The Daily Drip

Markets review, strategy and analysis

Note: The EW counts on the right edge are real-time, and they are prone to adjustments as price action develops. Elliott Wave has a fluid approach, is evidence-based, and requires constant monitoring of certain thresholds.

In the counts below, this (( )) = circle on chart

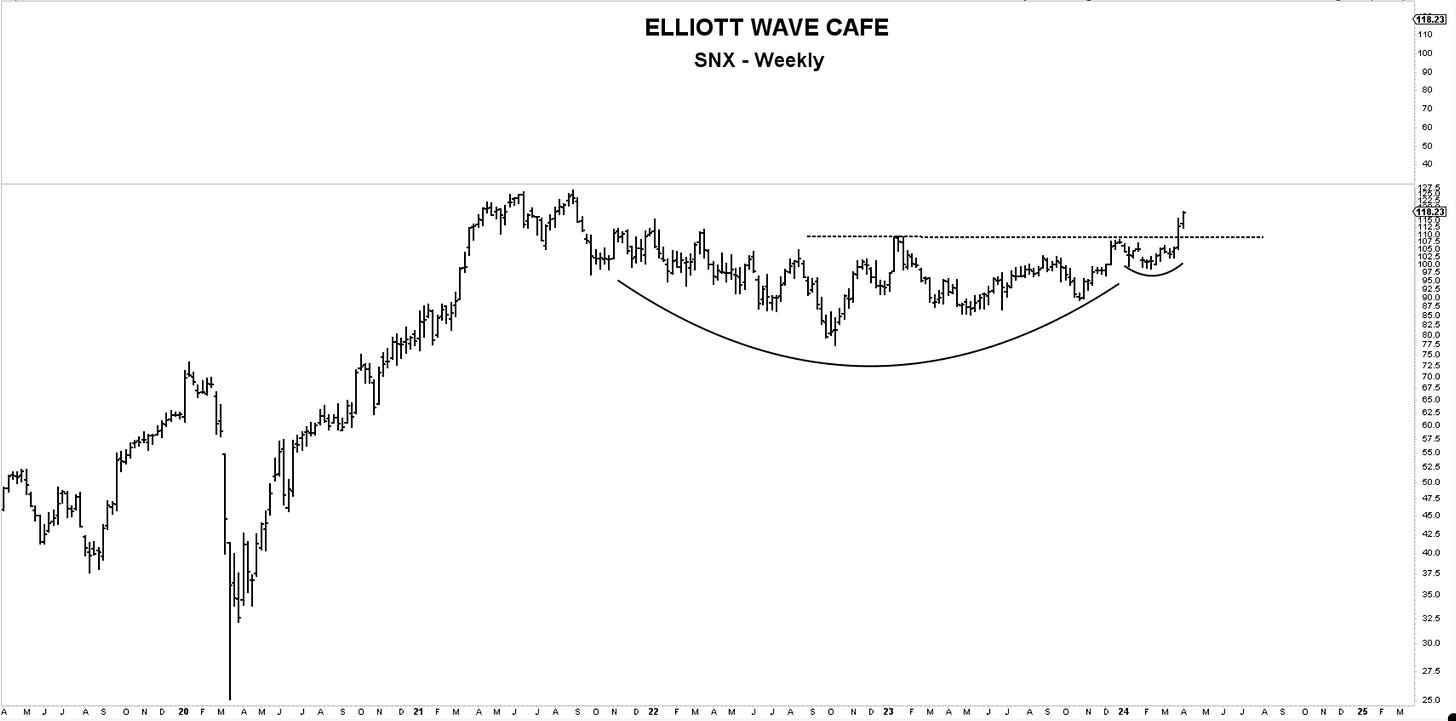

Chart of the Day—SNX— Tech/Computer Hardware. Long extended base and distribution, followed by a break above key resistance levels. While above 110, it has the potential to get towards 128 highs and even 150.

Here are some snippets from yesterday’s letter

Sp500 - This behavior mimics previous selloffs, so I added another green arrow to the chart. If the market wants to bounce and buyers are stepping in, this is the level to do it near term.

Nasdaq100 - The RSI tests 50, and support was found in prior instances. “Stick with what works until it stops working.” I heard this somewhere.

Dow30 - They briefly cracked support. However, being in an uptrend and counting ABCs against the trend is not a bad idea.

IWM - We’re still above the 200 mark even after a -2% selloff. The RSI is hitting 50 and the channel support is coming in along with horizontal support. A bullish bet here has a small risk/reward using 199 as a defense.

Gold - Gold has one mission: “going higher.” The move from 2150 could be a fifth wave of ((i)) of 3 or, very well, a wave ((iii)) of 3. Whatever it is I would not want to get cute with it. Stops below 2100 and let it ride.

Bitcoin - Bitcoin never broke 71,600, so it never triggered the “buy” signal. Instead, we came lower and got closer to the uptrending 50-day MA. While the move could “feel” scary, a broader look unveils the possibility of a simple 4th wave corrective pattern. 60k is a major support for any further drops, but if we’re building a triangle, we should not be getting there.

In the daily video we discussed market behavior and focused on Gold and BTC wave counts.

By the way, I put this on Twitter yesterday - SILVER

did not take long….

Today, I will examine the 11 main US sectors to see how they have behaved in this bull market, and in the video, I will present my thoughts on the other core markets.

Let's dive into the charts below …