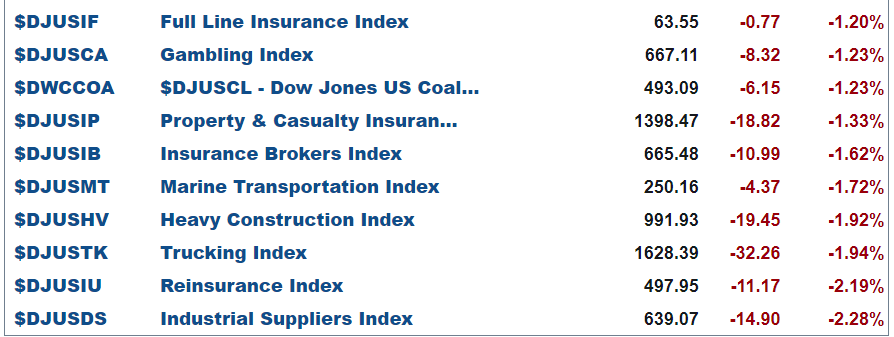

and bottom 10 …

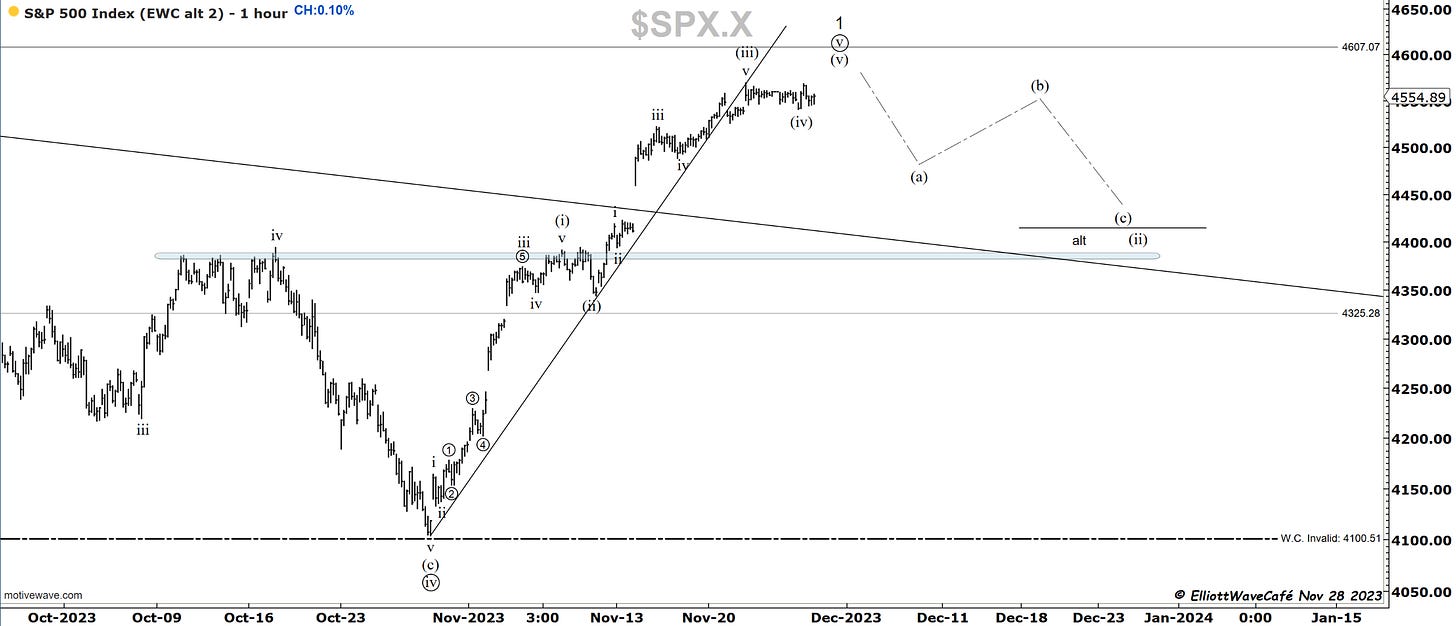

SP500

As soon as wave 1 is completed, wave 2 will start. It should retrace at least 50% of wave 1. The wave 1 internals are quite evident with an extended wave (i), a wave (iii) complete, sideways in (iv), and a quite short wave (v) expected. For those interested in fib measurements, I have an older YouTube video that explains them here. But basically, an extended wave 1, measures wave 5+3 vs 1 through fibs and gives you targets for wave 5.

Markets were quiet once again today, so it’s a waiting game for evidence of trend completion to be more significant. The break of the trendline is the first step. A move and ideally close below 4540 would be the second. A 5 wave move down is a good confirmation. That would probably set up wave (a).

