The Daily Drip

Core markets charts updates and commentary

Note: The counts on the right edge are real-time, and they are prone to adjustments as price action develops. Elliott Wave has a fluid approach, is evidence-based, and requires constant monitoring of certain thresholds.

In the counts below, this (( )) = circle on chart

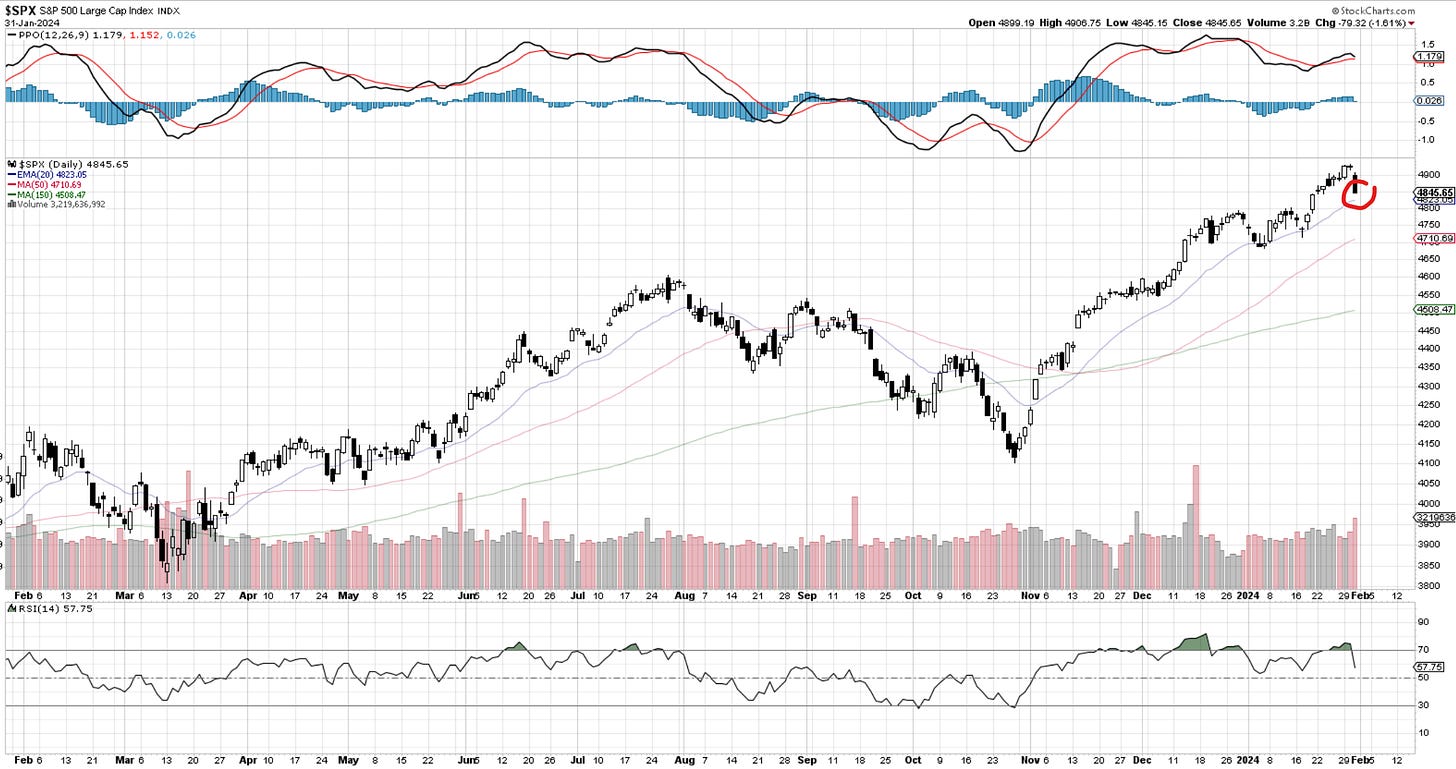

SP500

We closed -1.61% today, a move that started yesterday with large-cap tech earnings and was accelerated with the Fed meeting and comments from Jay Powell regarding the path of future rate hikes. The narrative seems to be that there is very little evidence and reason to cut at the March meeting. The market sold off on those comments at a time when a wave (v) topping seemed appropriate. The market will be quickly repricing the 5-6 expected cuts for 2024 to probably less than 3. Today, we dropped from 48% before the fed chair started speaking to 36% ( now 34.5%) and from much higher levels of 90% two weeks ago. There are 7 meetings left this year, and if they don’t cut in March, they will have the next 6 to do it. It’s clear that unless the economic data goes horribly wrong, the Fed will be that aggressive in cutting. Markets might have to wake up to that reality. One thing I want to mention is that a rate-cutting cycle with bad economic data is not bullish for the markets. It’s actually bearish. The bull cycle in the markets comes after the rate cuts are done historically. Something to keep in mind.

The proposed corrective path is below from a count that we have followed for several weeks on a tape that continued to extend with a longer 5th wave. We are now starting to have evidence that this might be the correct path. There are two very important levels below that will support price once it approaches them. That’s the old all-time high at 4818 and the breakout zone just below at 4793. I expect to hold on to the initial test. Those levels also coincide with the 61.8% retrace of the spike from Jan 17th. My goal is to see 5 declining waves from the current top. If that appears as best as possible, then we will know the correction is just starting. 4700 would be the next lower target.

01/30 - Channels are sometimes imperfect, but just a quick glance below suggests that the odds of a pullback would be higher than the odds of a continuous breakout. At this juncture, I would continue to be a trimmer, call seller, put buyer, and straight seller.

For the month of January, we gained +1.59%. I'm not sure if it really qualifies for the bullish January effect, but it’s better than closing negative. Also, notice that we have a monthly close at the new ATH by a small margin. This requires the next month, which begins tomorrow, to have a decent follow-up. Otherwise, a failed breakout might have larger implications. Food for thought.

We haven’t closed below the 20-day MA since briefly on Jan 4th. If we do it for at least 2 days, it would further confirm weakness.

