The Daily Drip

Markets review, strategy and analysis

Hello, everyone… I am in Columbus, Ohio, for the rest of the week, supporting my daughter at the BIG10 college swimming and diving championships. I will try to provide written coverage, but I am unsure about videos yet.

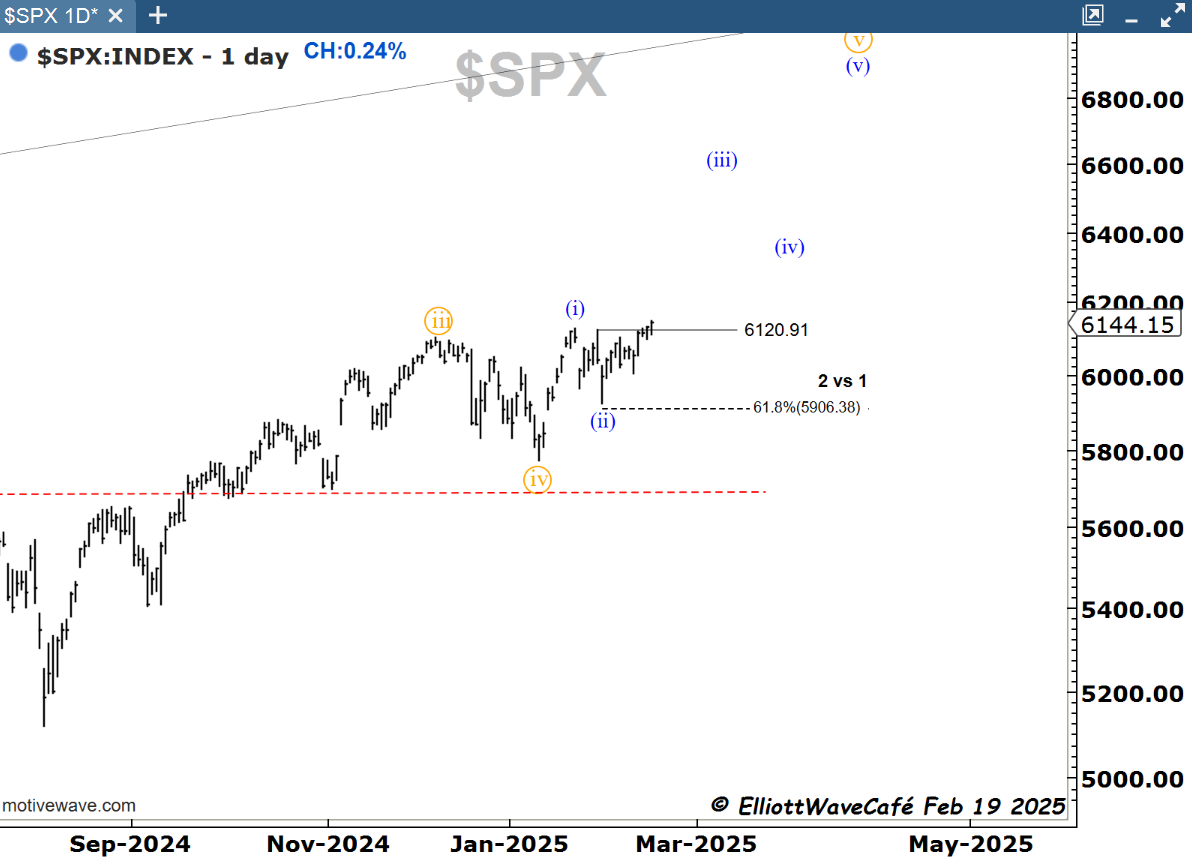

SP500.

A new higher close in this index above the suggested wave (i) top creates an expectation for the further continuation of wave (iii). Not that it matters a whole lot to project things upward, but for those interested, the 161.8% of wave (i) is 6524.19.

Per the weekly chart below we should have further advances in a proposed wave ((v)).

Today’s close and gains, although small, continue to feed into the existing uptrend and give further evidence that the correction has run its course. I will keep the Feb 13th candle low as the nearby line of defense currently.

The only stock I added today was COF and with this addition I am now involved in three financials COF, SCHW and C. It’s funny how the better chart setups showed up in this sector. I recognize maybe a bit of tilted exposure to this area and will try to re-balance it in the near future. One of the best ways to get feedback from the market is to look inside your own holdings and see how they fare against the overall leaders. Scans are another good way to see what shows up repeatedly and in what sectors. The info is there, just needs to be dug out.