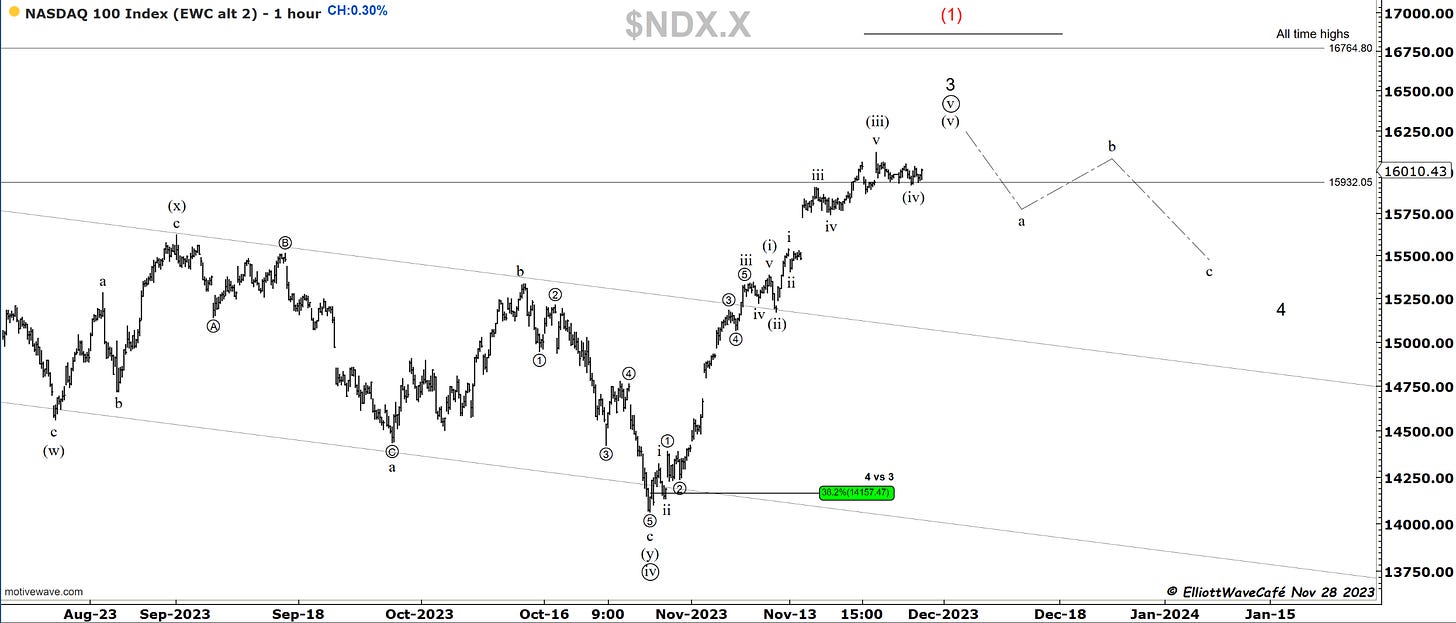

Nasdaq100

Here is a closer look at the wave internals so far. Must be aware of one more quick push higher before wave ((v)) completes. We spent the last two days not being able to stage another high, but let’s give the trend the benefit of the doubt. A break below wave iv low would tell us this impulsive leg is over, and the correction has begun.

