The Daily Drip

Core markets charts updates and commentary

Note: The counts on the right edge are real-time, and they are prone to adjustments as price action develops. Elliott Wave has a fluid approach, is evidence-based, and requires constant monitoring of certain thresholds.

In the counts below, this (( )) = circle on chart

Here are today’s top 10 best performers out of 104 industries.

38 positive closes and 66 negative.

and bottom 10 …

SP500

In anticipation of the CPI numbers tomorrow markets mostly threaded water today. If I am looking at the sectors that gained, I see mostly defensive positioning.

In the cap-weighted sectors, we have energy, healthcare, and staples as leaders. Consumer discretionary sneaked in there due to Tesla's performance today.

Here on the equal-weighted version, the picture is getting clearer as discretionary does not make it in. We have energy, healthcare, and staples as the top 3. All defensive. So while on the surface one could say we have breakouts, especially after Friday’s action, under the surface Wall Street is being cautious heading into a full week of important data and also a large options expiration on Friday.

Our own positioning in the portfolios sent over the weekend to members, took a defensive posture until we clear some hurdles and weaker seasonality heading into the end of November.

The call for an end to wave (i) last Thursday proved to be premature as markets rallied Friday one more leg higher. In the Nasdaq coverage, I mentioned that’s a possible scenario, I just did not assign it a high probability. Poor reading on my part, but markets do what they do, and we need to be able to adjust. Here we are now, sitting just slightly above the trendline and above the blue horizontal resistance. In the little blue square, I am showing the price action since we broke higher. If there is no strong continuation here, especially with the data looming, there is a risk of a failed breakout and the beginning of a wave (ii) correction. Since that pullback in wave iv was so short, it’s very hard for anyone who’s been counting waves for a while to switch it to a wave (ii) at this stage. It does happen that we get short 2nd waves in powerful trends, I doubt that’s the case here. A wave v makes more sense.

Nasdaq100

That flat in iv was a nice shakeout. Friday we pushed into a wave v and today we failed to continue in momentum. Let’s see what they do after CPI tomorrow but if we crack 15,350 I’d say chances of a deeper correction are rising.

Here is the (i) (ii) idea with a kiss back towards the broken trendline, before a larger wave (iii) can ensue.

