The Daily Drip

Core markets charts updates and commentary

Note: The counts on the right edge are real-time, and they are prone to adjustments as price action develops. Elliott Wave has a fluid approach, is evidence-based, and requires constant monitoring of certain thresholds.

In the counts below, this (( )) = circle on chart

This is the last Market Report of the week. I will see you on Monday. Have a great weekend. If you find my work helpful, leave a word and recommend it on Twitter and other forums. Thank you!

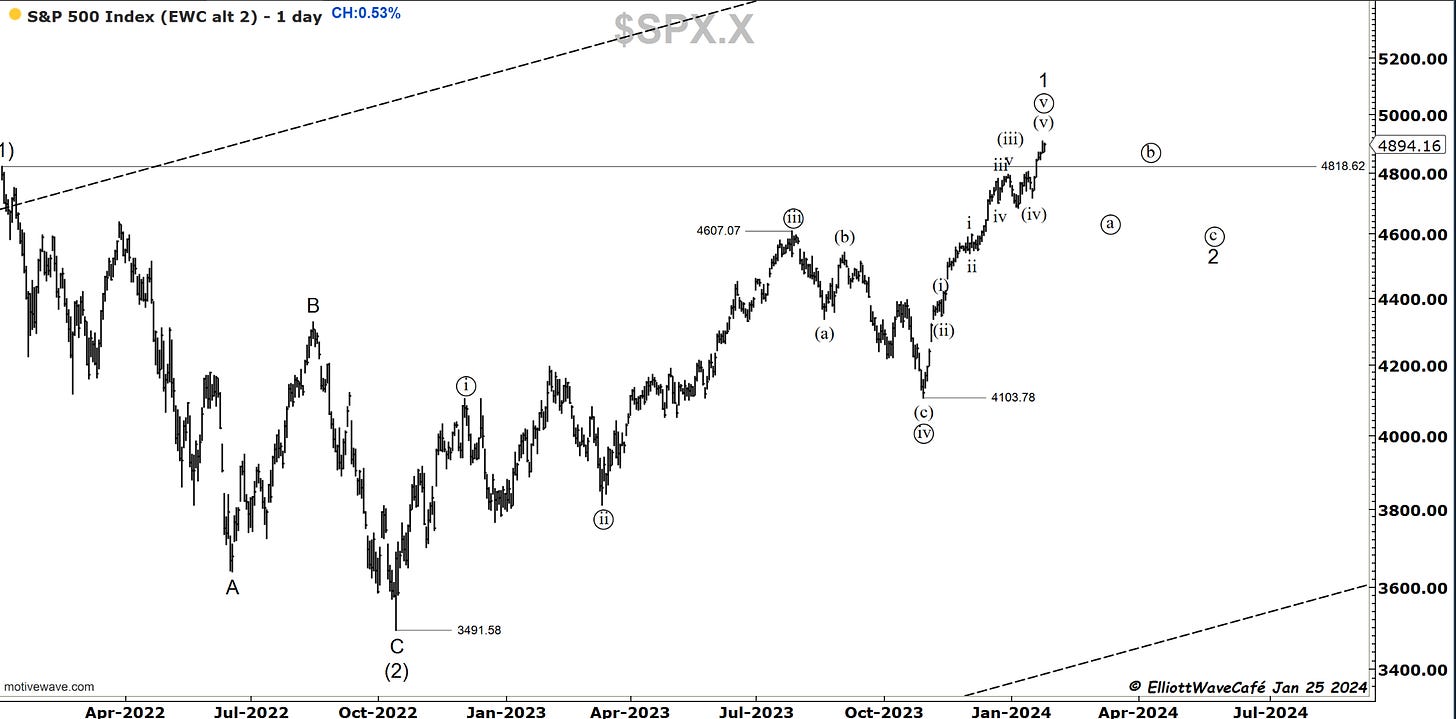

SP500

It wasn’t much of an action today, yet the index managed to close higher than it opened with +0.53%. Yesterday’s lows were revisited, but not enough selling pressure was present to clear that. The RSP equal weighted was actually stronger, climbing 0.92%. (below in the 2nd chart, you can see the action on the 1m charts). Overall, the large caps took a breather today, letting the microcaps be in charge for a change.

The count remains as looking at a final 5th wave from this November ‘23 thrust. The price evidence regarding when this correction will begin continues to remain inconclusive. Yesterday, we had a selloff that seemed to have initiated something. Today, it died off and did not continue. If the large-cap underperformance continues, the pressure will build for further downside breaks. Yesterday was a warning signal. Next week is the Fed meeting on Wednesday, and there could be not much happening on the tape until then. I continue to see elevated risks for stocks into February with a jump in volatility.

