The Daily Drip

Core markets charts updates and commentary

Note: The counts on the right edge are real-time, and they are prone to adjustments as price action develops. Elliott Wave has a fluid approach, is evidence-based, and requires constant monitoring of certain thresholds.

In the counts below, this (( )) = circle on chart

Here are today’s top 10 best performers out of 104 industries.

54 positive closes and 50 negative.

and bottom 10 …

SP500

For the last few days, the excitement around this stock market going higher has been accelerating. I watch and listen to several outlets throughout the day, and the general consensus seems to be that higher highs are given, Santa is coming, and the rally will continue in full force. The excitement around junk stocks is rising again; talks of GME call buys and short squeezes in stocks like AFRM and others abound. This market can do no wrong, the Fed is done, cuts are coming, and the party must be on. Will it tho? Remember, we need to keep cool heads when others are losing theirs. It’s our job to sense these swings in sentiment.

Here are a few words that caught my attention from Bloomberg:

“Knowledgeable investors big and small are bidding up stocks in a fresh sign of confidence that November’s impressive equity rally will continue. In a month where $5 trillion has been added to share values, Goldman Sachs corporate clients have evidenced a jump in repurchase activity, similar to what’s been happening at the buyback desk over at Bank of America, which just had one of its busiest weeks of execution orders. “We could see insiders buying into the bull case of inflation down, rate hikes over, mission accomplished,” said Mike Bailey, director of research at FBB Capital Partners. “Insiders want to take more ownership of that message and they are willing to pony up real money to do so. That is a double-barreled sign of optimism.”

I don’t think we heard any of this when stocks were “going to hell” on Oct 27th. Why not? Because we humans are master followers and chasers, we like to do what’s easy repeatedly. We copy each other, we look at what others have, and we want to have the same; we’re greedy and emotional. That’s why when something goes up, we have the “courage” to buy because it’s a “sure thing”. The problem is that we usually top-tick the move, and then the market reverses. That is how wave 5 tops are created. No matter how good something looks, one must resist the urge to buy into 5th waves. Identifying those is sometimes tricky, and other times not as much.

This morning, the market gapped higher, and it looked like it was ready to rip to new highs, and it won’t stop. Sure enough, after some excited heads posted gains on Twitter and more money poured into the open, the market gods pulled the rug and left people in the dust scratching their heads. Wait, what? It’s probably just a dip. And that’s how it starts, then traders hold to losses until they dump where? Exactly at the lows. Rinse and repeat.

As EW practitioners, we were expecting this move to take place. Whether this is it or not remains to be seen, but it sure acted like the 5th wave type of action. We have some inflation data tomorrow so things could get volatile. Even if another high is made, I think the market is clearly sounding the alarm that the higher road is getting tougher, and a reset is needed. One clue today that we would have a hard time rallying were the Mag7 stocks that acted red since the day started.

My take here is that if this correction is starting, then the only Santa rally we will get will be a (b) wave. The pundits will cheer it on, but we will know what’s behind it.

