The Daily Drip

Core markets charts updates and commentary

Note: The counts on the right edge are real-time, and they are prone to adjustments as price action develops. Elliott Wave has a fluid approach, is evidence-based, and requires constant monitoring of certain thresholds.

In the counts below, this (( )) = circle on chart

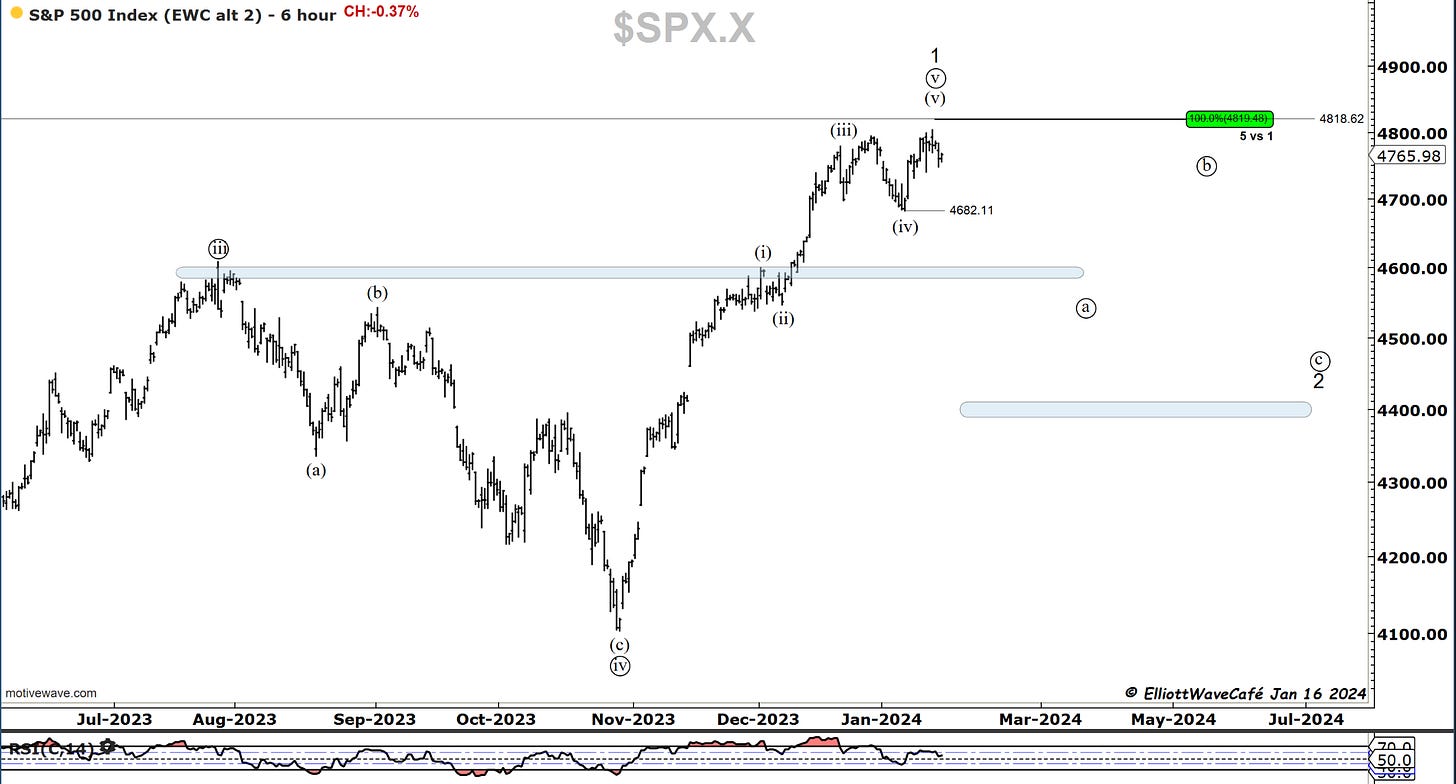

SP500

It was a choppy day after an extended weekend. There was another attempt at the highs early in the session, but then we spent most of the day working on a negative tape. The EW count has not changed and continues to point towards a larger correction in wave two at a degree of trend that is flexible. One of the first levels we need to take to raise the odds of deeper pullbacks is 4682. Once we lose that, 4600 becomes the clear target. Subsequent bounces will then lead to further selling towards 4400. This whole process will take several months to unfold.

