The Daily Drip

Core markets charts updates and commentary

Note: The counts on the right edge are real-time, and they are prone to adjustments as price action develops. Elliott Wave has a fluid approach, is evidence-based, and requires constant monitoring of certain thresholds.

In the counts below, this (( )) = circle on chart

SP500

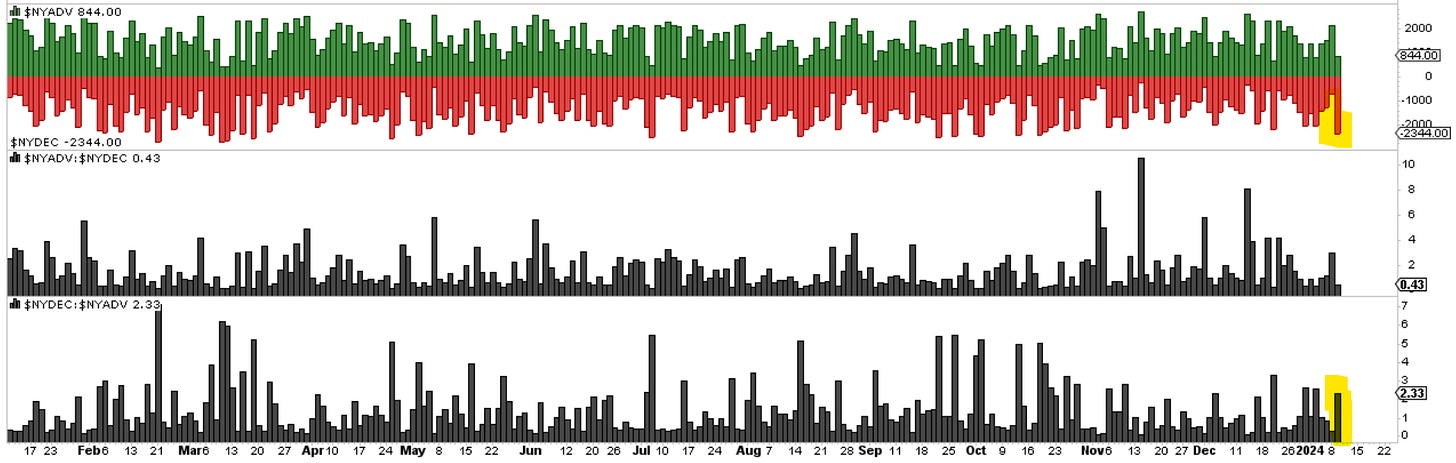

After gapping lower at the open today, the rally closed that gap and made a small marginal new high. If that was wave c of (ii), we should roll over and begin a larger decline in wave (iii). The stalling and lack of follow-through based on yesterday’s price action should be somewhat concerning for bullish views. Let’s assume today’s action was in anticipation of the CPI tomorrow and not many wanting to take unnecessary risks. Underneath the surface, though, we had more than 2 to 1 selling vs. buying.

.

