The Daily Drip

Core markets charts updates and commentary

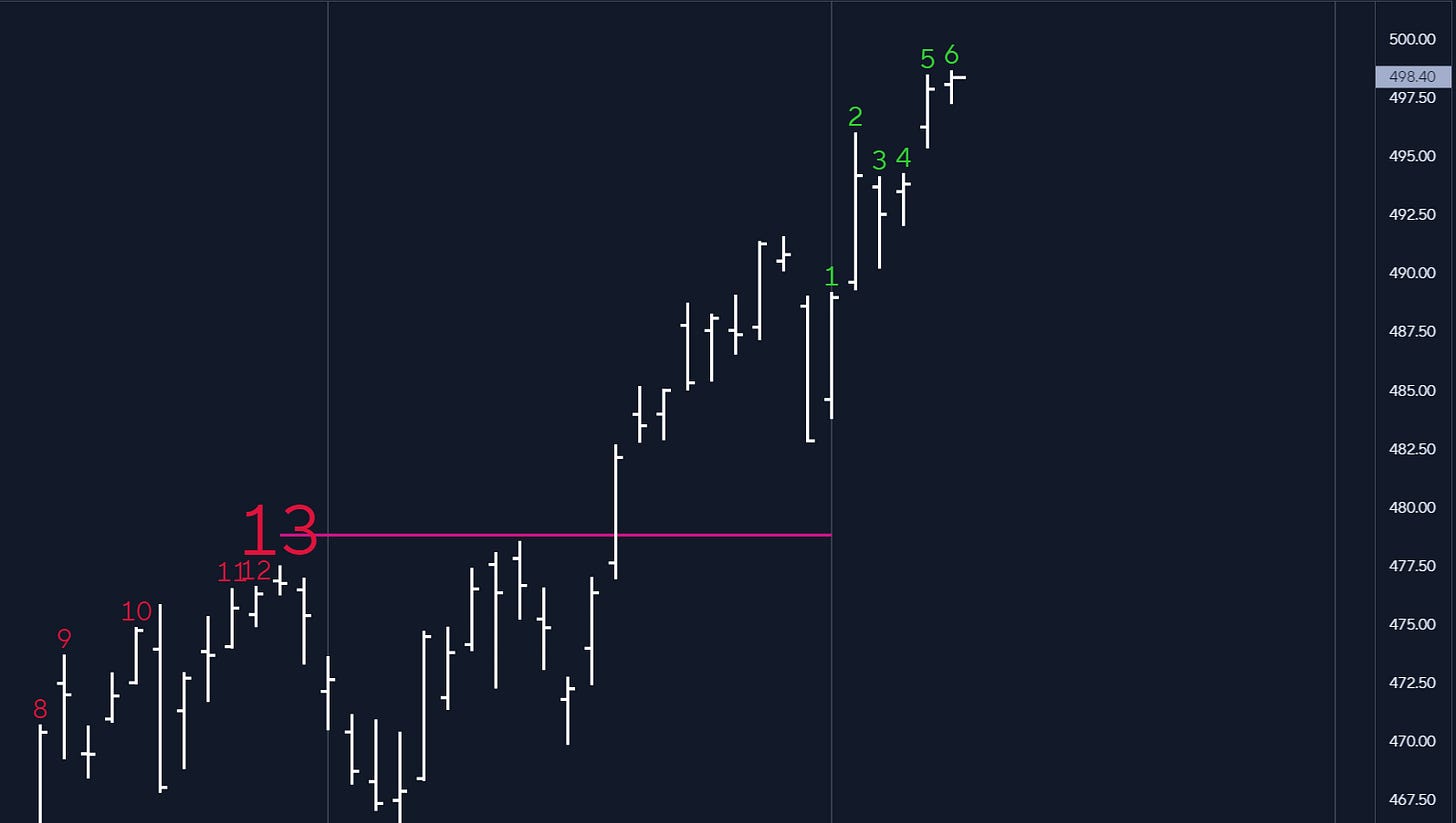

Note: The counts on the right edge are real-time, and they are prone to adjustments as price action develops. Elliott Wave has a fluid approach, is evidence-based, and requires constant monitoring of certain thresholds.