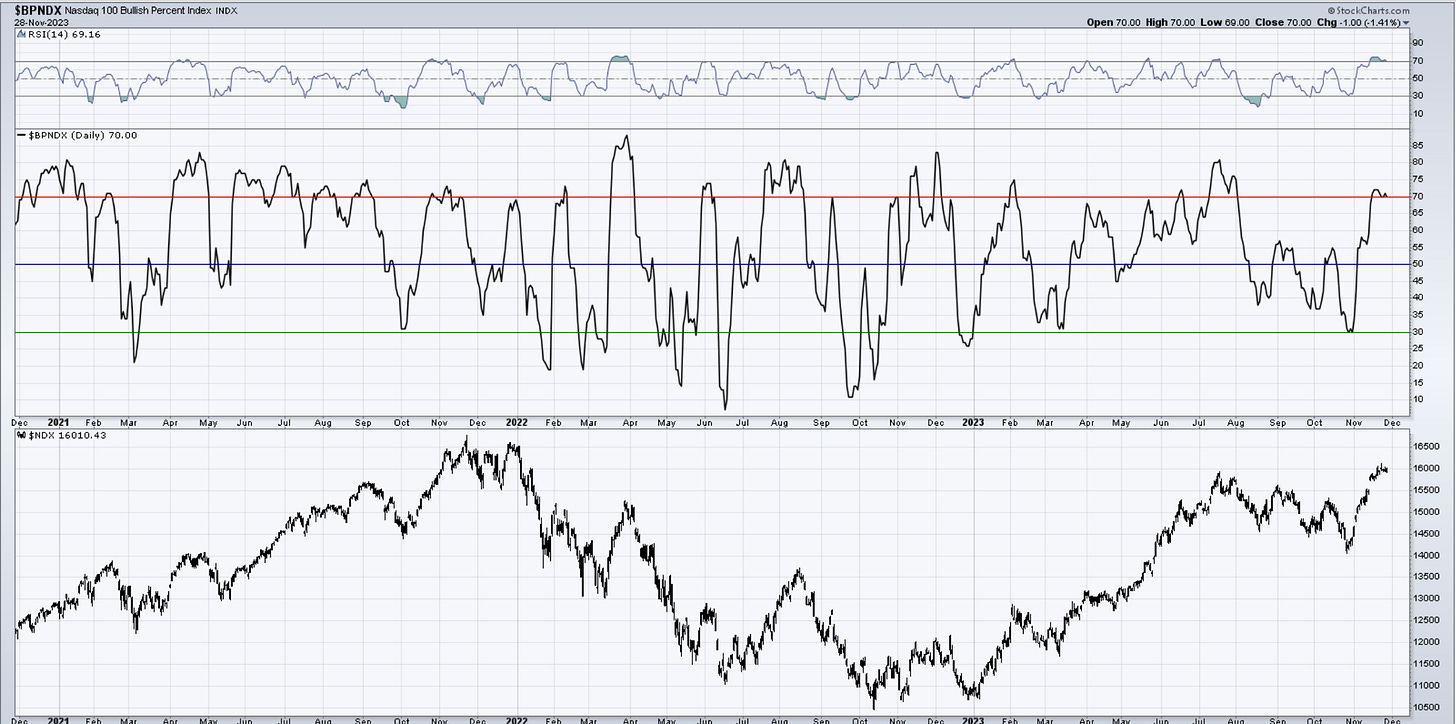

XLK here is in “caution” territory, with BPI surpassing 80. Not a place where one wants to get “too long.”

Here is the BPI for the NDX as well. Hot stove there, too.