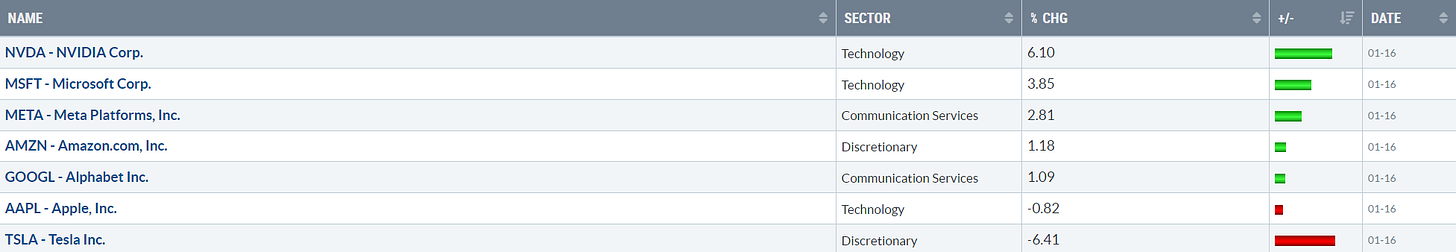

More than 75% of the issues across exchanges have been negative today. The cumulative advance-decline line is heavily diverging from the prices in the SP500. If the bulls want to take control of this behavior, they need to get some serious buying going. So far, that has been limited to only a few larger names like NVDA and MSFT. ( see below their performance, looking back one week). The way the declining issues behave, any weakness in these larger names can put the indices under some serious pressure.

Today was the largest one-day increase in the VIX since Dec 20th. Above 14.50, it would be a signal for money managers to reduce risk exposure further.

The bottom line is that I don’t expect any significant upside until we work through this corrective period. It can likely last until roughly mid-March. February is one of the weakest months of the year, right there after September and August.

