PYPL

on radar once again

I have discussed PYPL in detail in a January 16min Video right here.

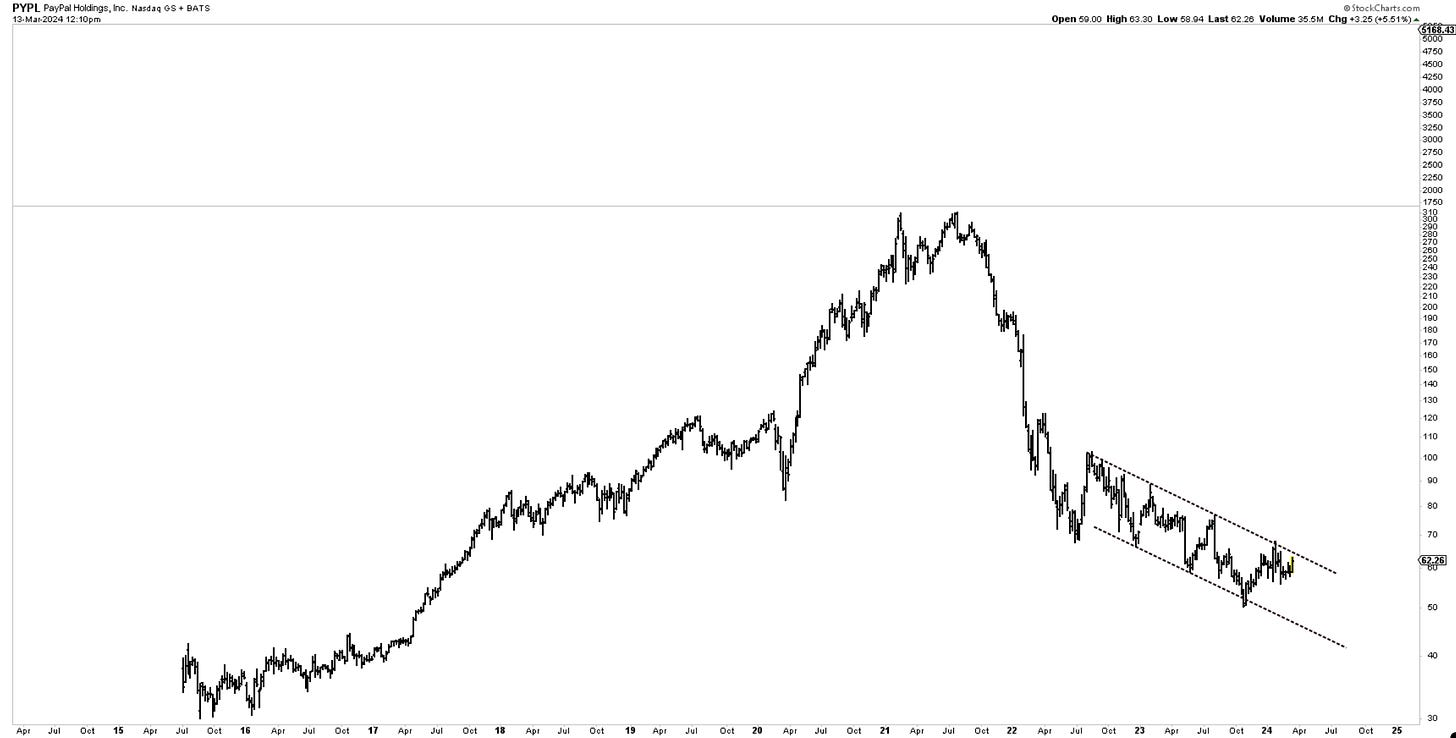

Some new developments since then as seen in the following charts

A declining channel that we’re keeping a close eye on for signs of breakout. 68.21 is the upside trigger.

The appearance of wave 1 of the lows with the buildup of wave 2.

January run was followed by a 3wave setback labeled here as 2 on the Daily charts.

A curl-up in the moving average will be positive for further price appreciation. The fact that the price is trying to establish itself above it is an encouraging sign.

This stock continues to build a base and has had a few false starts, but one has to try nibbling at these setups to create a position. Upon further confirmation, the position can be built within each person’s acceptable risk parameters.

Cris

EWCafe

ewcafe@pm.me