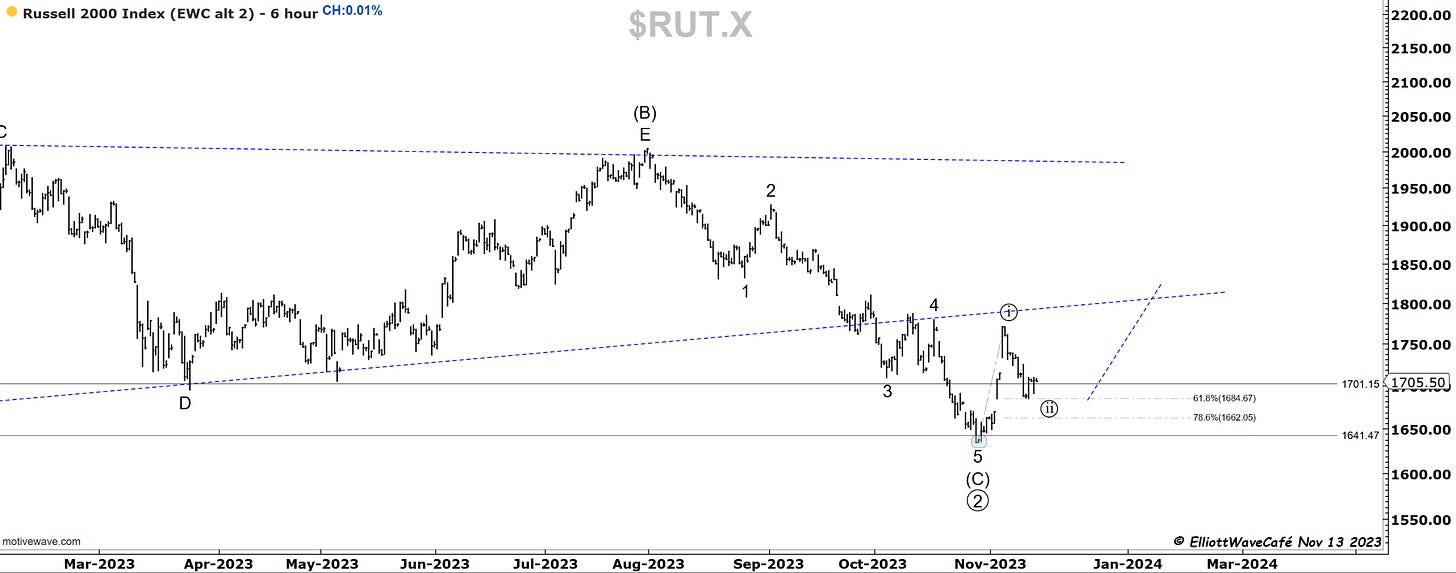

RUSSELL 2000

Small caps did stage a little bounce off that 61.8, but they’re still struggling. There are more and more calls I hear about an upcoming outperformance of small caps vs large caps. Not sure what to make of it just yet. It’s hard to wrap my head around small companies beating the large ones. The argument is that lower rates will help small caps. Will see. I feel safer somehow knowing I own strong solid companies rather than small weak ones. Unless on a very short term.

In terms of count, I will stick to this until we break 78.6 lower. If that happens, the odds are this whole rally was just a fluke.

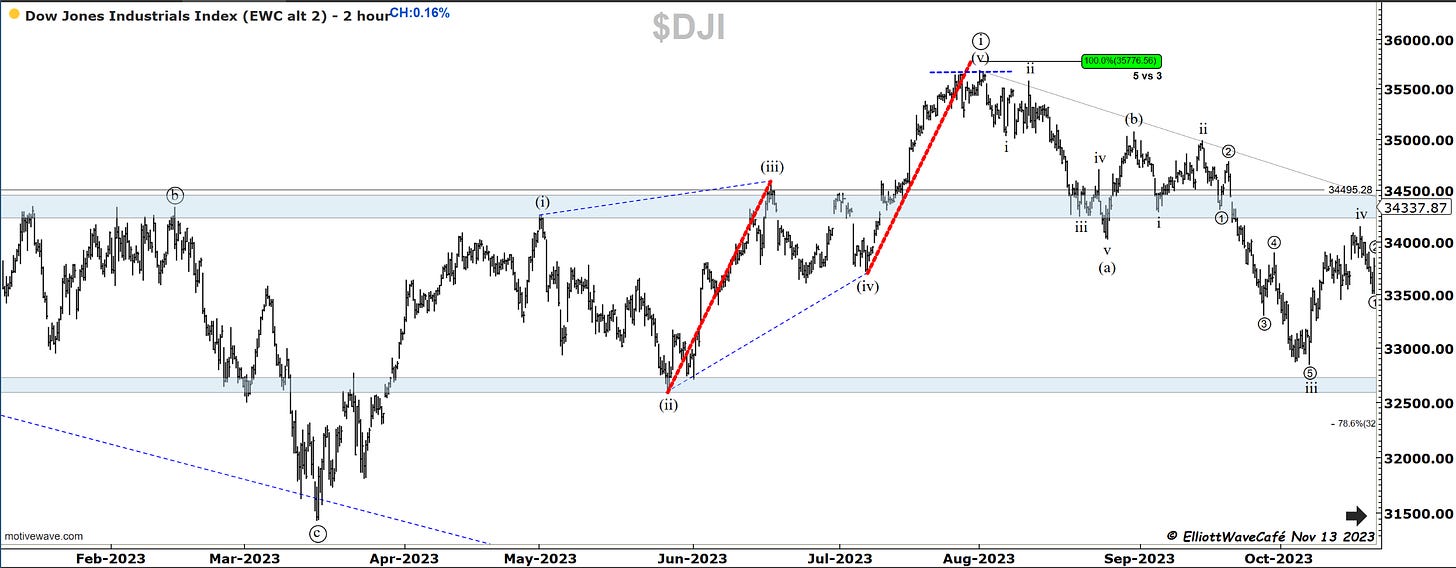

Dow30

Dow being a more defensive index shorter term, it managed to beat the other indexes today. If you look at the RSI, is struggling. A wave five top nearby would lead to the wave ii correction next.