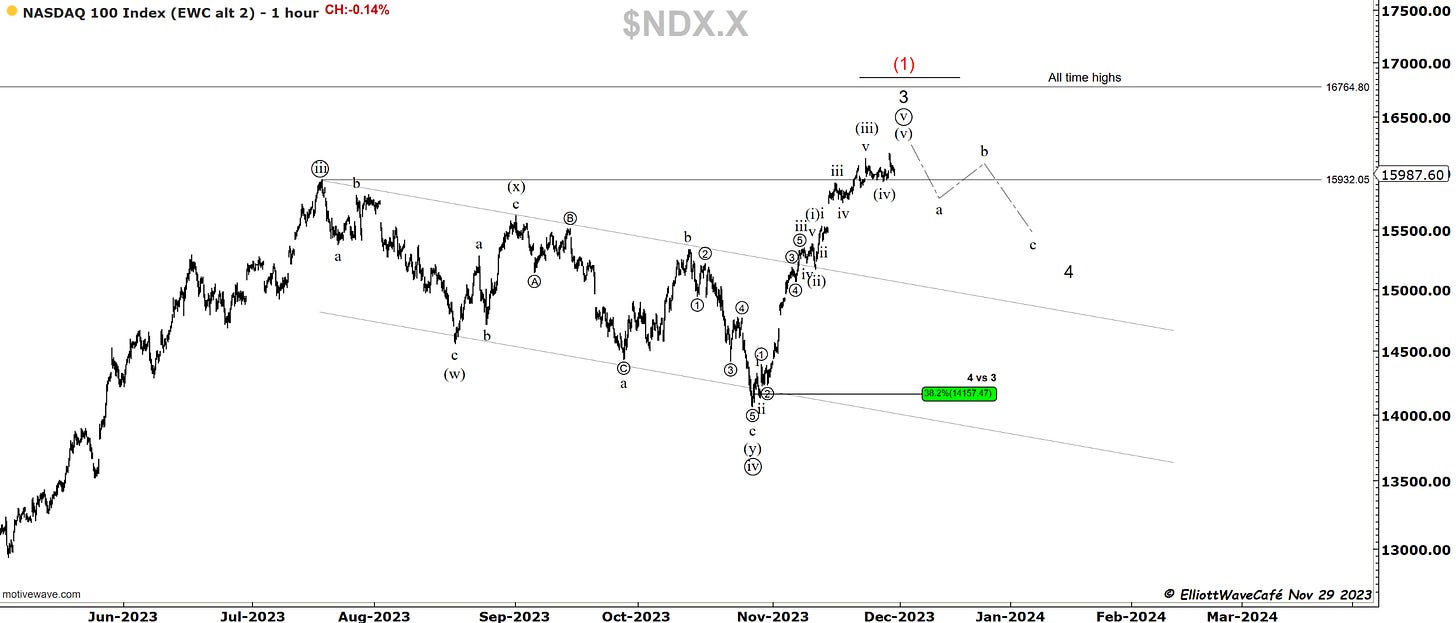

Nasdaq100

previous comments remain - today, we got that brief move higher. If that was a 5th wave, we have no business traveling above today’s highs.

Here is a closer look at the wave internals so far. Must be aware of one more quick push higher before wave ((v)) completes. We spent the last two days not being able to stage another high, but let’s give the trend the benefit of the doubt. A break below wave iv low would tell us this impulsive leg is over, and the correction has begun.

No 5-wave impulse yet from the highs, let’s see how she behaves tomorrow after data.