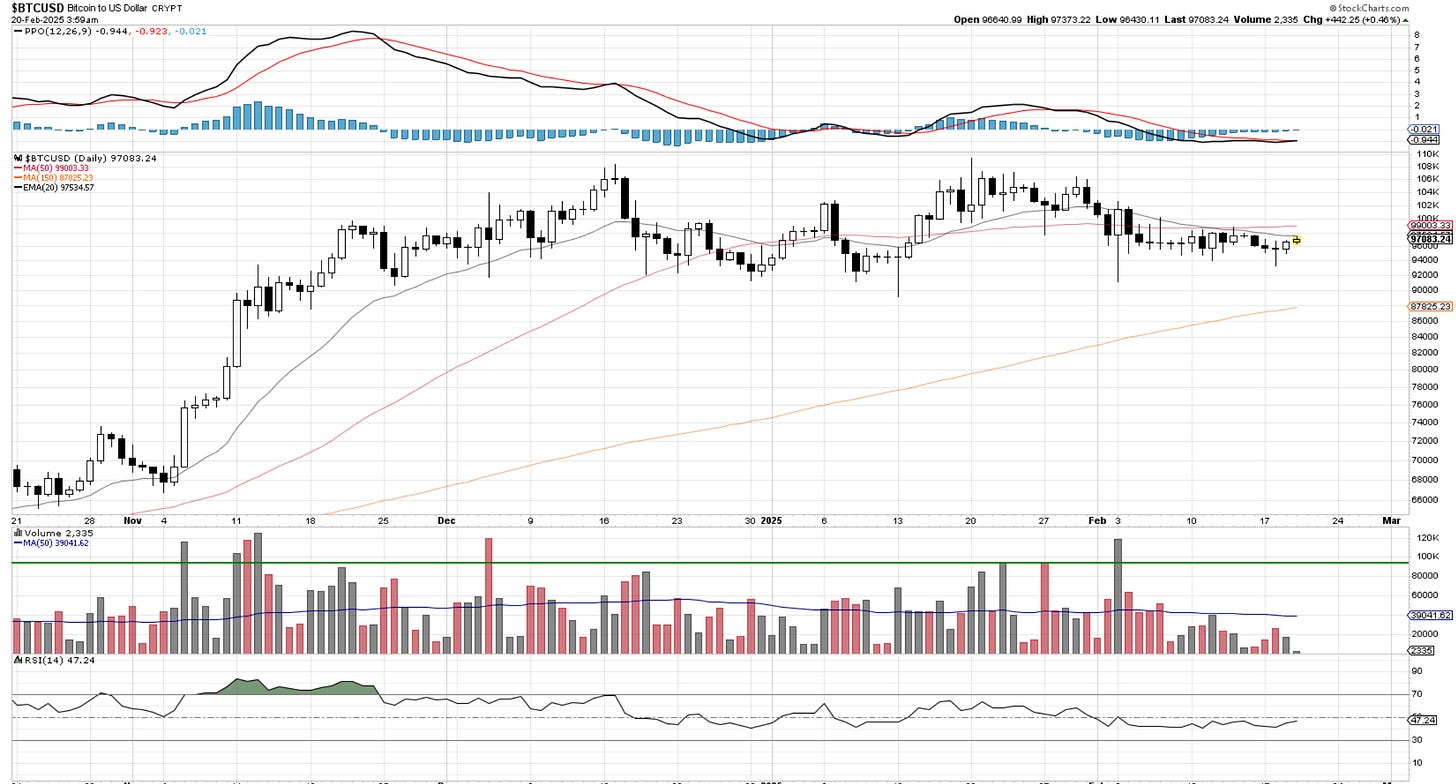

Bitcoin

After a failed move below 94k, bitcoin is turning back and trying the 98k area once again. A crack above that zone and above the moving averages should lead to additional buying. Will join that party if it gets going.

My wave count is a bit messy and with several scenarios but I continue to look for 129k before we can say that possibly a wave (5) top is upon us. I feel that if that top was already in place , we would have already started to correct deeper which we really haven’t. If we do break 92k, than it will be more evident either wave (5) or 1 are in place. Until then , we stay focus on further uptrend.

The 256k targets is what I am rally after as 100% of wave ((1)). But that’s a story for another day.

Sorry for the short note, my mind is not fully connected to market action, but from what I see, not much has been really happening. There are a few stocks with some wild swings but not major enough to create market disruption. CAVA has kicked my ass today for no apparent reason. That’s investing in stocks for you, like walking a minefield at times. Jeez.

By the way, I am getting tired of this winter.

Did I tell you I love futbol? Messi just played in zero degrees F in Kansas City a full 90 min at 38yo. Oh boy. I wonder if Ronaldo can do that :)).

Cris

For those wanting to chat with fellow traders, the link is below.

Thanks for reading.

Cris

If you’re new to Elliott Wave or need to refresh, there is a 7-hour video course with downloadable slides under The Coarse tab on the website. Requires a yearly “Founding Member subscription.” You can find it HERE.

Cris

email: ewcafe@pm.me

Regarding BTC, my attempt at wave count was we're in wave 4 of (5). Maybe we're now starting wave 5 of (5)?