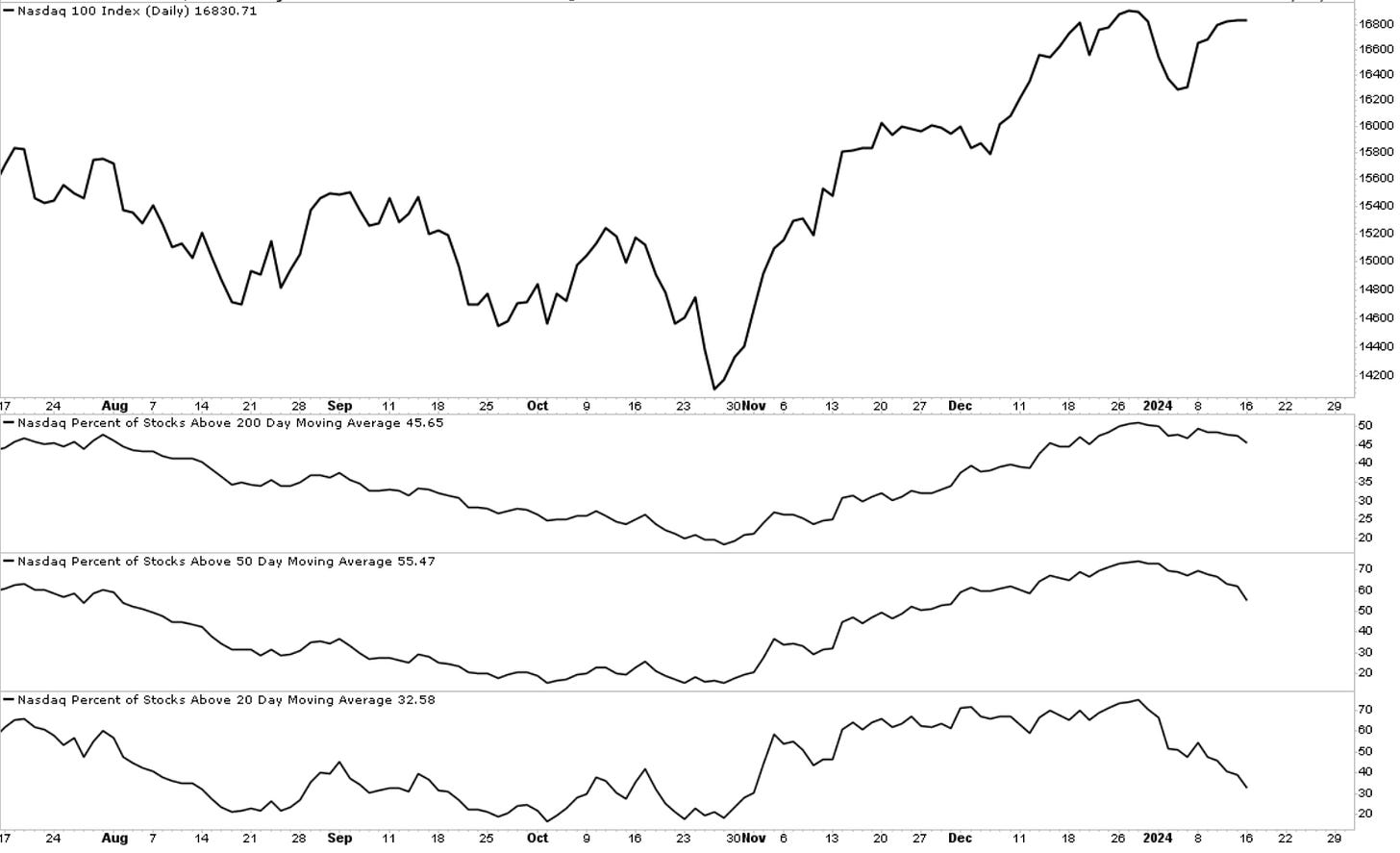

Nasdaq100

The Nasdaq is holding near the highs, likely supported by those few larger names mentioned. Only 32% of the stocks in this index are now above their 20-day MA. We’re dropping further in the 50-day as well. These are signs of weakness, and it should be just a matter of time before they’re reflected in the actual index pricing.