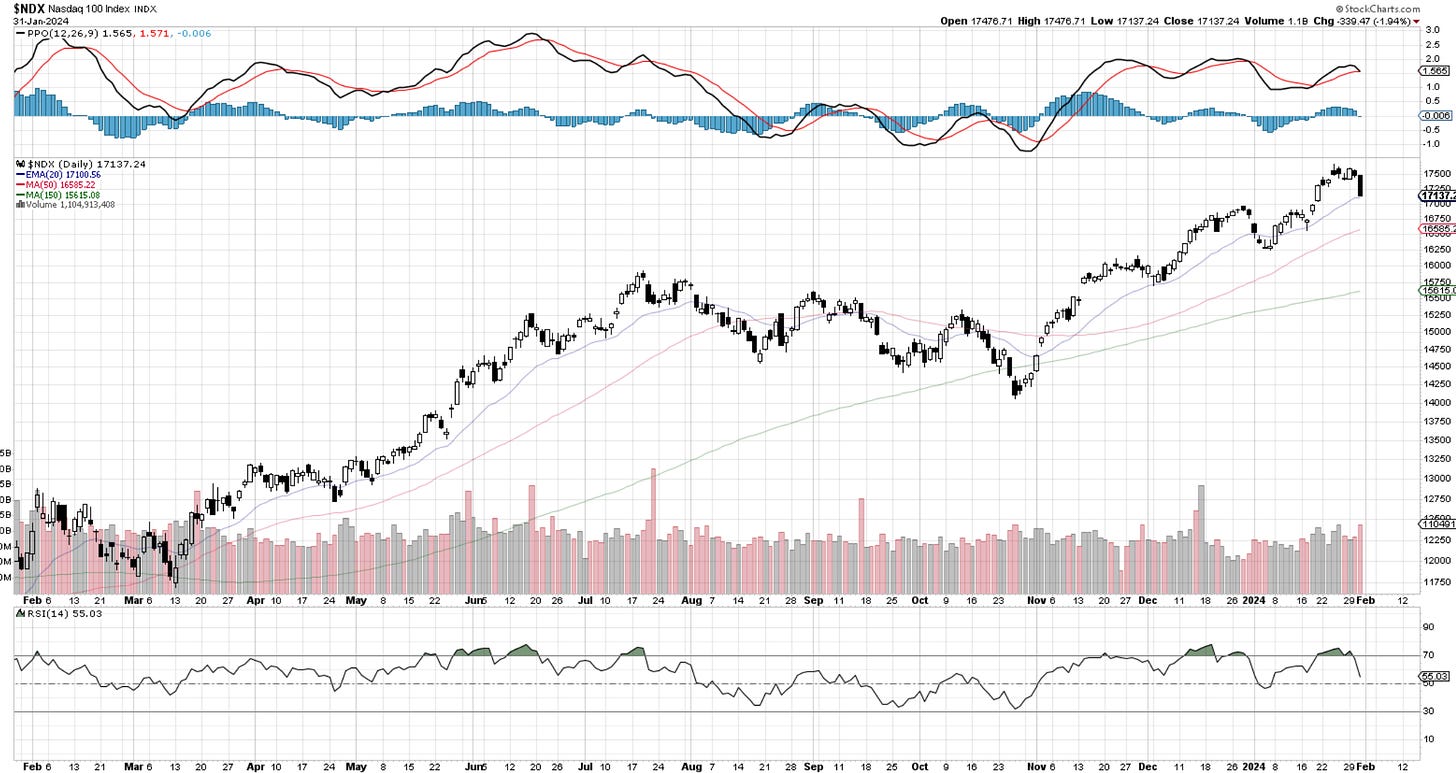

Nasdaq100

Today’s selloff, while significant, is still premature to be convincing of a wave (v) top. A clear break of 16,900 would put more logs in that fire. Notice below in the first chart how EW counting is put to the test in terms of rules. Wave iii is the smallest wave, due to a short, quick move higher in that wave v. Notice where 100% rests. In the second chart, you can see an