The Daily Drip

Core markets charts updates and commentary

Note: The counts on the right edge are real-time, and they are prone to adjustments as price action develops. Elliott Wave has a fluid approach, is evidence-based, and requires constant monitoring of certain thresholds.

In the counts below, this (( )) = circle on chart

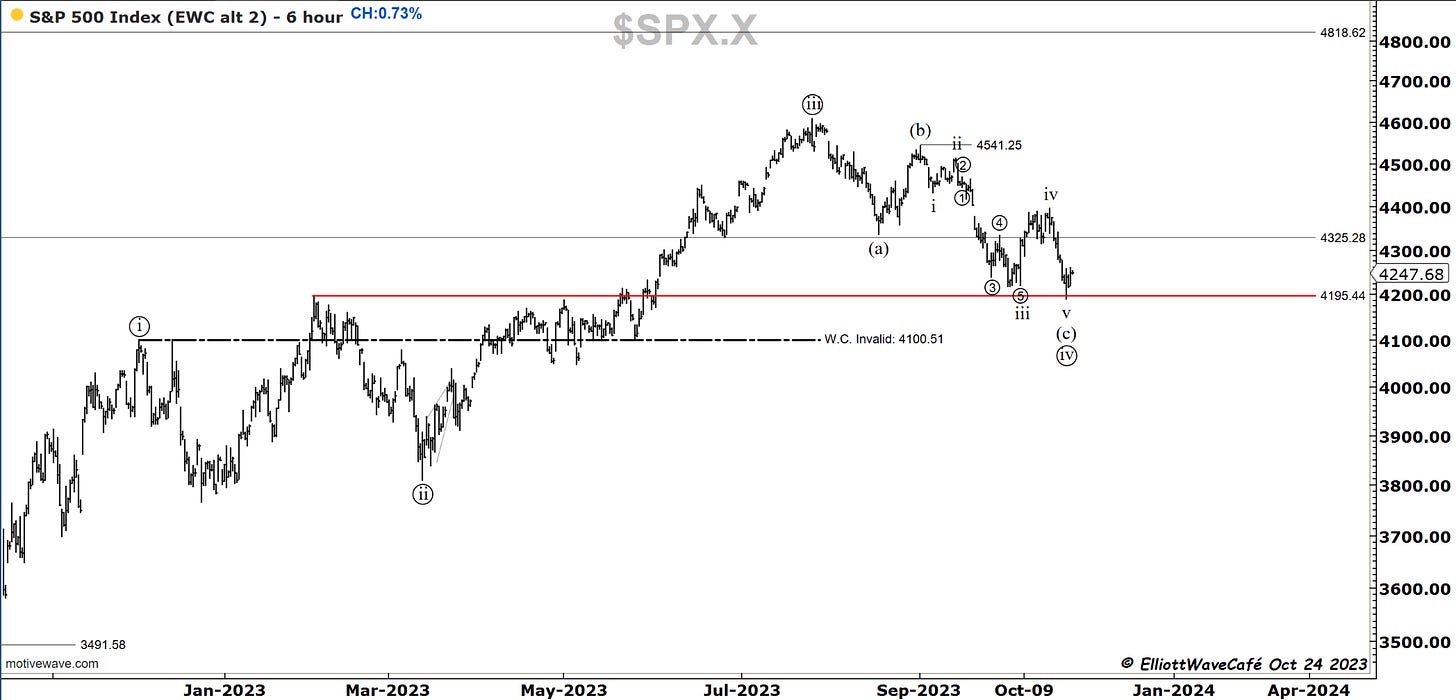

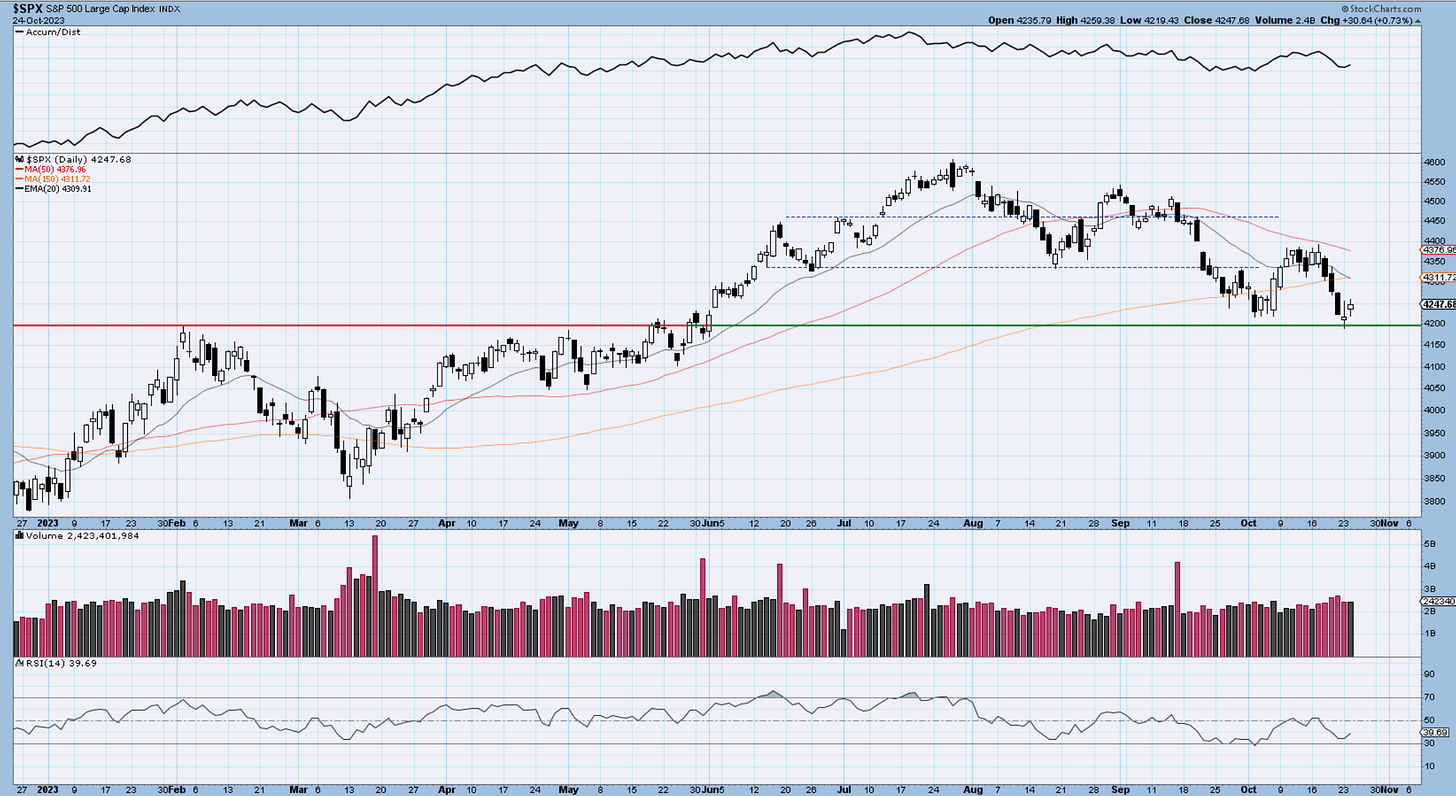

SP500

I have been looking in a bit more detail into the decline in the SP500 and there is a possibility that the latest drop was actually wave v of (c ) of ((iv)). If you look inside the internals of wave iii, it makes sense. So what appears to be a 5-wave decline it’s quite possibly 3 waves. I will track this besides the count presented yesterday. Remember the bear’s approach is a 1,2 1,2 here from July top, so they need a collapse in prices fairly rapidly. The longer this lingers the less validity that approach gets. A move above 4400 will make that bearish scenario quite difficult if not impossible.

Today is the second day that we’re getting a positive close after the 4200 support test.

43 more stocks have managed to get above their 20-day MA today for a total of 133. That means that we still have 367 stocks below that line. The patient is still sick but appears to be recovering.

Nasdaq100

An almost +1% rally today in this index. The wxy in red is a possible alternate in case we manage to build up further gains, it just does not look very pretty. I have doubts on that one. A break of that upper trendline would have me secure that count.

