The Daily Drip

Markets review, strategy and analysis

Note: The EW counts on the right edge are real-time, and they are prone to adjustments as price action develops. Elliott Wave has a fluid approach, is evidence-based, and requires constant monitoring of certain thresholds.

In the counts below, this (( )) = circle on chart

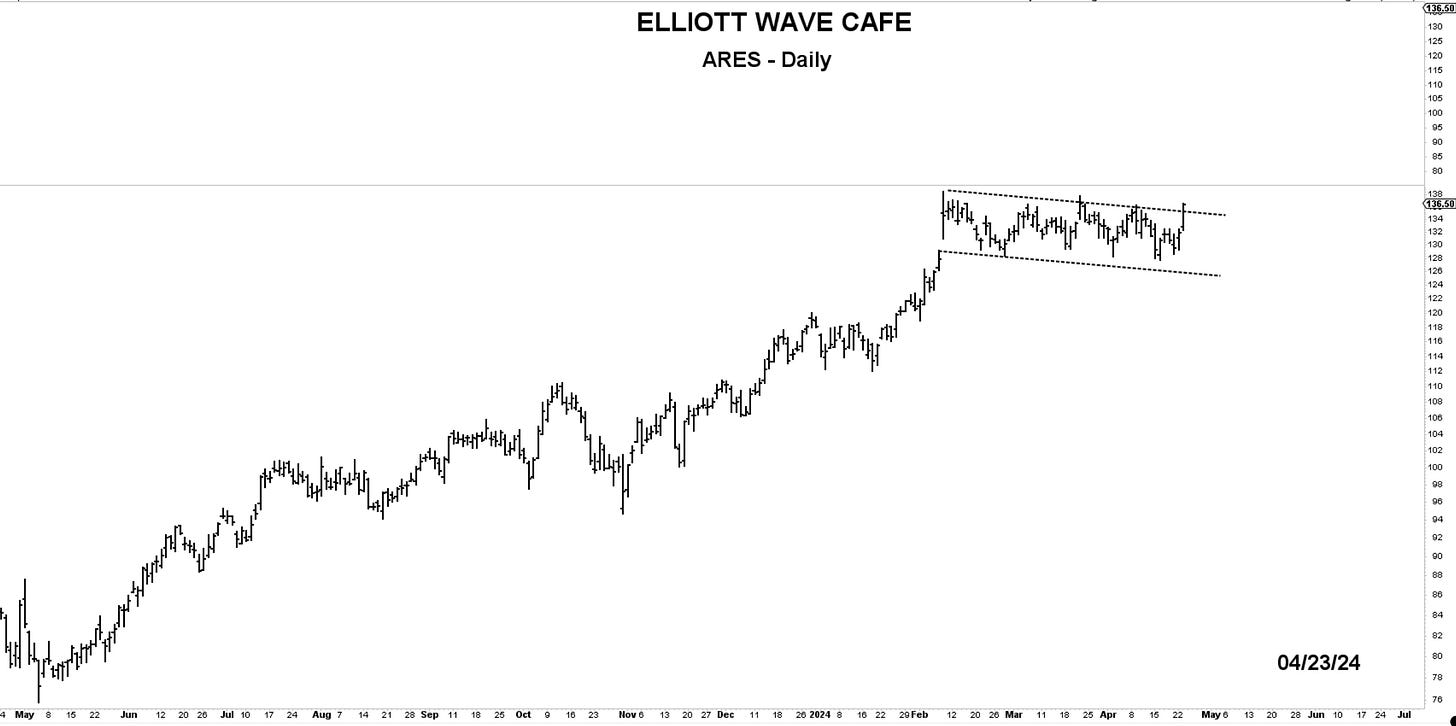

Chart of the Day—ARES—A textbook corrective structure put this stock into a relaxed mode beginning Feb 8th. Today it is attempting to break that structure with a close at the highs of 136.50. Using 132 as defense, it provide a small risk for a bet towards a larger breakout.