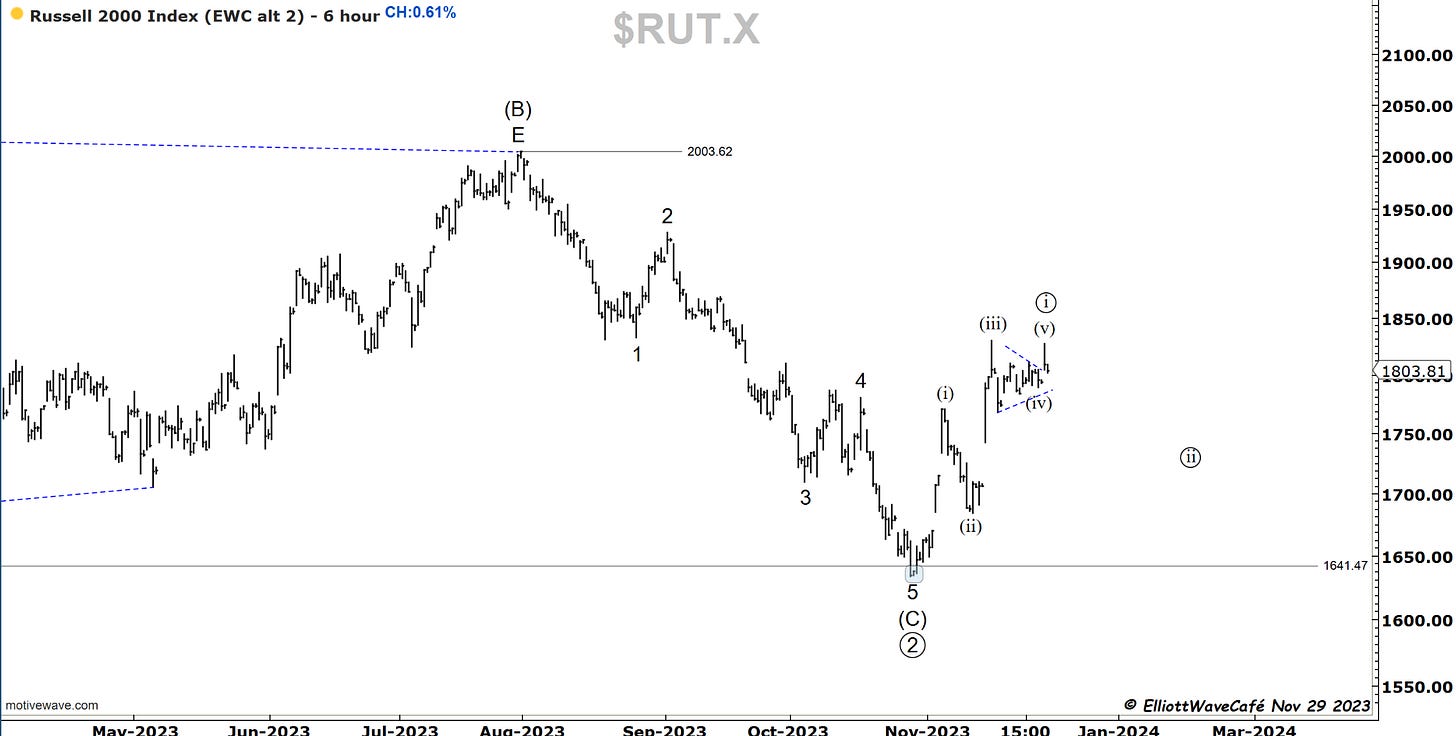

RUSSELL 2000

Moves out of a triangle are terminal moves for that particular sequence and I think so is the case in the Russell here. So is this an ABC from the lows or a 1,2,3,4,5 ? Maybe none of the two scenarios, but the exercise is worth having. You know what’s funny? There are 2 ways to look at it, but both point lower as the next likely move. This is where EW gives the odds we so need as traders. Again, it does not have to work out, but at least we’re not grasping at straws, and one could formulate a plan.