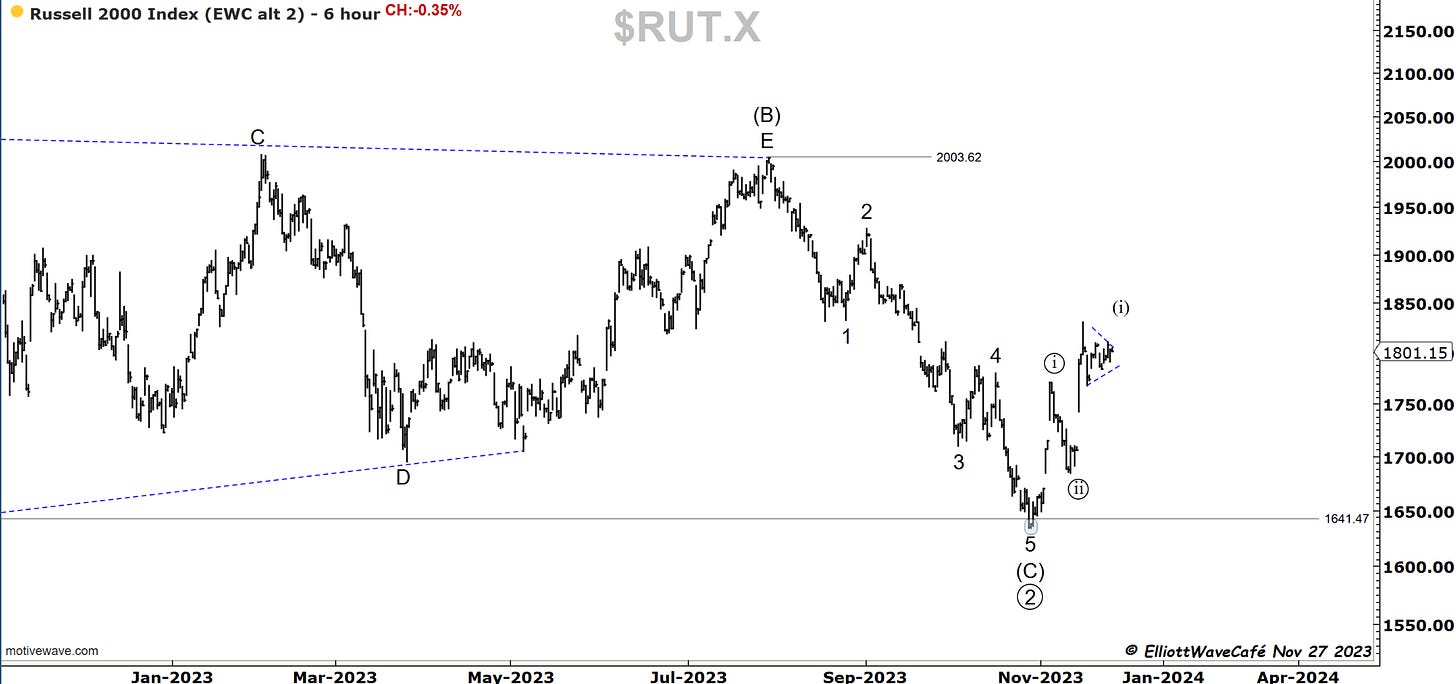

RUSSELL 2000

previous comments here remain. - it was the weakest today.

That price action in the small caps smells like a triangle. If we’re not closing below wave ((i)) high, it could actually be 5 waves from the lows with a triangle wave ((iv)). I will explain more in the video tonight.

The three-wave setup still lingers on this count but has yet to gain any traction. Small caps sold off initially today, then recovered later in the day.