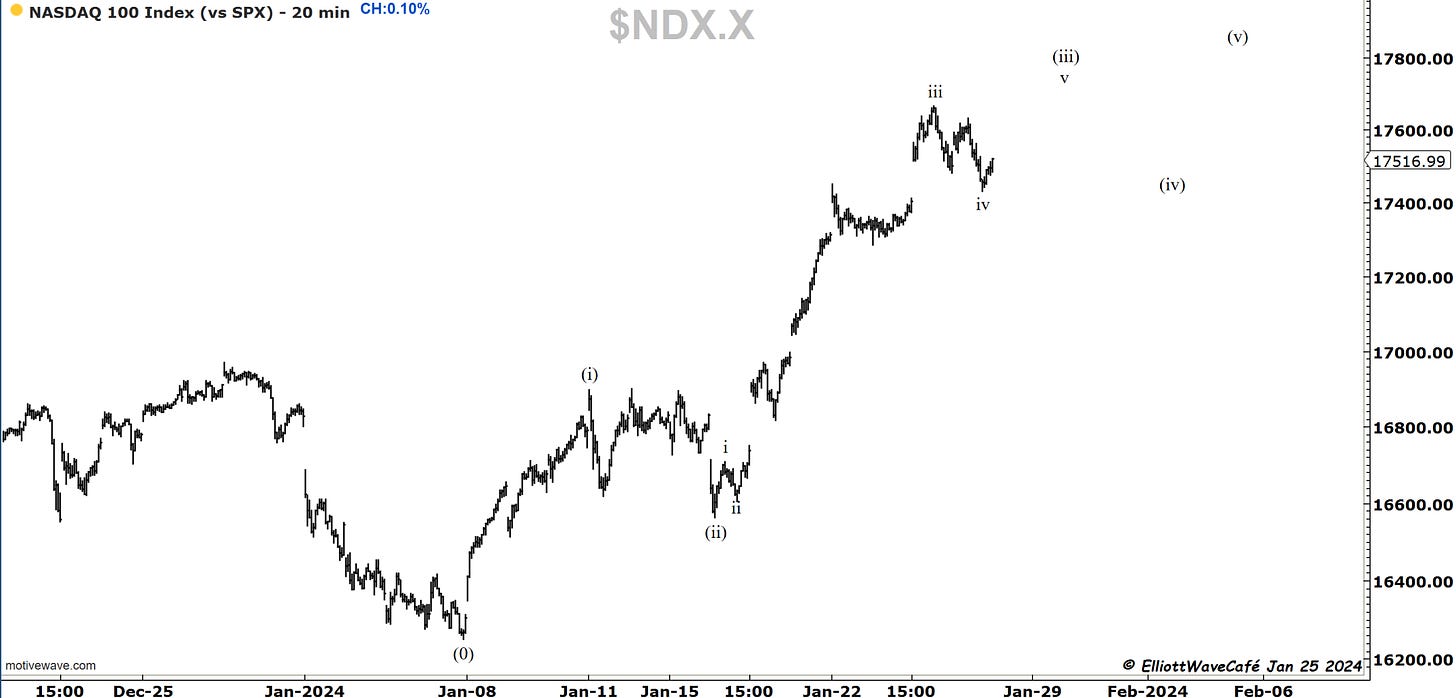

Nasdaq100

I would not be surprised to see something like this in the NDX over the next few days. I was talking yesterday about how it seems that the Nasdaq count is missing some internal legs to get near completion. The below information would help make that a reality. If we lose 17,300 this will have to be revisited. Notice, however, that the bulk of the move has been made, and it will get harder from here. It’s something that the top large stocks seem to be experiencing as well.

RUSSELL 2000

If we squint at the 5 min of the Russel, something interesting is happening. Every day, the market makers opened higher with a gap, closing the gap during the rest of the day. It's pretty good price manipulation if you ask me. Draw people in at the open and then take the other side. Ding ding. Ring the registers. It does look corrective and in a channel. What is that telling us? There is a decent chance she might try to attempt higher. A larger time frame is in no man's land for now; we are waiting for a resolution.