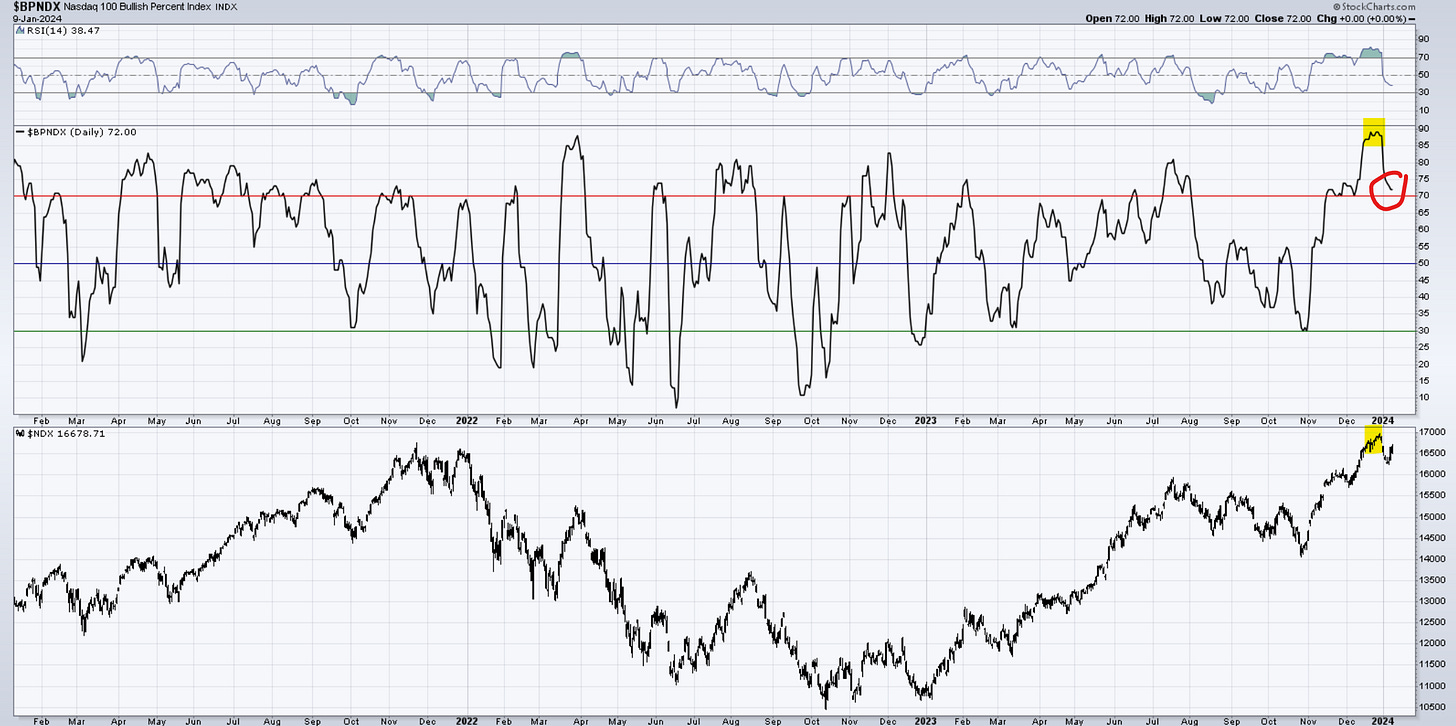

Nasdaq100

A small three-wave move has already been formed in the NDX. It’s either wave (b) or ii. The BPI has finally cooled off from the overheated 90 levels. It is now back to 70, but remains in Hot Zone territory. I think there is more to unwind.

RUSSELL 2000

Looking at the 1H price in Russell, we can see a strong impulsive decline from the top. It is now followed by a countertrend move. It’s either wave (b) or part of (b). ( when I specify that, what I mean is that wave (b) can continue to unfold in a complex series higher). The most common retracement for a B wave is 38.2% in the case of zigzags, followed by 61.8%. Run a fib from top to bottom and see where the rally stopped. The bottom line is that the pullback in Russel is not complete, and I am looking for lower prices below wave (a) low.