I want to clarify an email I received over the weekend regarding the leading diagonal suggestion in the Dow30. The argument from the subscriber was that I should not count a leading when wave 5 is longer than 3, as the rules state wave 3 should not be the shortest. I agree and as you can see in the picture below, wave (v) is not longer then (iii). The 100% wave equality comes in at 35,776 which is points higher than where wave (v) ended. There is a visual trick that the market plays here when you look at the waves, but the actual measure is correct. I would also like to add that in certain situations you might have a small wave disproportion in diagonals, but if it looks right I would not let that stop me from using diagonals after you exhausted any other decent way of counting that move.

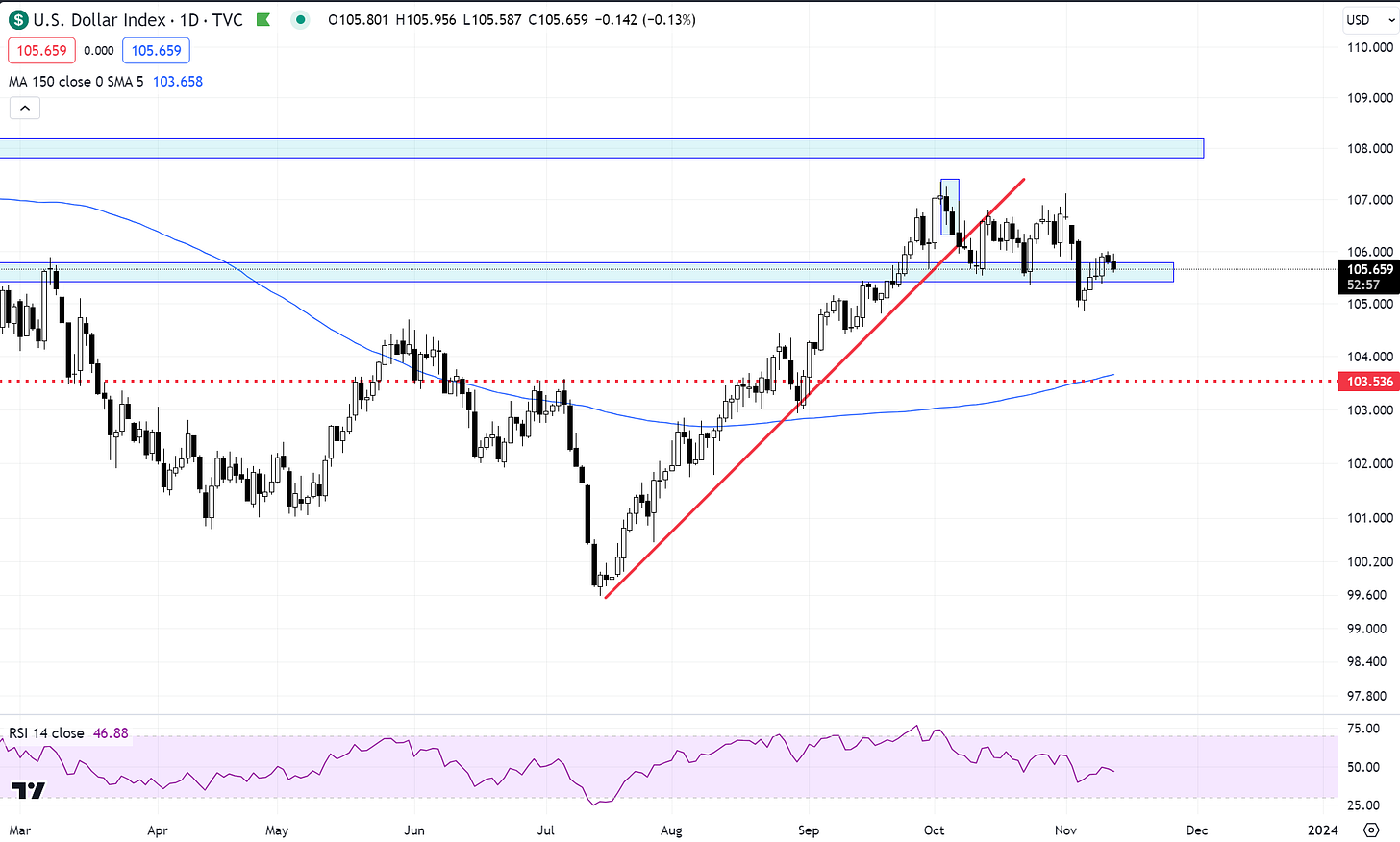

US Dollar and Yields

No major changes in the dollar at this stage. A break below 105 has a decent chance of follow-through and could provide more tailwind for risk assets. CPI and yields reaction will give further clues here. Interesting how both the dollar and the Sp500 have been moving higher since Nov began. Something has got to give here.

Yields have failed to continue their breakdown. They have gone back above the trendline and are following the suggested script for now. If they press higher, it will become very hard for risk assets to continue climbing. I think that the 4.80 test is coming before the next moves happen.