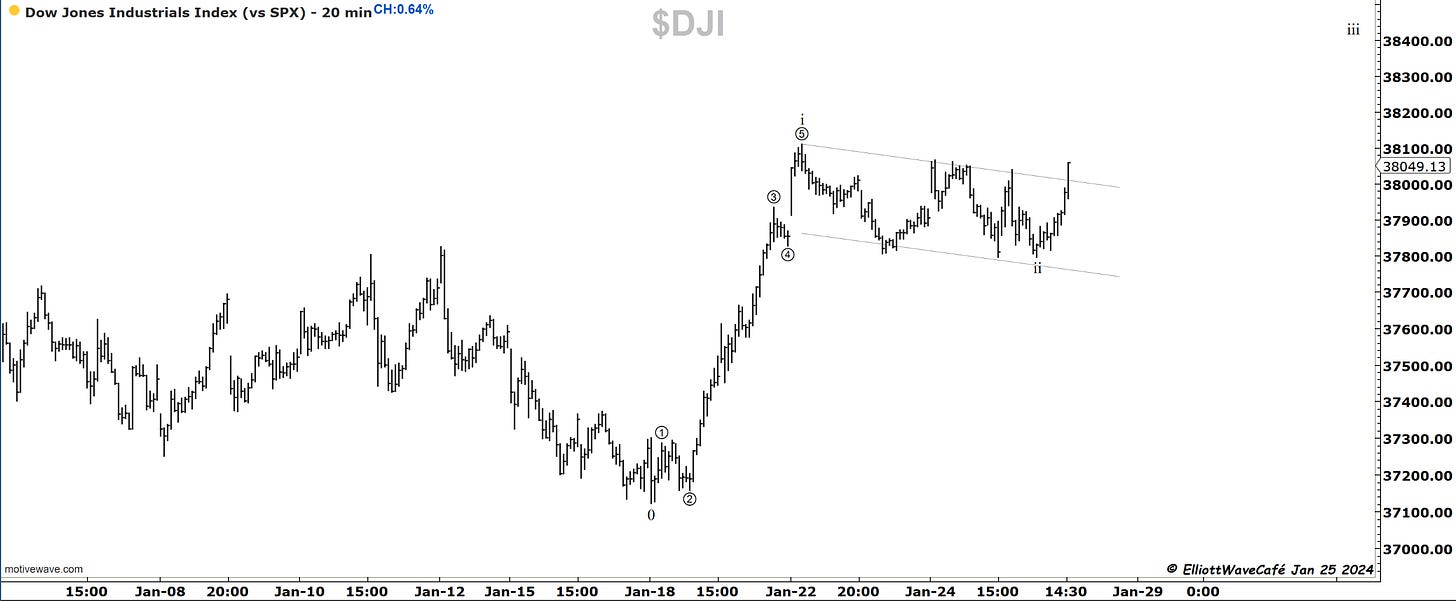

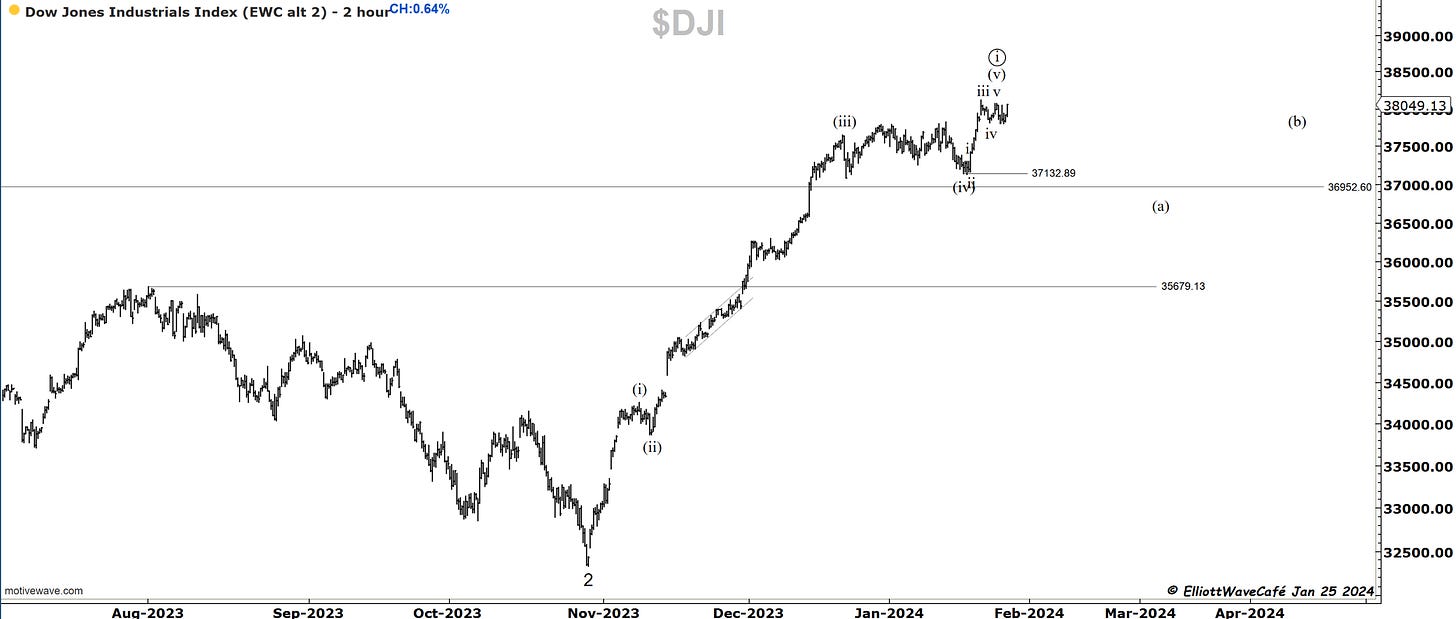

Dow30

Looks familiar? It's a pretty interesting setup. It puts the count in the second chart under scrutiny. It would not be wave (v) completed but only wave i of (v).

US Dollar and Yields

There is some funky business happening in the dollar at current levels. If an ABC flat took place, we need to get going and today started as such. Only a small three-wave rally so far and no fresh high. However, it continues to diverge heavily from the pricing of risk assets.

10-year yields also remain elevated. Today’s strong GDP data did not do much to push them further. If anything, they dropped -1%. I wonder what’s already priced in at this point. Tomorrow, core PCE, which the Fed watches, will be the next catalyst for movement. If it clears the 150-day to the upside, stocks will feel some punches. If not, and PCE drops further, it could be a large party like in the small time frame updates above.