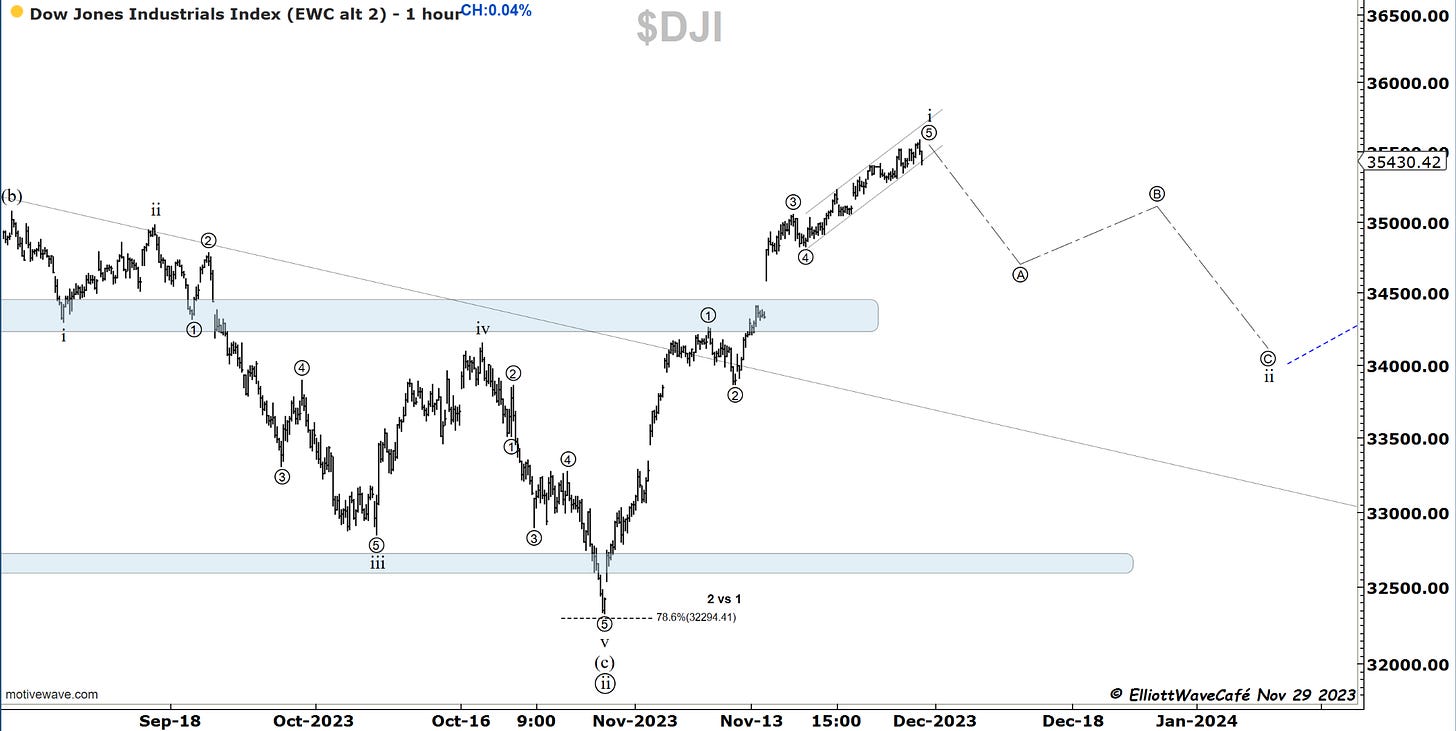

Dow30

Yesterday, I showed you why I think Dow is running into thin air. There is also a nice channel that’s been containing prices so far. If it breaks, we have the 1st clue of the start of the correction.

US Dollar and Yields

61.8 was hit to the penny. I don’t make this stuff up. Why would anyone long stocks when the dollar hits the golden zone? We don’t need to know a lot more than that. Keep it simple at times.

Overall, I think reading markets is like flying an airplane or driving an F1 car. I see a bunch of gauges on the dashboard that tell pilots what they need to do and what to watch for. Same for us traders. I talk about these instruments all the time in this paper. The dollar should have a larger space amongst the others.

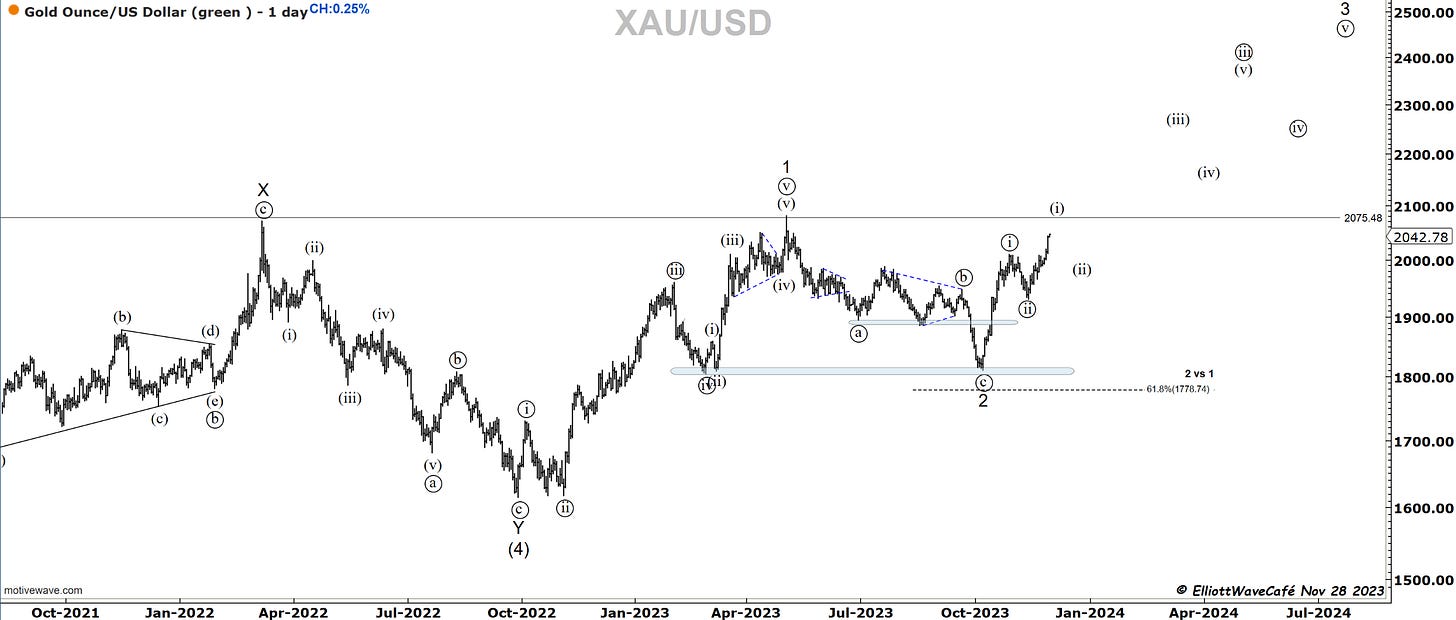

Gold

previous comments on gold stand, but I will add this. - gold chatter is increasing. We will get a top in wave (i) soon enough.