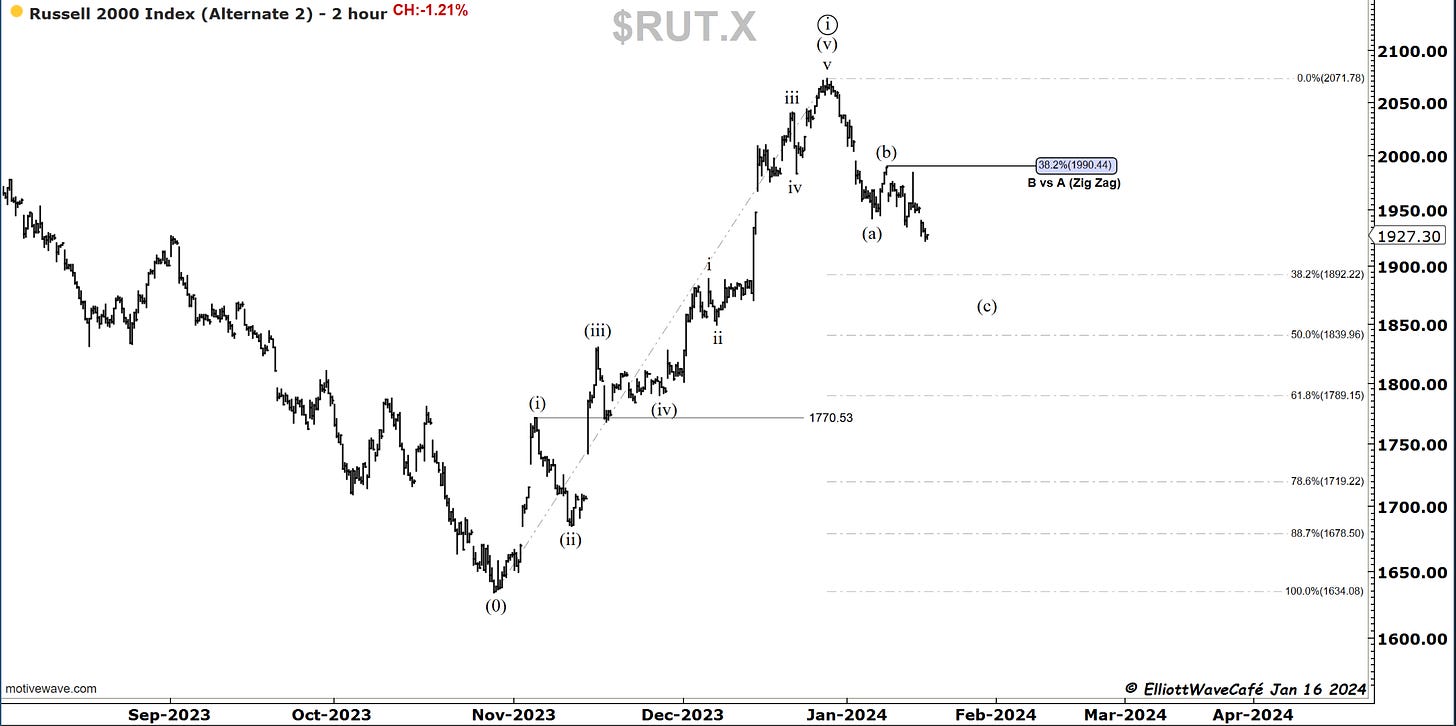

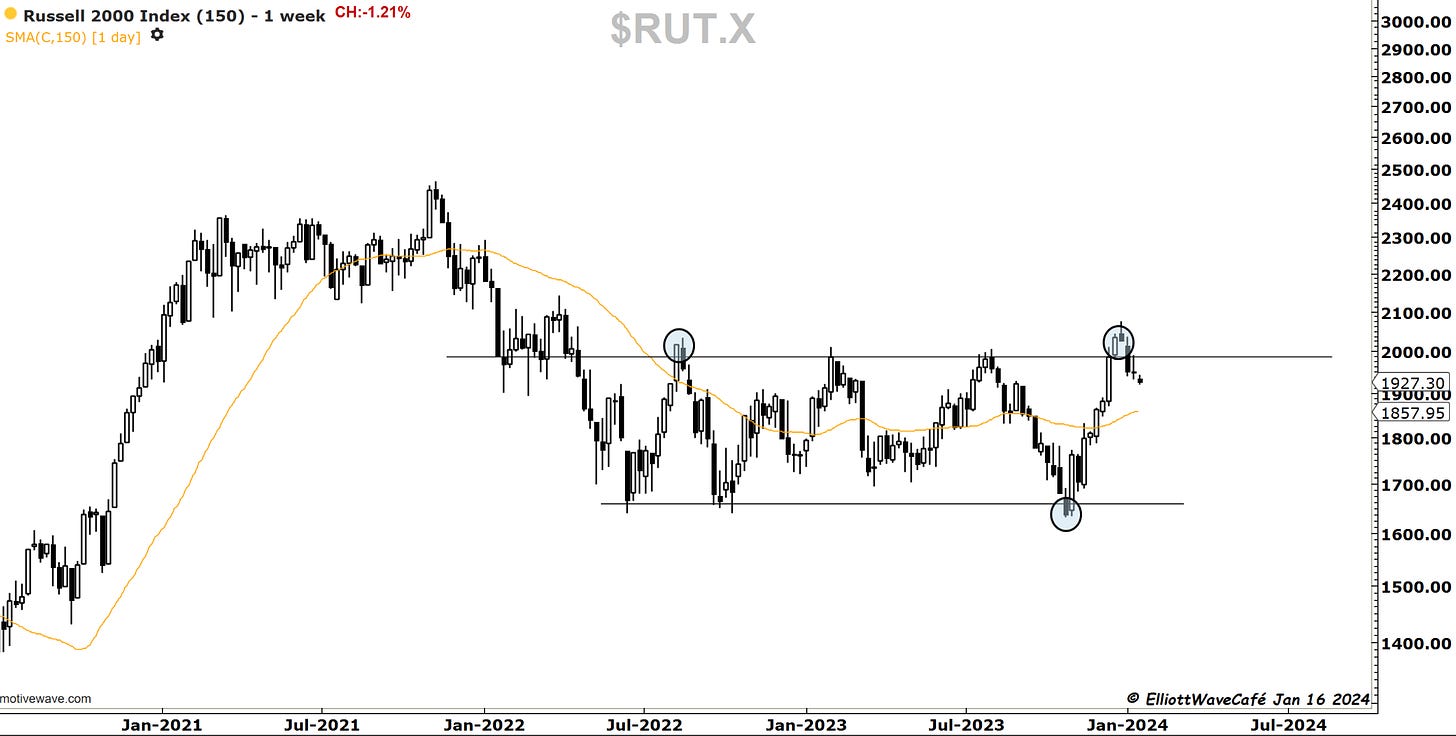

RUSSELL 2000

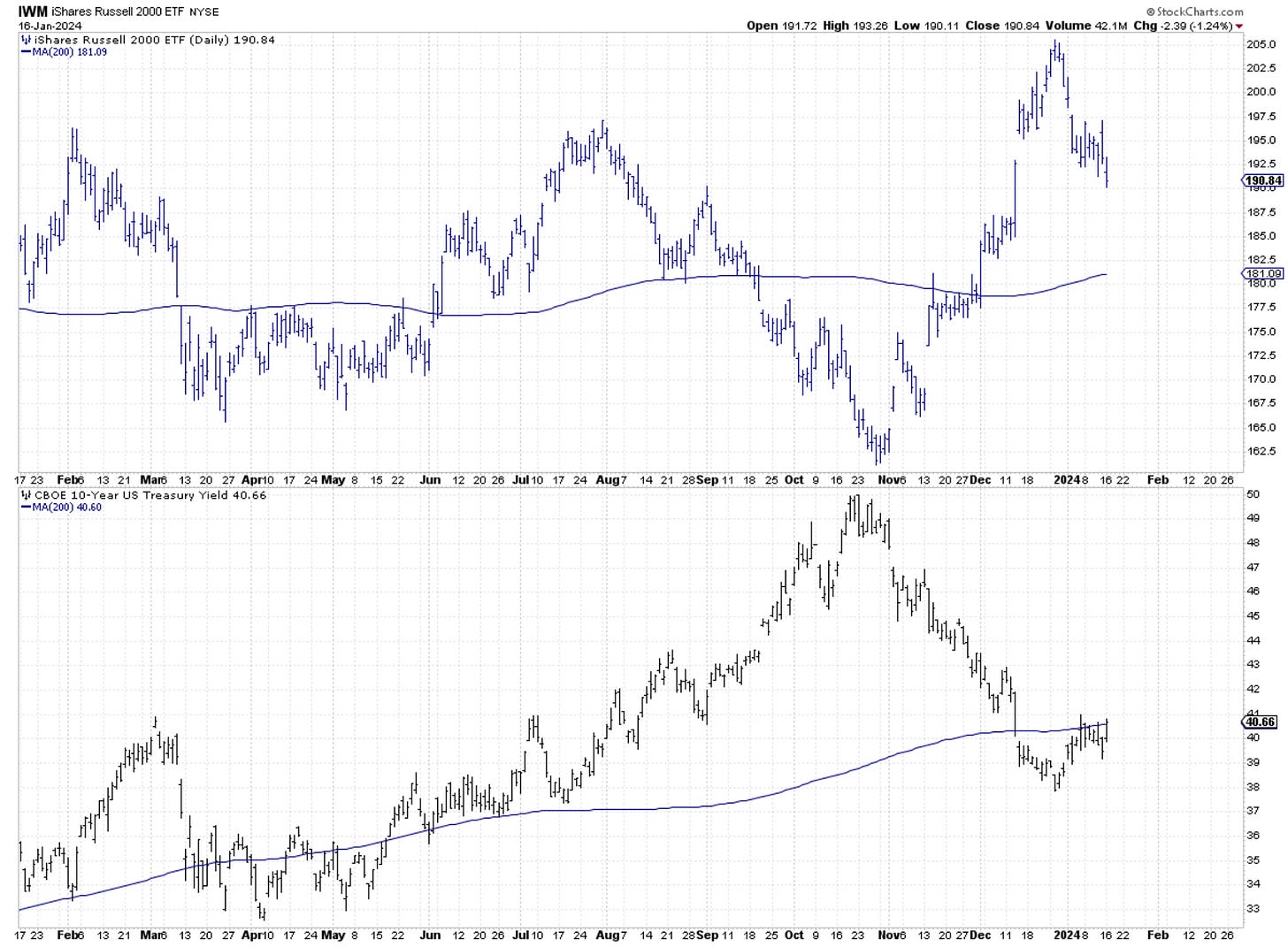

Small caps were once again the weakest of the bunch. I think there is more to go here. We have not yet corrected 38.2% of the Nov advance. If you remember, there was lots of excitement about the small caps heading into the New Year. The weekly chart clearly shows the upside failure up to this point. Support lies near the 1850 zone.

A rise in yields is not usually a favorable environment for small caps. Yields are in an upswing cycle (see in the yield/dollar section below).