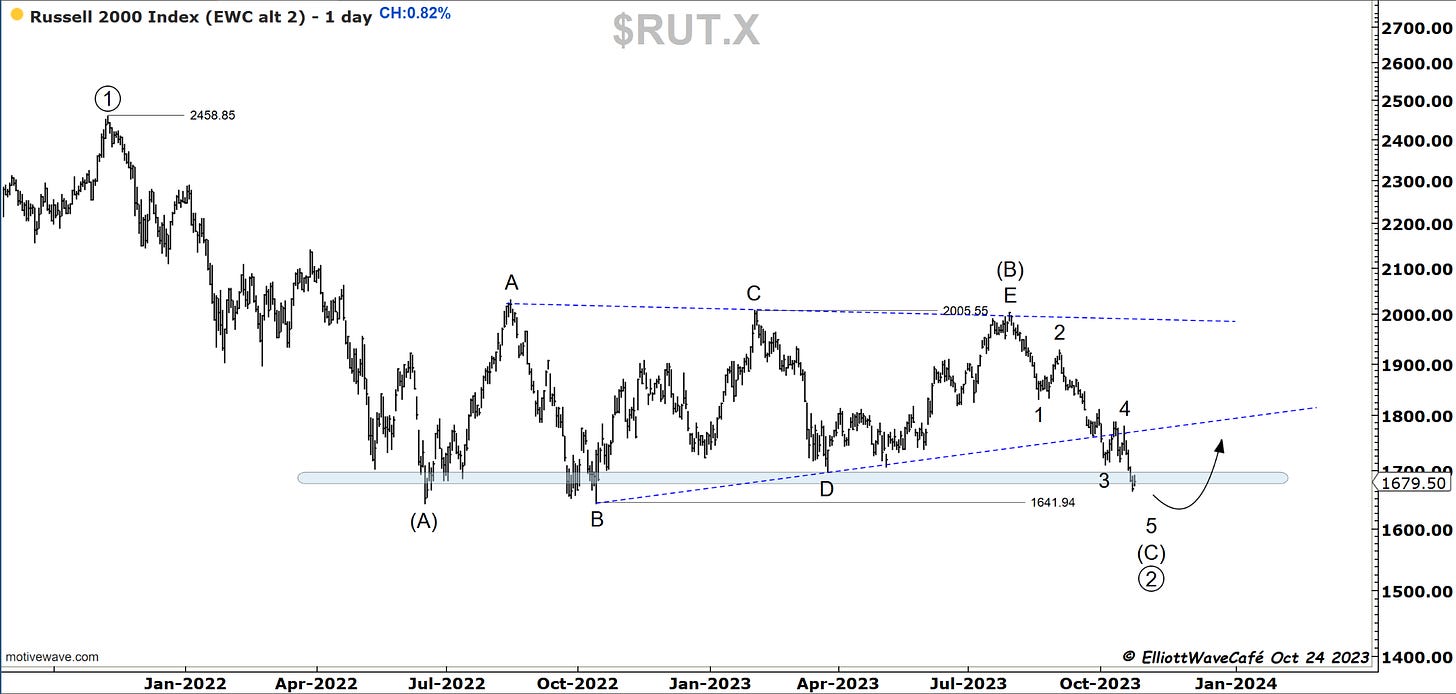

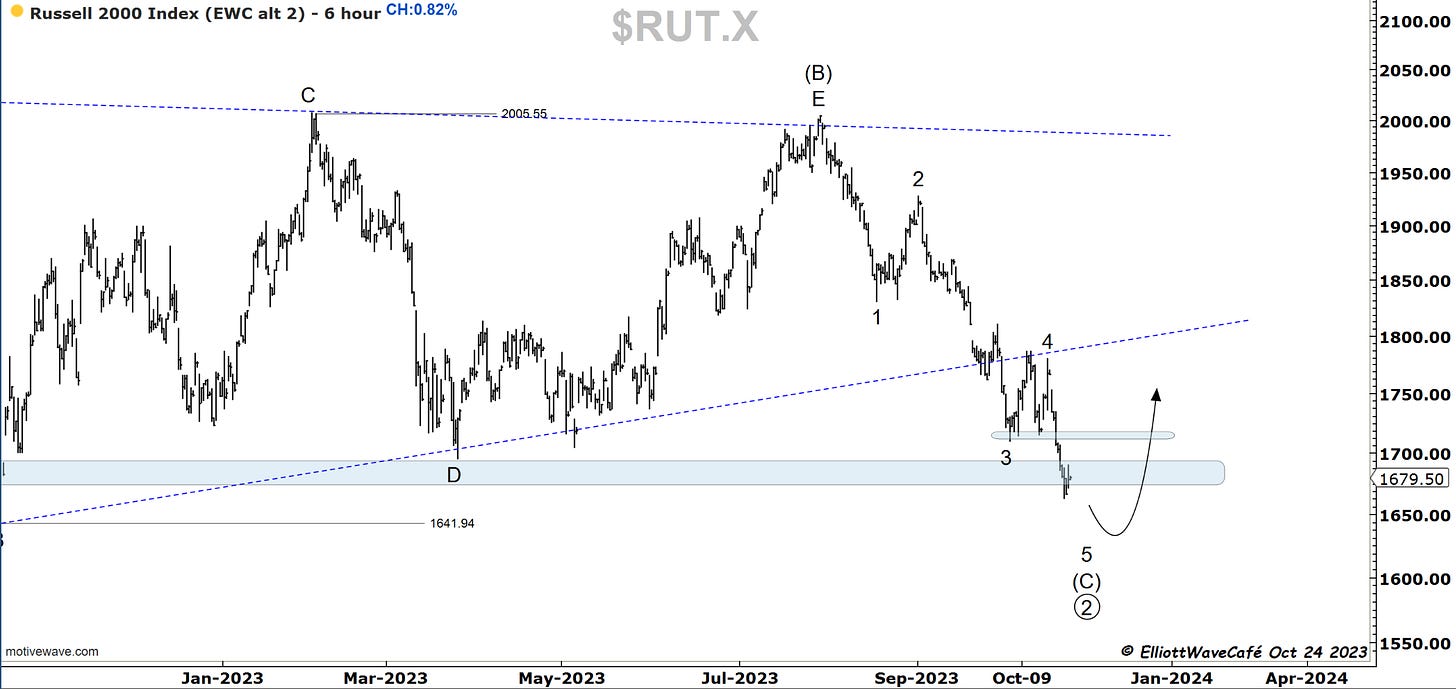

RUSSELL 2000

Russell remains quiet from this support, staging a +0.82% advance. It needs to crack back above 1800 to secure the 5wave decline. 1730 is the first major hurdle ( second chart).