Higher again. Could this really be the moment for gold? I am not fully dismissing yet that B wave of a flat for ((ii)), but if this is correct it will only shake out late buyers before resuming the trend. Watching for that (i) (ii) as the lower degree move that will build the larger wave ((iii)). Strap on, this could get a wild ride come 2024.

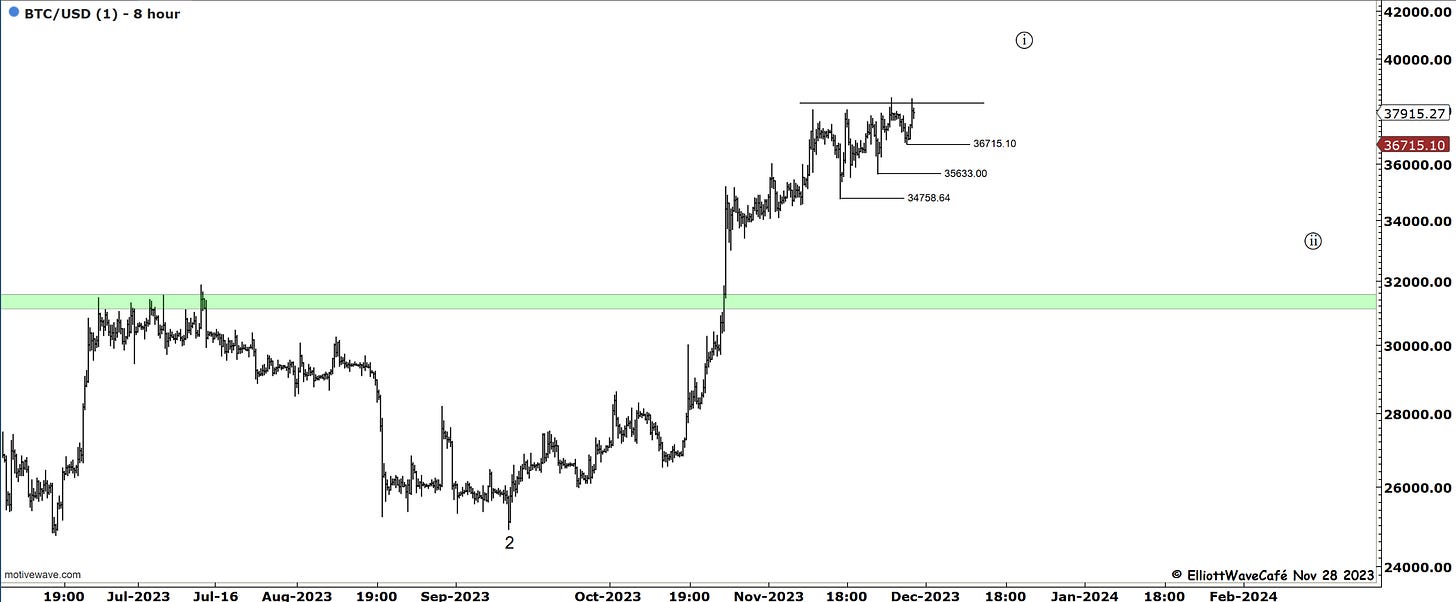

Bitcoin

nothing to add on BTC - prior comments stand. A simplified version of a quick 5th wave up below. Some will say ascending triangle, we rip higher. And they will be right if it happens.

Someone is really protecting that 38k level. But every lower swing is higher than the one before, meaning traders are lifting their bids. Something will have to give soon enough. I think the market wants to see who’s hiding above 38k. The question is what happens after we get there? Do we unleash an avalanche of stops and rally strongly, or does the market take them out and reverse? There are several tactics to play this which I won’t get into here. Based on some of the 150-180 day cycle work I follow combined with a nearby wave 5 top, I am still wary into 40k.

The cycle line depth is not for price targets but for time. So no, I do not expect 22k, but possibly a grind and correction into spring next year. Let’s see how it plays out.

Daily video coming up next,

Have a great day wherever you are! - trade well, and don’t forget to subscribe and drop a like if this letter helps you in any way.

Cris

email: ewcafe@pm.me