alternate count that would solve that issue, although I don’t like some of those proportions. I will revise and clear it as more data comes along. Looking for this correction to take us towards 16k eventually. How we get there I am curious myself.

17k support just below that 20-day MA. Uptrends are still intact for now.

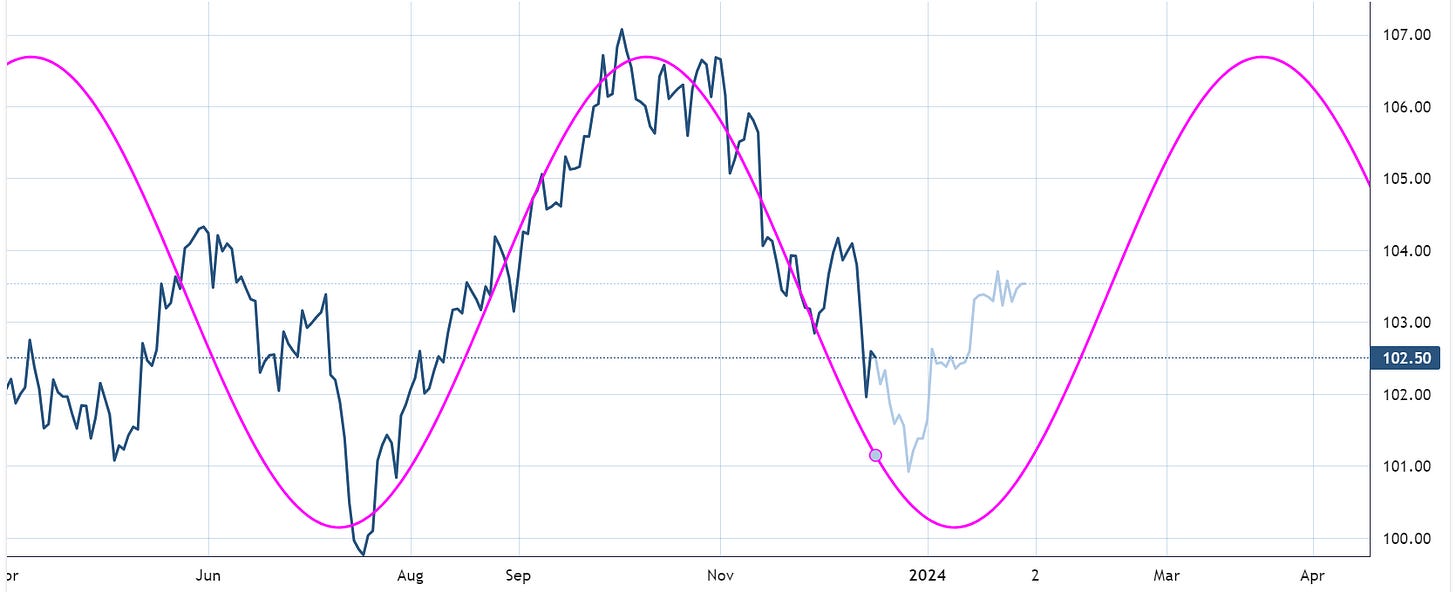

The downcycle is starting and lasts until roughly the end of March.