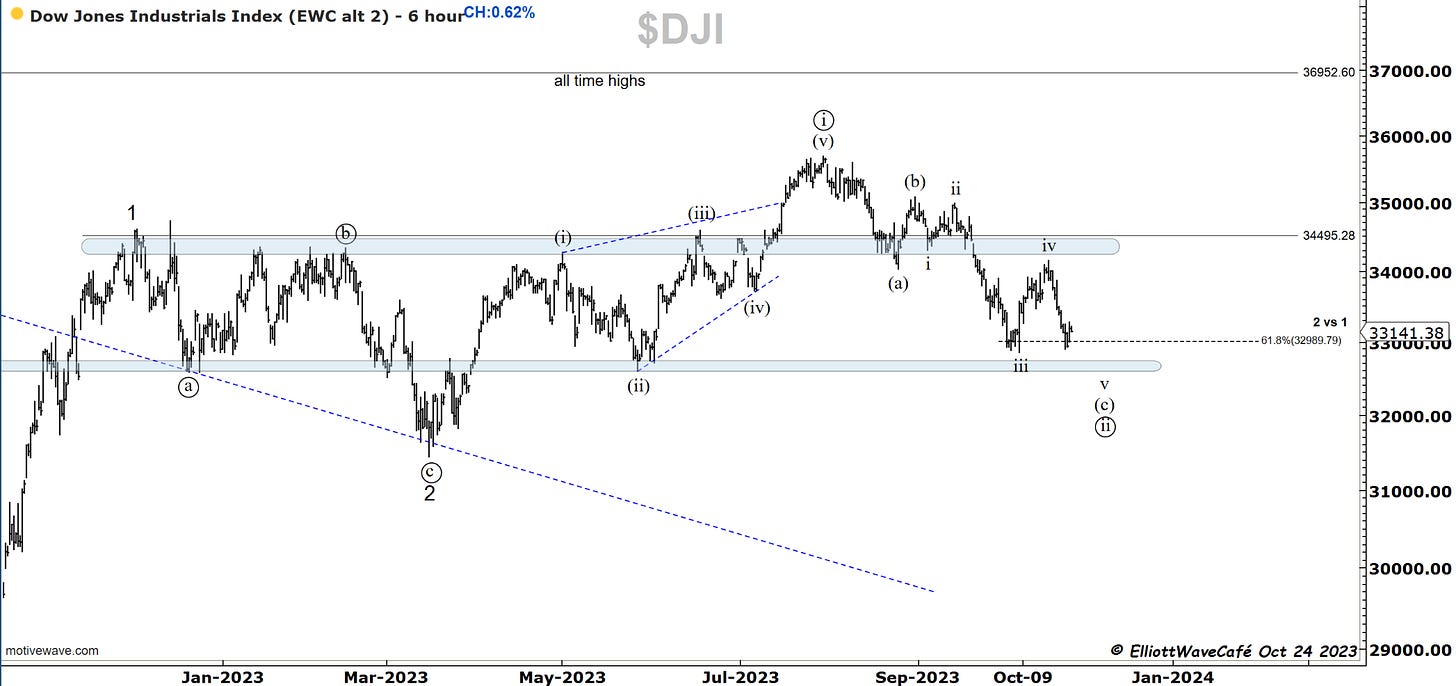

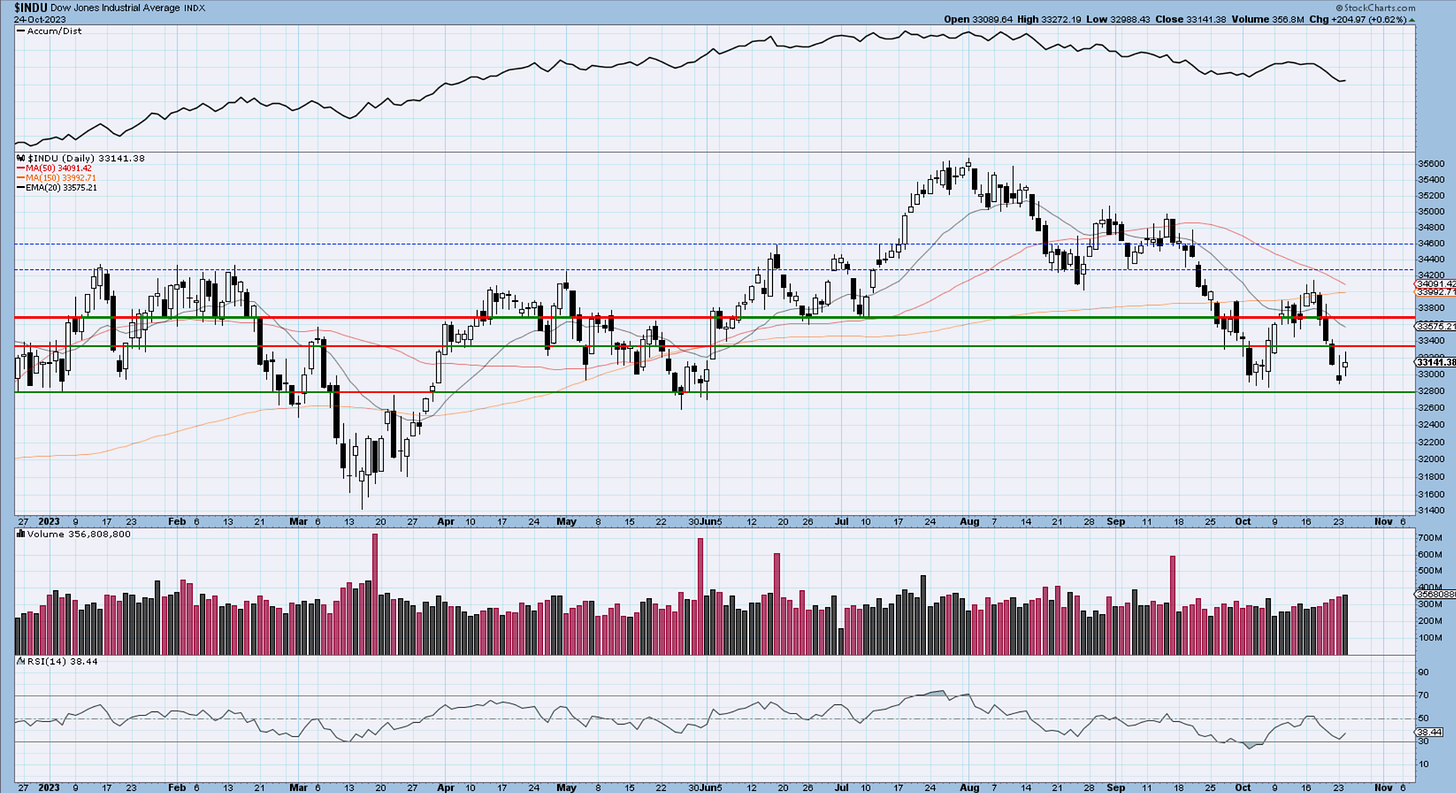

Dow30

Just like in the SP500, we can label this a 3-wave. Wave iii has the needed structure. Wave v will be truncated if we don’t stage one more low. The band of support below is obvious.