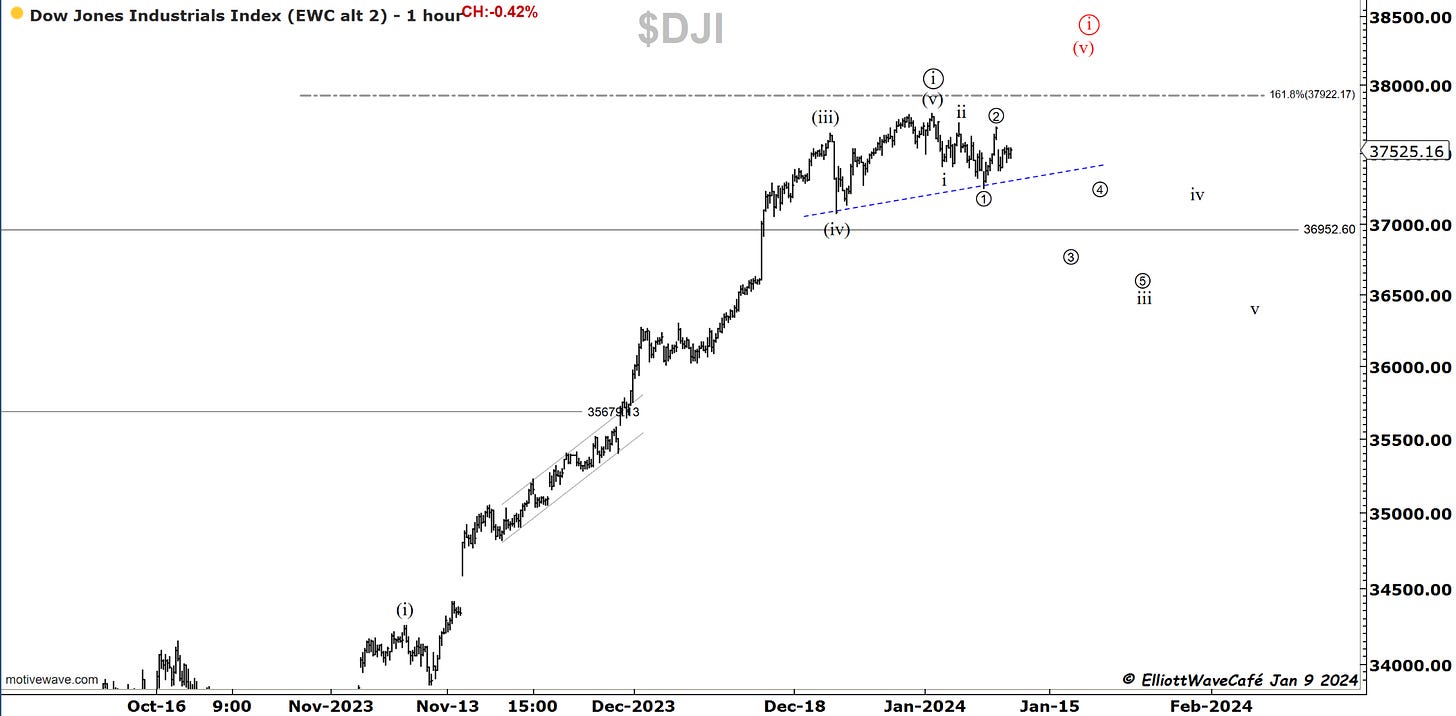

Dow30

You can probably spot the head and shoulder formation by yourself. Our count should take additional charge on a break of that blue neckline. There should be good support at 37k, so expect selloffs to be met with bids. It should not derail the larger upcoming corrective action too much. It has the potential to go towards 36k.

US Dollar and Yields

Yields have been stable today, but that won’t be the case tomorrow. CPI should shake things up a bit.

The Dollar pulled some gains, and the pattern of the lows suggests further upside, at least for another month, if not more. Any throwbacks will find support near 101.50.

