The Daily Drip

Markets review, strategy and analysis

Here is a only quick update on markets since I am out of town for a good part of this week. The regular coverage and videos will resume Monday evening.

Bottom Line: After the bearish failure of May 1st, the market continues to improve. The recommended bullish exposure started after the close on May 2nd and has been slowly increasing. Key levels have been taken out to the upside, and the momentum is with the bulls. However, caution must remain exercised until we see stronger daily volumes and participation. Once we do, I will be ringing louder bells.

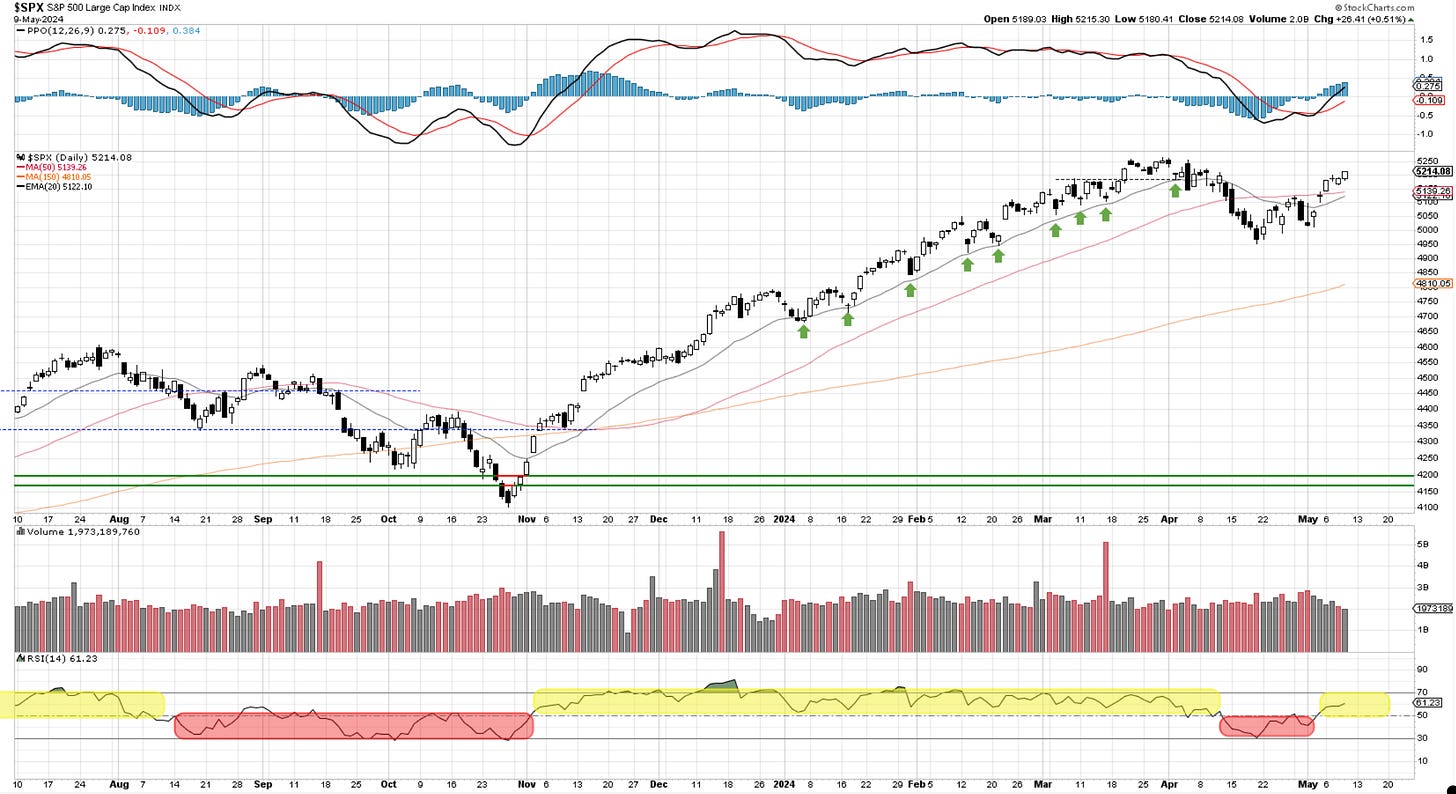

SP500

The SPY is now less than 1% from its All-time Highs. The RSI prints 61; the PPO has crossed into bullish territory, and the price trades above key moving averages. The market is doing what it is supposed to be doing when a bullish trend forms. From that perspective, being involved makes total sense. The one piece of data that is still worrisome a touch, is the lower volume. For that reason, I am still not fully “pedal to the metal” on purchases. 20day, crossing back above 50day, would bring additional trust to this rally. Closing back below 5100, would bring concerns to the sustainability of this upswing.

For those wanting to chat with fellow traders, the link is below.

Bitcoin

previous comments remain -

Bitcoin has not joined yet the stock indices by breaking its average. The loss of 60k was brief. Seems like a quick shakeout followed by a recovery. However, the daily action is not yet convincing enough. The RSI remains below 50, and the price remains below the 50day. It needs to recapture 67,500 to embolden further bullish activity. Until that happens, it’s still on the watch list.

If you’re new to Elliott Wave or need to refresh, there is a 7-hour video course with downloadable slides under The Coarse tab on the website. Requires a yearly “Founding Member subscription.” You can find it HERE.

Cris

email: ewcafe@pm.me