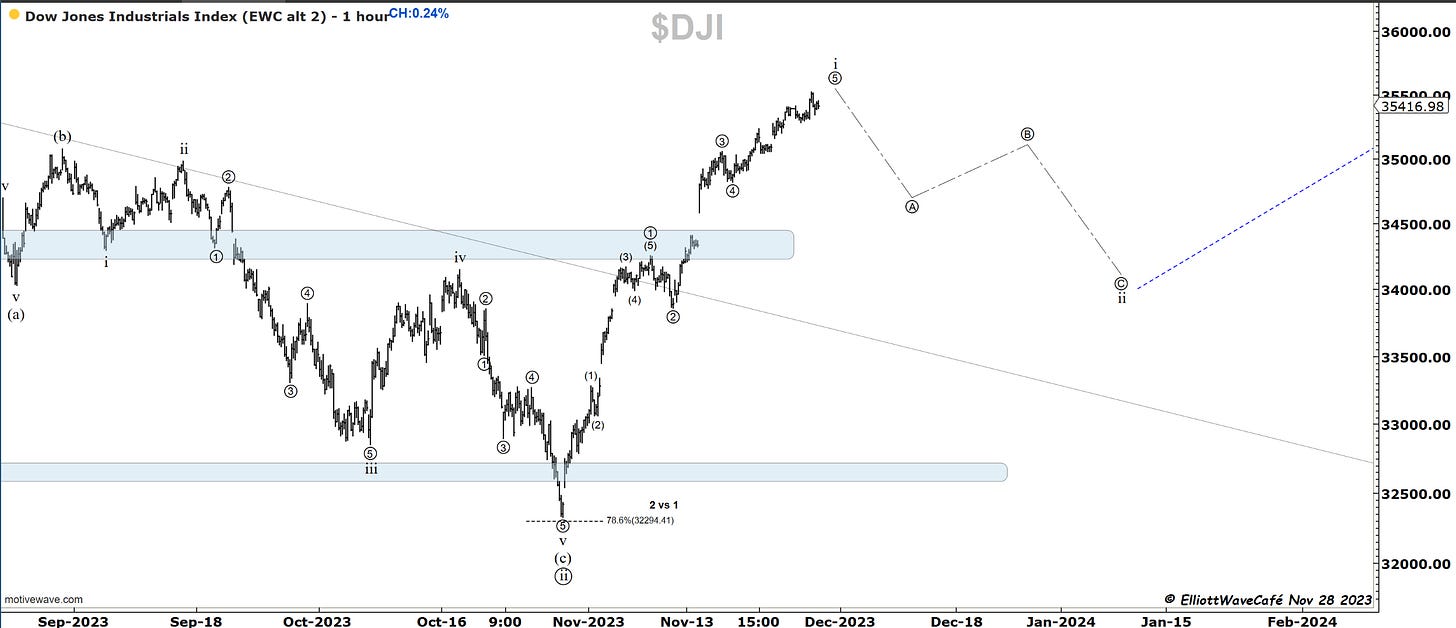

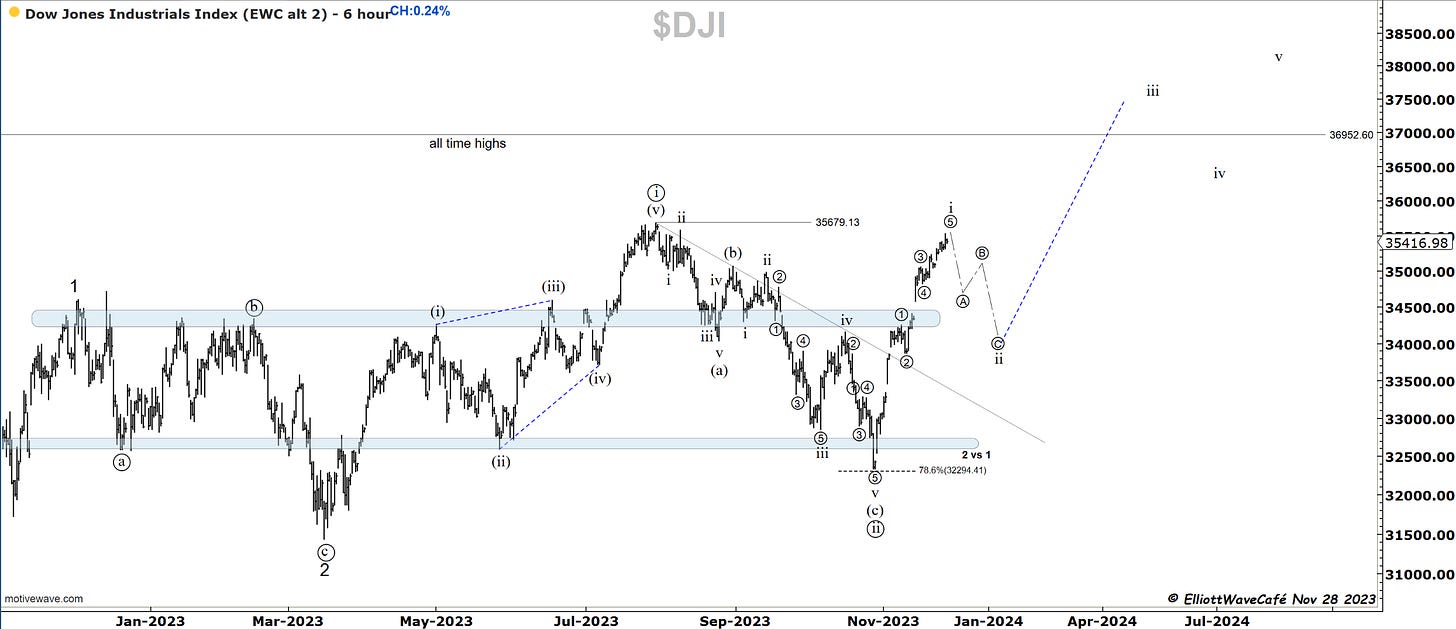

Dow30

Dow is a bit trickier here on the subdivisions, but I will go with this for now, given the better clarity on the other indices. We’re looking for a wave ii pullback here as well back towards 34500 at least. Let’s see if the market plays ball.

BPI here into the Hot zone in this index as well. This time could be different, but I would rather bet on what happened in previous instances as buy signals get too heated.

