The Daily Drip

Core markets charts updates and commentary

Note: The counts on the right edge are real-time, and they are prone to adjustments as price action develops. Elliott Wave has a fluid approach, is evidence-based, and requires constant monitoring of certain thresholds.

In the counts below, this (( )) = circle on chart

SP500

Quite interesting that even with today’s drop the wave ((1)) territory has not been penetrated by wave ((4)). Good bounce into the close, showing an appetite still to buy this dip. The daily cash charts left a small tail behind, let’s see if it gets negated tomorrow or has the power to continue higher. It’s a green shoot. We’re looking for a move above 4600 next.

Nasdaq100

Nasdaq gave a quick trip below the March ‘22 highs, only to return back above it. It’s a bit far from saying we have a completed correction, but combining support with 50-day MA, should be a pretty powerful zone for at least a bounce toward 15600. If you turn off the news and just look at that daily chart objectively, what do you see? By my work is nothing else than just a correction in an ongoing trend. I opened a small tactical buy in TQQQ, to see how it behaves into Thursday.

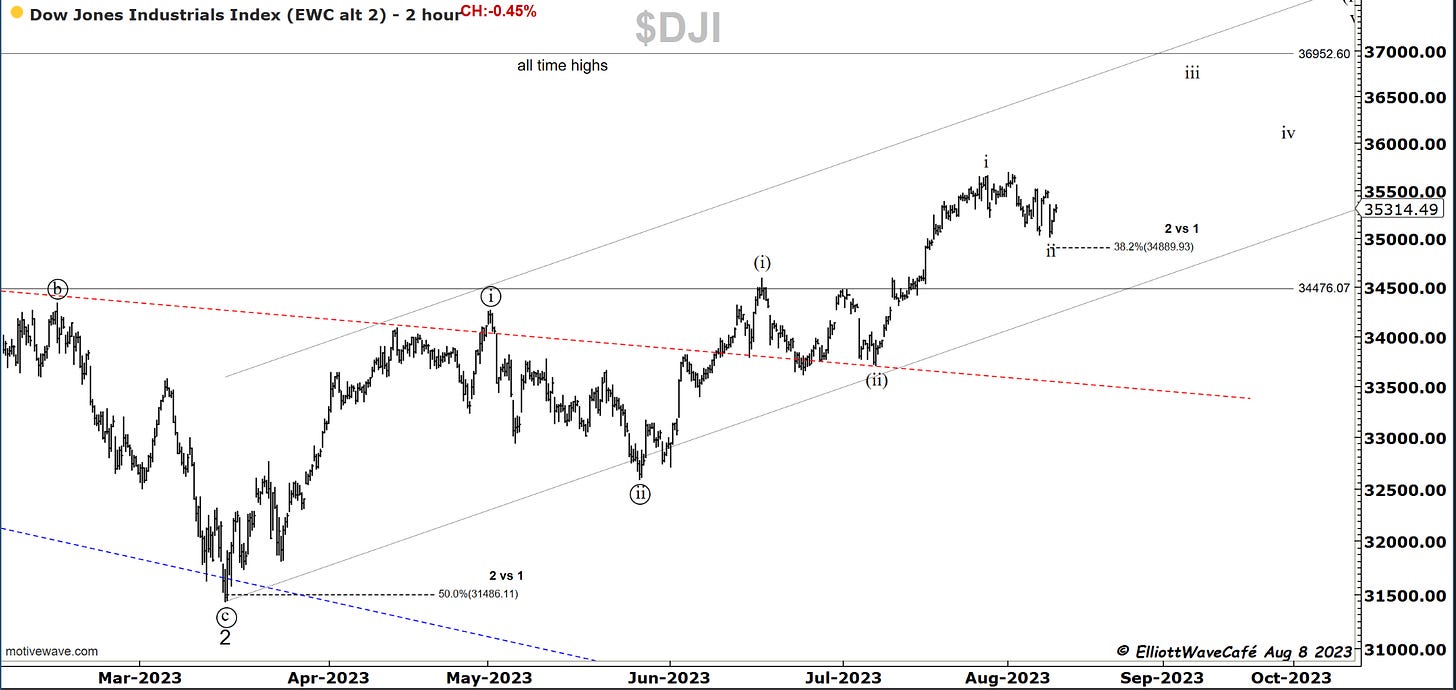

Dow30

I can’t tell you exactly what’s inside that proposed wave ii drop, but in my view, it does not matter. It’s a yoyo price action, a term that RN Elliott did not have in his vocabulary. What we do know from his writings is that if it’s overlapping a lot it’s probably corrective. I expect the resumption to be to the upside, once this backing and filling is over. I remain very bullish above 34,500.