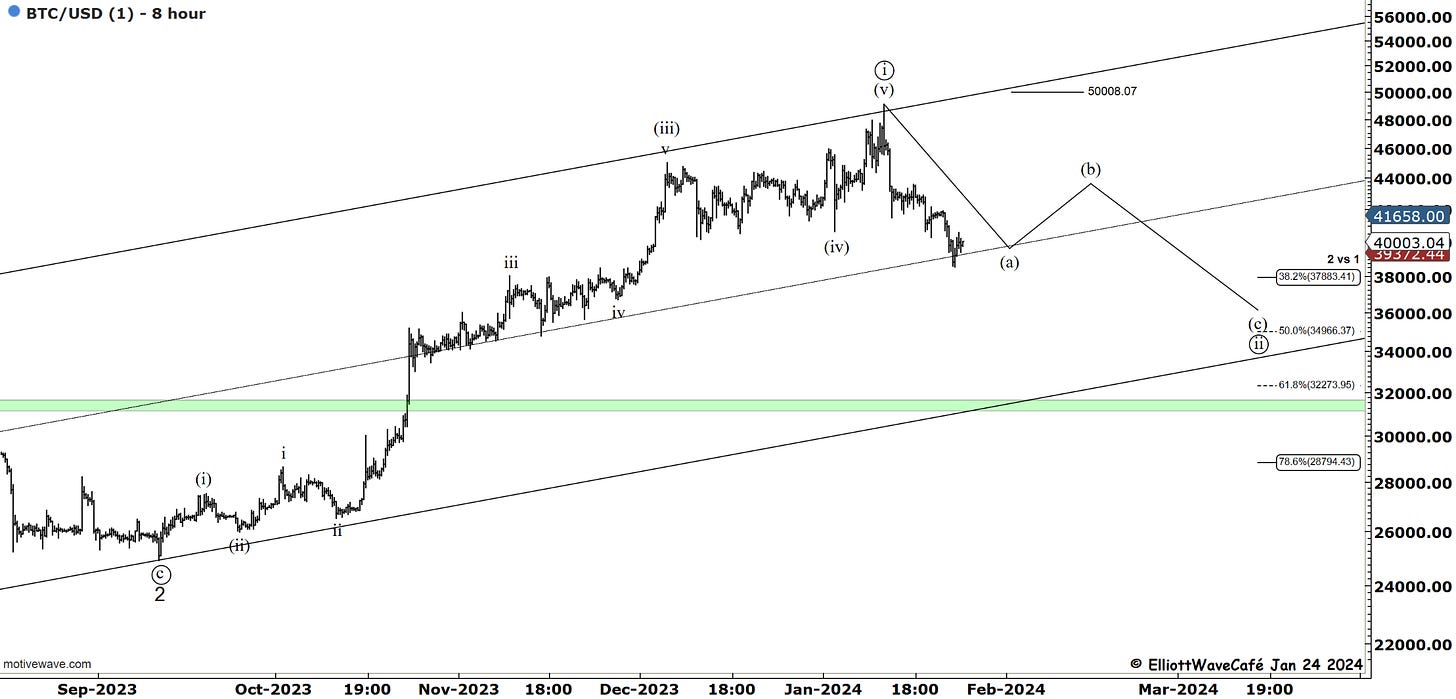

Bitcoin

No further opinion on BTC price structure as it remains unchanged. Just because it’s stalling a bit does not make it any stronger. Prior comments stand.

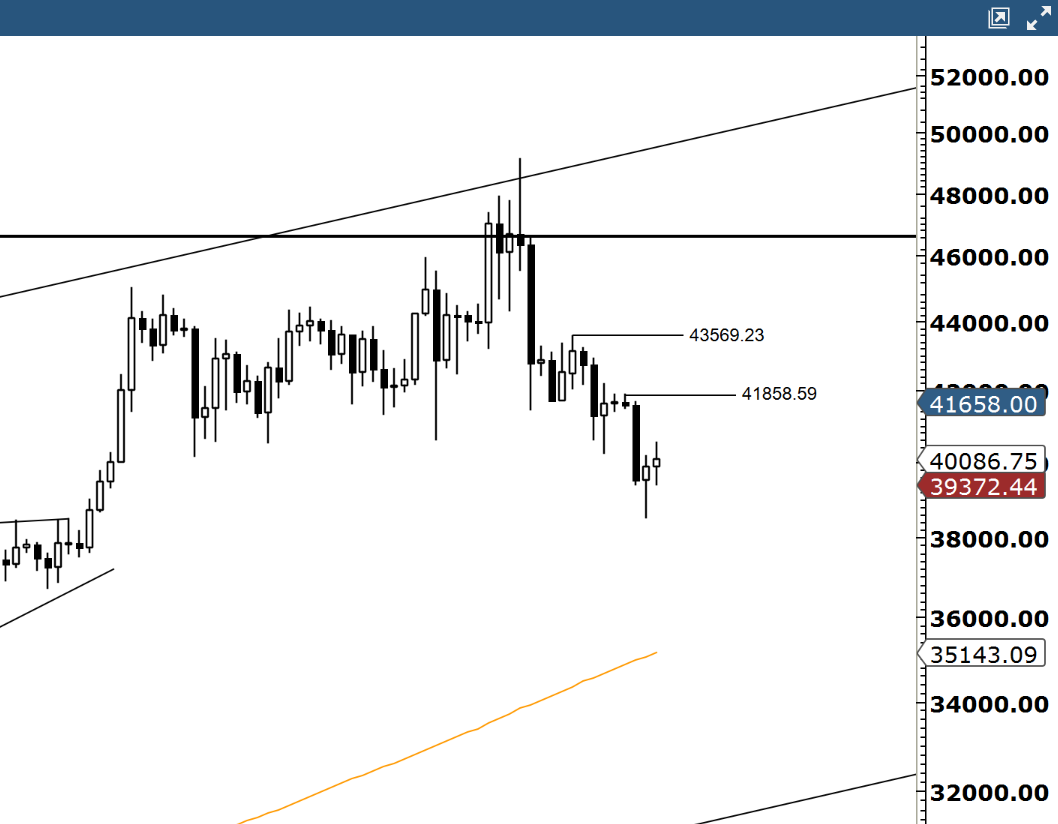

Bitcoin selloff has stabilized a bit but has yet to have a meaningful recovery. We continue to display a series of lower lows and lower highs from the channel top. I have reduced my short exposure a bit down here. The down sequence seems incomplete still, so I'm not sure if we’re ready to stage a (b) wave rally just yet.

Sellers will likely show up again near 41800 and then 43500. If those levels get taken out, we can discuss the (b) wave. For now, it's still a bit premature. By the way, as a suggestion, trading B waves is a pain in the butt. Stick with the A waves and even better C.

“Double shot” Daily member video coming up next,

If you’re new to Elliott Wave or need to refresh, there is a 7-hour video course with downloadable slides under The Coarse tab on the website.

Have a great day wherever you are! - trade well, and don’t forget to subscribe and drop a like if this letter helps you in any way.

Cris

email: ewcafe@pm.me