The Daily Drip

Elliott Wave and technical market updates on SPX,NDX,DOW,IWM,DXY,BITCOIN

Note: The counts on the right edge are real-time, and they are prone to adjustments as price action develops. Elliott Wave has a fluid approach, is evidence-based, and requires constant monitoring of certain thresholds.

In the counts below, this (( )) = circle on chart

SP500

Even with a bit of a selloff later in today’s session, there is not a significant change in the character of this market. The bulls are enjoying a series of higher highs and higher lows, along with a trend established above the key moving averages and trendlines. Stocks like NVDA are being praised on financial networks as they can do no wrong and “every day it’s going up.” It does feel a little “frothy” out there, with stocks like ARM climbing over 100% in a couple of days. It‘s at times like this when wave five behavior is taking over.

My work suggests we are in the final stages of this move, and “reversals are imminent.” A more substantiated daily reversal formation, a break of trendline, and key averages will be seen as confirmations of this anticipation. The market should then break below 4818, the old-time high. The second part of February is notoriously weak for stocks and should provide a headwind going forward.

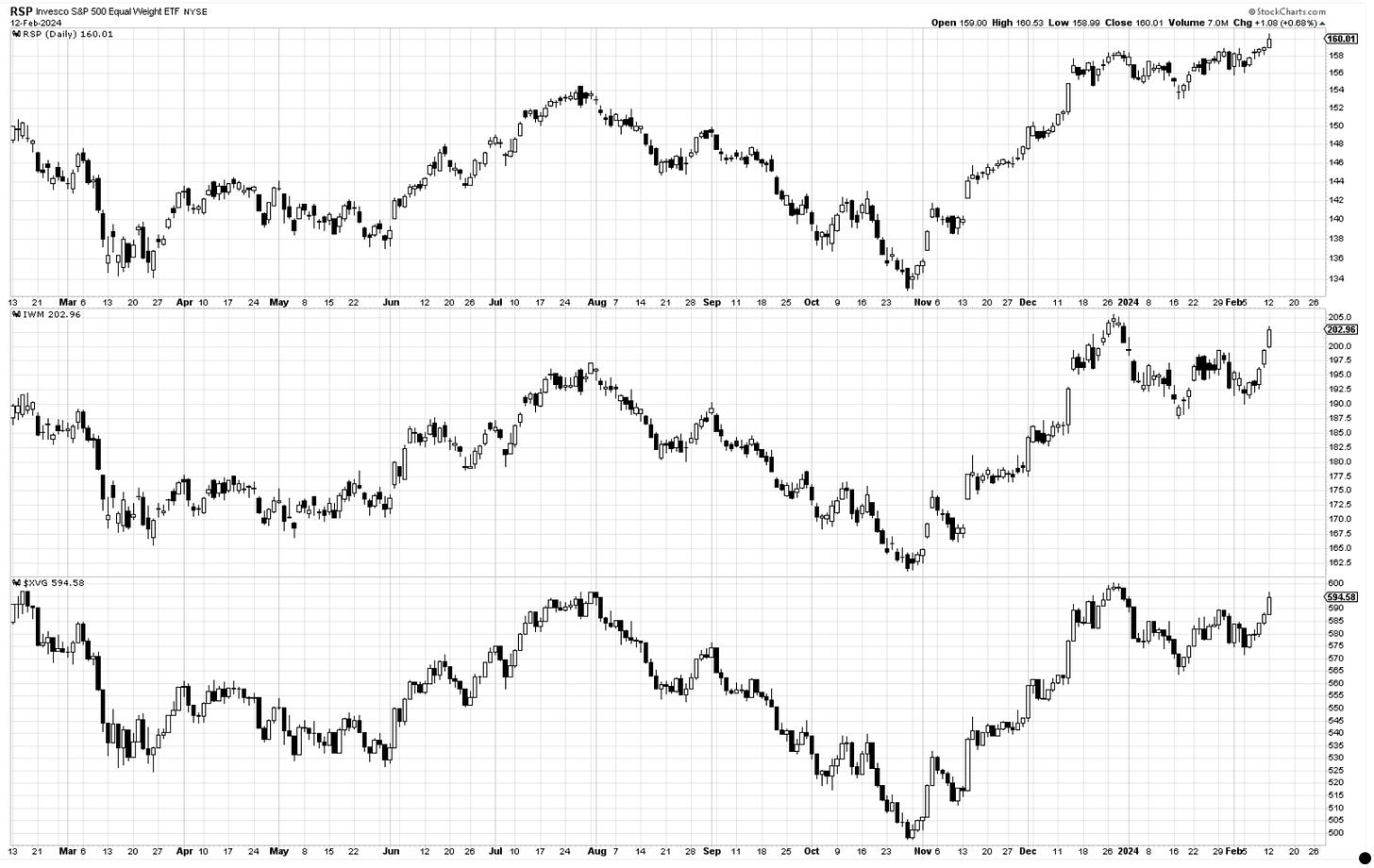

In the positive “rotation” column, we can see a bit more participation from small caps and equal-weighted indexes like RSP and value line XVG.

More in tonight’s video.

Now let’s discuss NDX, DIA, IWM, DXY, Yields, and BTC.

You can support my work in writing this newsletter with a small monthly subscription; see the new pricing offerings below.