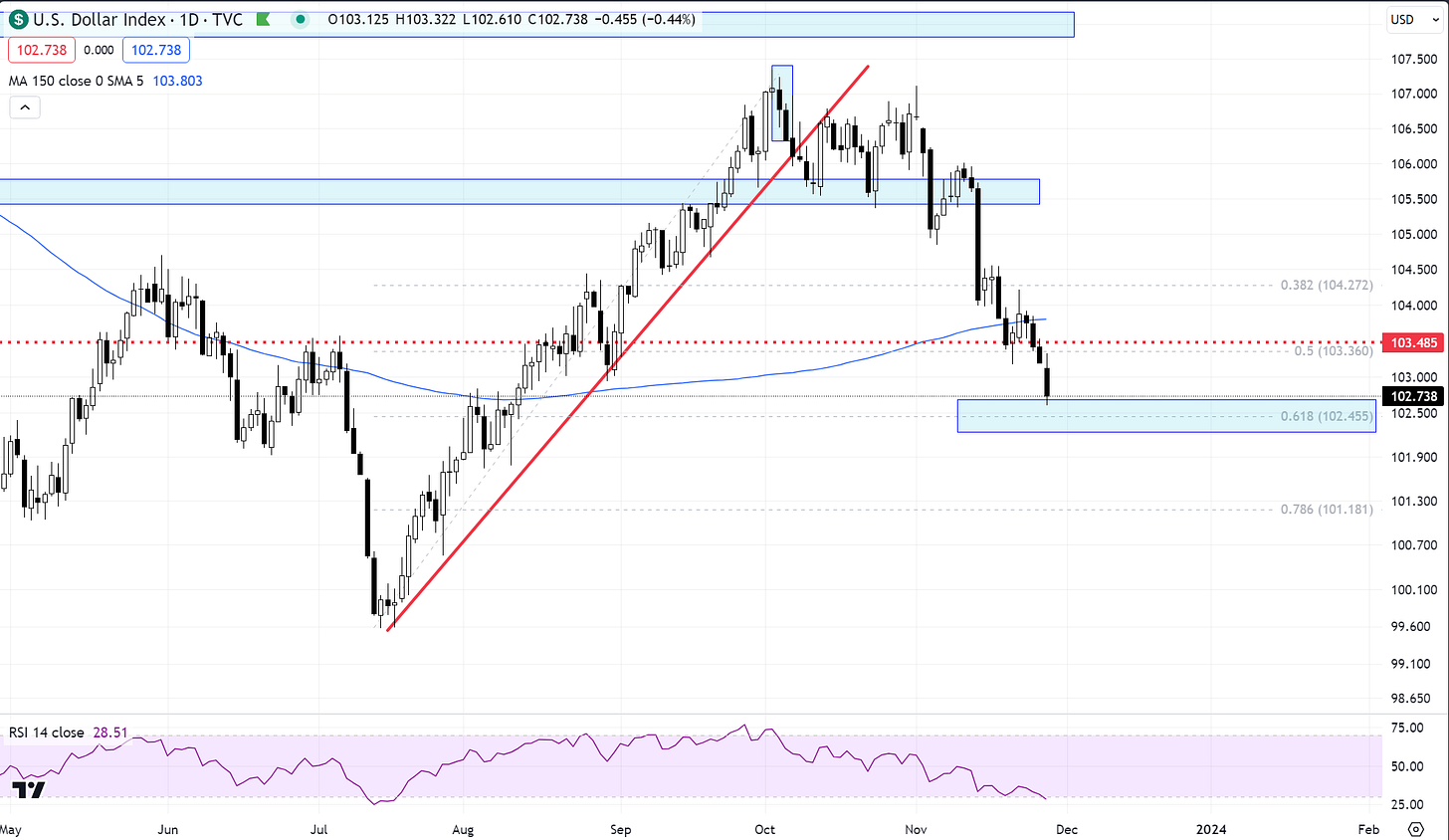

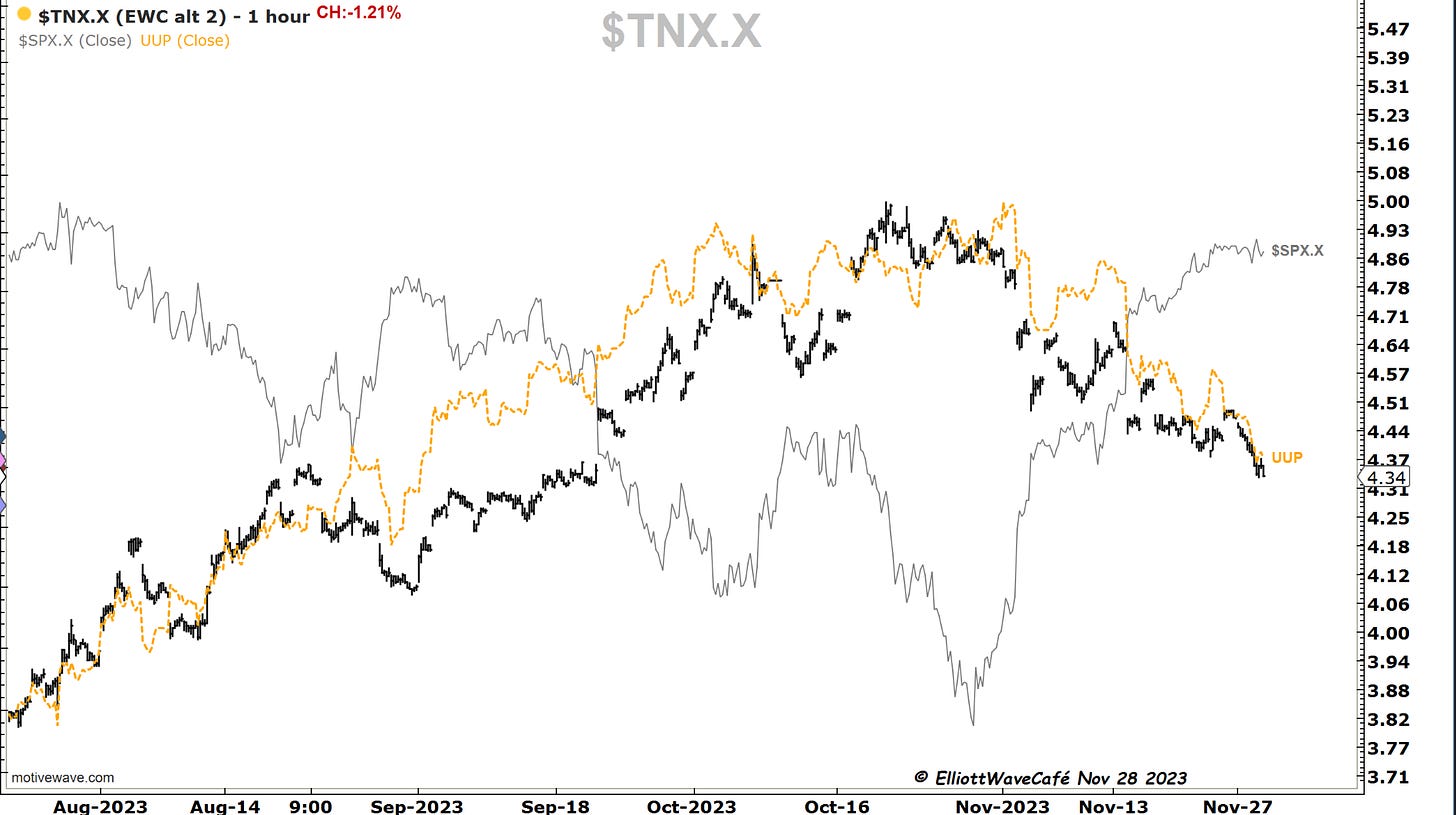

US Dollar and Yields

Here we are one day later testing the golden fib zone in the dollar. For the decline from the top to become a 5 wave, we will need to form a 4th wave toward year-end. Expecting some headwinds here for a few days. Will discuss the dollar wave count in tonight’s video.

Here it is again that direct correlation dollar - yields and inverse correlation yields/dollar - stocks. The 10-year hit 4.34 today making a new low. Scanning for a 5 wave move there into this 4.30 support. The next large support is at 4.00.

