The Daily Drip

Elliott Wave and technical market updates on SPX,NDX,DOW,IWM,DXY,BITCOIN

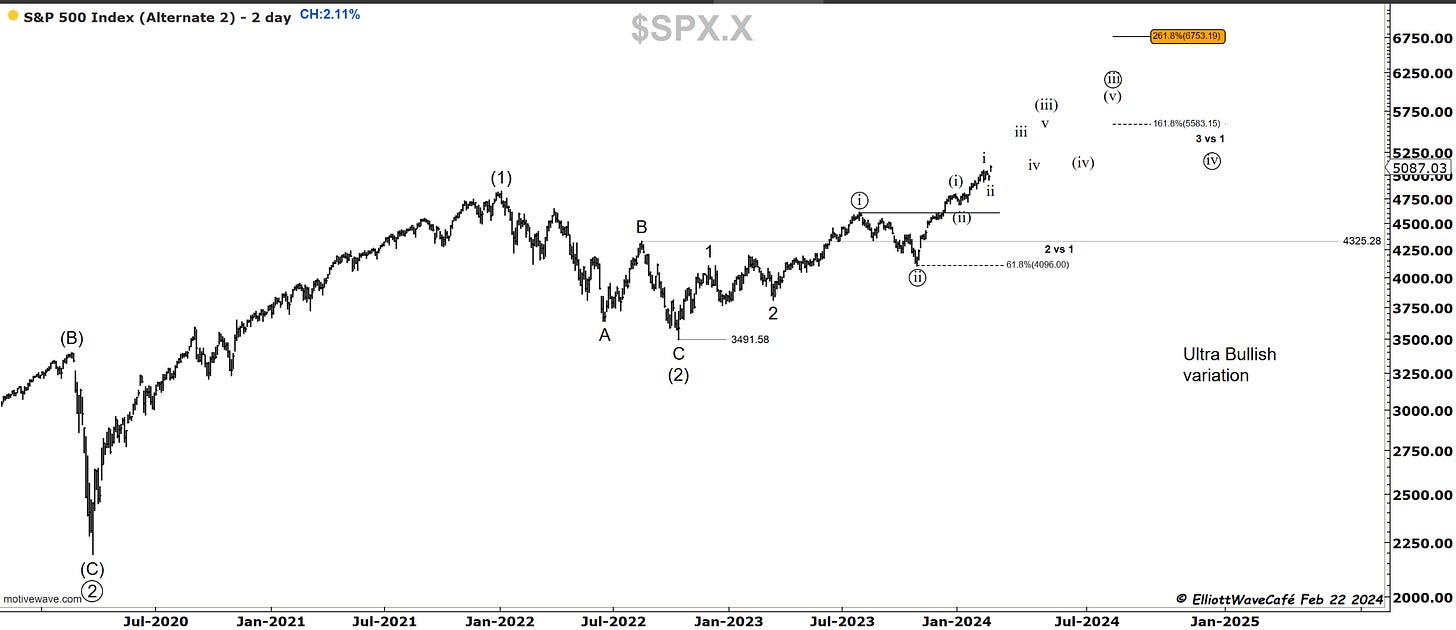

Note: The counts on the right edge are real-time, and they are prone to adjustments as price action develops. Elliott Wave has a fluid approach, is evidence-based, and requires constant monitoring of certain thresholds.

In the counts below, this (( )) = circle on chart

For the new readers “The Daily Drip”update is now available as part of a lower subscription tier $8/month or $6.67/mo yearly. Here is a free preview….

This is the last Daily Drip of the week. I will see everyone next week!

Chart of the Day EFA 0.00%↑ - Breakout in full force. This is an index composed of large- and mid-capitalization developed market equities, excluding the U.S. and Canada.

SP500

You can’t keep a good market down. Whatever NVDA did to lift the rest of the boats, it worked. Breakouts once again occurred across the board. It’s becoming harder and harder sitting here and labeling a correction while this market relentlessly continues to make new highs. The trend tried to get interrupted, but it failed to do so. The 20-day MA continues to drive short-term momentum, supporting all dips.

Here is the count that the market is imposing on us with its current behavior. A part of me is still thinking about this being a fifth wave as shown in prior updates, it’s just getting way to long from standard counts and it’s not usually a characteristic of equity markets to have extended 5th waves. Those appear mostly in commodities uptrends during times of fear. I will refer to this from now on and send the 5th wave idea to the back burner and monitor in the background.

Do you know how twisted the markets work? I am sure you do. Now that I am displaying a bullish count watch for reversals :). Will see. You look at stocks like APPL and see massive underperformance. You see multiple 5th-wave structures in many tech stocks. And yet we seem to get somehow more participation on an equal-weighted basis, but Russell still struggles. It's tough to make sense of any of it. In the end, price is king, and however misleading at times, it continues to show strength.

Let’s continue to analyze the rest of the markets; the Daily Video is also attached below.