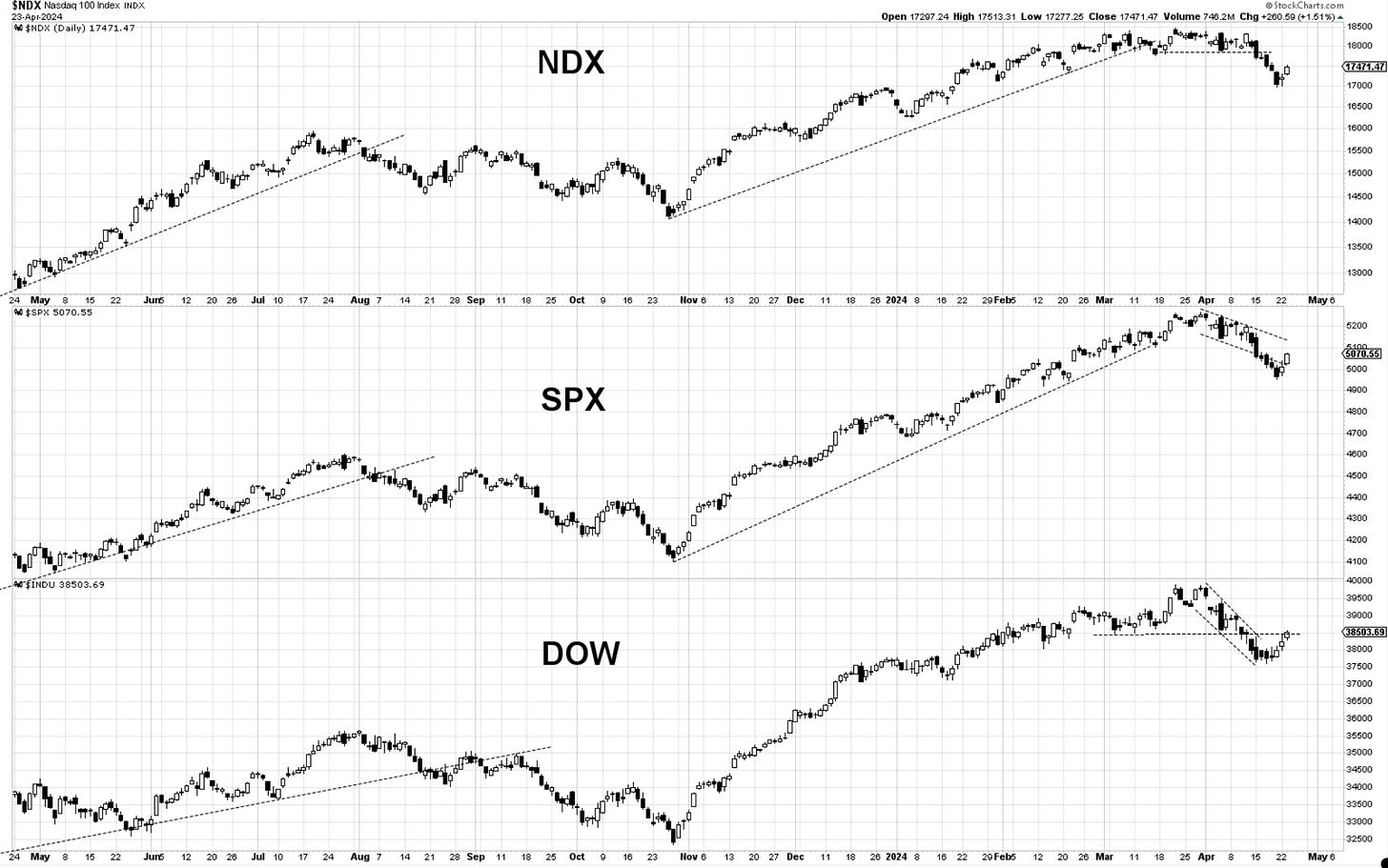

Bottom Line: Markets have staged gains above 1% today, less Dow at 0.69%. The proof of securing a low on Friday, April 19th, continues to build. There is a bit more work that indices need to do, but the breadth has been strong, with advancing stocks beating the declining ones 5 to 1 on the NYSE. We are now heading with strength into zones where markets broke lower from about a week and a half ago. Getting through those without failures or rejections is the next test of the bulls.

Let’s dive into charts and further analysis below…