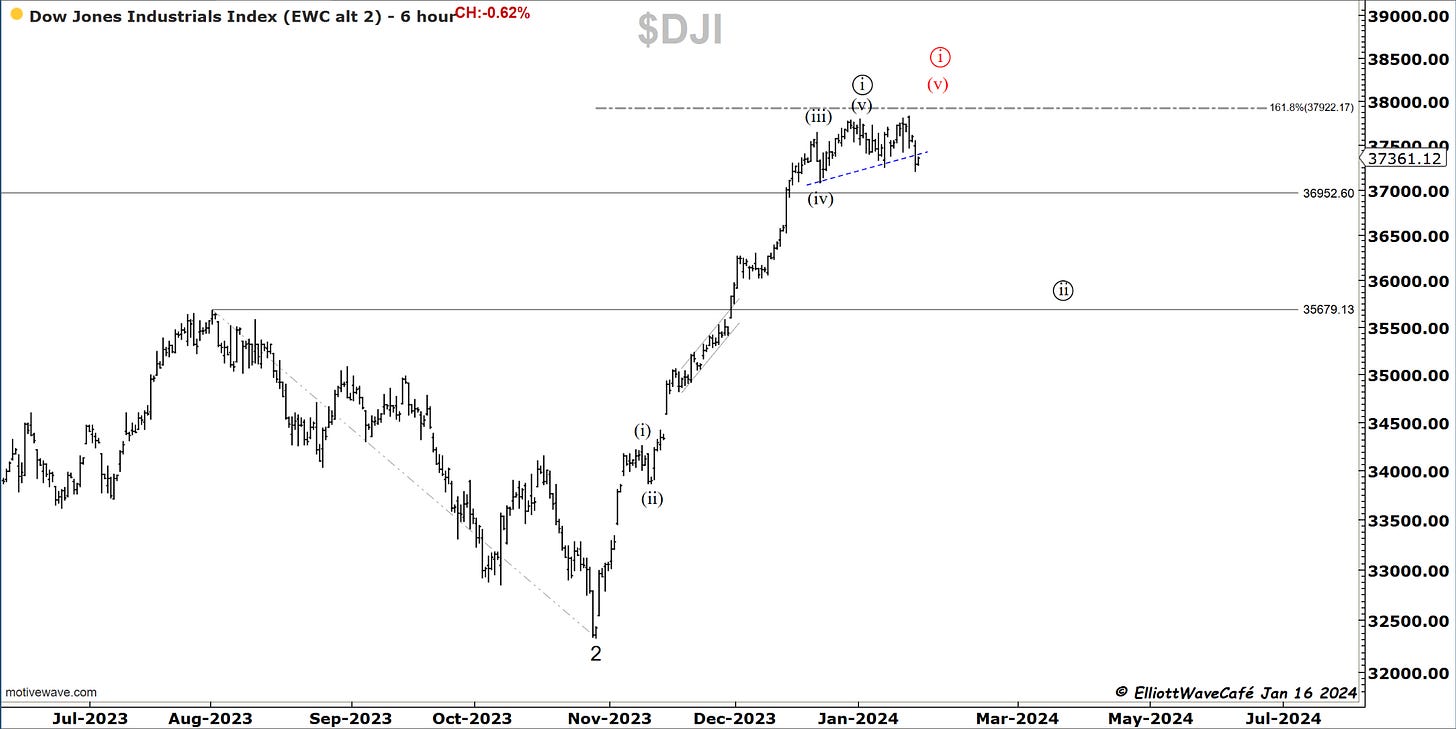

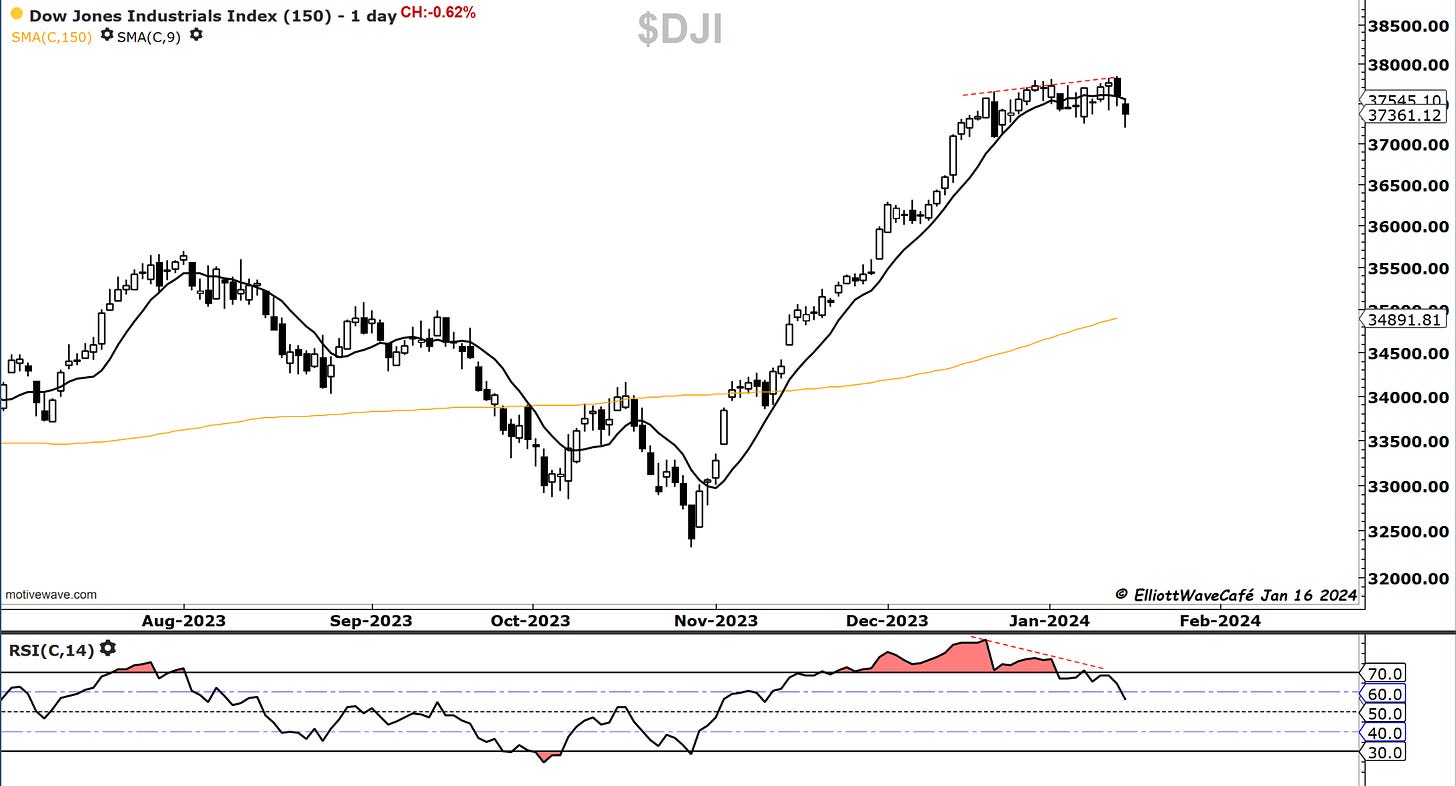

Dow30

Today’s selloff has violated the small trendline that supported prices since Dec 20th. The cracks are appearing, and the uptrend in this index is likely over for the time being. A break of 37k will provide further confirmation. I will provide downside labels once we get a more significant decline.