US Dollar and Yields

The dollar pushed higher from the support band, displaying a 3wave move from the 107.50 top. It creates the risk of one more high but it’s still premature until we overtake 106.75. A failure tomorrow and a break of 105.50 will grow the odds of the dollar top in place and increase the tail wind for risk assets.

Yields were stable today and actually sold back after an initial rally attempt. Further failures here can help equities as well. The weekly and daily charts display 13 TD combo sell signals, showing exhaustion of buyers. Maybe Bill Ackman knows his technicals. Was 5% the top?

Gold

Previous comments stand. Getting long gold here has high risks.

The move in Gold should be now complete and an appropriate fib correction should take place. Let’s start with 38% and see how that appears on the chart for a wave (ii). It looks like it front ran the dollar, so I am quite curious how it reacts if the dollar sells.

I guess the surprise would be a dollar rally, gold drop.

Bitcoin

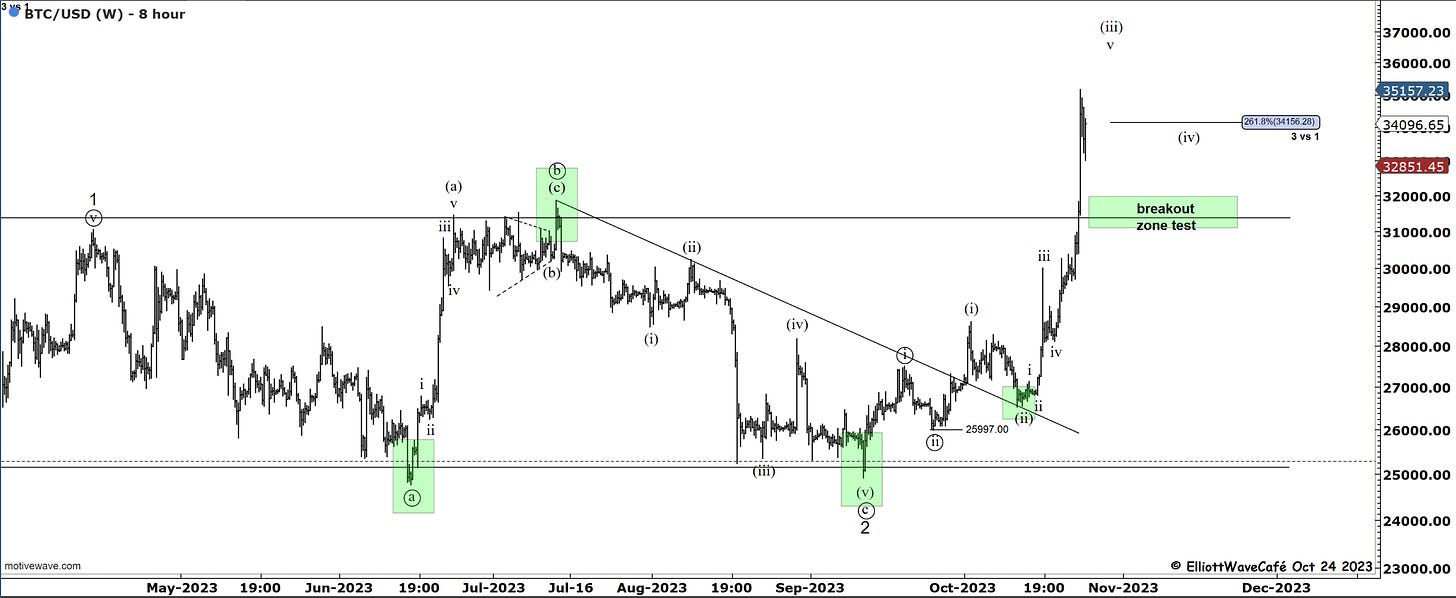

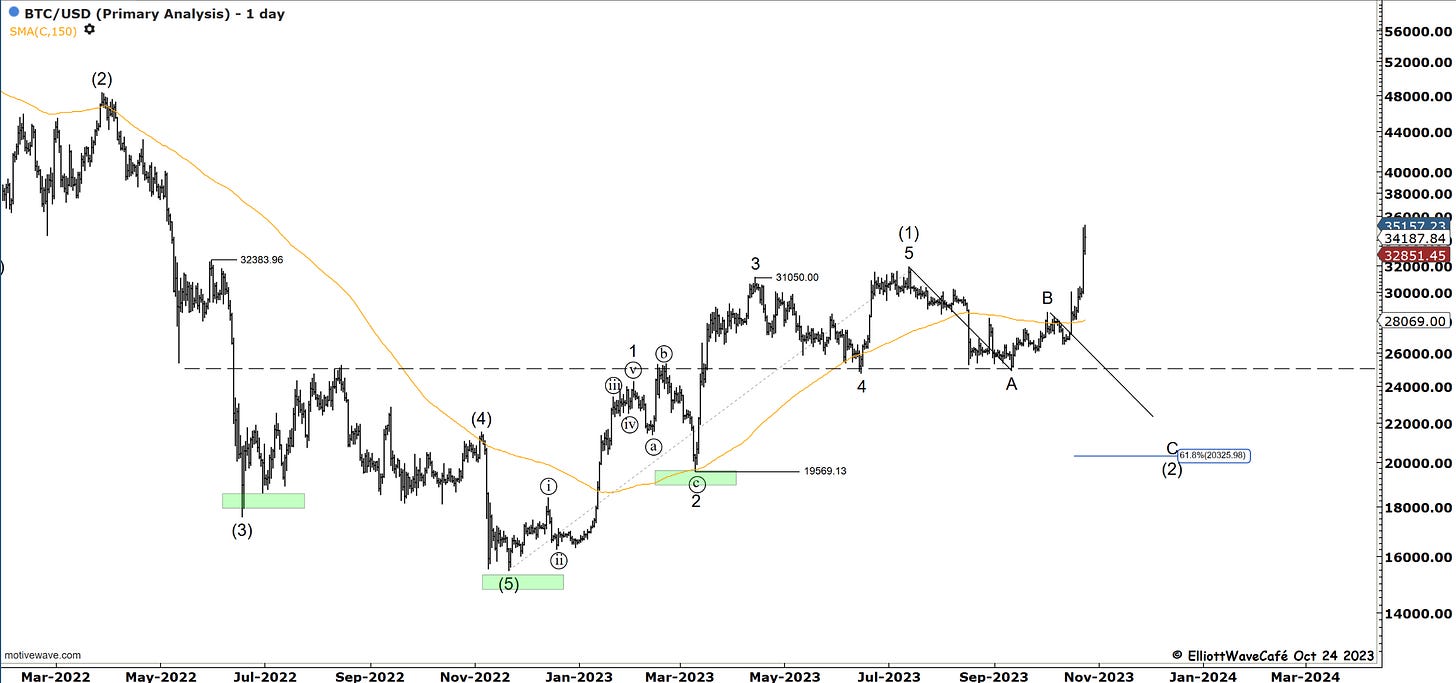

The rally in BTC extended to 35,150 just above the 261.8% multiple of wave (i). Wave (iii) might have one more push, but it’s reasonable now to expect a wave (iv) consolidation. I have labeled wave (iii) with an extended 5th wave in my view.

Some readers complained about the ((b)) wave from July as being a 5wave move. By my work, I don’t think it is and I am showing here why. You have a long wave (a) , followed by a (b) triangle then a short (c). Counting the whole correction in BTC from April to now as a flat, makes sense to me, especially since we’re getting the proper advance, but if some are not happy with that, you need to find a way to place wave 1 where ((b)) is and count it that way. Then wave 2 needs to be labeled corrective. I think that whole exercise is harder and makes less sense, but that’s me. Elliott Wave is open to interpretation at times and that’s what makes it challenging and beautiful at the same time.

Take a look at the 3rd chart that we had as an alternate in case BTC was going to break 25k. Maye that helps with the wave 1 location and counting up to that point. In my view that count has failed, but of course, some would argue that the current rally is just a B wave and wave C still needs to come. So is life in markets.

Daily video coming up next,

See you next tomorrow - trade well,

Cris

email: ewcafe@pm.me

very helpful.