In the counts below, this (( )) = circle on chart

“The Daily Drip”update is now available as part of a lower subscription tier $8/month or $6.67/mo yearly. Daily videos are also included with subscriptions until March 18th.

SP500

Today’s story is seen below. Small caps decided to shake the tree to see what had fallen. The market is pretty much unchanged on the three most followed indices. The tape is quiet and has no evidence of reversals. With all the “yellow signs” flashing and warning “caution” at these levels, until we see something appear in the price, one has to stay the course and assume a continuation of the status quo. DeMark counts below are still about 3 days away from flashing a sell setup 9 sequential.

The wave count is unchanged and is looking for the final sequences of this fifth wave. It will be followed by a correction that will likely dip below 4800 in the first leg lower.

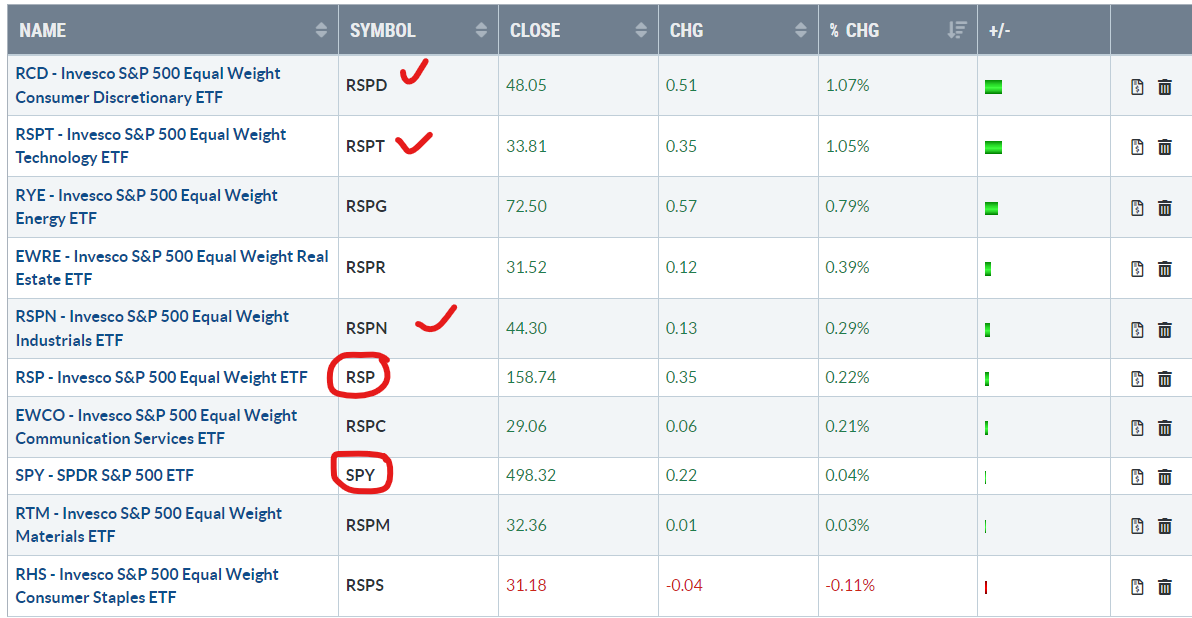

Today’s market had good participation from some of the equal-weighted sectors, even with a flat tape in the SPX. The RSP was up 35bps, but discretionary, tech, and industrials did some of the heavy lifting. This is the type of action that you want to see to grow your confidence in a healthy market.

Some of the flashing signs hinting at an upcoming pullback are below :

price hugging the top side of the trending channel

a 5-wave structure from Oct 2023 lows

converging trendlines on smaller time frames

seasonality approaching a weak period

still persistent breadth issues when you eliminate the large cap names.

A late fuse on the 85day cycle but still within timelines

VIX approaching upswing on cycle analysis

The bottom line is that I am wary of this market and its behavior at these highs. My bet is that we will see a corrective move unfold over the next couple of months. The pure price evidence still remains inconclusive and will remain so until we break some of the key levels mentioned.

Now let’s discuss NDX, DIA, IWM, DXY, Yields, and BTC. Let’s look at NVDA today as well.