Another close here below the 9-day MA with a falling RSI.

US Dollar and Yields

We have downtrend violations in both of these markets. I would expect the upside to continue in both until we run through this upswing cycle. That should be negative for risk assets in general.

DXY daily cycle.

10-year yields upswing to continue until mid-march.

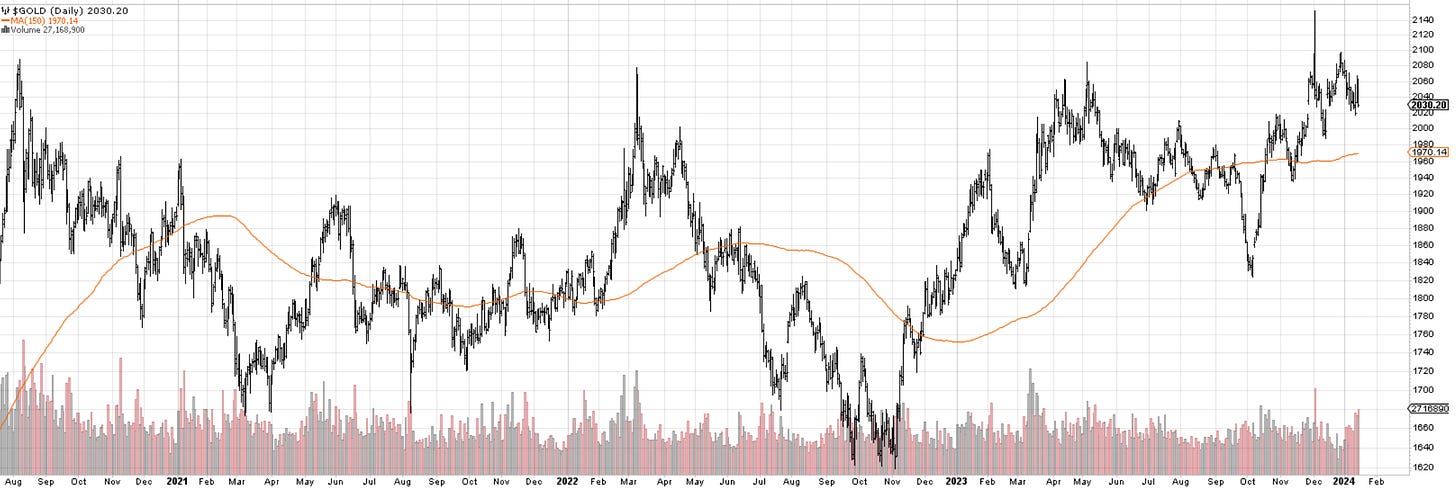

Gold

Gold has done a 3-wave move into those new highs. Since then, it has continued to struggle. The dollar upswing does not help. My view here is for one to remain defensive until 2100 gets taken out. If I were a poker player here, I would throw my cards out and wait for the next hand.

What a mess.