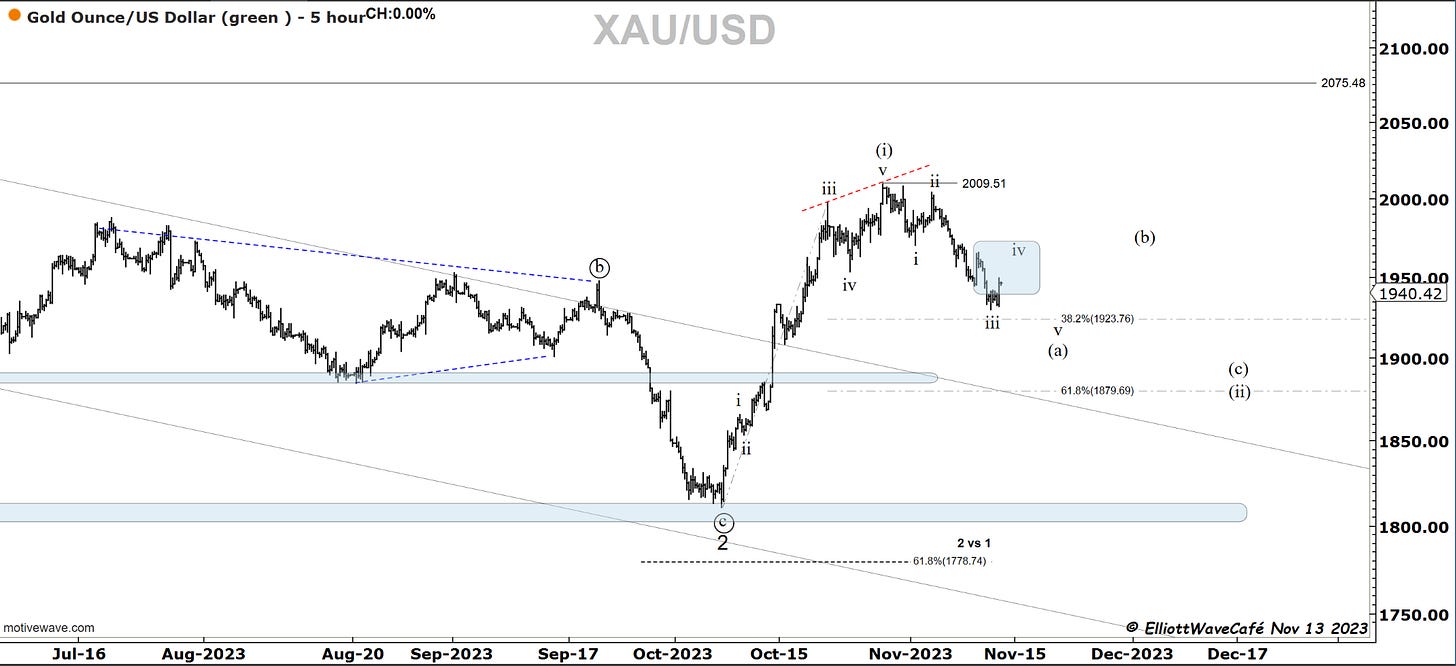

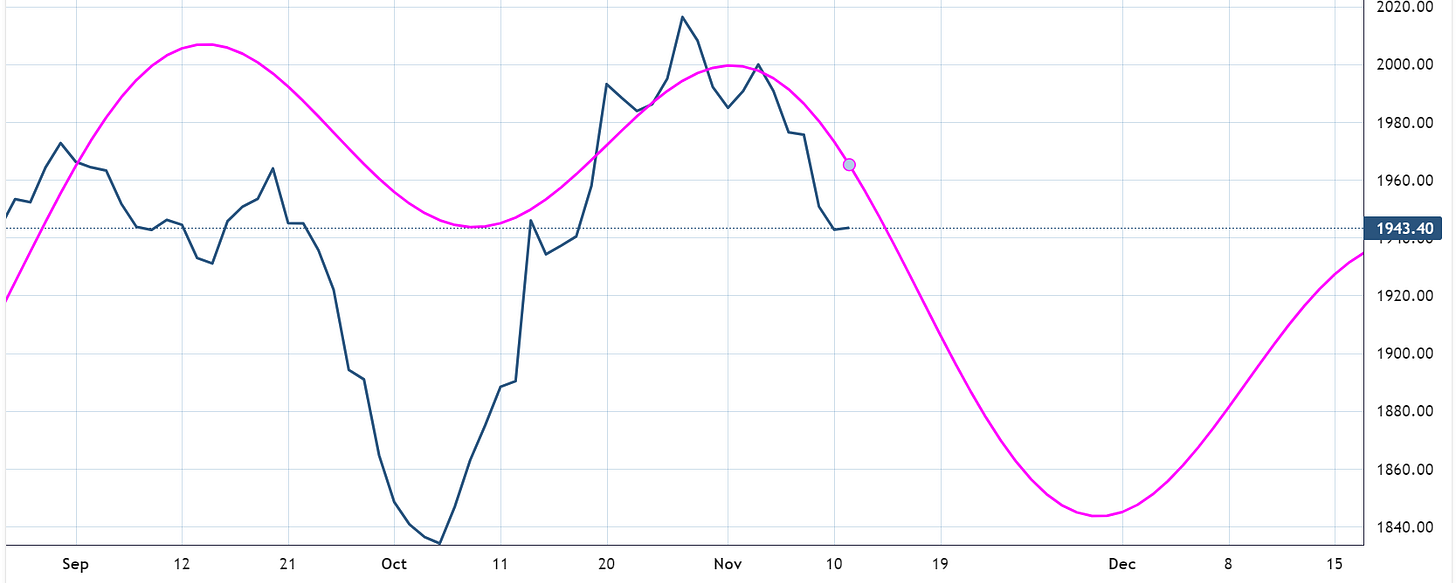

Gold

Gold fell further last week working towards an end to wave (a). If I look at the decline, it does seem that we still need a proper wave iv. That is not clear yet. If we’re rallying above the prior swing high I will be keen to secure wave (a) low and say wave (b) is underway. My bet is that it is premature to label a wave (ii) completion yet, based on the decline so far.

My cycle work suggests weakness still until November ends, maybe even December.

Seasonally as well ( red line).

