The Daily Drip

Markets review, strategy and analysis

Note: The EW counts on the right edge are real-time, and they are prone to adjustments as price action develops. Elliott Wave has a fluid approach, is evidence-based, and requires constant monitoring of certain thresholds.

In the counts below, this (( )) = circle on chart

Chart of the Day—ALAB—Fresh IPO in semicondutor/AI arena. There has been a three-wave correction after the initial rally. The buildup of a five-wave move is in progress. Ideally, wave ((iv)) should stay at 38.2% compared to wave ((iii)).

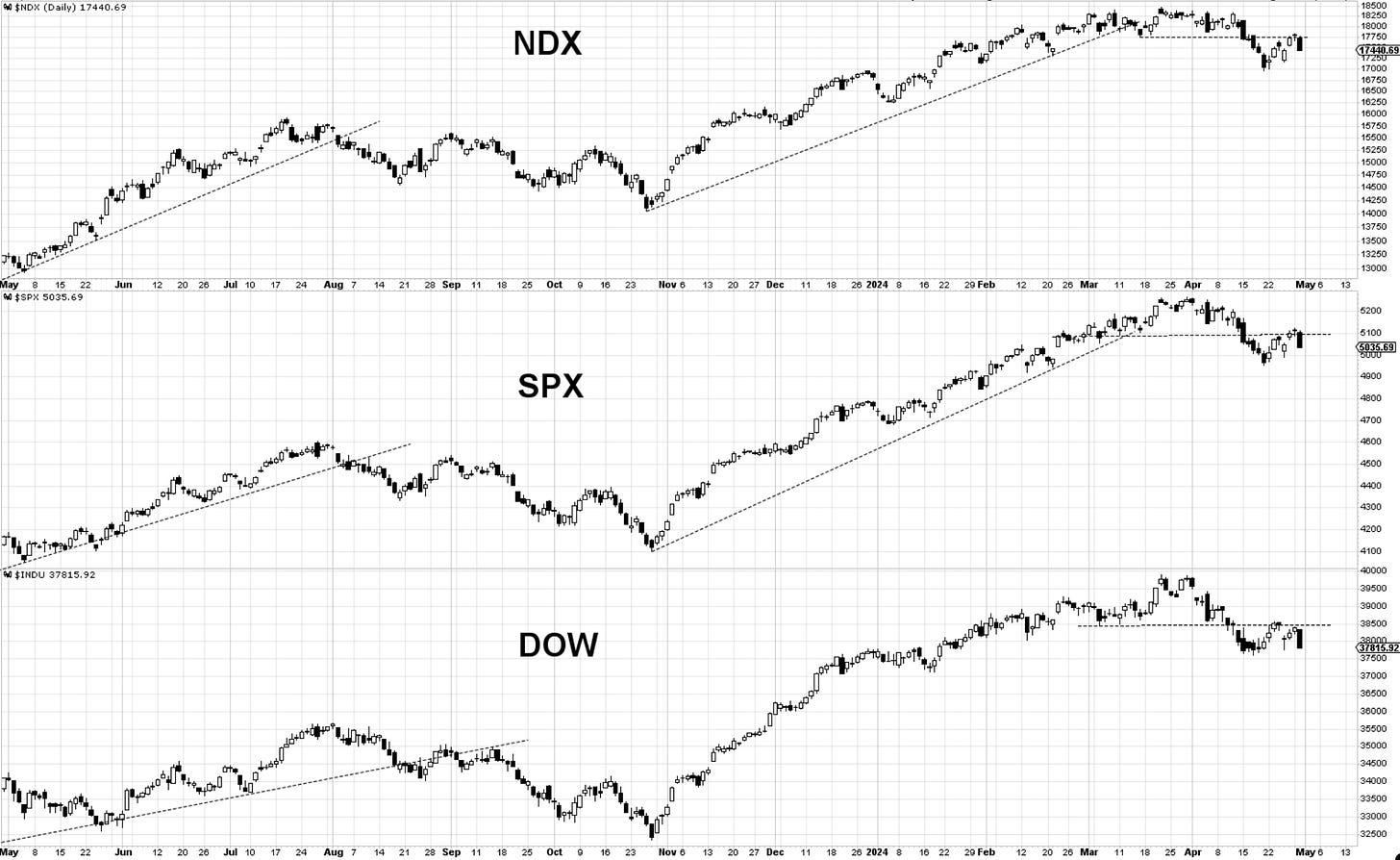

Bottom Line: In yesterday's note, I mentioned this: “Any move below last Thursday’s closing high will raise upside failure concerns and point toward safety once again”. Today’s selling sent the market below those levels and elevated the downside risk. A break below the April 25th lows will confirm the three-wave move and likely open the door for lower prices. Paring back risk exposure is suggested until the rejected levels below are recaptured.

Let’s now dive into charts and further analysis below… then the Double Shot daily video.