RUSSELL 2000

There is a strong sell in this index, as it is mostly the case in these higher beta stocks. Clear rejection from the levels mentioned yesterday. As I said, if we break 1900, that wave (iv) will be deleted.

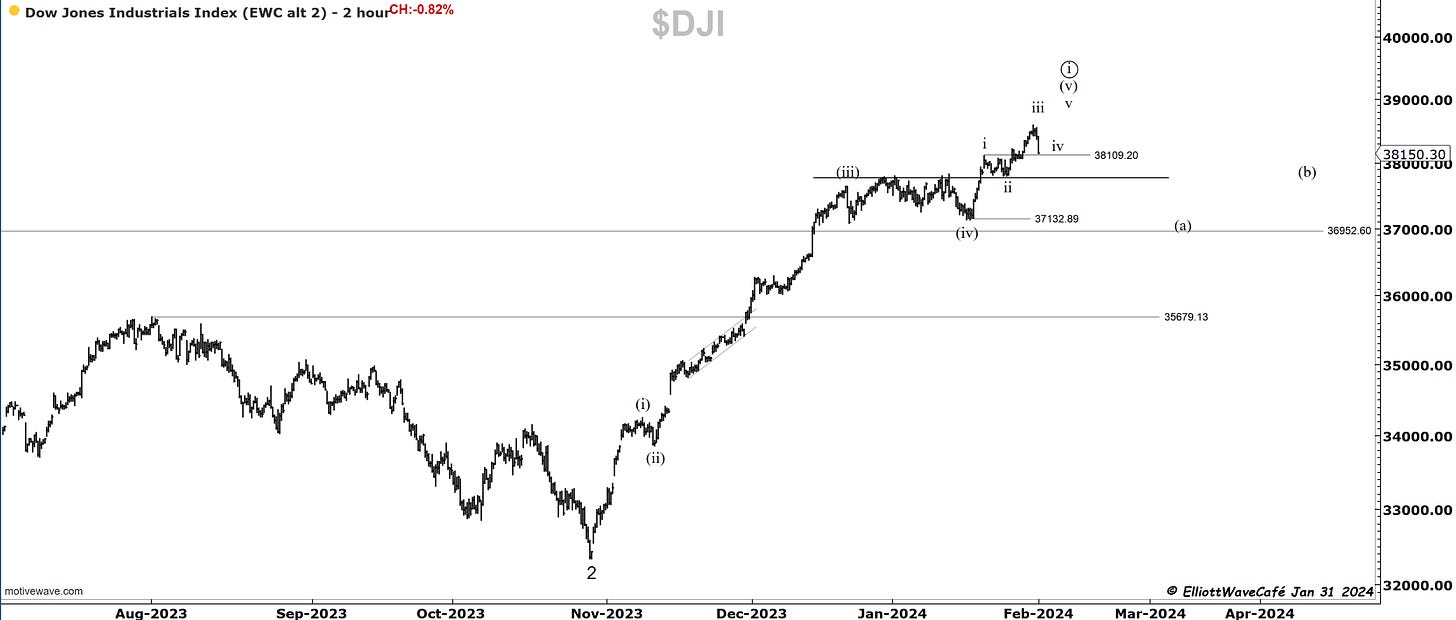

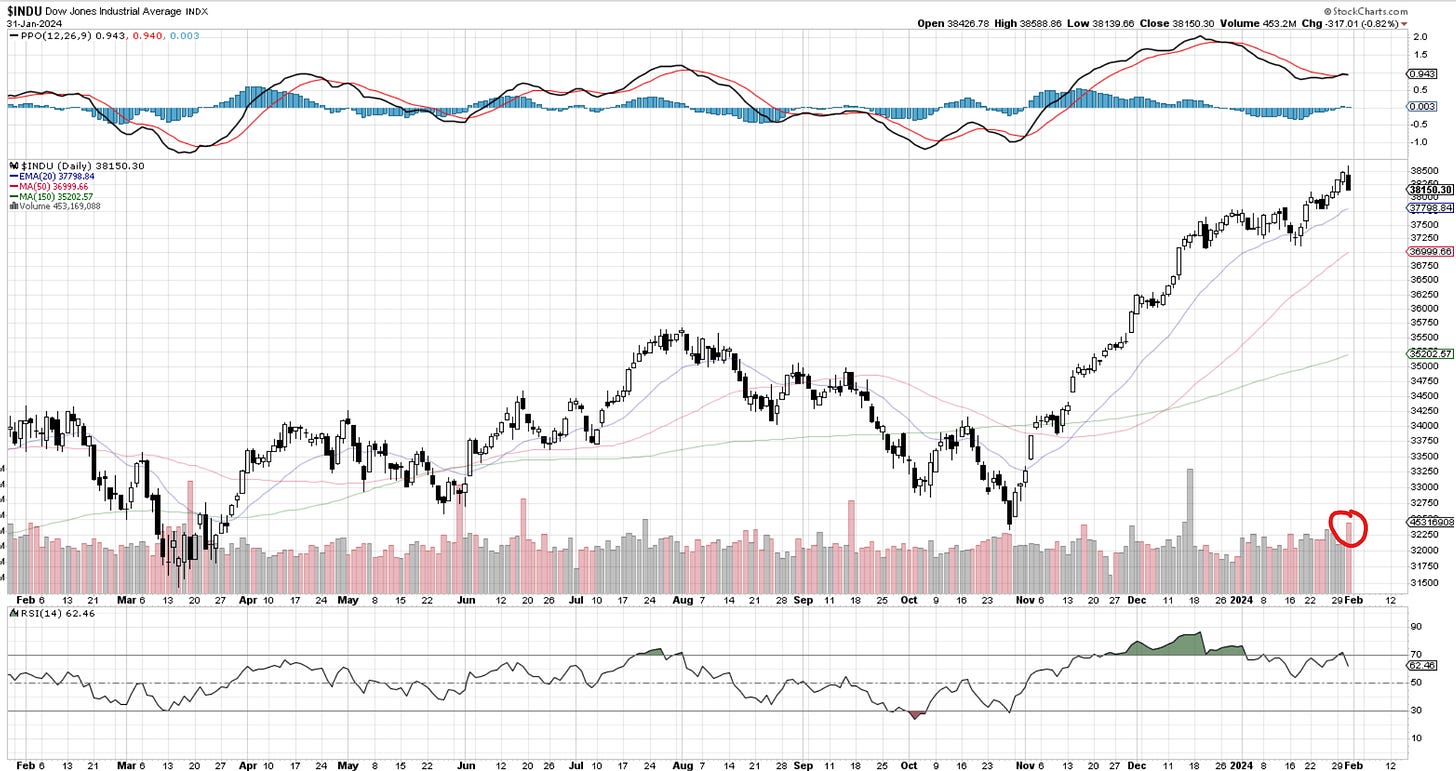

Dow30

Dow was trying to hold pretty well and was positive most of the day. It wasn’t until late in the session that it started to accelerate lower. Even with this, wave iv has not yet penetrated the proposed prior wave i top. Once below 37,800 we can secure that top with more confidence. 37k would be an appropriate target initially.

The volume here was larger then usual. It’s probably unlikely that this is all we’re getting. Watch that 20day which sits exactly at 37,800.

US Dollar and Yields

The dollar was a bit volatile today but finished with a strong close and up +2.48% on the month. Notice the strong support reaction on the second chart and the bullish engulfing candle. Some of my cycle work presented at the end of Dec 2023 also continues to suggest that we have more time left in this bullish cycle. If you notice, everything lines up with equity cycles towards the mid-end of March. We call this Intermarket analysis, where we try to overlap multiple assets and make sense of the larger risk picture.

The yields have taken a beating, which is a bit at odds with the market message from other areas but in line with the 3-wave correction upwards. We are now at prior swing low support; let’s see how they move here.