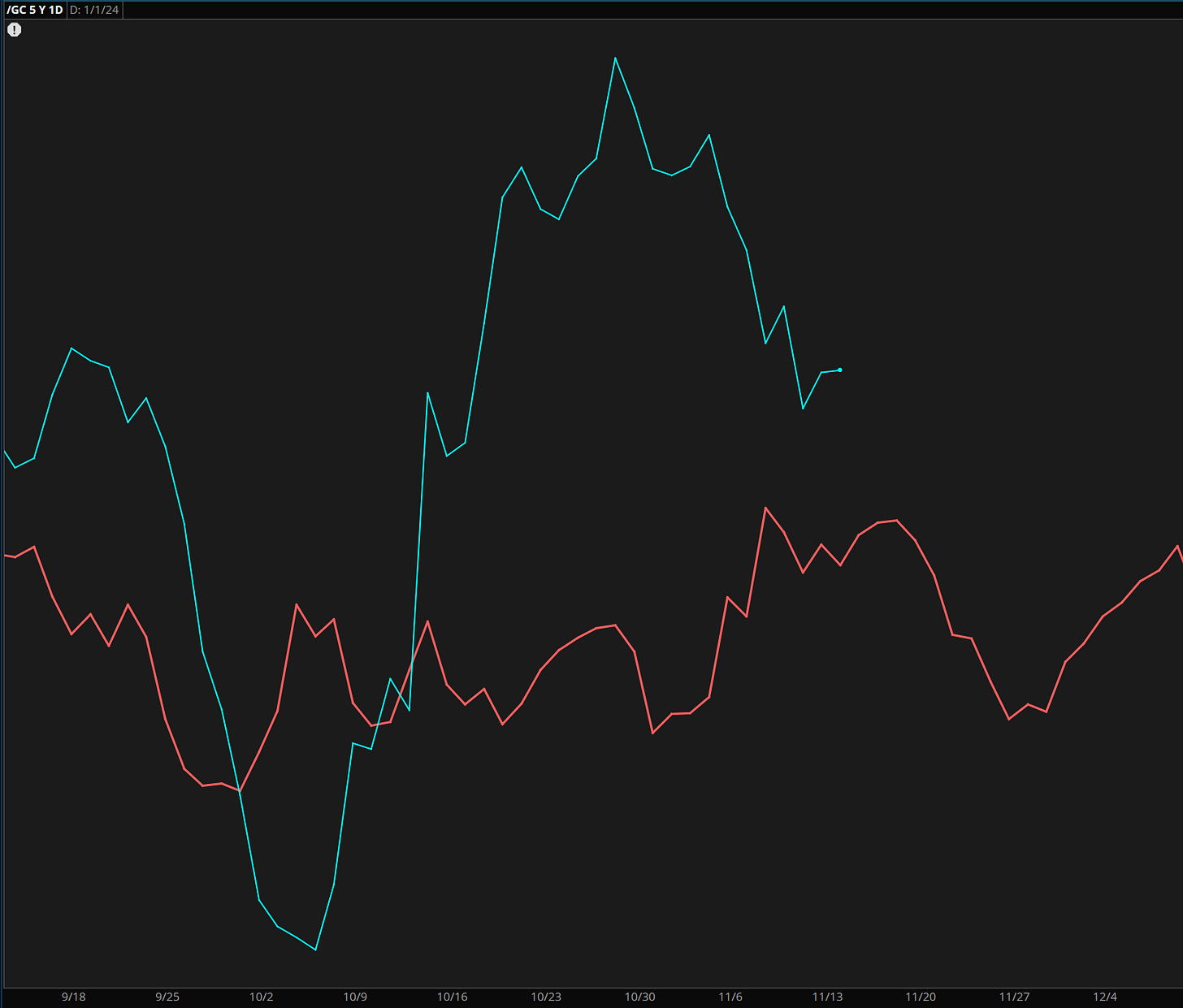

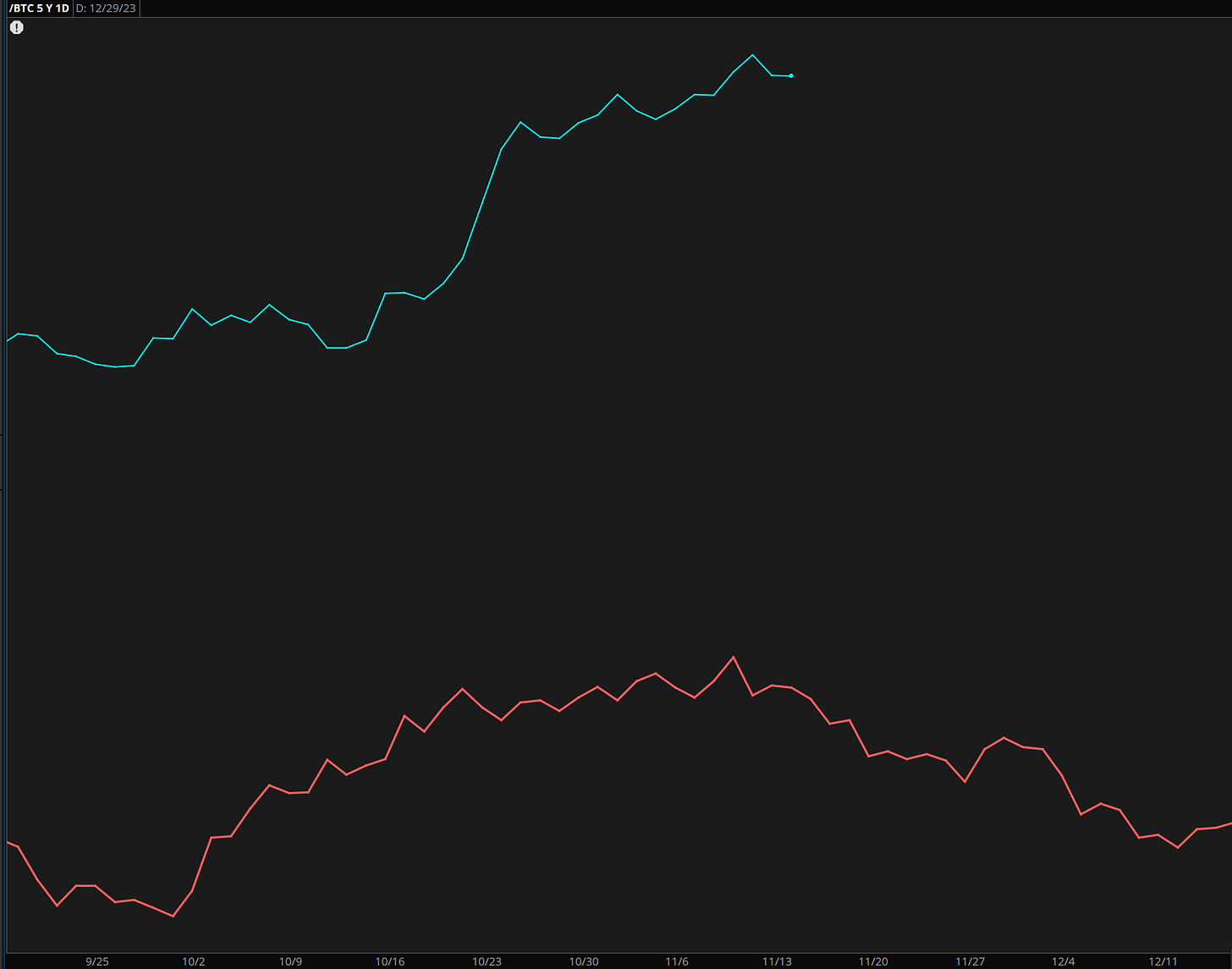

Bitcoin

BTC buyers have dried up a bit, and there was no power to take this any higher over the weekend. Stalling after that thrust higher in wave (v) increases the odds of that wave being accurate. I would expect at least a return back toward the prior wave (iv) as part of a corrective wave ((iv)). Even tho the sentiment is not at super laser eyes extremes, it was high enough at the end of the week, by my monitoring of social media and other outlets, to warrant some pullbacks near term.

Here is a bit of a count variation over the next couple of months, that points sideways to down in a series of 4th waves.

Once again BTC seasonality until roughly mid-December.

Daily video coming up next for members,

Have a great day wherever you are! - trade well, and don’t forget to subscribe and drop a like if this letter helps you in any way.

email: ewcafe@pm.me