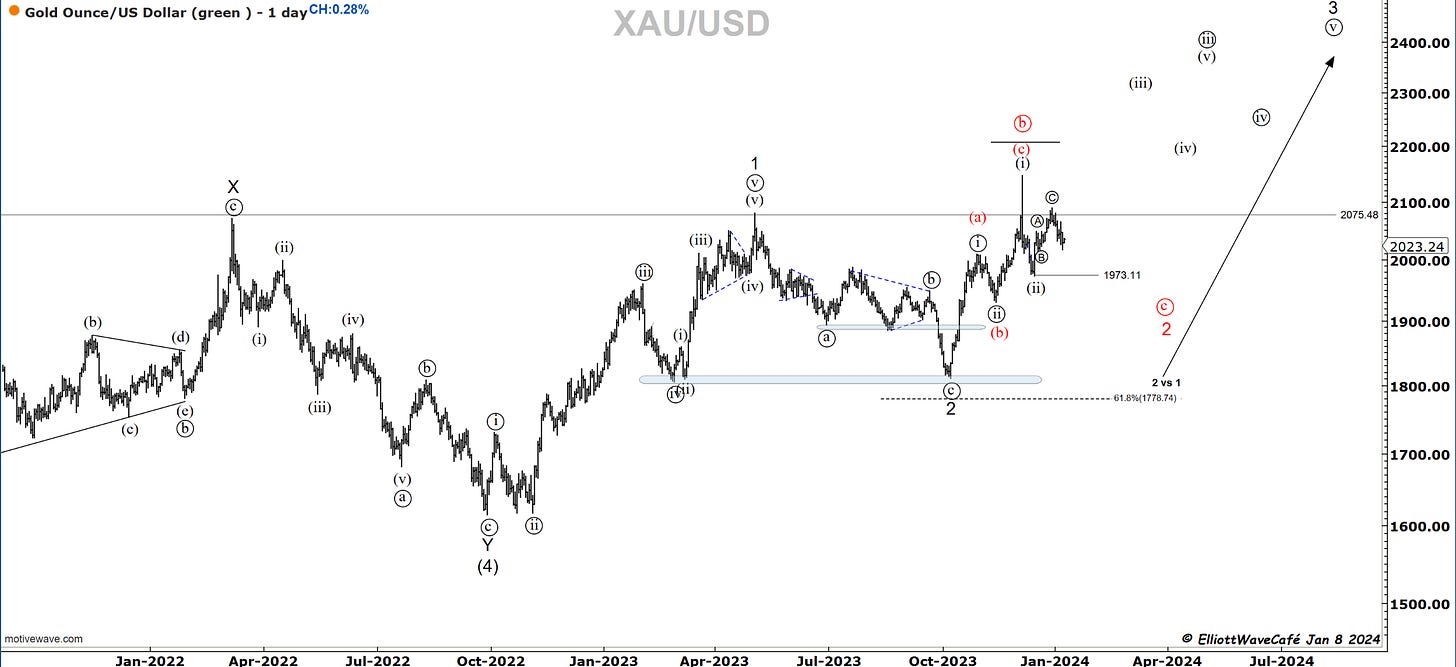

Gold

No changes in Gold - prior comments remain.

Gold continues to tease just under the ATH. There are multiple macro views that one could take by looking at money supply, liquidity, inverted curve, real yields, dollar, etc. I am sure everyone can make a compelling case of why gold should do one thing vs the other. I am also sure that once a move is made, all those reasons will be offered as proof of why something happened.

The reality is that Gold has not followed upwards after the failed move, and under a possible 1,2 1,2, it should have broken already. It has not yet succumbed lower either in a ((c )) wave of 2. There is really not a whole lot that can be done here for a swing trader looking a week or 2 out. It’s one of those markets best left being observed until more levels get taken out.

Bitcoin

There is never a dull moment in Cryptoland. You probably heard by now the “hack” announcement from the SEC that the Bitcoin ETF was approved. The dismissal of that report sent BTC lower quickly by about $3500. ETF approved or not, my thinking here remains that we will see a deeper pullback in BTC from this channel top. It will fit with the overall structure and count balance. Keep in mind, price-wise, there is not enough evidence yet to support the corrective leg. If we break below 43200, those odds start really increasing.

If the ETF approval does not send prices soaring, expect cold showers next as anticipated events and excitement fade away. It will become a “what now?” type of question. The Bitcoin story continues….

Bonus chart —- NatGas. Today’s move was quite impressive, with a 12% jump at one point, and came during a seasonally weak period for this commodity. It seems that we could have a truncated wave (5) in place. I have discussed this numerous times in daily member videos and on the latest YouTube posting. 4.50 -5 for NatGas prices seems reasonable. I would be a buyer on dips.

“Double shot” Daily member video coming up next,

If you’re new to Elliott Wave or need to refresh, there is a 7-hour video course with downloadable slides under The Coarse tab on the website.

Have a great day wherever you are! - trade well, and don’t forget to subscribe and drop a like if this letter helps you in any way.

Cris

email: ewcafe@pm.me