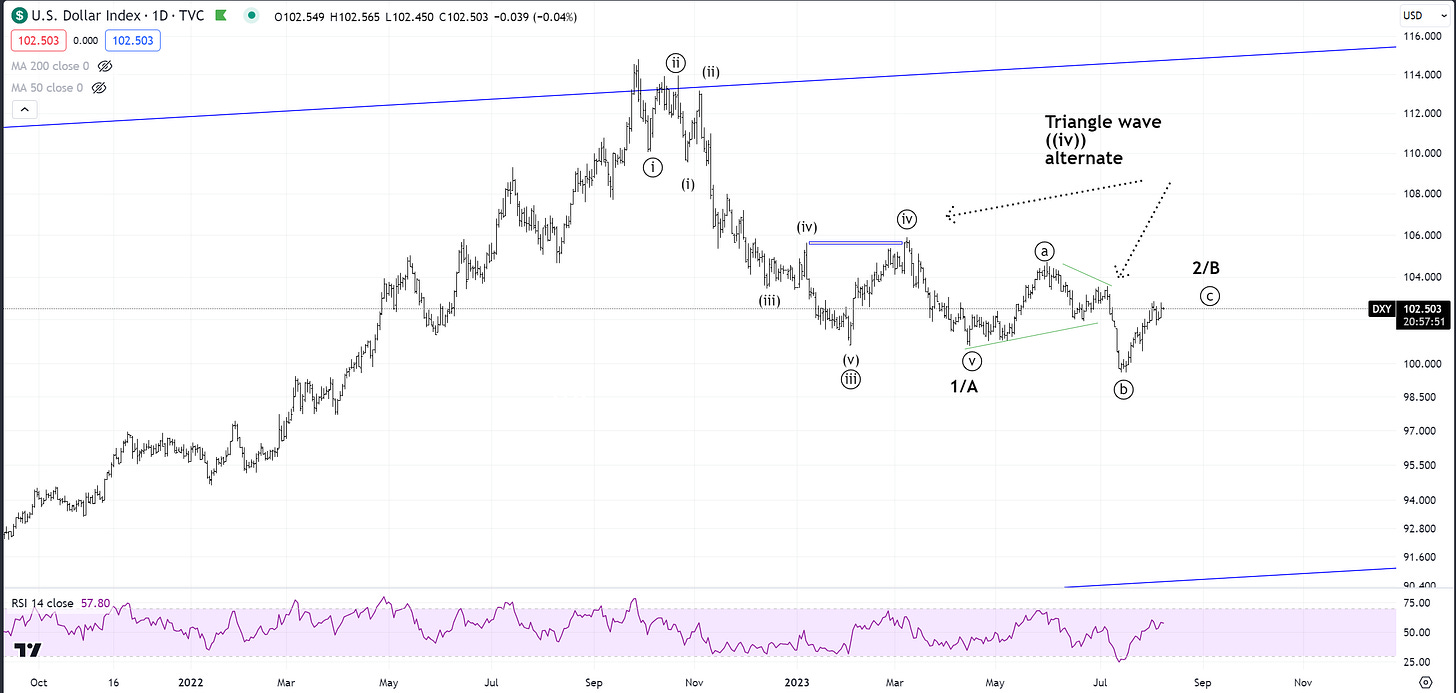

US Dollar

The dollar closing above that subjective trendline is a negative for bears, being capped by the 150-day is a positive. I think we fail soon here and resume moving lower. A lower dollar is positive for risk.