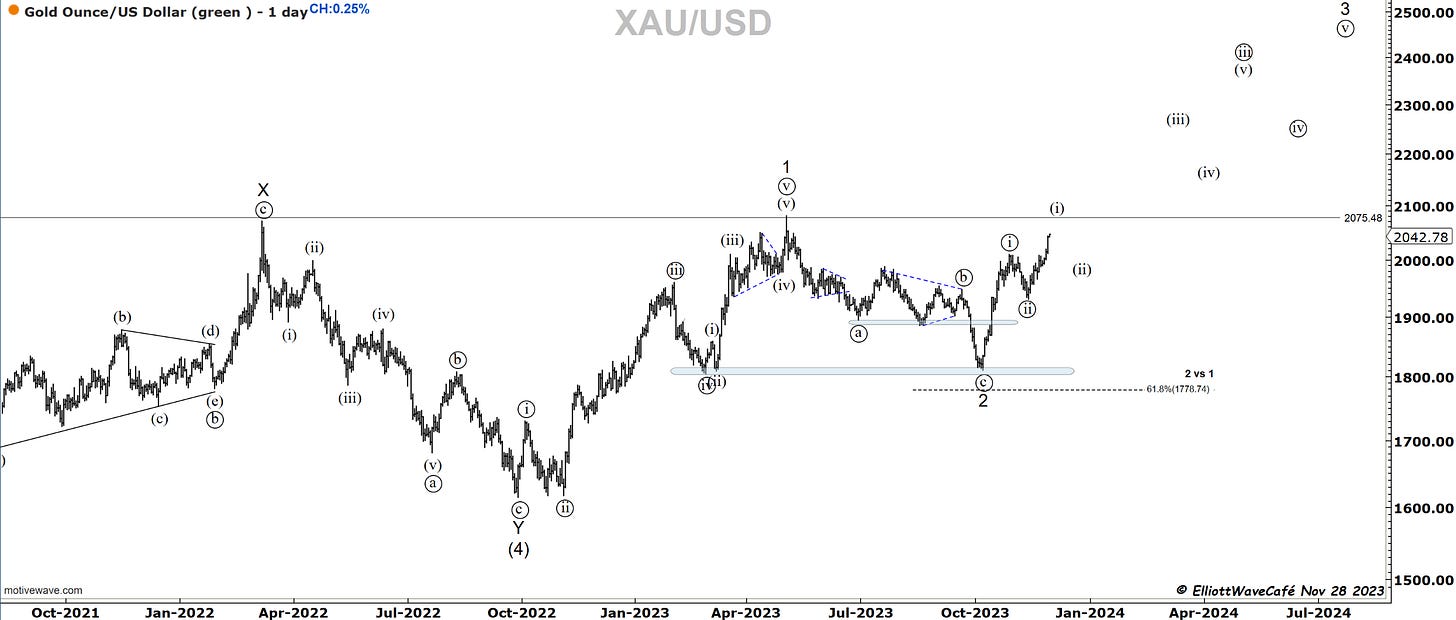

Gold

Higher again. Could this really be the moment for gold? I am not fully dismissing yet that B wave of a flat for ((ii)), but if this is correct it will only shake out late buyers before resuming the trend. Watching for that (i) (ii) as the lower degree move that will build the larger wave ((iii)). Strap on, this could get a wild ride come 2024.

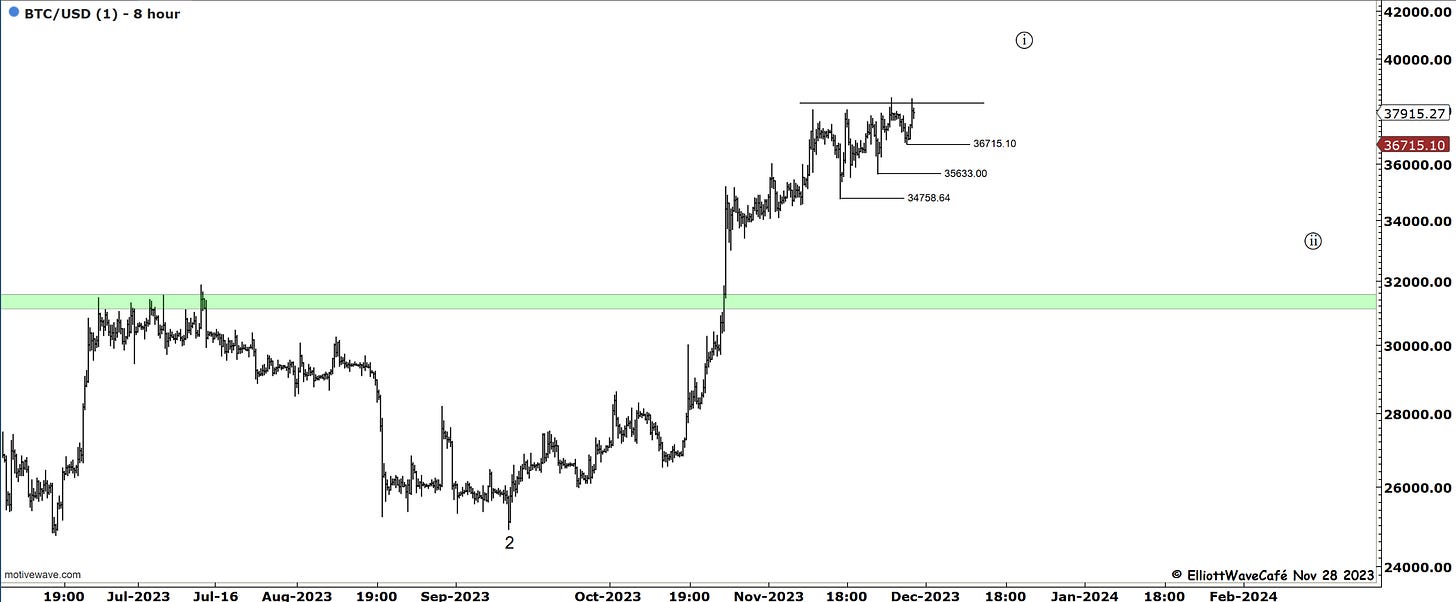

Bitcoin

Someone is really protecting that 38k level. But every lower swing is higher than the one before, meaning traders are lifting their bids. Something will have to give soon enough. I think the market wants to see who’s hiding above 38k. The question is what happens after we get there? Do we unleash an avalanche of stops and rally strongly, or does the market take them out and reverse? There are several tactics to play this which I won’t get into here. Based on some of the 150-180 day cycle work I follow combined with a nearby wave 5 top, I am still wary into 40k.

The cycle line depth is not for price targets but for time. So no, I do not expect 22k, but possibly a grind and correction into spring next year. Let’s see how it plays out.

Daily video coming up next,

Have a great day wherever you are! - trade well, and don’t forget to subscribe and drop a like if this letter helps you in any way.

Cris

email: ewcafe@pm.me