My cycle work suggests that this is a temporary dip that should be followed by higher moves. What can trigger that? Stronger economic data and inflation upticks.

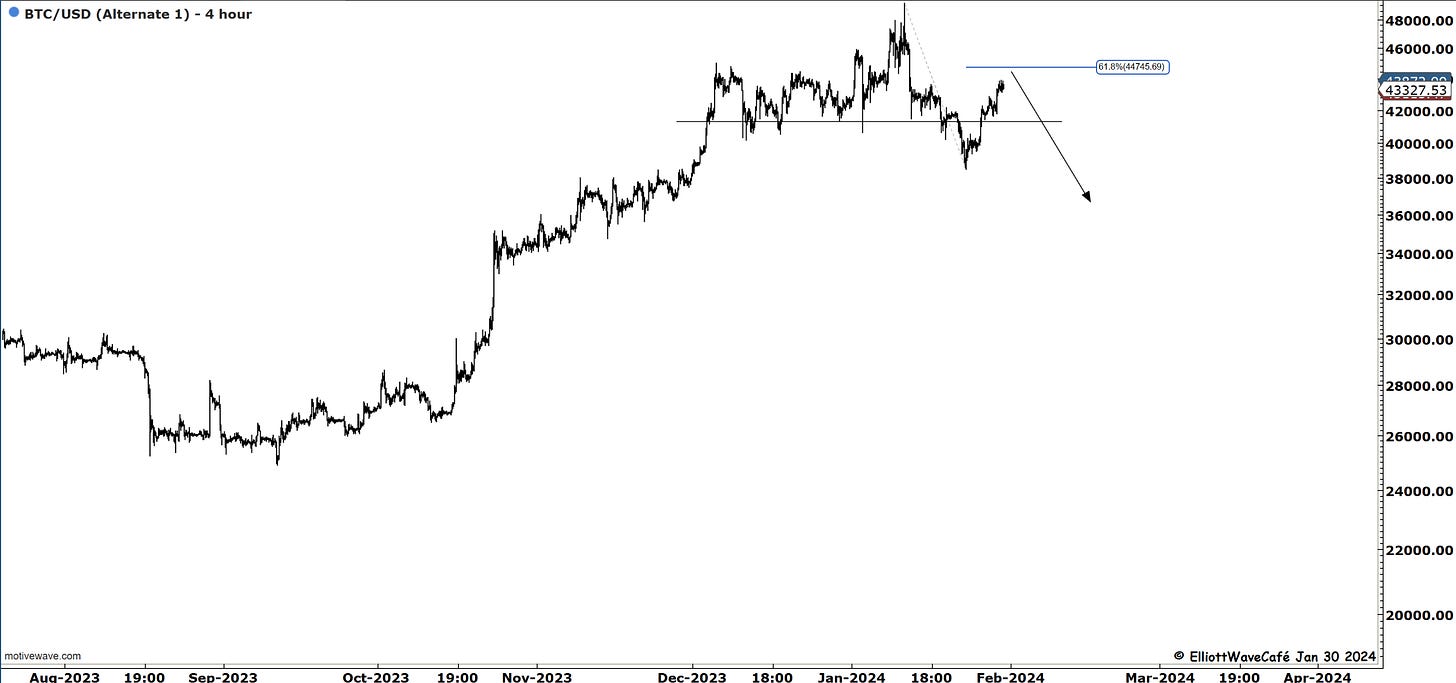

Bitcoin

Bitcoin managed to respond well from the highs for now without triggering additional gains. A bit on nowhere land, there is not much to do. The short idea was expressed below yesterday. Long here, it’s a bit tough with so much upside resistance. The downcycle in BTC I showed in mid-December continues to work at 149 days. It appears to be complete just when the other markets are as well. Fascinating.

From 01/30 post —- A simple way to take a short view on this would be to protect above 45k and look for a break below 38.5 with initial targets at 41k.

“Double shot” Daily member video coming up next,

If you’re new to Elliott Wave or need to refresh, there is a 7-hour video course with downloadable slides under The Coarse tab on the website.

Have a great day wherever you are! - trade well, and don’t forget to subscribe and drop a like if this letter helps you in any way.

Cris

email: ewcafe@pm.me