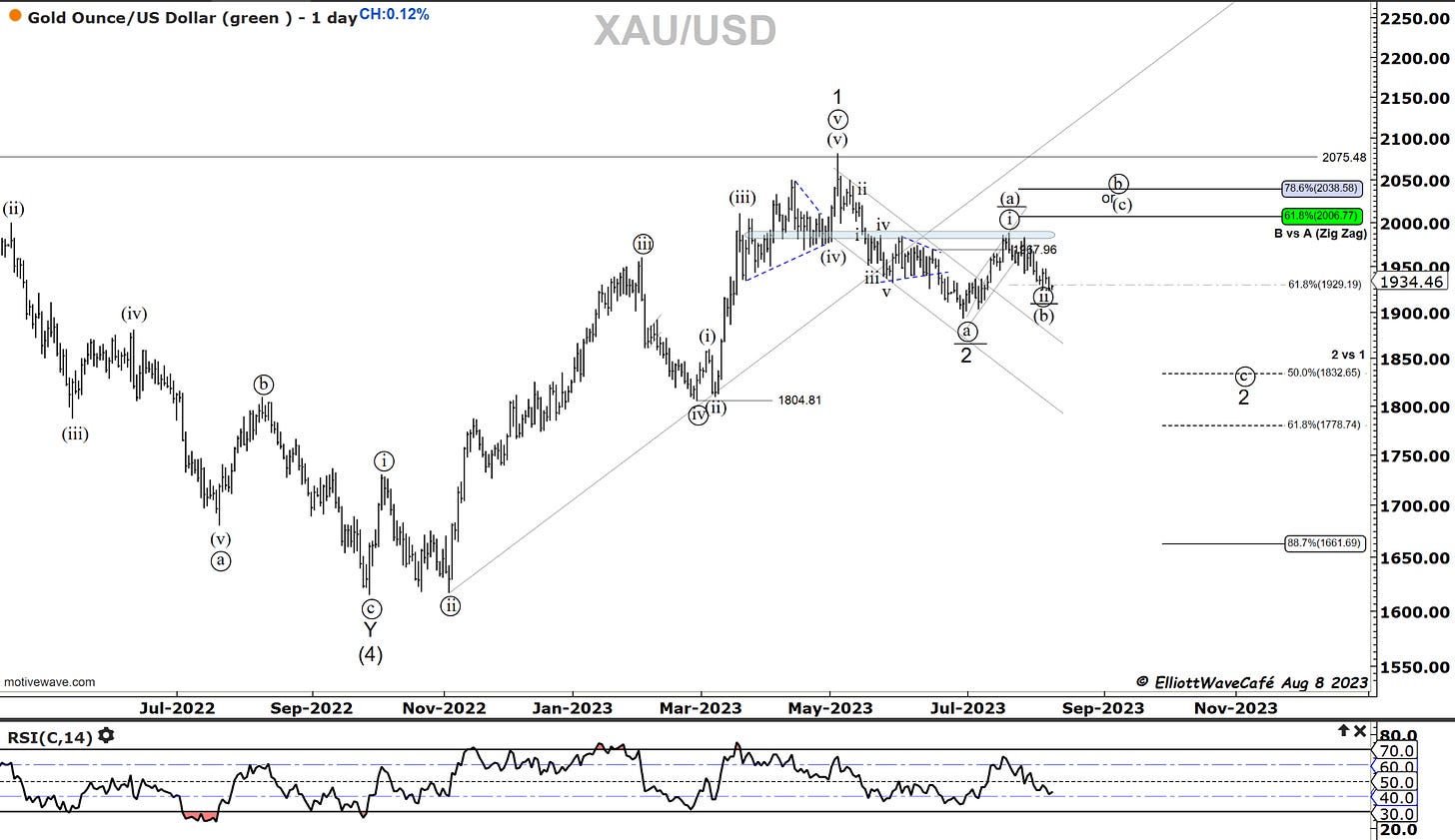

Gold

Nothing to add on the dollar at the moment, prior comments remain

Gold is in the “neutral zone” , a place where all the moving averages converge. It will eventually lead to a breakout, for now it’s just a market I am monitoring. A dollar rejection should help gold rally for a bit; combine that with the .618 support and could be a positive cocktail for the yellow metal. I don’t have a particularly strong opinion on it at the moment, just watching key levels, like 1980 to the upside.

Silver

I spent a little time cleaning up the previous silver count and suggesting a leading diagonal with wave 2 in progress. If you measure that wave ((v)) is shorter than ((iii)) by a touch. Maybe in other platforms is ok, but I won’t let that take away from the fact that is pretty good-looking. You can also have a 1,2 1,2 if that makes you happier. Bottom line, we should be heading higher when this wave 2 completes.

Bitcoin

A quick attempt to rally that seems to have faded away. I like the crack above the channel but as I said in tonight’s video, there is a risk of this being a flat with another move ower to come. The larger structure mimics the one from May/June, has a corrective look and should resume higher. I would like to see a break of 30,500 to get excited about adding to longs. Check out the Double Shot for more details.

See you tomorrow - trade well,

Cris

email: ewcafe@pm.me