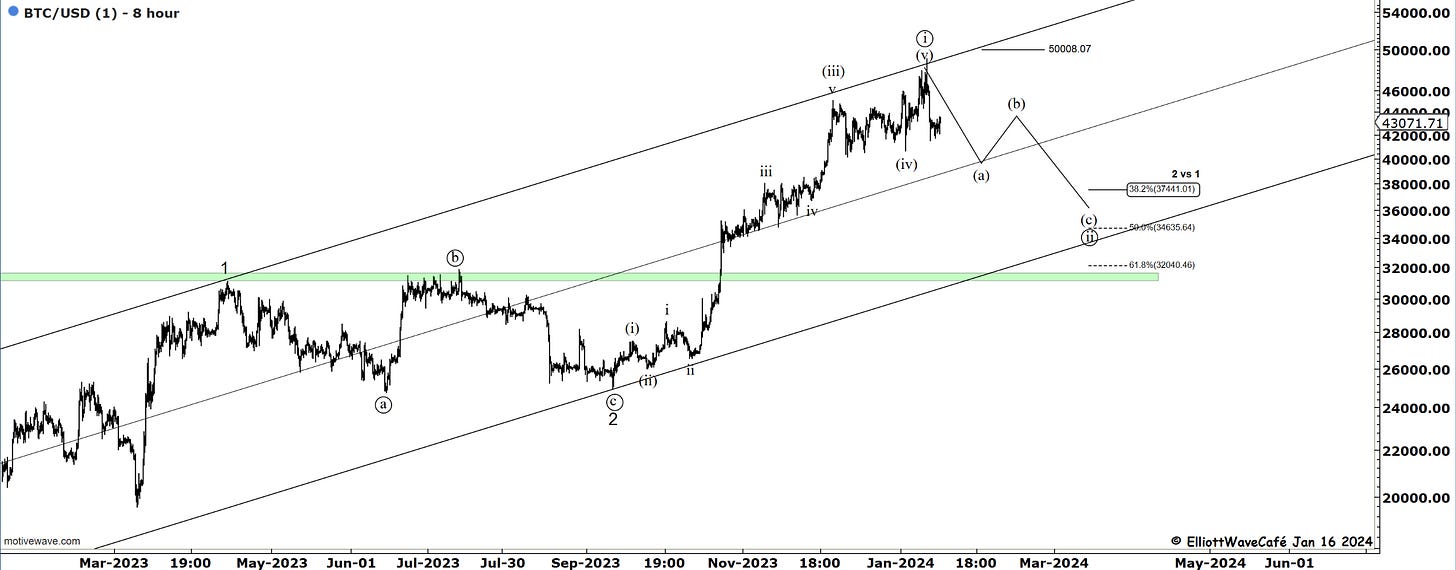

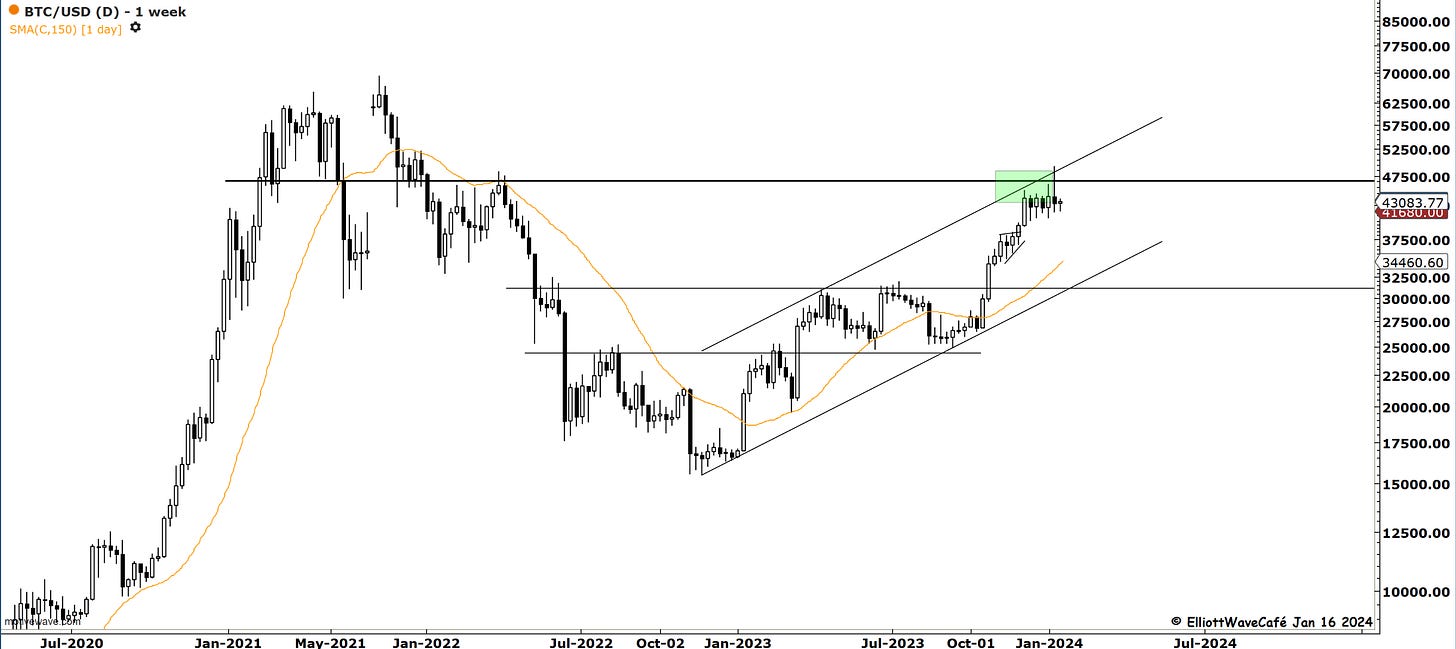

Bitcoin

Bitcoin has begun a corrective period that should take prices below 40k in the weeks ahead. The weekly candle displays a clear rejection of higher prices. This is coming at a time when the BTC cash ETF was approved. Any rally from current prices would be an opportunity to short or ease off on long positions. I will comment on this in tonight’s video.

“Double shot” Daily member video coming up next,

If you’re new to Elliott Wave or need to refresh, there is a 7-hour video course with downloadable slides under The Coarse tab on the website.

Have a great day wherever you are! - trade well, and don’t forget to subscribe and drop a like if this letter helps you in any way.

Cris

email: ewcafe@pm.me